According to exclusive new data from the Citco group of companies (Citco), the global alternative investment asset servicer with over $1.8 trillion in assets under administration, hedge funds delivered another positive performance in May, although performance dipped month-on-month, with a total weighted average return of 0.4%.

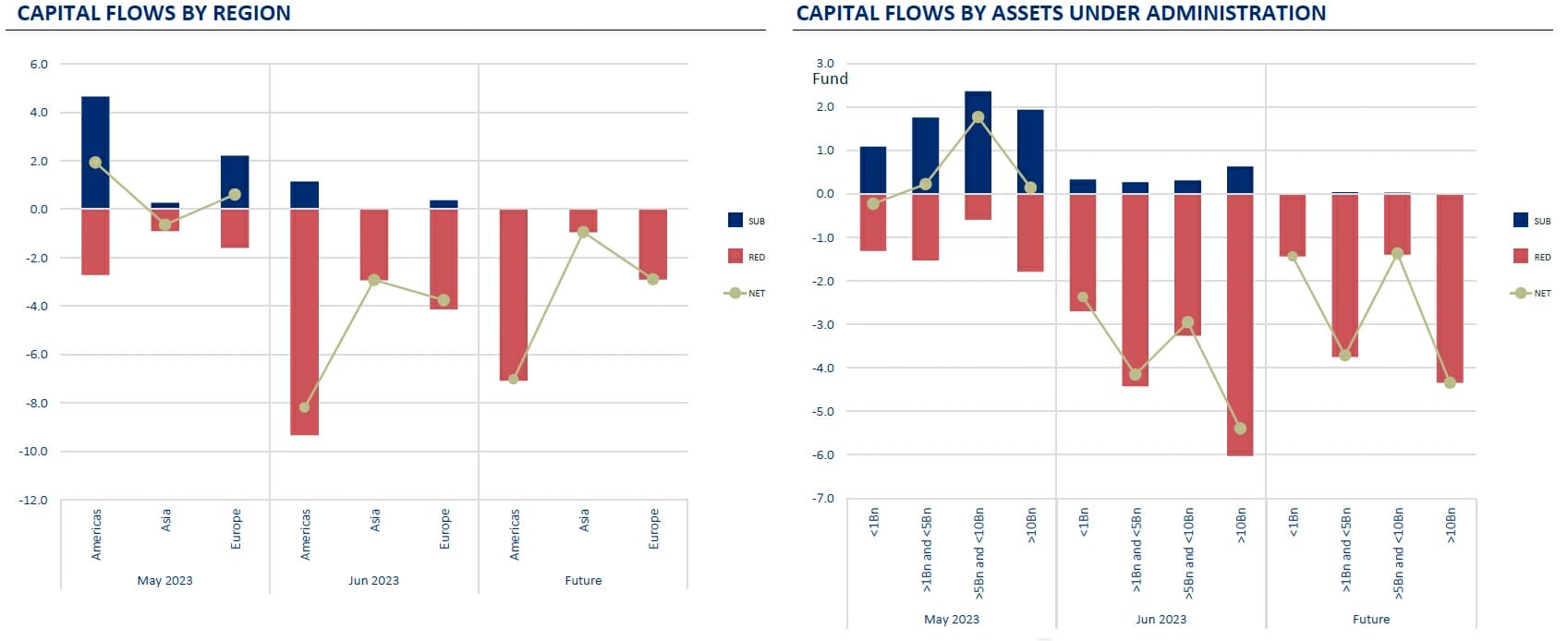

Net inflows into funds based in the Americas and Europe continued in May, while funds situated in Asia once again saw outflows. Overall, net inflows in May reached $1.9Bm, almost four times’ April’s total of $05.B, as subscriptions of $7.1B came in well ahead of redemptions totalling $5.2B.

