Horos Asset Management commentary for the third quarter ended September 30, 2020, discussing Horos Value Internacional increasing stake in ONE and Tang Palace.

Q3 2020 hedge fund letters, conferences and more

Dear co-investor,

We finished another quarter affected, to a greater or lesser extent, by the evolution of the pandemic and the decisions made by our governments. It is difficult to get used to this "new normal” situation, but the Horos family sends you all its encouragement and support for these difficult times.

At the market level, after last quarter's recovery, markets have once again entered a dynamic in which large companies with more predictable earnings are favored by the investment community, to the detriment of smaller companies and those with more cyclical businesses.

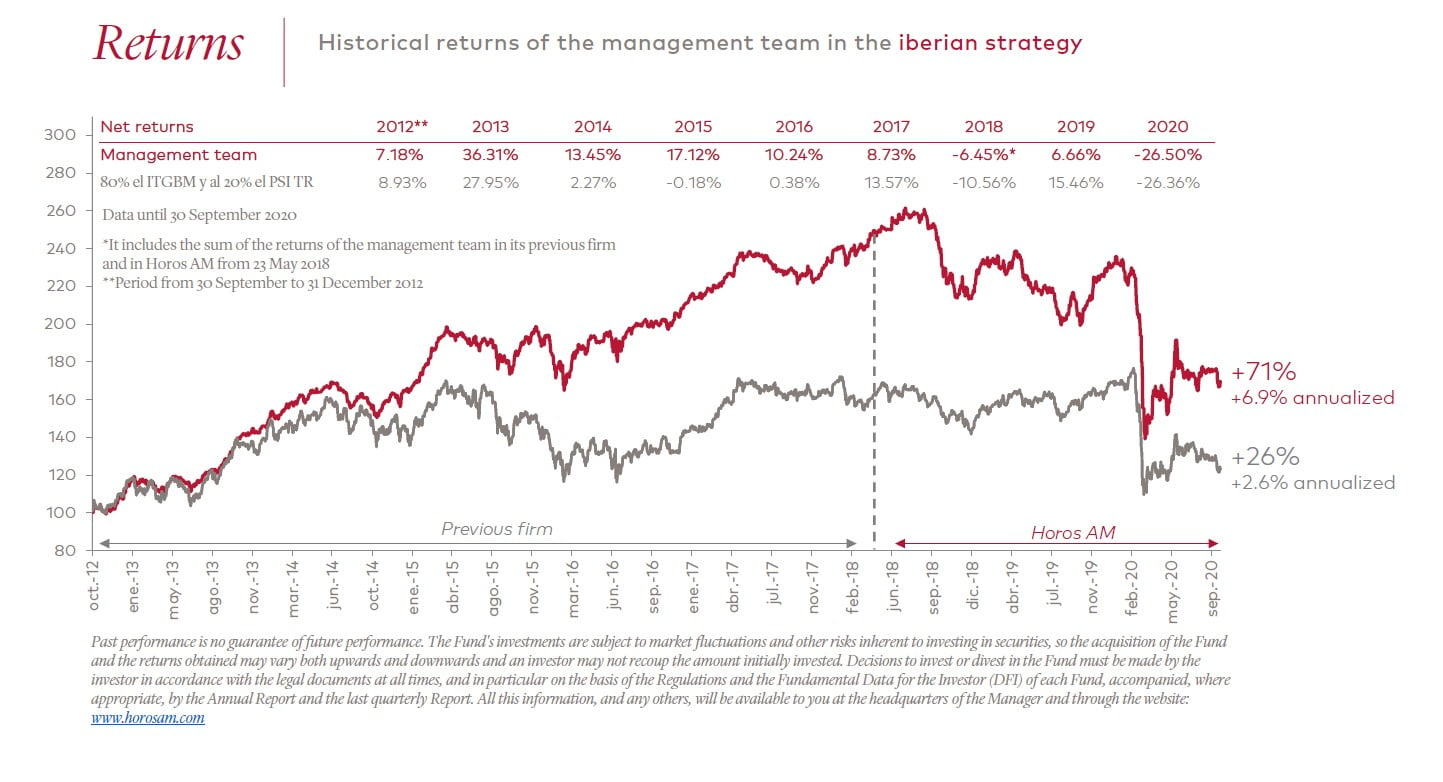

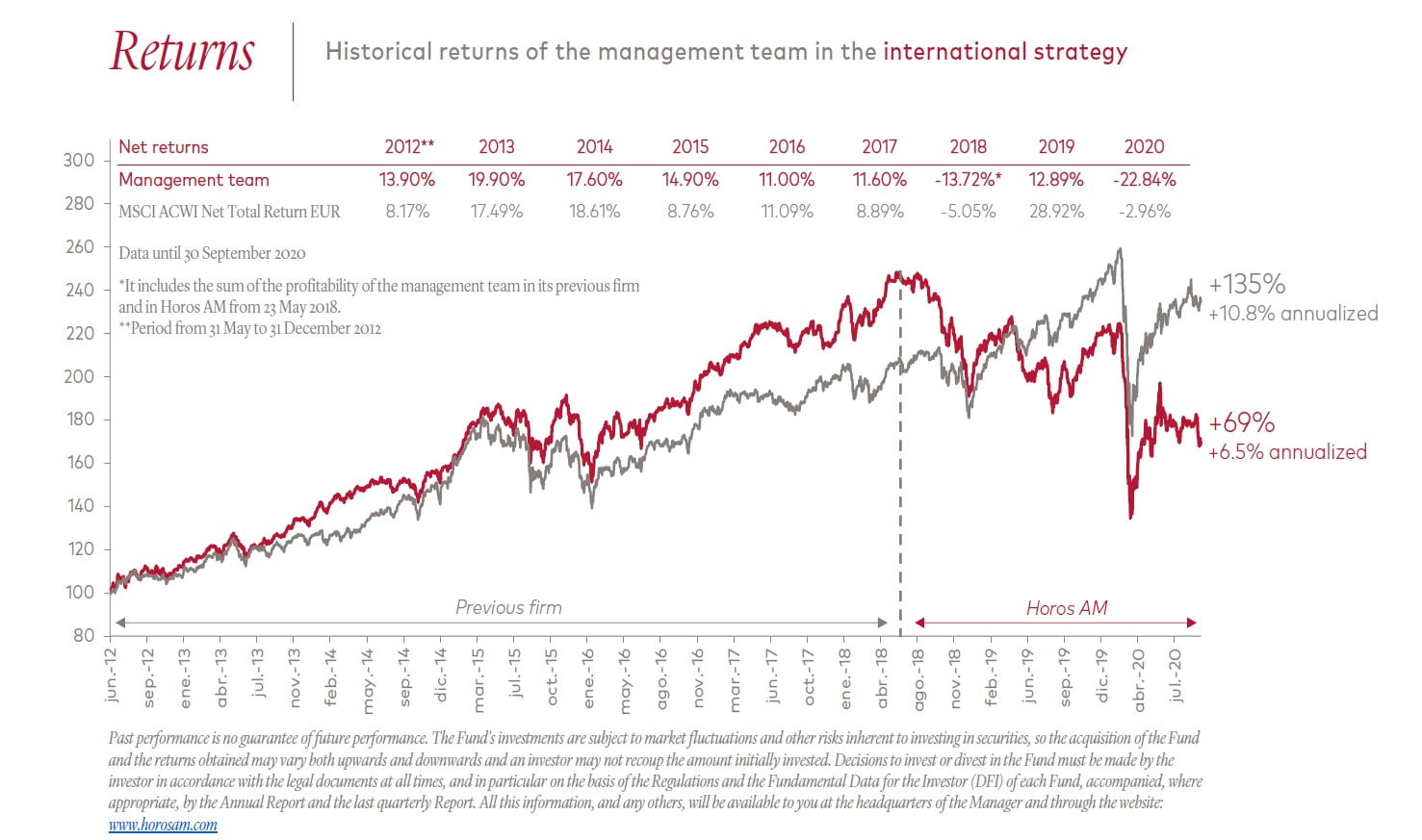

Horos Value Internacional has not been immune to this dichotomy of performance, posting a -4.7% return in the quarter, compared to 3.6% of benchmark index. On the other hand, Horos Value Iberia returned -0.8%, outperforming the -6.3% of its benchmark index.

