The markets were confused after, a.o., speculations about who is responsible for launching missiles that fell near the Polish-Ukrainian border. What about oil?

Macroeconomics

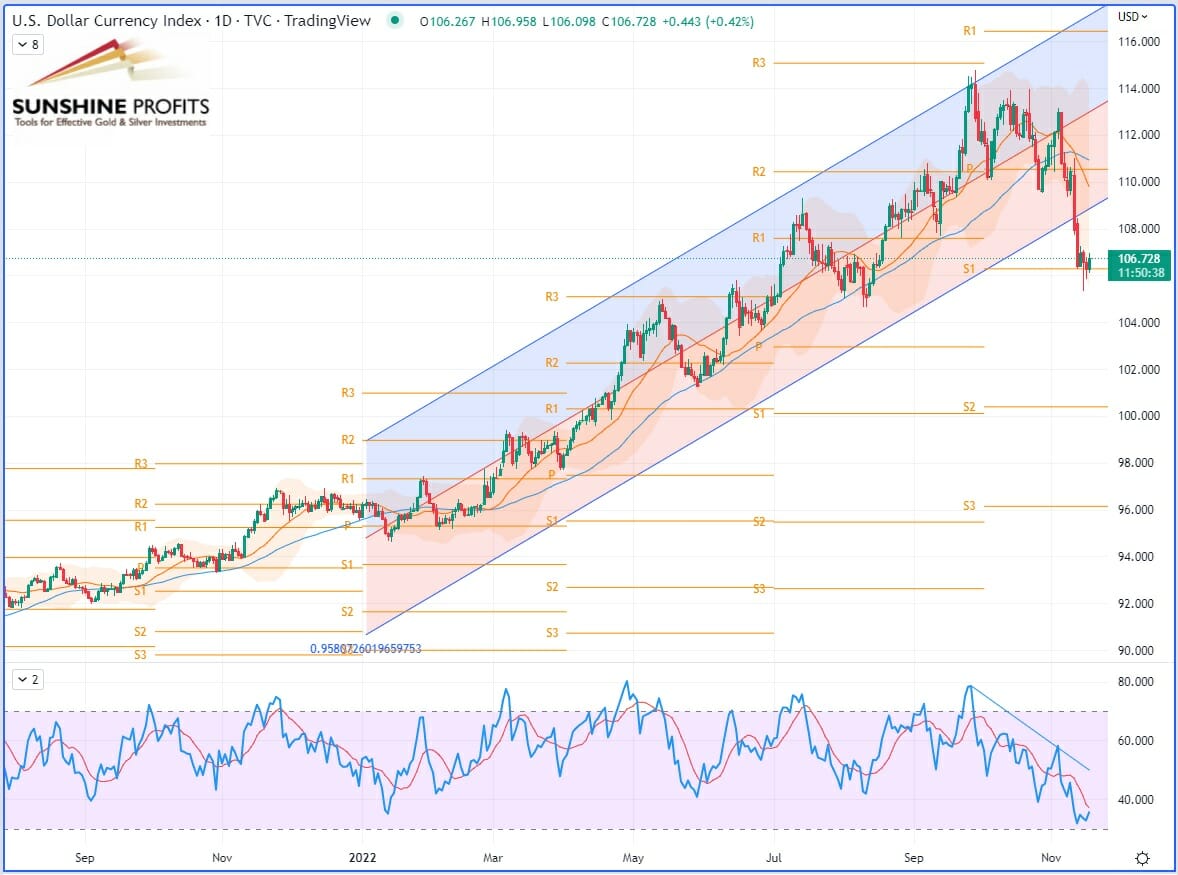

On the macroeconomic view, the greenback explored the lower floor as the DXY fell just below $106 on Nov. 15 – thereby dropping well below (outside) its yearly regression channel with a Pearson’s R (correlation coefficient) near 96 %.

Q3 2022 hedge fund letters, conferences and more

U.S. Dollar Currency Index (DXY), daily chart

Fundamental Analysis

Oil prices fell on Thursday (Nov. 17), with the prospect of a slowing global economy adding to a lower risk of geopolitical escalation as NATO and Washington denied Kiev's accusations that Russia fired missiles against Poland.

Now, the oil market is focusing more on the bearish elements, such as poor macroeconomic data in China and low demand.