Executive Summary

Performance

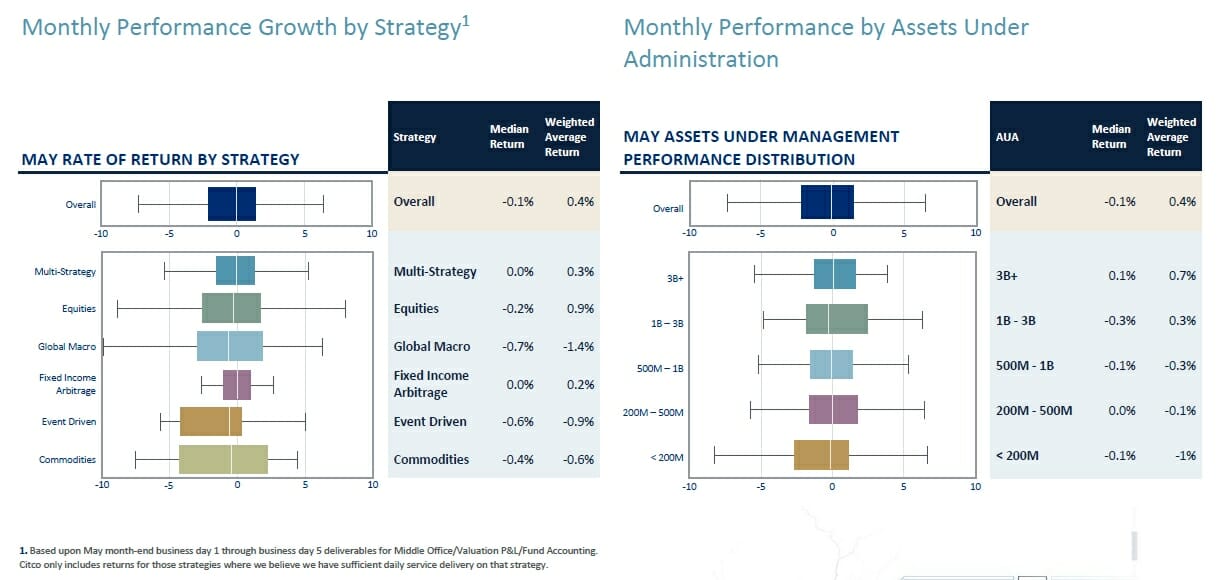

Hedge funds built on their recent performance with another positive month in May, achieving a total weighted average return of 0.4%, although performance dipped compared to the previous month.

Returns were driven by larger funds, with the median return for funds administered by the Citco group of companies (Citco) coming in at -0.1%. Overall, May’s gains took the year-to-date weighted average return to 6.02%.

Less than half of funds achieved positive returns, with the figure dipping to 48% in May, having been at 65% the previous month. The rate of return spread, which shows the difference between the 90th and 10th percentile fund returns, also widened back out from 6.7% in April to 8.6% in May as returns volatility increased.

At a strategy level, the same three winners from last month continued to post positive – albeit lower – returns in May. Equities strategies were the top performers, with a weighted average return of 0.9%, followed by Multi-Strategy which saw returns of 0.3%. While they managed to stay in positive territory, Fixed Income Arbitrage funds experienced the largest drop in performance in May, with a weighted average return of 0.2% – a significant fall from the 2.2% it achieved in April.

Returns for the remaining strategy types all worsened month-on-month, with weighted average returns of -0.6% for Commodities, -0.9% for Event Driven, and -1.4% for Global Macro funds, with some negative outliers within the Global Macro funds category dragging down the overall performance.

On an assets under administration (AUA) basis, the picture was also more mixed in May. The largest funds in the $3B+ category had the highest weighted average return of 0.7%, followed by 0.3% from the $1B-$3B category.

All remaining AUA categories had negative months, with the smallest funds with less than $200M seeing the worst weighted average return of -1%. The $200M-$500M and $500M-$1B categories had weighted average returns of -0.1% and -0.3% respectively.