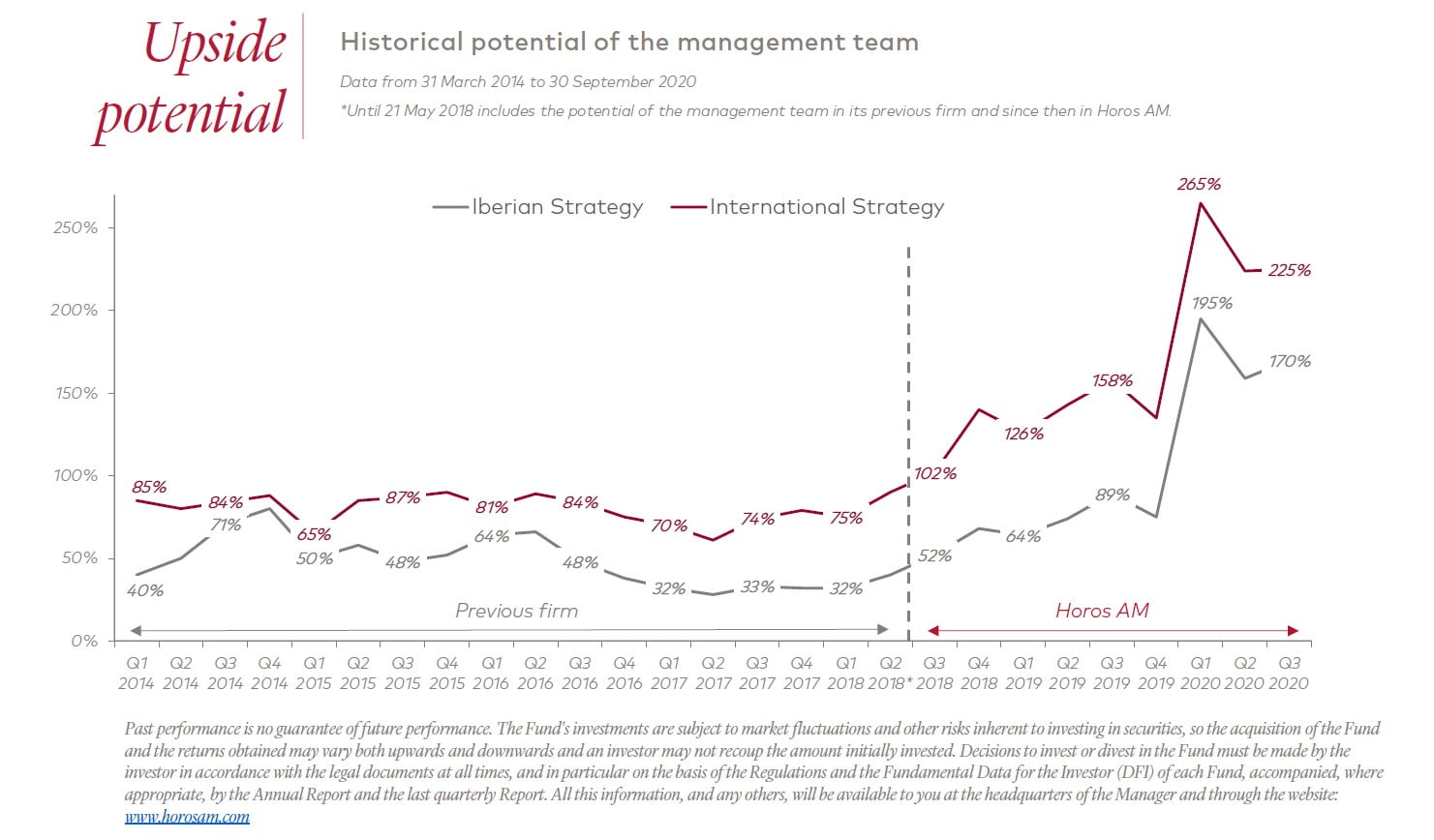

This dynamic, which we already highlighted last year, has even been exacerbated by the uncertainty we are experiencing today, as well as the policies enacted by central banks and governments around the world. At Horos we are convinced that we are not going to play a game in which the risk taken does not compensate for the potential reward of certain investment. We also understand that the current dynamics are not helping our investment style. However, we still prefer to invest where the opportunities exist, without being carried away by the irrational investment flow that feeds on the gains of the same type of companies, making them more and more expensive. History has shown, time and again, that valuations ALWAYS determine the returns we can expect as investors. This time, it will be no different. This is what we will dedicate this letter to.

Yours sincerely,

Javier Ruiz, CFA

Chief Investment Officer

Horos Asset Management

Executive summary

Eventually, though, valuation has to matter. - Howard Marks

After the strong stock market recovery in the second quarter of the year, the last few months have once again been characterized by large investment flows into large companies with more predictable earnings (either because they have relatively stable businesses or because they have benefited from the current economic situation), to the detriment of those smaller and more cyclical businesses and, therefore, with greater uncertainty about their future prospects. This divergence, which has been exacerbated by the policies adopted by governments (massive deficits) and central banks (expansion of balance sheets never before seen), is beginning to reach clearly overvalued levels, with quality companies trading at multiples not seen since the 90s and with market action rife with speculation, with companies posting large gains after announcing stock splits.

In this environment, in which what is expensive becomes more expensive and what is cheap becomes cheaper, we continue to invest in companies with a high margin of safety and make small adjustments to our portfolios. Specifically, in Horos Value Internacional we exited our position in Sonae Capital, following the announcement of a takeover bid by the Azevedo family, and trimmed our investment in the technology holding company Naspers (owner of more than 30% of Tencent). In contrast, we have continued to increase our stake in the restaurant companies The One Group Hospitality and Tang Palace China Holdings. In Horos Value Iberia, we trimmed our weight in Atalaya Mining (after its excellent performance during the period), in Meliá Hotels International (where we reduced its upside potential) and Sonae Capital. Finally, we increased our investment in Gestamp, taking advantage of its weak stock price.

That constant feeling of deja vu

Do you ever have déja vù, Mrs. Lancaster? I don’t think so, but I could check with the kitchen - “Groundhog Day” film (1993)

It is difficult to talk about the current market conditions without the feeling that we are merely repeating what we have said in previous letters. However, the dynamics that we have highlighted in the past, far from being reversed, have been exacerbated, especially as a result of the policies taken by monetary and government authorities across the globe to try to combat the effects of the coronavirus pandemic. For this reason, we believe that this update is necessary, so that we can better understand our portfolios' performance over the last few quarters, as well as the reasons that lead us to invest in out-of-favor sectors or companies, avoiding those that are currently favored by the market.

