Hedge funds are having a much better year this year after posting four months of performance-based gains, but it seems investors aren’t happy yet to leave their money in. According to Eurekahedge, investor redemptions in March more than offset performance-based gains. In April, investor allocations to hedge funds were balanced by outflows from fund liquidations as performance-based growth remained strong.

Eurekahedge Hedge Fund Index gained in April

Q1 hedge fund letters, conference, scoops etc

The Eurekahedge Hedge Fund Index was up 1.06% for April, marking the fourth consecutive month of gains. Year to date, the index is up 5.15% through the end of April. The global equity and bond markets have been in recovery mode since the beginning of the year. Fund managers recovered the losses recorded last year thanks to promising economic data, dovish central banks and optimism about the trade talks between the U.S. and China.

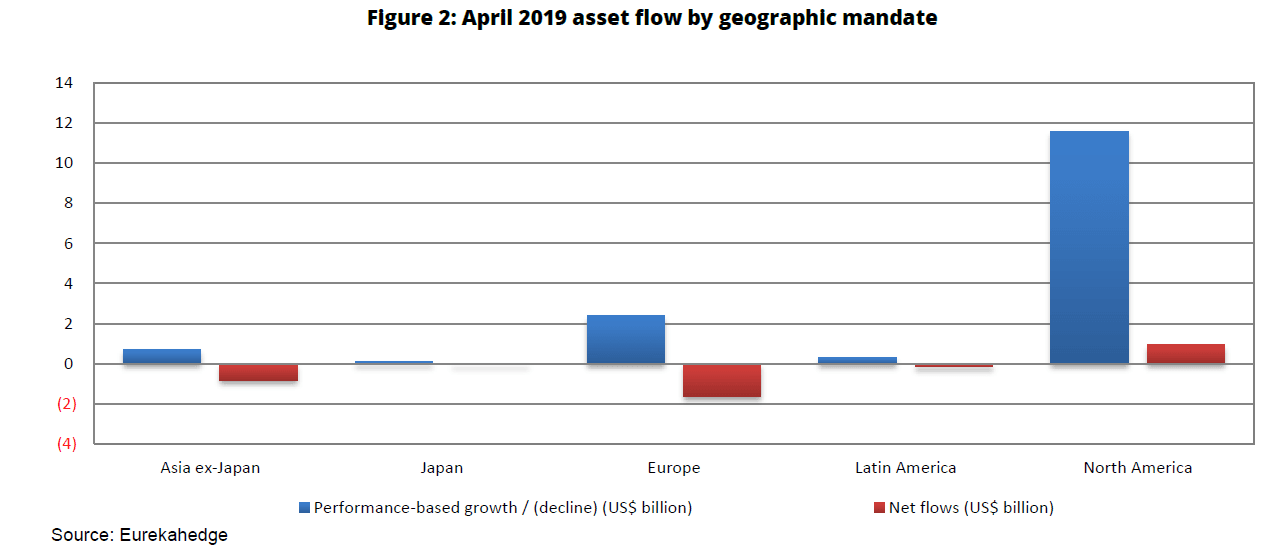

Most managers who are tracked by Eurekahedge ended April in the green. Those with geographic mandates in North America and Japan beat their peers focused on other parts of the world.

Redemptions are finally starting to slow

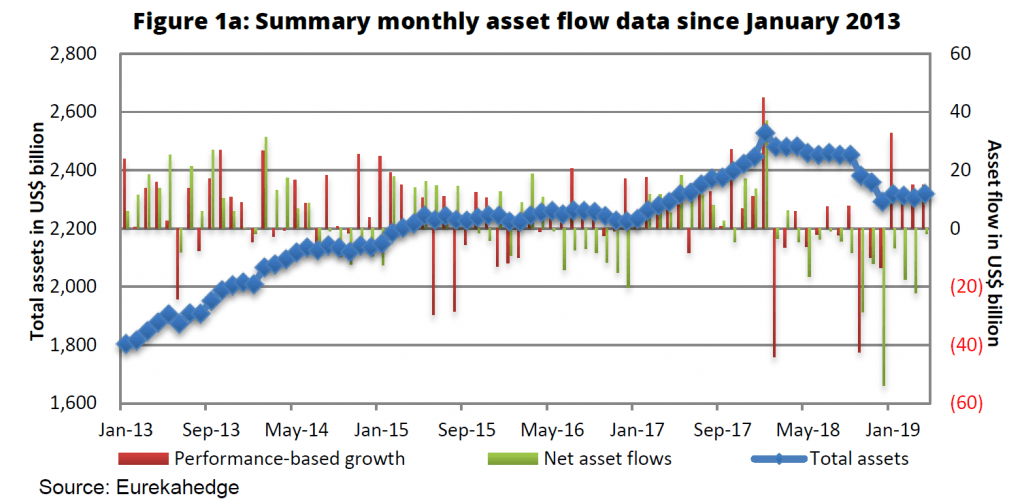

The final numbers for March show $14.9 billion in performance-based gains and $22.2 billion in investor redemptions. The first three months of the year saw one of the strongest first-quarter returns since the financial crisis. Preliminary April numbers showed $15.1 billion in performance-based gains and $1.8 billion in investor outflows.

