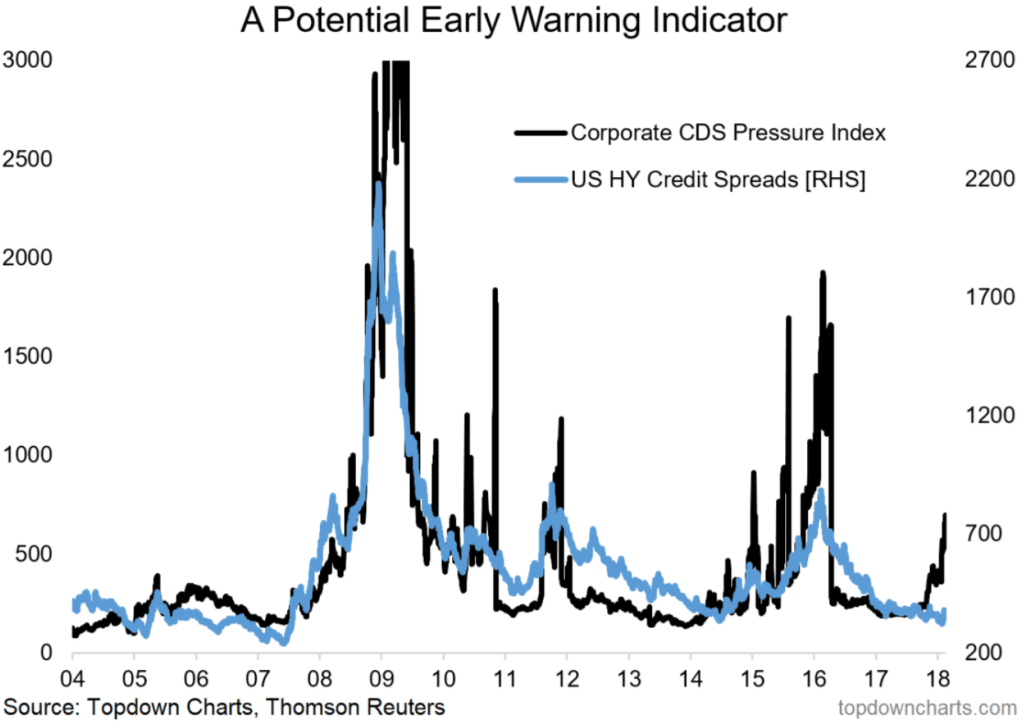

US high yield credit spreads seemed to basically slumber through the stock market correction and VIX spike. This leaves a question as to whether this is all as it should be or indeed if credit investors are asleep at the wheel. We introduce a new indicator which seems to be presenting a potential early warning sign for credit spreads.

The indicator, which we call the “Corporate CDS Pressure Index” is based on sectoral CDS (Credit Default Swap) premium pricing from Thomson Reuters. The index is designed to give extra weight to sectors which are seeing a widening of risk premia. As you can see it lines up fairly well with previous blowouts in US HY credit spreads.

The indicator appears to work most of the time as a coincident/confirming indicator, but there are times were say a series of spikes preceded a more sustained and significant widening in spreads. It makes sense because usually if there's trouble in one sector then there is the potential for that to spillover across broader risk pricing and credit conditions, plus with ETFs and passive investing it can contribute to indiscriminate selling.

So the open question is whether this early warning indicator is sounding a false alarm or is an omen of things to come for credit and risk assets in general. It certainly provides food for thought, particularly alongside the initial comment around how credit spreads seemed to almost sleep through a major VIX spike.