If you recall, about a year ago (see here), we used the expression of “the great escape” to describe the market environment that existed at that time. In particular, there was a clear divergence in the (positive) performance of the stocks of companies with more stable and/or predictable earnings, in relation to the (negative) performance of those companies with more cyclical business. This same trend was occurring according to the size and liquidity (ease of buying and selling company shares) of the companies, benefiting those of greater size and market capitalization and penalizing, to a great extent, the smaller companies.

The reasons? In our opinion, three main factors were behind this dynamic. The first was the uncertainty associated with the trade wars between the United States and China and their consequences on the rest of the world's economies. The second was the low yield provided by fixed income assets, in light of the distortion caused by the (ultra) expansionary policies of central banks. Finally, the continuous growth of index or passive investing (mainly through ETFs), whose inflows show a very significant correlation with the performance of the stock market indexes that they replicate.

Interestingly, shortly after writing those lines, the tide began to turn and the last few months of 2019 were very positive for the companies overlooked by the investment community. However, we will never know if that was a turning point towards a new trend that would close that great divergence or simply a happy coincidence. As we all know and, sadly, have suffered from, this 2020 has seen the greatest shock that humanity has experienced in recent years, impacting our lives, businesses and, of course, stock markets around the world.

If we focus, due to its relevance, on the US stock market, we find that from the end of February to the end of March, the S&P500 index plummeted almost by 35% (in just one month!), which shows the magnitude of what happened. However, as we highlighted at the beginning of this crisis (see here), as the uncertainty of the real impact on economies and companies of the pandemic was gradually removed, markets would begin to better adjust the expectations in the share prices of listed companies. Thus, after the market sell-off, a strong recovery began in April. In the case of the S&P500, it rose nearly by 45% through early June.

Since then, however, there has been another evasion of investment flows into certain larger and more stable companies, except that, on this occasion, we think there are symptoms of what we could call "excessive enthusiasm" on the part of the investment community. Given that the US stock market is the most representative of this type of business, as it includes large, global companies with greater earnings stability or with growth business models that have benefited from the current environment—because of the lockdown measures to fight the pandemic—it has rallied unrelentingly over the period, reaching all-time highs in September. Such a stark contrast to the Madrid Stock Exchange General Index! whose performance since June has been the opposite, regularly approaching the March lows.

Signs of increased speculation

Living like crazy feels better - A lo loco se vive mejor (original) - Jarabe de Palo

Although the narrative underlying the positive performance of the US stock market is totally justified, we believe that its valuations are not. Most US companies have seen an enormous multiple expansion. Let's take Microsoft as an example. Its stock price has risen by 60% since March, reaching all-time highs and a valuation level not seen since the dot-com bubble at the end of the 90s, trading at 34x its free cash flow—we still miss the years when we were Microsoft shareholders, it was trading at a 7x multiple and no investor shared our enthusiasm for this investment. PayPal is another example, with a return of over 100% from the March lows, also at a price never seen before and with a valuation of 42x its estimated free cash flow for this year.

I have used these two examples because they have been holdings in our portfolio for a long time. These are extremely high-quality businesses, as a result of having powerful network effects in their products and services, as well as strong economies of scale that support these network effects and allow them to sustain high growth in revenues and earnings. However, no matter how much it frustrates us (and even more so in an environment where market action insists on proving the opposite), the margin of safety of investments continues to be the key pillar that determines the future returns we can expect. One can be right in its analysis about the growth rates and the quality of companies like Microsoft and PayPal, but if we invest in them at valuations in which very favorable scenarios for their businesses need to be realized, the risks that we will be incurring will be, in our opinion, unacceptable.

There is certainly what I would call a highly speculative nature to the markets today, a willingness to take on risks, a willingness to get excited about projects that may be five or 10 years in the future, that we haven't seen since the ‘99-time frame.1

One could argue that this multiple expansion, while raising large companies’ valuations to very high levels, does not justify our categorization of the current environment as euphoric or speculative. I am afraid, however, that we have other clear signs that this time it is indeed different. One of these signs can be found in the revival of the magic of stock splits. Basically, the split consists of increasing the number of a company’s shares outstanding without changing its share capital, thus adjusting the stock price downwards. This practice is common in companies that trade at high unit prices, with the theoretical goal of making their shares more liquid and affordable for investors. The reality, however, is that the effect is totally neutral for its shareholders and, normally, does not have a major impact on the company's stock performance.

I write normally because in certain market environments where speculation rules over reason, investors assume that these measures create value and lead to significant gains in a very short period of time. One of these recent cases can be found in the stock of the "controversial" Tesla, the company that manufactures electric vehicles, electric batteries and energy solutions. We will not go into the discussion of whether Tesla deserves its current market capitalization of over $400 billion (more than the combined market capitalization of the next five largest automakers in the world) or its criticized accounting practices (see the comments of investors who are short the company, such as David Einhorn or Jim Chanos). I would simply like to point out that, at the end of August, Tesla carried out a 5-for-1 stock split (that is, it "gave away" four shares as a dividend to its shareholders). Well, during the two weeks that followed the announcement of the split, the stock returned more than 80%. If this is not magic...

