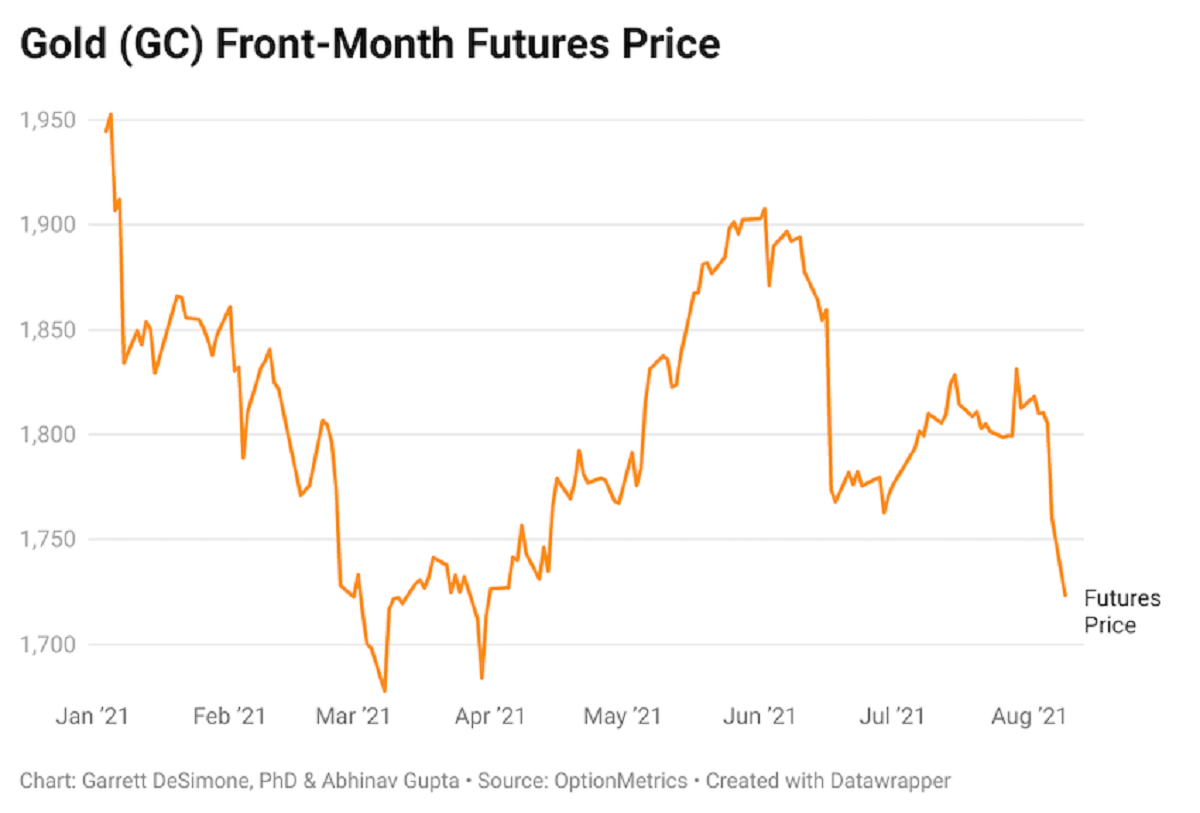

Gold spot prices fell in early Asian trading sessions on August 9th to a four-month low of $1,688 – down more than 4% since Friday’s close. While the price has since recovered, stabilizing around $1730 or down 1.8% intraday, there is still considerable pressure on gold prices as investors rush to hedge further drops.

Q2 2021 hedge fund letters, conferences and more

Current speculation suggests that Friday’s better-than-expected US jobs report numbers were the key driver in falling gold spot prices. According to the Bureau of Labor Statistics report, nonfarm payrolls rose to 943K (expected 845k) and the unemployment rate dropped to 5.4% (expected 5.7%). Given these strong numbers, there is growing expectation that US economic recovery is ahead of schedule, leading to a sooner than expected tapering of stimulus by the Federal Reserve. A hike in interest rates would therefore decrease demand in non-yielding gold, and increase investments in interest-yielding assets.

