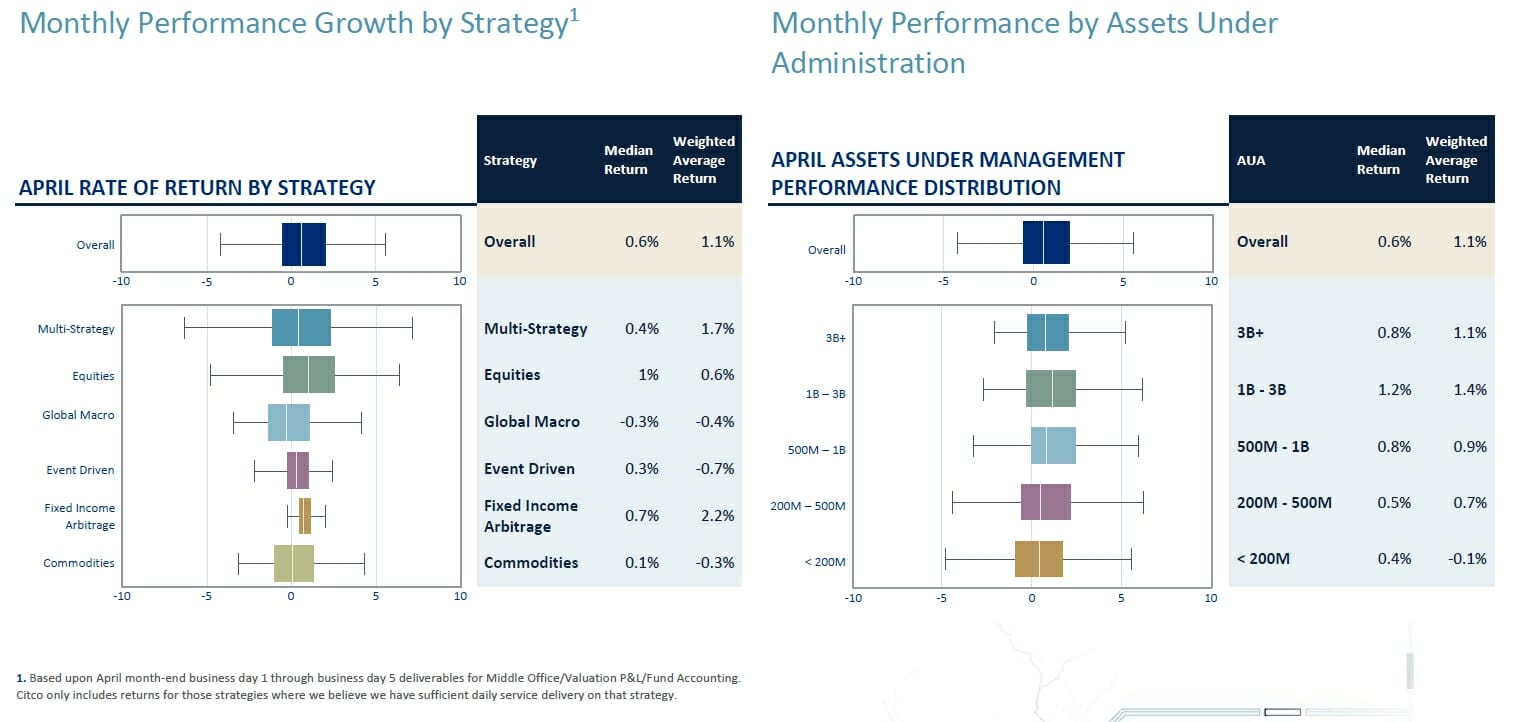

According to exclusive data from the Citco group of companies (Citco), the global alternative investment asset servicer with over $1.8 trillion in assets under administration, hedge funds recorded another positive month in April, with a total weighted average return of 1.1%, taking the YTD return 5.58%.

On top of this, Citco’s data shows that larger funds delivered a stronger performance in April and that the market seems to show signs of a reduction in returns volatility across funds.

Executive Summary

Performance

Funds administered by the Citco group of companies (Citco) also recorded a median return of 0.6%, with the difference between the two suggesting stronger performance from larger funds in April.

Some 65% of funds had positive returns in April, a big jump from the 48% in March. The rate of return spread, which shows the difference between the 90th and 10th percentile fund returns, also dropped from 7.8% in March to 6.7% in April. This points to a reduction in returns volatility across funds.

At a strategy level there were two standout winners. Fixed Income Arbitrage funds were the top performing strategy type, with a 2.2% weighted average return in April, followed by Multi-Strategy funds which continued their upwards trajectory this year with a weighted average return of 1.7%, which followed a 1% gain the previous month. Equities also saw positive performance of 0.6%.