Since Tesla is a very particular case, we are going to give another example of a company with a much more proven and solid business model which, moreover, has the support of investors of the likes of Warren Buffett: Apple. At the end of July, the US technology giant announced its intention to carry out another split (4-for-1 in this case). Did the magic work in this split as well? It seems so. In the month following the announcement, its price rose by 45%. Although this is not the same magnitude as the Tesla move, it is still a dizzying figure, especially considering that Apple now has a market capitalization of over two trillion dollars. By the way, Apple would be another example where a large multiple expansion has taken place, as it currently trades at about 30x its current cash flow generation, when not so long ago it could be bought for less than 7x.

Right now, we’re in an absolute raging mania. We’ve got commentators encouraging companies to do stock splits. Companies then go up 50%, 30%, 40% on stock splits. That brings no value, but the stocks go up.2

Another clear sign is the continuous emergence of "large" new companies, as our admired Bill Nygren explains in his latest quarterly letter. 3 Historically, the largest companies on the stock market were also those with the highest sales or earnings numbers. However, this reasonable dynamic is changing and, this last year alone, the category of large companies (composed of the 250 companies with the highest market cap) has seen 40 new companies enter with sales numbers that are much lower than the average for the rest of the group's companies ($2,400 million compared to $14,000 million). 4 Therefore, the market is pricing in very high growth rates for these new players.

Perhaps the most telling example, also cited by Nygren in his letter, is that of Zoom Video Communications ("Zoom"), one of the companies that has benefited the most from the coronavirus pandemic by offering video conferencing solutions to its users. While we agree that the company has an excellent product (we often use it to talk to the companies we invest in), we find it harder to be comfortable with its market capitalization, especially when competing with large technology companies, such as Microsoft and its Teams application. At the time of writing, Zoom has a market value of around $140 billion. This figure compares, for example, with IBM's market cap of $115 billion or Cisco Systems’ $170 billion, two technological giants in decline, but with the capacity to generate billions of dollars annually. Specifically, IBM generated $12 billion in 2019, while Cisco made $15 billion in cash. These huge numbers are compared with the meritorious, but substantially lower of $1,200 million (if we annualize the first half-year period) that Zoom could achieve this 2020. We have no idea whether Zoom will be able to grow its cash flow generation to five-digit levels, but we do know that the market may be being overly generous with what it is implicitly discounting for this company.

Those two forces that never stop

No tree grows to the sky forever. — Warren Buffett

Lastly, we cannot ignore the two forces that have been increasingly fueling this divergence between a certain type of companies (mostly from the US) and the rest: index funds and central banks' monetary stimulus.

As far as index funds, I would first like to stress that we prefer this name to "passive" because, actually, you are investing in an active way when you decide to buy this type of product, by taking exposure to the performance of the stocks that make up these indices. As is always the case in the investment world, we must be very careful to be guided by labels, as they can distort the reality they are trying to describe (see here about the pointless debate between "value" and "growth" investment styles).

What leads us to think that the rise of index funds may be distorting the market or contributing to this divergence? On the one hand, although drawing out causalities in markets is very difficult, there has been massive money flows into ETFs for years, while actively managed funds have been withdrawn. It is worth noting that since 2008, nearly 2 trillion dollars have poured into index products and a similar amount has exited those actively managed.

5 These money flows into ETFs cause the stocks that make up the tracking indexes to be purchased. So far, so good. All products, whether index or active funds, try to keep their portfolio stable in the face of subscription and redemption activity. The problem comes when we deal with such huge numbers, since ETFs can have a (positive) impact on the performance of the stocks that make up the indexes that they track, as a kind of bottleneck occurs: the larger ETFs with the greatest amount of inflows invest in a small number of companies (usually, as we mentioned earlier, the large US stocks).

Why is this a problem? There are two reasons. The first is that the traditional mechanism of price formation can be distorted, with ETFs buying the basket of the index stocks, regardless of their business performance. In a scenario where money flows incessantly into these products, one may doubt whether, in the end, it is more important for future returns to continue to analyze each company in isolation or to try to anticipate the next trend that will benefit from index funds (e.g. the US stock market and ESG investing). Obviously, we are not saying that analyzing companies’ fundamentals does not work. It is simply that for years now it has not seemed to work for a certain type of companies, which happen to be absent from these index funds. We cannot forget that, as a friend of mine in the industry always says, the ETF business is not about selling you quality sardines, but about selling you the cans that contain them (whether they are quality or not is another issue). Hopefully, over time, investors will begin to see the difference this makes.

Typically, market index changes are the result of the movement in underlying constituents. Today, market index changes are the driver of the underlying constituents.6

The second reason, derived from the previous one, is that securities that are not part of these trends favored by ETFs further suffer from the redemptions in actively managed funds. This is a very similar situation to that experienced by active managers at the end of the 90s, when the investment flow was looking to enter that company that promised to reinvent the wheel thanks to the internet, selling actively managed funds that greatly underperformed in that environment and that also contributed to some of those declines, as they were forced to sell the stocks in their portfolios. A vicious circle that lasted several years and caused much hardship in the industry. Although we don't think we have reached that extreme, we do find companies, generally smaller in size, that have been completely ignored by the investment community. As we always emphasize, we do not have a crystal ball to anticipate when this trend may change, but we are convinced that, if history has shown anything, it is that buying one euro for fifty cents usually ends up paying off, especially when that euro increases in value over time.

