Analysts remain cautious on Adagio, but they’re watching for more discipline regarding drug pipeline

M28 Capital Increases Adagio Therapeutics Stake

Last Friday, health care focused hedge fund M28 Capital filed a 13D/A with the US Securities & Exchange Committee revealing it bought 2.85 million Adagio Therapeutics (NASDAQ:ADGI) at an average of $4.28 per share, bringing its holding to 9.2 million, or 8.5% of the company.

M28 Capital bought its first 5.6 million ADGI shares in May 2021 and the second in April 2022.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

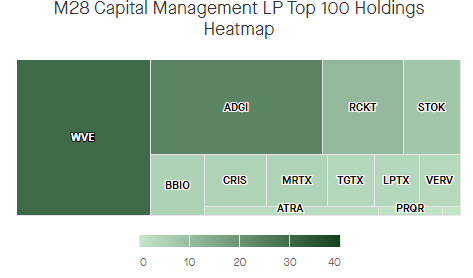

This latest transaction likely makes ADGI the fund's largest holding by market value. The fund also holds stakes in Wave Life Sciences (US:WVE), Rocket Pharmaceuticals Inc (US:RCKT), Stoke Therapeutics Inc (STOK) and BridgeBio Pharma (US:BBIO).

The heat map below displays the largest positions by size before this latest ADGI transaction:

Adagio released second quarter financial results on Aug. 15, posting a 47 cents a share loss, slightly ahead of the consensus estimate of 53 cents.

Additionally, the company recorded research and development expenses of $37 million, which came in below market forecasts.

ADGI reported $475 million in cash and cash equivalents at quarter end. Management believes the funds are enough to fund operations through the middle of 2024.

"With numerous antibodies identified, we intend to select multiple candidates to advance into the clinic in the first quarter of 2023," Adagio said.

Investors cheered the results and outlook, lifting the stock by five percent last week.

Stifel analyst Stephen Willey said the results and its new product pipeline are encouraging. Still, he kept the shares rated hold, with a $5 price target, and cautioned about uncertainty regarding the COVID-19 pandemic.

Jefferies' Michael Yee believes investors focus on clinical execution and the company's most promising assets. He believes a recent activist-driven board refresh should provide more oversight of Adagio's drug development. Jefferies reiterated its 'hold' rating and $3.50.

ADGI carries a consensus 'underweight' rating and an average $3.83 target, or 9% lower than its Friday close.

Article by Ben Ward, Fintel