The remaining strategies all saw muted negative returns but they were much improved from the previous month; Event Driven funds had a weighted average return of -0.7%, followed by Global Macro at -0.4% (a big improvement from the -3.7% seen in March), and Commodities funds at -0.3%.

On an assets under administration (AUA) basis returns were positive for all but the smallest of funds. The $3B+ category saw a weighted average return of 1.1%, below last month’s reading of 1.8%, but nonetheless continuing their positive run this year, with gains every month so far.

The $1-3B category was the top performer, coming in at 1.4%, while the $500M-$1B and $200M-$500M categories achieved performance of 0.9% and 0.7% respectively. Funds with assets below $200M came in at -0.1%, but this was a big improvement on last month’s weighted average return of -1.1%.

Capital Flows

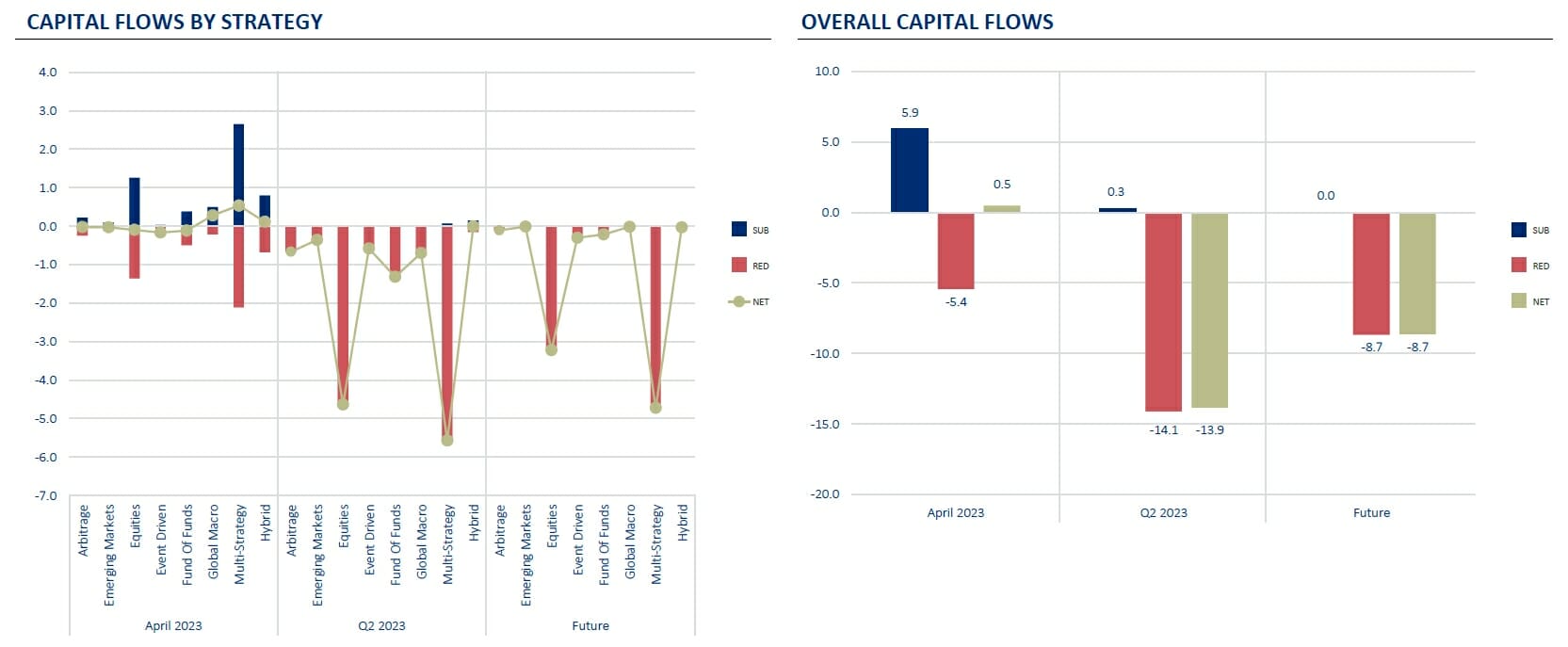

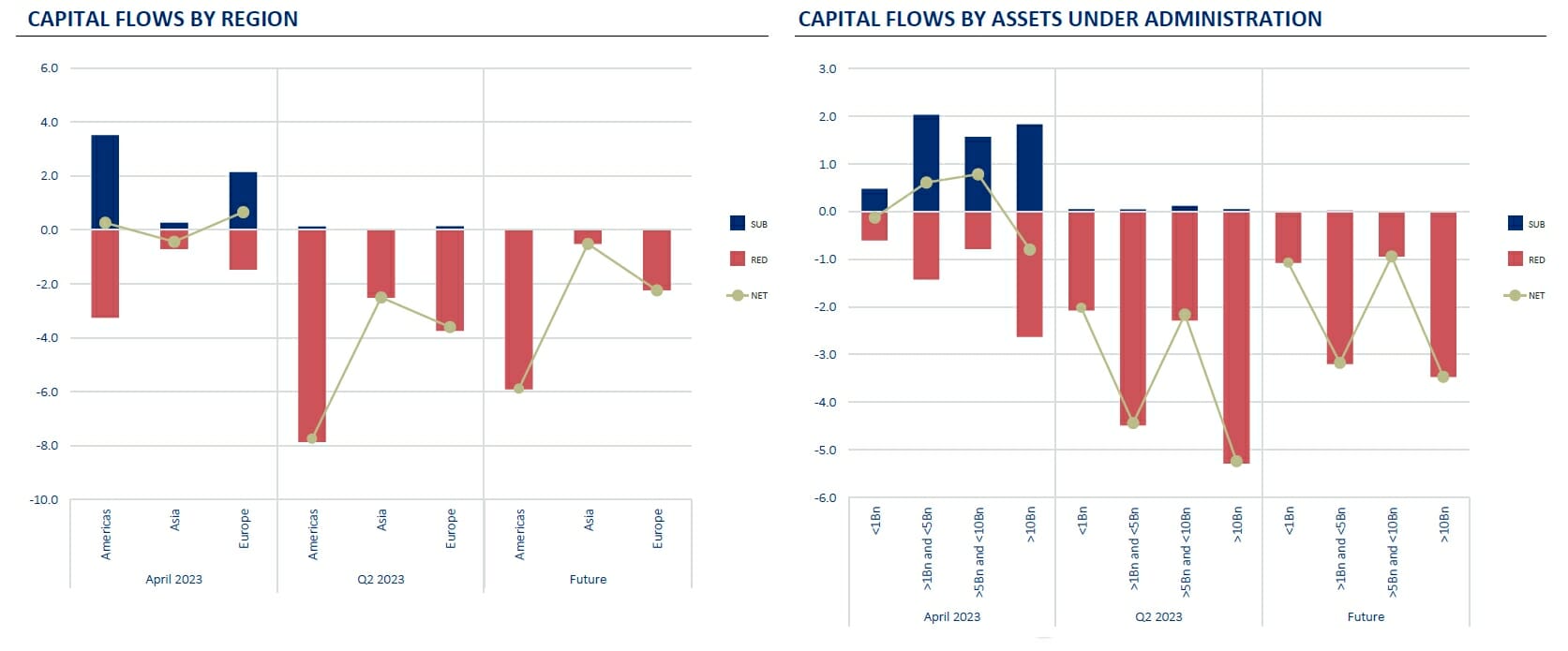

Investor flows swung back into positive territory in April as strategies including Multi-Strategy and Global Macro saw positive inflows.

In total, net inflows came in at $0.5B, with subscriptions of $5.9B ahead of redemptions of $5.4B.

Multi-Strategy funds saw the highest inflows of $0.5B, followed by Global Macro funds at $0.3B, and Hybrid funds at $0.1B.

Arbitrage and Emerging Markets funds were both flat for the month, while Event Driven, Fund of Funds and Equities all saw muted outflows between $0.1B and $0.2B.

At an AUA level, the majority of the activity was seen in larger funds. Funds with assets between $1B-$5B and $5B-$10B saw overall net inflows of $0.6B and $0.8B respectively, while the largest funds with more than $10B of assets saw outflows of $0.8B.

Funds based in the Americas and Europe enjoyed inflows in April, reversing last month’s outflows after coming in at $0.3B and $0.7B respectively. Funds in Asia saw outflows of $0.4B, although this was far lower than the previous month’s outflows of $1.7B.

The current forecast for Q2 shows overall net redemptions at $13.9B, a jump on last month’s forecast of $8.3B. Longer term, future outflows have ticked up to $8.7B from $7.2B in March’s report.

Citco Middle Office Solutions Report: Treasury Values Surge To $418B In Q1 2023

The value of treasury transactions among alternatives and institutional funds increased by 25% to $418B in Q1 of this year versus the previous quarter, according to Citco, amid an on-going, near-unrecognizable interest rate environment and a surge in banking sector volatility.

The banking sector volatility seen in the first quarter – which resulted in the back-to-back collapses of Silicon Valley Bank and Signature Bank, as well as the takeover of Credit Suisse – created large cash movements and drove up the dollar value of funds.