Meanwhile, the action taken by governments and central banks around the world, frantically expanding their deficits and balance sheets to alleviate the economic effects of the pandemic, has impacted the fixed income market to unprecedented levels. Thus, sovereign bonds have been posting negative yields on a large part of governments’ debt issuance for some time now. What once seemed an aberration is now completely normal and no one is surprised that this dynamic, far from being normalized, continues to deepen over time.

An example is Greece, whose 10-year bond yield is below 0.9%. Let's remember that we are talking about a country with a debt over its GDP of more than 200% and a “junk" credit rating. It does not seem to be the best candidate to lend it any money, does it? We can give other examples, such as Italy, which today has the highest debt in its history (about 140% of its GDP) and yet its 10-year bond yields less than 0.7%. Or that of our beloved Spain, with a yield of 0.15% for this same maturity. We could fill out sheets counting similar cases for other economies. All of this, with estimated deficits for the Eurozone as a whole ten times greater than last year's. The reality is that we have entered into a dangerous dynamic in which the more a country spends beyond its means and, as a consequence, the more it gets into debt, the less it pays for that debt. And we were talking before about the magic of stock splits! Faced with these yields (that yield close to nothing), investors are forced to invest in high liquid companies with cash flow stability, regardless of the prices at which they trade. It's every man for himself, where the risks incurred are ever-increasing.

For our part, we are not going to participate in this dangerous game, even if it means continuing to suffer from this headwind in our portfolios. We live in a tough investment environment, where the cheap gets cheaper and the expensive gets more expensive. It is neither normal nor sustainable for expensive companies to become more expensive. It is neither normal nor sustainable for a company to split its shares and nearly double its market cap in two weeks. It is neither normal nor sustainable that active management has not added value for a long time. It is neither normal nor sustainable for countries to pay less for more debt. Experience tells us that these excesses end up being reversed. However, we do not know when this will be the case. Again, we do not have a crystal ball—no one does. Today, more than ever, the soundness of the investment process and patience will make the difference in the returns we can achieve with our portfolios.

Main changes to our portfolios

In the world of investing, being correct about something isn’t at all synonymous with being proved correct right away. - Howard Marks

The following is a summary of the most significant changes to our funds’ portfolios:

Horos Value Internacional - Stake decreases & exits:

FINANCIALS

Exposure trimmed from 24.6% to 22.2%

Holdings discussed: AerCap (3.9%), Qiwi (1.4%) and Sonae Capital (exited)

The combined weight cut to financials was mainly due to the exit of our full position in Sonae Capital and the lower weight of Qiwi and AerCap.

Sonae Capital's exit follows the takeover bid launched by the Azevedo family—the management team of the company, as well as of the other entities of the Sonae group—and its majority shareholders through Efanor, for a price of 0.70 euros per share, a premium of c.46% on the previous day's price. As happened with our investment in Clear Media a few months ago, these transactions demonstrate that market inefficiencies cannot be perpetuated indefinitely over time. Sooner or later, someone will decide to take advantage of the low prices at which many companies are trading. Usually, this move will occur earlier in companies controlled/managed by families, who are well aware of the true potential of their businesses and have a clear interest in generating value for their shareholders by having skin in the game. Although we believe that the price offered is much lower than our valuation of Sonae Capital, the alternatives we have in our portfolio offer greater upside potential. For this reason, we decided to exit the position—though we still hold it in our Iberian portfolio.

Additionally, we trimmed our exposure to Qiwi after outperforming the other holdings that make up Horos Value Internacional. The Russian digital financial services company benefited during the period from the announcement of the sale of its consumer financing project, Sovest. As we have pointed out in the past, it was clear that the new initiatives launched by the company in recent years were having a negative impact on the investor community's perception of Qiwi, as the real cash flow generation capacity of the payments business was being concealed and these projects were not delivering immediate results. In the end, Qiwi has been reorganizing, selling or liquidating these lines of business, uncovering its strong cash generation capacity and regaining some of the investors' lost confidence.