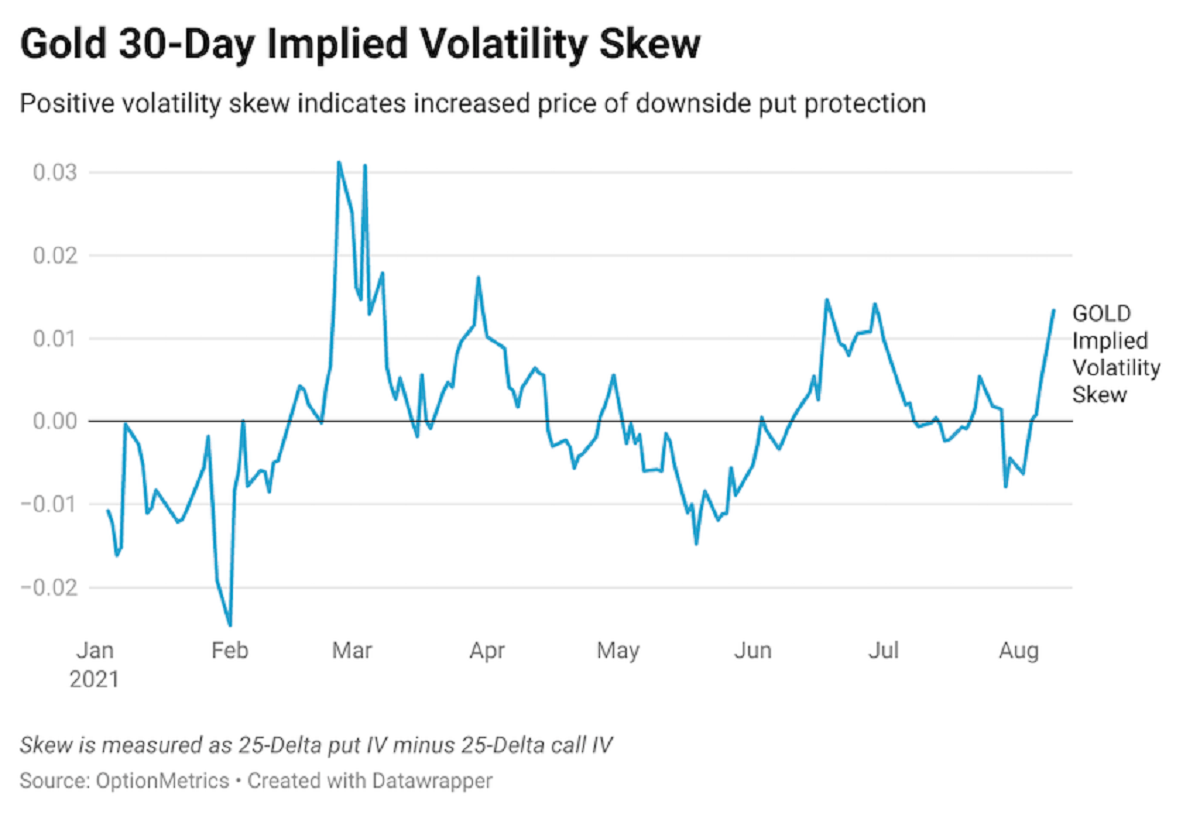

The implied volatility (IV) skew in options provides a gauge of investor’s fear of crash risk. The skew is calculated as the difference between 25-delta put IV and 25-delta call IV. This metric signals the probability weights option traders assign the distribution of future price movements.

The Gold IV Skew

The gold IV skew is generally negative, indicating that out-of-the-money (OTM) calls are relatively more expensive than OTM puts. This is a result of investors primary need to hedge upside moves in the commodity.

On Monday, downside risk became the principal concern for traders after a rough session. The IV skew jumped to +1.3%, signifying higher costs of downside protection due to increased investor demand for OTM put options. This skew level is extremely high when compared historically; the value on August 9th has been in the top 90th percentile of values since 2005.

While gold traders may be on edge after the interest rate news, large skew levels are frequently a bullish signal for the commodity. This is because options traders often become excessively fearful and tend to overestimate the probability of downside price movements. Ultimately, this results in overpricing for put insurance. A contrarian investor could utilize Monday’s selloff as an opportunity to invest in gold with intermediate upside potential.

Article by Garrett DeSimone, PhD & Abhinav Gupta - OptionMetrics