The global hedge fund industry had $2.32 trillion in assets under management as of April, representing a 1.2% increase year to date. Last year assets in the industry were down 6.3%. Year to date, hedge funds have seen $75.2 billion in performance-driven gains and $48.2 billion in investor redemptions. In the first quarter, net outflows totaled $46.4 billion, compared to the $94.7 billion in redemptions recorded in the fourth quarter of 2018.

North American funds were on top in APril

North American hedge funds gained 1.36% in April, and long/ short equity funds in the region gained 2.07%. Funds in the region saw net inflows of $900 million and $11.6 billion in performance-based gains.

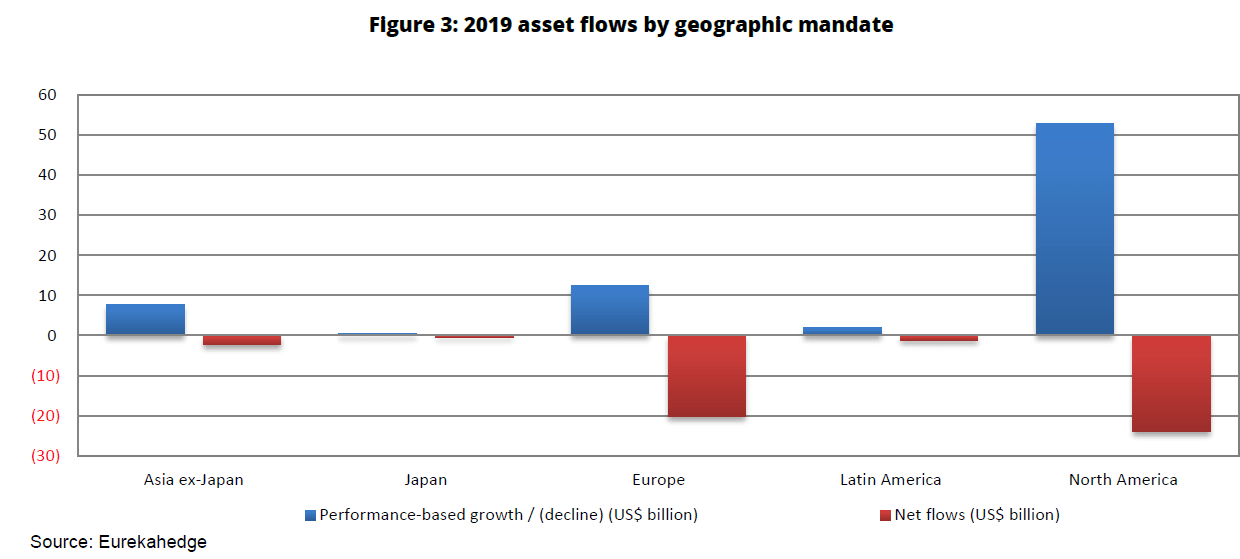

Year to date, North American funds have recorded $52.9 billion in performance-driven gains and $24 billion in outflows through the end of April.

Investors became more optimistic on the North American equity market due to positive earnings surprising and continuing dovish commentary from the Federal Reserve. For the first four months of the year, the Eurekahedge North American Hedge Fund Index gained 6.73%.

