Gold royalty or streaming companies have a very compelling business model. In this video I explain what they are, what are the risks and rewards they offer in comparison to normal gold mining stocks.

I must say that the business model is very compelling with low gold procurement costs but the valuations are a bit high. All in all, gold royalty companies give a low risk portfolio exposure to gold.

Invest in Gold Royalty or Streaming Companies – Franco Nevada, Wheaton, Royal Gold

Transcript

Good day fellow investors. What are gold royalty companies or gold streaming companies? In this video, we will discuss what they are and are they are better investments than gold or gold miners.

It’s a very interesting, relatively new asset class to invest in, performed really good. So let’s see how it did. So first, as you know, gold is relatively fixed asset, the amount of gold above the ground grows really slowly over time, and therefore it’s a great protector against inflation. In the last 30 years gold prices have increased as has the M2 money stock increased.

However, there is a small divergence in the last five years so it looks like gold is undervalued. This is because people expect the money stock to go lower as the Fed trims their balance sheet. We’ll see if that happens.

However, for now gold is undervalued. So gold is undervalued. You want to be exposed to go because it’s a positive a symmetric risk reward you can lose on so much but the benefits if gold prices increase are very high.

Cash usage

Now what are precious metals royalty or streaming companies? Those are companies that have cash and they invest in the development project or exploration of a miner and they say here I will finance part of your costs.

But when the mine becomes operational, I will get a certain percentage of revenue for gold royalty companies or I will get a stream, streaming companies practically the same thing, where I can buy certain amount 25%, let’s say of your silver production at a lower cost. Let’s say $4 per ounce of silver, or usually it’s $400 per ounce of gold.

For example, Wheaton Precious Metals bought 25% of all future silver production at a price of 3.9 per ounce from the Penasquito Mine from Gold Corp in 2007 for 485 million in cash.

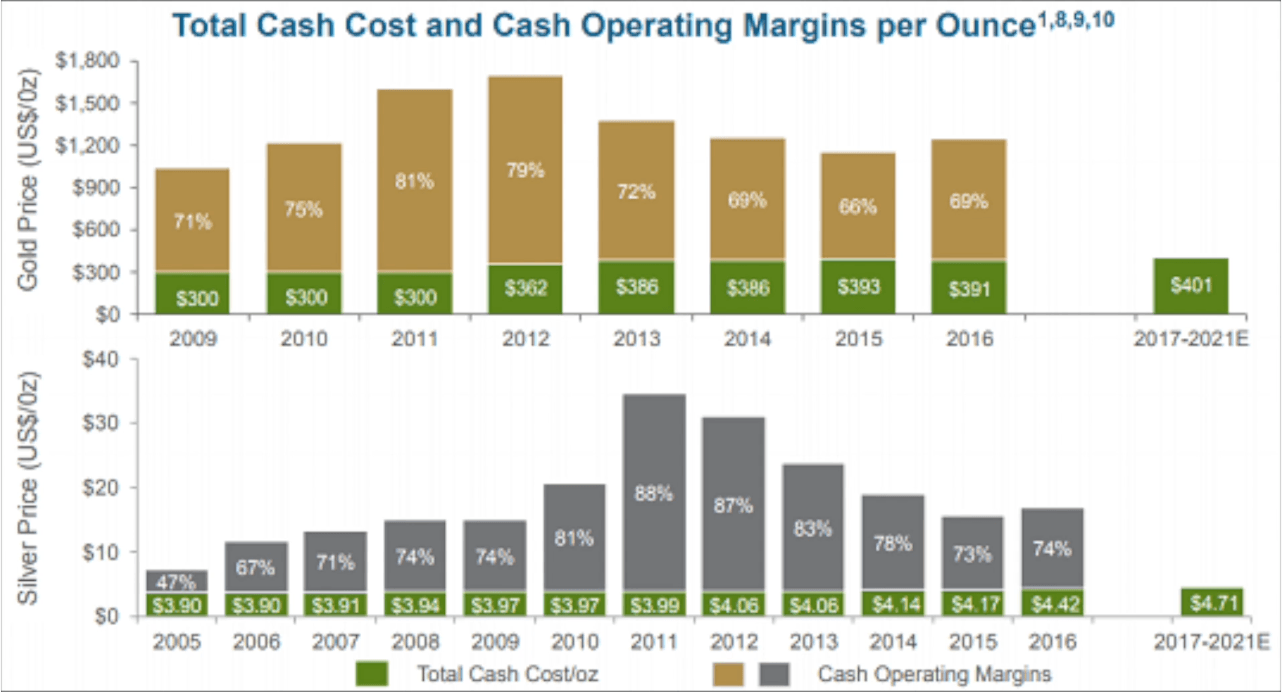

That money allowed Gold Corp to invest, develop the property, derisk the property, but it costs them a nice percentage of their silver revenue. So this is a chart from Silver Wheaton and you can see that their gold costs are now around $400.