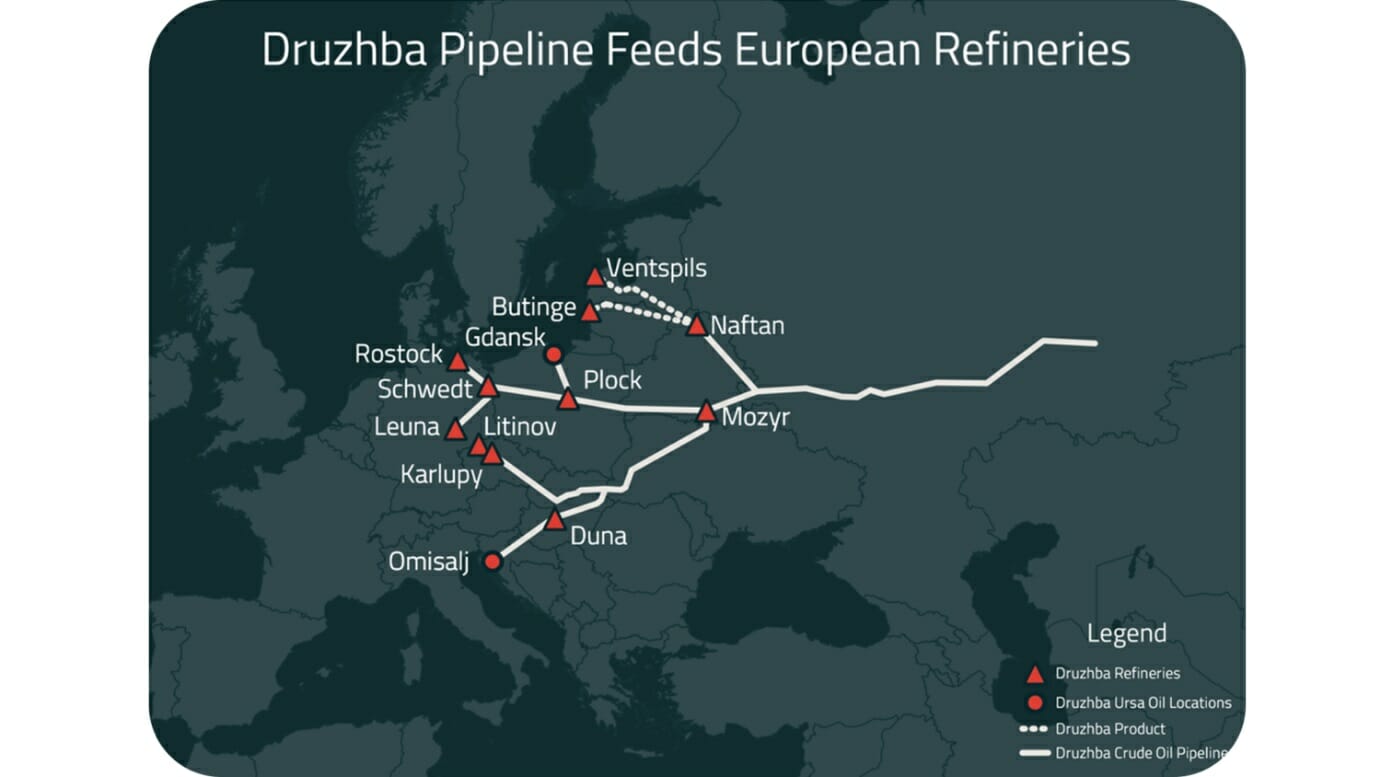

On the supply side, flows in the Druzhba pipeline, which carries Russian oil to Hungary, resumed after a brief blackout that caused a fall in pressure.

The supply outlook, however, remains cautious, with the European Union set to impose a ban on Russian crude imports beginning next month and OPEC+ expected to maintain a tight supply..

(Source: Ursa Space)

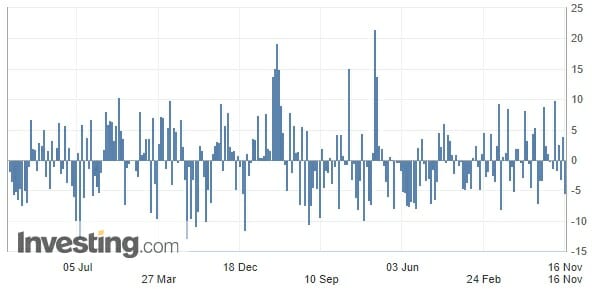

U.S. Crude Oil Inventories

Commercial crude oil reserves fell sharply last week in the United States, much higher than expected, according to figures released Wednesday by the US Energy Information Agency (EIA).

During the week ended November 11, these commercial stocks contracted by 5.4 million barrels, or ten times more than expected.

This decline is even more significant given that, at the same time, US strategic crude reserves fell by 4.1 million barrels, which means that inventories fell by almost 10 million barrels in total over the week (or 9.5 million barrels more precisely).

(Source: Investing.com)

Geopolitics

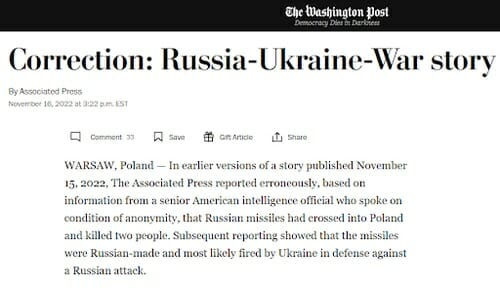

In addition to the news that Russian missiles had fallen into Polish territory, the announcement that an oil tanker had been hit by a projectile attributed to Iran by Washington off the coast of Oman on Tuesday (Nov 15) had slightly pushed prices higher.