Capital Flows

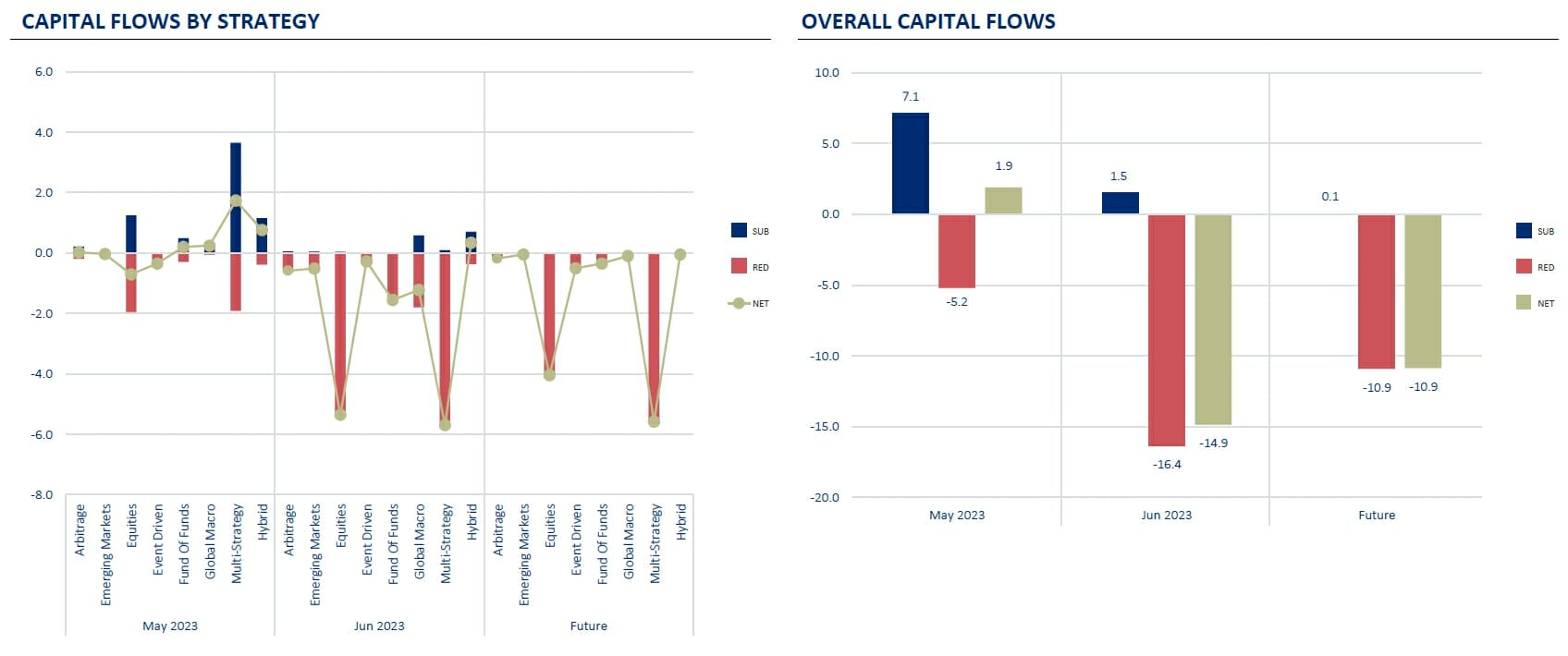

May saw investor flows remain positive for a second consecutive month as Multi-Strategy and Hybrid funds continued to attract capital.

Net inflows came in at $1.9B, almost four times’ the previous month’s total of $0.5B, as subscriptions of $7.1B came in well ahead of redemptions totaling $5.2B.

Multi-Strategy funds took the lion’s share of net inflows, at $1.7B, followed by Hybrid funds at $0.8B, while Fund of Funds and Global Macro strategies also saw net inflows of $0.2B each.

Once again, Arbitrage and Emerging Markets funds were both flat in terms of investor flows, while Event Driven and Equities funds saw net outflows of $0.3B and $0.7B respectively.

Net inflows were also seen across most Assets Under Administration (AUA) buckets. Funds with assets between $5B-$10B stood out from the pack in May with the highest net inflows of $1.8B, while funds with assets between $1B-$5B and more than $10B saw net inflows of $0.2B and $0.1B respectively.

April’s trend of net inflows into funds based in the Americas and Europe continued into May, with net inflows of $1.9B and $0.6B for the two regions. Meanwhile, funds situated in Asia once again saw outflows, with these climbing to $0.6B in May, up from $0.4B the previous month.

Looking out longer term, the forecast for the end of the quarter continues to indicate outflows will climb, with the current projection of $14.9B an increase on last month’s $13.9B. Future outflows also one again ticked up, this time to $10.9B, versus last month’s figure of $8.7B, although we expect further fluctuations here.

Citco Named ‘Best Administrator – Middle Office Services’ At The With Intelligence Hfm European Services Awards 2023

The Citco group of companies (Citco) was named “Best Administrator – Middle Office Services” at the With Intelligence HFM European Services Awards 2023.

