Russian production, the Fed’s decision to raise interest rates, and the weakened dollar. What other factors are driving crude oil prices these days?

Midweek, black gold gained 5% after rebounding from a 6-month low, as a sharper-than-expected drop in U.S. crude inventories outweighed fears over rising Russian output, export sales, and recession concerns.

Q2 2022 hedge fund letters, conferences and more

Macroeconomics

On the macroeconomic side, the greenback diminished its gains on Wednesday following the U.S. Central Bank’s July minutes. Indeed, during its monthly meeting, the Fed appeared to be more hawkish than expected. This raised concerns from some officials in the U.S. Central Bank, who were debating whether the Fed could raise rates too far to regain control of inflation on the one hand, and the need for further hikes on the other.

As I mentioned in my last article published last Thursday, when all data turns into bearish territory for both legs – the greenback and black gold – it is usually the optimism (or pessimism, depending on which point of view we take) triggered by the macroeconomic perspective that leads the markets. In that case, as the news has rather been bullish for the US dollar, it is the one which will set the tempo for the positively or negatively correlated assets.

Fundamental Analysis

On Wednesday, the Energy Information Administration (EIA) released the weekly change in Crude Oil Inventories.

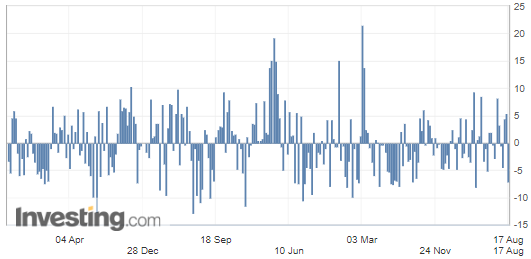

U.S. Crude Oil Inventories

The commercial crude oil reserves in the United States surprised the market by sharply dropping to -7.056M barrels while expectations were just showing a tiny drop (-0.275M barrels).

US crude inventories have thus decreased by over seven million barrels in volume, which is a very significant deviation displaying greater demand and is a strong bullish factor for crude oil prices, since the drop can be explained, in part, by the increase in U.S. crude exports, which more than doubled last week to 5 million barrels per day (Mbpd) against 2.1 Mbpd.

(Source: Investing.com)

The decline in commercial reserves is due to strong domestic demand and rising exports as US trading partners seek to compensate for the loss of Russian hydrocarbons.

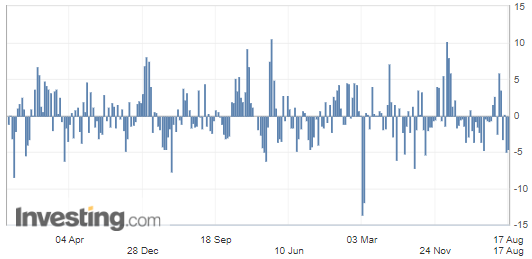

U.S. Gasoline Inventories

Like the previous week, U.S. gasoline demand figures have significantly dropped as well:

This is once again where we could see a sustainable rise in demand marked by an unexpectedly sudden drop in gasoline reserves, since the latter were reduced by four and a half million barrels. Another factor to note is that a few refineries also operated at a lower rate of capacity, at 93.5% versus 94.3%.

Geopolitics

On the geopolitical scene, the ongoing negotiations around the Iranian nuclear agreement, which could allow this major producer to resume its exports, still hover over prices as a bearish factor. However, even a return to the market of Iranian crude oil production would not compensate for the loss of Russian supply. In short, there is little new information about this agreement.