After some false press reports that could have led to some worsening escalation in the Black Sea basin these past days, it appears that some mainstream media are correcting their stories following the recent missiles that fell into Poland:

So, it looks like there is no immediate escalation in the conflict from the Russian side, which may temporarily eliminate some short-term crude supply risks, at least globally (in the EU, it is another story).

Technical Analysis

Our members had a successful trade last week, which was liquidated for the most part just before the weekend around the mid-$88s level.

On the daily chart, WTI crude oil (December contract) is moving towards the median of the regression channel (also known as the mean regression line).

WTI Crude Oil (CLV22) Futures (October contract, daily chart)

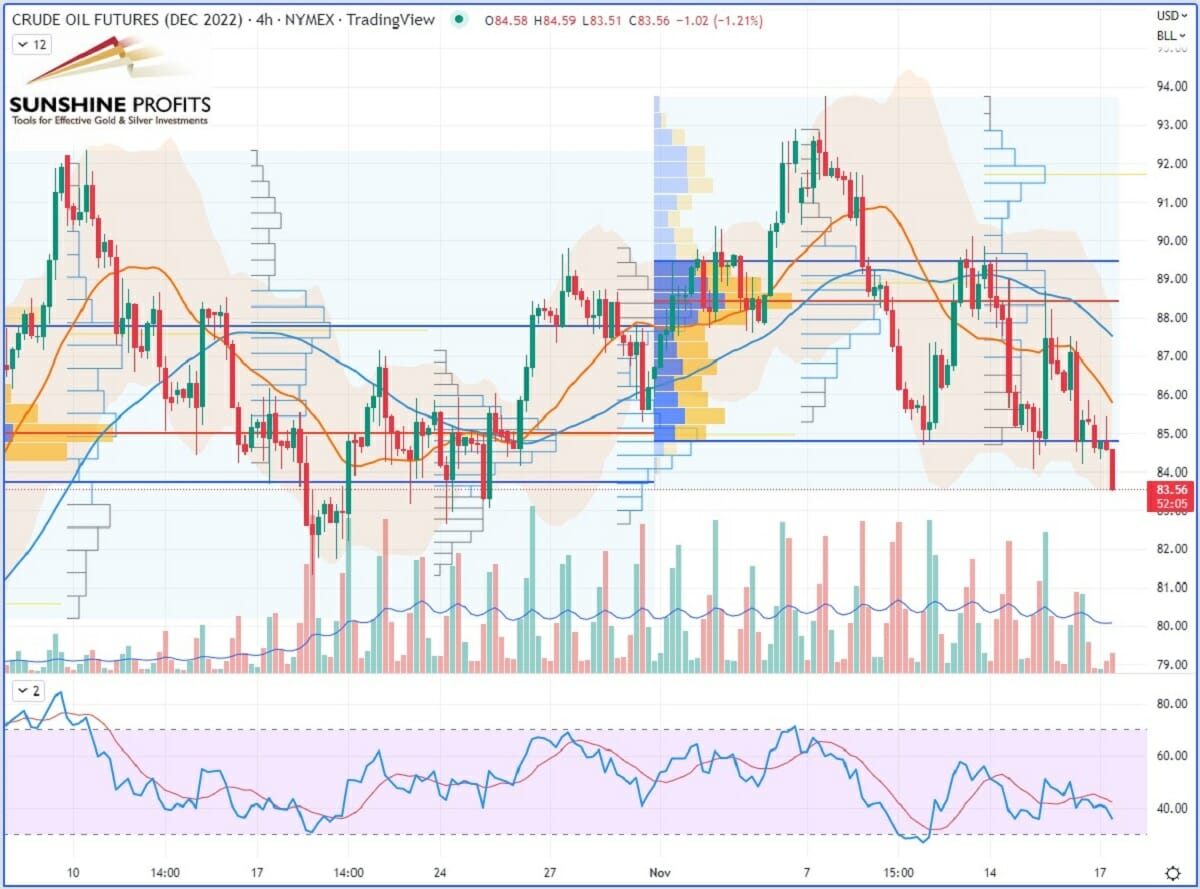

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

RBOB Gasoline (RBV22) Futures (October contract, daily chart)

Brent Crude Oil (BRNZ22) Futures (December contract, daily chart) – Contract for Difference (CFD) UKOIL

A Word on Natural Gas

Following spot gas prices falling into negative territory last week, liquefied natural gas (LNG) is arriving at an unprecedented level by sea routes, but due to a lack of infrastructure capacity (such as regasification-equipped terminal ports) and concerns in that sector, it looks like natural gas is not finding lots of buyers right now.

That’s all, folks, for today. Stay tuned for our next oil trading alert!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice.

At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness.

The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports.

Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.