Finally, we slightly reduced our position in the aircraft leasing company AerCap, as it became clear that the situation in the airline industry will remain extremely weak for some time. We have no doubts about AerCap's solvency, as the company has continued to issue debt at a similar cost to that before the pandemic and is also taking advantage of the discounts on its debt outstanding to make early redemptions. However, we do believe that its ability to negotiate with the airlines is not the same, given that in the current environment it is the airlines that set the tone. As they say, if you owe your bank manager a thousand pounds, you are at his mercy. If you owe him a million pounds, he is at your mercy.7

A recent example of this can be found in the bankruptcy process of the airline Aeroméxico. The Mexican company has managed to renegotiate with all the entities that lease it aircrafts, modifying the conditions of the contracts in order to adapt the lease payments to the effective flight hours, instead of paying a fixed monthly amount. AerCap and the rest of the lessors would not accept this type of change in a "normal" market. Similarly, AerCap and the rest of the players have been granting delays in lease payments to the airlines, in order to give them some breathing room, usually in exchange for increasing the duration of the contracts and charging future interest on this delay. The goal is twofold. On the one hand, to avoid putting too much financial pressure on their clients, since in this very tough market they could go bankrupt. And on the other hand, to try to minimize the negative impact on the expected return of those leases. Therefore, a very challenging environment (as we kind of expected), in which the upside potential for this excellent company has been significantly hit.

We continued to gradually trim exposure to the technology platforms segment. A high-quality sector, in which we have maintained a significant historical weight in our portfolio. However, as we have always stressed, the margin of safety is the most important factor in obtaining sustainable returns over time and the current market dynamics, which we discussed above, are leading these companies to become more expensive at a dizzying rate. For this reason, we sold part of our position in Naspers (the South African holding company that controls more than 30% of the Chinese giant Tencent), which explains the weight reduction to this theme in the quarter.

On the other hand, we would like to highlight that we maintain our conviction in Baidu, the other great Chinese technological platform included in our portfolio. The company continues to demonstrate, as the quarters go by, its capacity to adapt in a competitive environment that is totally disruptive to its traditional business of searching for information on the Internet (remember that it is known as “China's Google”). This is due to the progressive consolidation of its super application (Baidu App) that brings together its services, as well as others that keeps adding, thus increasing the value of its ecosystem compared to its peers, such as WeChat (Tencent) or Alipay (Alibaba).

LNG AND CRUDE OIL INFRASTRUCTURE AND SHIPPING

Exposure trimmed from 8.4% to 7.8%

Holdings discussed: Golar LNG (1.9%)

At the end of August, Golar LNG's subsidiary, Hygo Energy Transition (formerly Golar Power), announced its intention to go public through an IPO (sale of new shares issued with a capital raise). The aim of this move was to raise funds to finance its expansion in electricity generation and liquefied natural gas distribution. The valuation range released by Golar LNG for this subsidiary turned out to be significantly higher than our own valuation as well as the analyst estimates, which caused the stock to rally by 45% following the announcement.

However, on 23 September, an accusation against Eduardo Antonello, Hygo's CEO, was made public. Specifically, he was accused of being involved in the incrimination of the oil drilling company Seadrill, where he worked until 2015, for bribes made in 2014. Following this announcement, Golar LNG's share price plummeted by more than 30% in a single day and it was forced to suspend Hygo's IPO, in addition to dismissing Antonello. Golar LNG claims that whatever happened to Antonello's previous job position has no impact on Hygo. In our opinion, the tenders in Brazil conducted in recent years are especially transparent, with a computerized process, in which the submission of bids is done telematically. That said, an accusation of this nature is not good news for the company, whatever the result, since the reputational damage is high, takes some time to be repaired and may end up affecting the awarding of new contracts in this area. As of writing, Hygo's valuation represents just over 25% of the value of the Golar LNG group.

Despite this, we still believe that Golar LNG has a high upside potential, not only because of the value of Hygo, but also because of other parts of the business, such as FLNGs (ships that liquefy natural gas at sea), where Golar LNG is one of the pioneers and most experienced and successful players in this market. Proof of this is that Golar LNG has restarted the manufacture of the FLNG Gimi—let’s recall that their client, BP, had asked for a 1-year delay in the manufacture, alluding to force majeure causes.

Stake increases:

RESTAURANT BUSINESS

Exposure increased from 2.3% to 4.0%

Holdings discussed: The ONE Group Hospitality (2.6%) and Tang Palace China Holding (1.4%)

This weight increase is due to our interest in continuing to build a larger position in both companies, after initiating our investment in the previous quarter.

As we highlighted in our previous letter, The ONE Group Hospitality ("ONE") controls, develops, manages and franchises high-end restaurants in the United States. In addition, the company provides turnkey food and beverage solutions to luxury hotels, casinos and other premium locations. In the second quarter, as could be expected, the company’s sales plummeted, ranging from 53% (Kona Grill) to 81% (STK). However, the measures taken before the pandemic by the new management team have allowed ONE to weather the storm and, with the improvement in occupancy in recent weeks and the progressive implementation of food delivery, is even being able to generate cash. Something very commendable and that reinforces our conviction in this investment. In fact, as a result of this “good” business performance the share price rose by 25% in the quarter.

For its part, Tang Palace China Holdings ("Tang Palace") is a company that owns restaurants and food production and service businesses in China. Tang Palace operates under both its own brands and those of third parties through joint ventures. As in the case of ONE, the Asian company has had a very challenging six months, during which sales fell by around 45%. However, the gradual recovery of the business, as well as the company's cost efficiency, allows it to continue generating cash flow in such a difficult environment. This, together with a solid financial position, gives Tang Palace the capacity to withstand the uncertain future.