They invest in projects and they say, okay, we can buy a certain amount of gold from your project or percentage say it’s more correctly at $400 or an ounce. So they buy at 400 and they sell at 1200-1250.

Their margins are huge, the same for silver. So a company like a royalty company, invest in a project and they say okay, they buy the percentage of revenue of that project, whatever happens. So there are no additional mining costs.

Precious metals mining

There are no exploration costs, there are no development costs. So practically the only risk around the company runs is that the mine is shut down. If the mine continues to work, they simply get a cut of the revenue. That’s the deal. And that has worked very well in the past for gold royalty companies.

The benefit is also if the mine finds a new deposit, let’s say more depth, then also those revenues go into the stream for the gold royalty streaming company. So as long as the mine is mine, if the initial plan was 20 years, and it becomes 100 years for the whole 100 years, the royalty company gets its percentage of revenue.

Even if it didn’t have to invest anything in the development of the underground mining and so on. So that’s a very great benefit. You have very high upside and very low downside because you buy your ounces at the fixed price and when you make a deal, the deal is structure so that the gold royalty company has upside, but limited downside.

The risks for the companies are, of course, negative movements on commodity prices, and they lower their margins, it’s very difficult that they don’t make positive cash flows. Then the mine can also be shut down, if the mine is shut down for political reasons, no production, no streaming revenues.

The third thing is royalty companies look very stable, they produce cash, they have dividends, which makes them expensive when you compare it to the rest. And then of course, if they invest in a project and that project is not put into production, then there is no reality so that’s also potential loss.

Gold royalty company examples

Let’s now discuss a few royalty companies to see how they work, what are they doing and to see if they are fit for your risk/reward appetite and your portfolio. The first stock I want to discuss is Franco Nevada Corporation, the largest royalty commodity company with a market cap of 14 billion.

It owns 41 Gold producing assets, 31 advanced projects and 135 exploration projects, in addition to 80 oil and gas projects. So it’s a really huge company with huge exploration potential. If of those exploration many mines become operational then Franco Nevada will explode.

Just to see here which are those projects and which are the operators. You have Kinross, infinite company Carlin Gold Corp must be interesting. McEwen Mining, Barrick Gold and other producers. So they finance the exploration of their future potential project.

Nevertheless, Franco Nevada is a bit expensive, the price earnings ratio is 99, the price to cash flow is 28.6, so they are doing well and they are therefore priced well, the dividend yield is about 1.14%.

Wheaton Precious Metals is a little bit different from Franco-Nevada because it’s has 20 operating mines and only 9 development projects so the upside is a little bit lower. Partners you can see, Valle, Glencore, Barrick, Lundin, HudBay and so on. HudBay we mentioned and they get, I think, as percentage of their gold and silver production.

Gold royalty and miners

The third company I want to mention is Royal Gold that can tank in success to the Cortez mining Nevada that has been continuing on with the mining growing, improving, and they continue to get their royalties no matter what at no cost.

Another thing to mention from these royalty companies, for example, Royal Gold has only 22 employees. So they assess a project, miners, geologists, yes, we can invest, this is the rate of return we can expect, this is the upside. That’s it they don’t need. They’re just a company that deploys capital and then gets the revenues from that.

That’s it. Simple, simple, simple, but a bit expensive so be careful about that. Let’s check the performance. Since 2005, all three gold streaming companies we mentioned here have significantly outperform gold. Of course gold prices went up and those companies outperformed.

If we look at the five year chart, and in the last five years gold prices have been falling, we can see that still 2/3 have outperformed gold because they offer a dividend, they have many growth projects, they are cashflow positive, so we can say that they offer lower risk with higher potential rewards.

That’s very, very interesting. To continue to dig on the subject of soon make a comparison about Barrick Gold, the biggest miner and Franco Nevada, the biggest throughout the company, their market caps are close and I really want to dig into which one is the best and which one offers the best risk/reward.