However, this flight did not entirely underpin this quarterly increase in transaction value: it is a continuation of last year’s trend of managers putting more cash to work as return-generating assets following soaring inflation and rapid rate hikes – as well as funding and transfers, the majority collateral-related resulting from increased margin calls.

According to Citco’s Q1 2023 Middle Office Solutions Report, the value of treasury transactions not only increased by 25% quarter-on-quarter, but the volume of securities-based margin movements also soared by 66% in Q1 – as managers looked to post securities rather than cash as collateral, leaving cash to work as an alpha-generating tool. To read the full report click here.

Insights into Trade Volumes

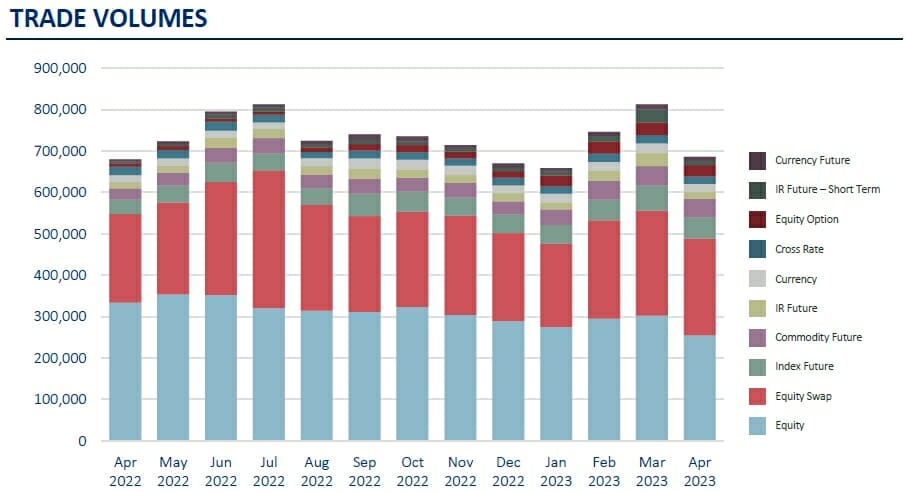

We noticed a steady decline in volatility through the second half of March, which then continued on through April. There was a decline in trade volume levels compared to February and March, mainly led by high-frequency trading strategies.

Meanwhile, market volatility dropped to its lowest point since the summer of 2021, and this translated into lower trade volumes in equity markets, focused on managers that have larger volumes in the equity and equity swap markets.

However, the daily average volume across the rest of the managers was marginally higher than prior months, particularly in commodities and equity derivatives. Our trade ingestion STP rate was a healthy 97.4% in March.

Insights into Payments, Treasury and Collateral

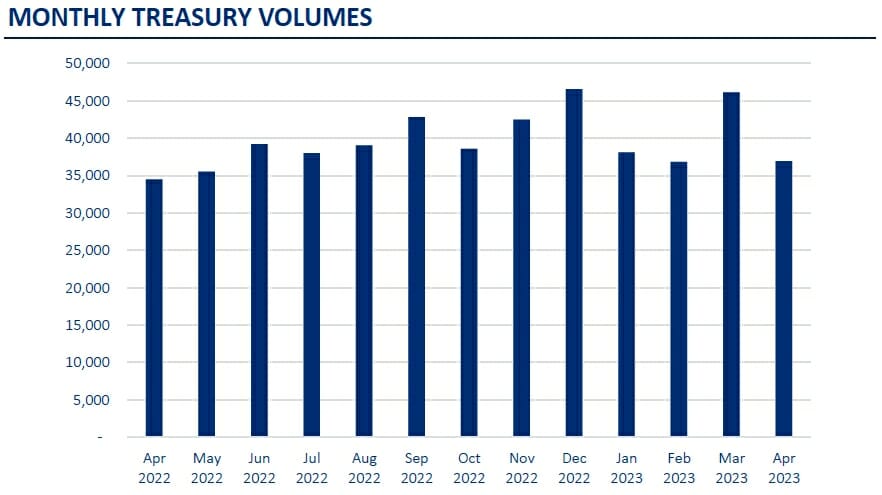

Treasury volumes recorded their highest ever total for the month of April, although they dipped back from the highs seen in March.

Treasury payments came in at 36,929, some 7% higher than the corresponding month last year, but below March’s reading of 46,120 – itself the second highest level ever seen.

The fall month-on-month continues a long-running pattern seen in previous years, with transaction volumes typically lower as investors take stock of portfolios after a busy quarter end.

Looking further ahead, the economic backdrop remains supportive for Treasury assets, with interest rates at multi-year highs as central banks continue to tackle stubbornly persistent inflation. This in turn continues to present investors with opportunities to put cash to work as an asset class, something Citco data continues to suggest they are doing.