Horos Value Iberia - Stake decreases:

COMMODITIES

Exposure trimmed from 15.3% to 14.5%

Holdings discussed: Atalaya Mining (2.1%)

The copper producing company, Atalaya Mining ("Atalaya"), has greatly benefited from the strong recovery in copper prices since we made our investment in mid last quarter. In particular, the metal has risen by nearly 40% from the lows reached at the end of March, which led to a gain of almost 100% for Atalaya since our entry. As a result, we slightly reduced our position in the company.

On the other hand, Atalaya has continued to demonstrate its ability to improve its operating efficiency once the expansion phase of the Riotinto project was completed, reducing costs during the quarter and demonstrating its strong cash generation capacity.

OTHER

2.3% of the fund

Holdings discussed: Meliá Hotels International (5.1%) and Sonae Capital (4.0%)

As far as Sonae Capital goes, the reasons for reducing the size of the position are due to the takeover bid process we have discussed in the section on Horos Value Internacional.

In the case of Meliá Hotels International ("Meliá"), the business deterioration continues to be very pronounced, especially after the effects of the recent increase in coronavirus cases and the restrictions announced by the various governments. In fact, the company announced that the latest quarterly results were the worst in its history as a listed company, with a nearly 95% decline in revenue. As a result of this, Meliá has written-down its hotel assets and it is unlikely to be the last time this happens. At the financial level, Meliá has a relatively comfortable schedule for the maturity of its debt and mechanisms to deal with prolonged situations of stress, such as the sale of some of its hotels. Additionally, Meliá is testing alternatives to generate income, such as converting some of its hotels into workspaces for companies.

Of course, the company is in a complicated situation, which has led to lowering our upside potential estimate on several occasions. Nevertheless, we believe that the risk-return equation remains attractive at current price levels, which is why we still own a significant—albeit smaller—position in this company. On a positive note, the Escarrer family (business managers and controlling shareholders) increased their stake in Meliá at the end of September, buying shares for the sum of one and a half million euros.

Stake increases:

REAL ESTATE

Exposure increased from 9.7% to 12.6%

Holdings discussed: MERLIN Properties (5.2%) and Inmobiliaria del Sur (3.6%)

We took advantage of their persistent stock price weakness to increase our position in the real estate companies MERLIN Properties and Inmobiliaria del Sur.

Regarding the REIT MERLIN Properties SOCIMI ("MERLIN"), we already mentioned in previous letters the quality and good balance of its assets, where the negative aspect can be found in the near 20% exposure (in terms of gross asset value) to shopping centers, offset by the excellent performance of its logistics centers, which have benefited greatly from the accelerated growth of e-commerce. Furthermore, the REIT has a solid financial position, with a very comfortable debt maturity schedule, as well as one of the best management teams in the sector. Finally, there has been speculation this quarter about the possibility of MERLIN being taken over, taking advantage of its current attractive valuation. In particular, it seems that Brookfield Asset Management might be interested in the Spanish firm. In any case, we believe that current prices discount a very unlikely scenario of falling asset values for MERLIN, which provides a very high margin of safety for this investment.

Inmobiliaria del Sur has also shown its resilience in this crisis, having a property division with quality assets (occupancy rates close to 90%, with more than half of the idle capacity under reform) that gives the company recurring revenue. On the other hand, the development division is managed in a very conservative way, relying on agreements with third parties through joint ventures for the development of the projects. In addition, the company leverages on this division to grow its property business.

An example of this is the Parque Empresarial Río 55 project. This is a complex with two office buildings located in Madrid, each with an area of 14,000 square meters and a total of 400 parking spaces. This project was developed by the development division of Inmobiliaria del Sur. While the Edificio Sur was sold in 2018 to a fund managed by AEW, the Edificio Norte is 90% controlled by the company and was rented out in its entirety to Banco Cetelem a few months ago, for a period of ten years, substantially increasing the rent received annually by Inmobiliaria del Sur's property business.

OTHER

1% of the portfolio

Holdings discussed: Gestamp (4.2%)

Finally, we would like to highlight the increased exposure to Gestamp, the company that manufactures bodywork products, chassis and other systems for automobiles. The firm has suffered, as it cannot be otherwise, from the terrible crisis that car manufacturers are experiencing. Specifically, its sales fell by 59% in the quarter, resulting in negative EBITDA for the period. Although the company has a relatively high debt level in the current context—as a result of the large business expansion of recent years—there are several reasons to be optimistic about this investment going forward. On the one hand, Gestamp has demonstrated a surprising capacity to reduce costs in this difficult environment, in addition to announcing a Transformation Plan that will help improve the company's expected profitability in the long term (EBITDA margin for 2022e of 13%). On the other hand, the growing penetration of hybrid and electric vehicles will benefit Gestamp's product by offering solutions that lighten the weight of its structures (batteries, in addition to taking up space, increase the weight of the car). If we add to this a first-class management team, a family shareholding structure and a share price at all-time lows, one can understand the attractiveness we see in Gestamp today.