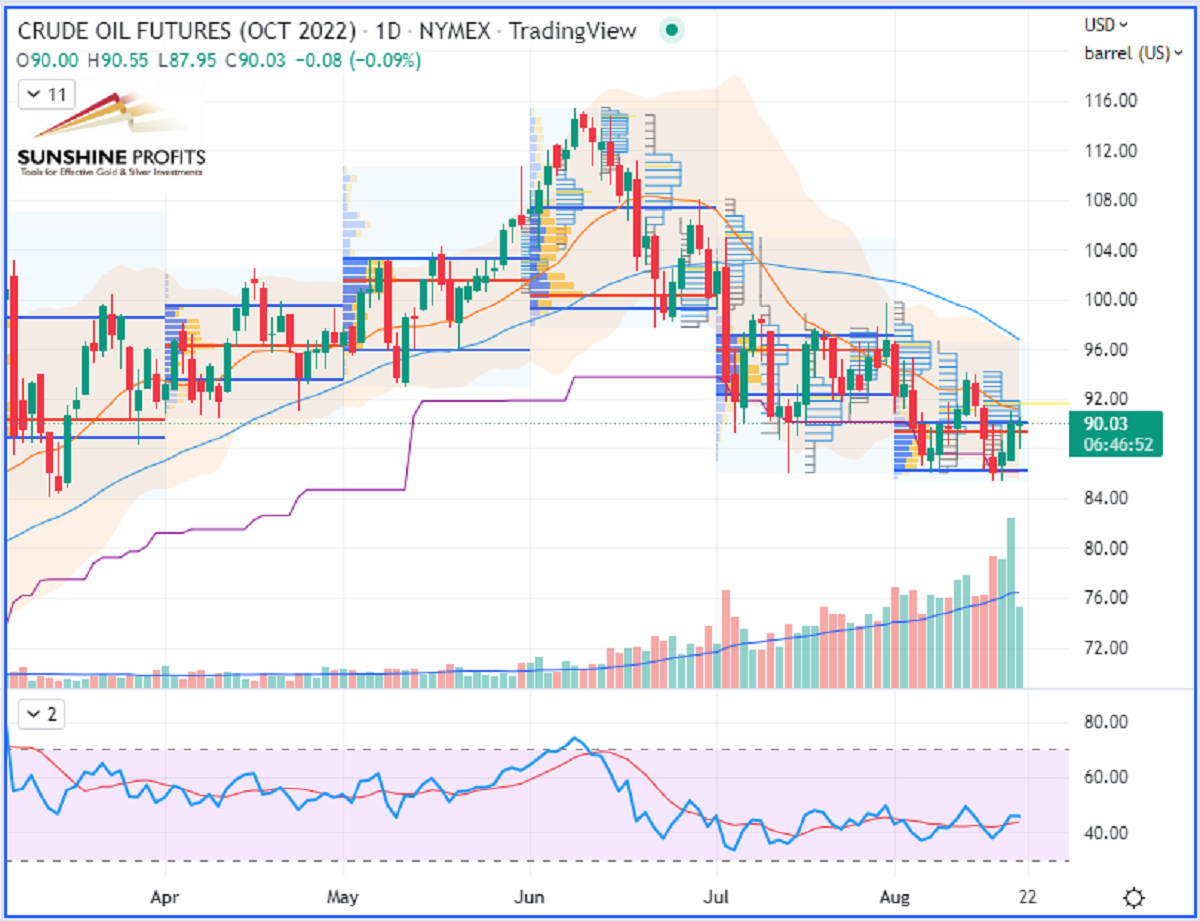

WTI Crude Oil (CLV22) Futures October contract, daily chart)

RBOB Gasoline (RBV22) Futures (October contract, daily chart)

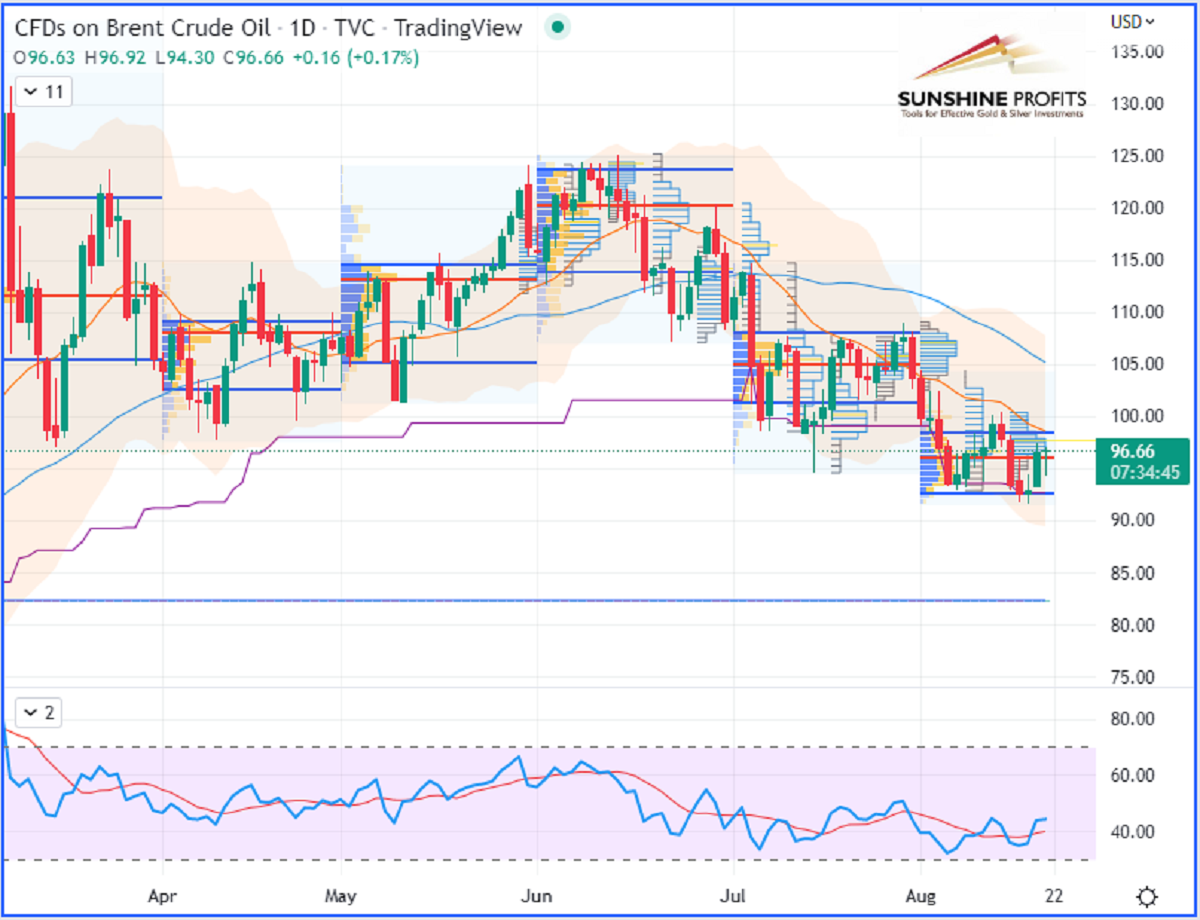

Brent Crude Oil (BRNV22) Futures (October contract, daily chart) –Contract for Difference (CFD) UKOIL

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.