Each year, With Intelligence recognizes hedge fund service providers who demonstrate exceptional client service, innovative product development, and strong and sustainable business growth by bringing the European hedge fund services community together to connect and celebrate the latest achievements.

We are thrilled to win this award, and it is great to see industry recognition for our team and the dedication they show to their work every day.

Performance

Overview of Investor Flows

Insights into Trade Volumes

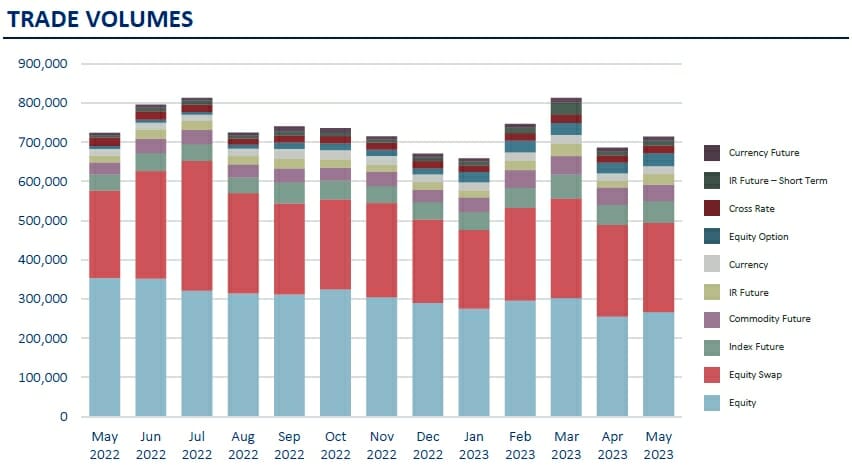

Trade volumes were up 4.1% overall in May as volatility in equity markets continued to decline towards pre-pandemic levels. Volatility has dropped sharply in recent months and now sits at its lowest point since late 2019, against a backdrop of central banks continuing to raise rates.

The moderate increase in volumes was evident across all trading strategies. Trading in index futures & options, as well as interest rate and credit default swaps, was up significantly month over month, with bets on rates up 80% in May. This was led predominantly by high-frequency trading strategies. Our trade ingestion STP rate was a healthy 97.6% in March.

Insights into Payments, Treasury and Collateral

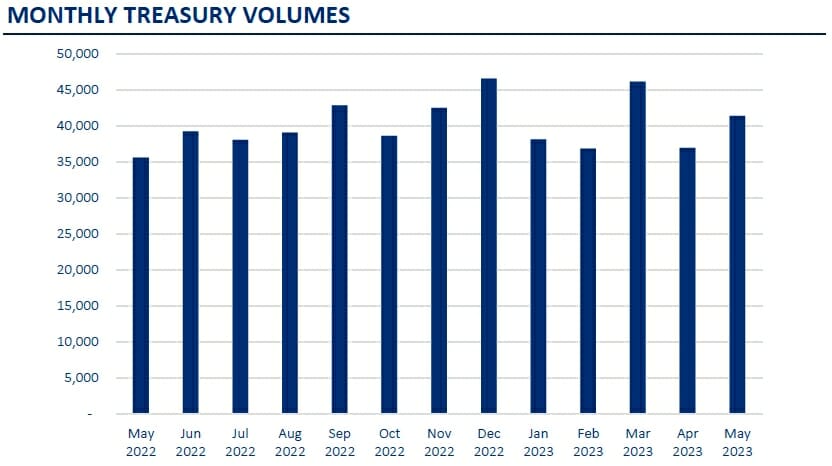

Treasury volumes jumped more than 10% month-on-month in May to climb back above 40,000 payments. Having dipped at the start of the quarter to 36,929, payments rebounded to 41,379 in May. They were also 16% higher compared to the same month last year.

On a multi-year basis, the trend of increasing payments is well established. May’s total is almost 50% higher than volumes seen in May 2021, and is more than double the amount seen in the corresponding month in 2020.

As we move into the summer, policy decisions by the Federal Reserve have continued to boost the appeal of certain Treasury assets, especially as inflation continues to cool – albeit slowly. Over the coming months, more signs that inflation is coming under control will likely increase the appeal of these assets further.