Long/ short equity led the way in April

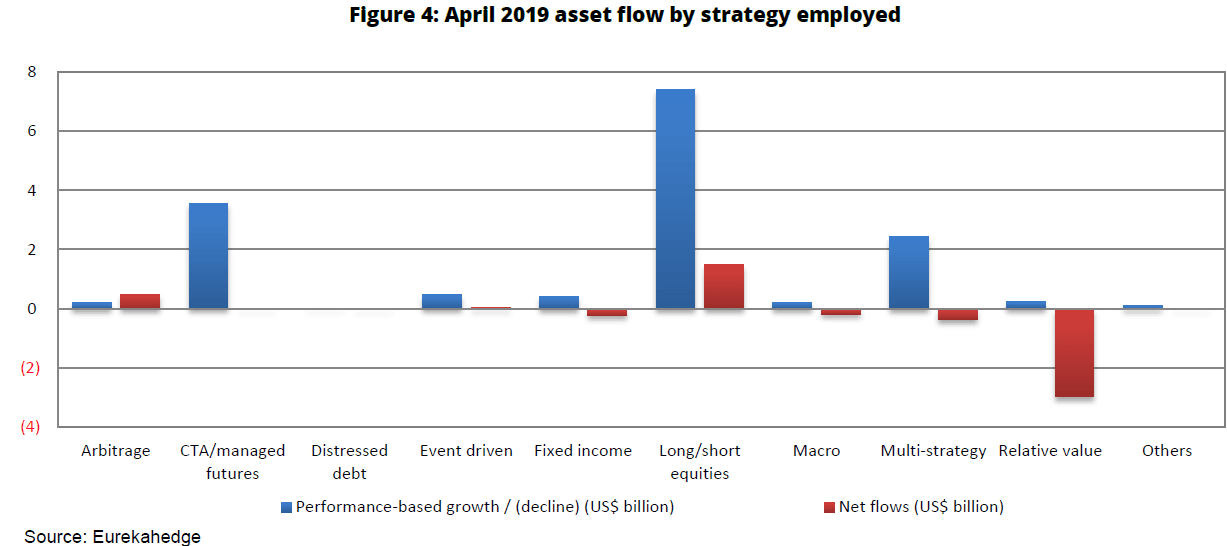

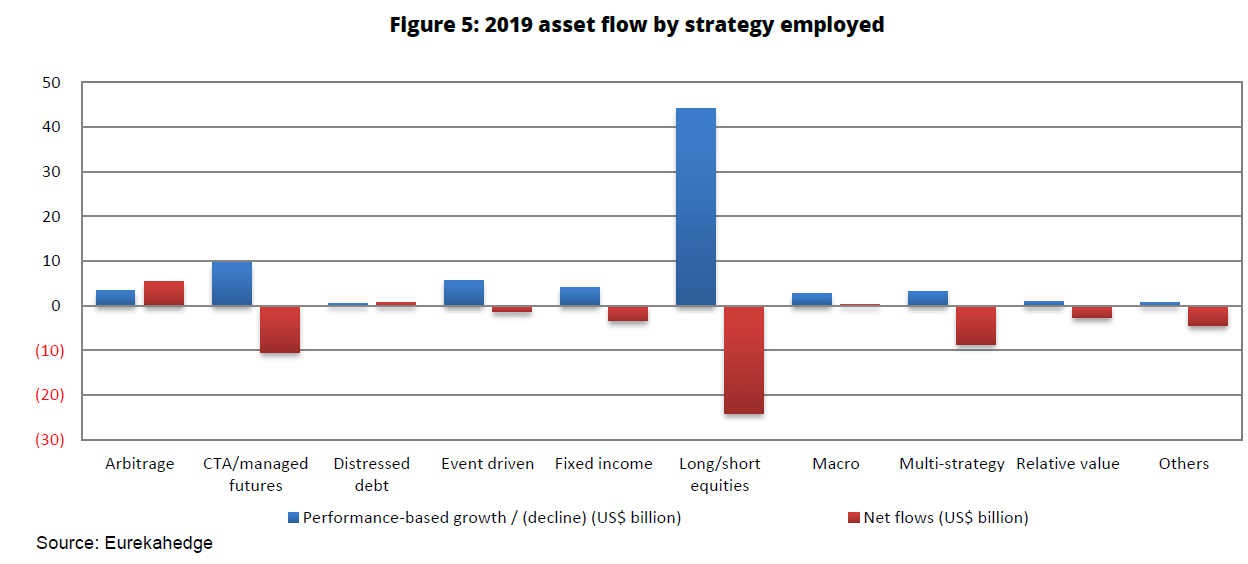

Among major hedge fund strategies, long/ short equity funds significantly outperformed the others. Long/ short equity funds recorded $7.4 billion in performance-based gains during April after benefiting from risk-on sentiment.

CTA/ managed futures funds saw $3.6 billion in performance-driven growth. Relative value funds saw the steepest investor redemptions at $3 billion in April.

Year to date, long/ short equities funds have felt the wrath of investors as redemptions totaled $24 billion despite the $44.1 billion in performance-driven gains they have recorded in the first four months of the year. CTA/ managed futures and multi-strategy funds recorded outflows of $10.4 billion and $8.6 billion, respectively. Arbitrage funds recorded $5.5 billion in investor inflows for the first four months of the year.

This article first appeared on ValueWalk Premium