It’s Powell’s doing, as always… the Chair signaled that tapering could be announced as soon as next month. What does this mean for gold bulls?

Q2 2021 hedge fund letters, conferences and more

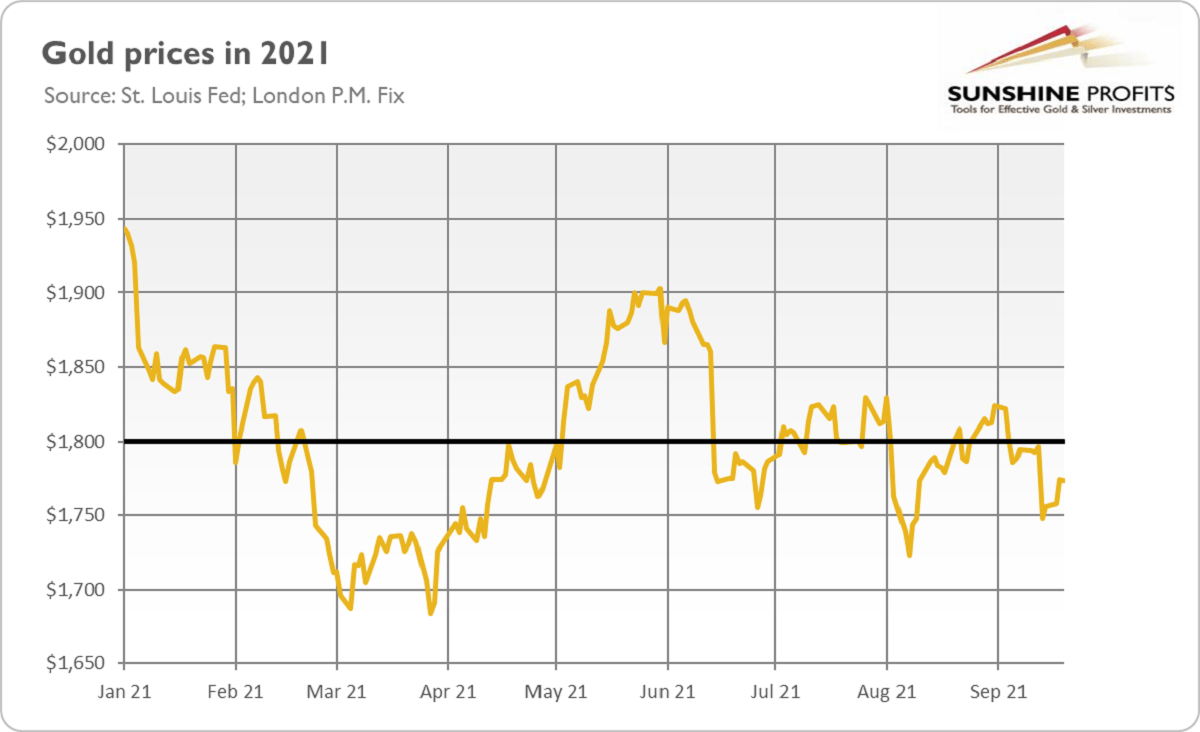

In the latest edition of the Fundamental Gold Report, I covered the FOMC’s newest statement on monetary policy and the dot-plot. I concluded that “gold will struggle until the Fed’s tightening cycle is well underway”. As the chart below shows, the yellow metal has been struggling for the most part of this year, and I don’t expect any shifts from that trend anytime soon.

Now, it’s high time to analyze Powell’s press conference! In his prepared remarks, the Fed Chair offered a rather upbeat view on the US economy:

Real GDP rose at a robust 6.4% pace in the first half of the year, and growth is widely expected to continue at a strong pace in the second half (…) Looking ahead, FOMC participants project the labor market to continue to improve.

Powell also downplayed the inflationary risk. He acknowledged that inflation has stayed at a high level for longer than the Fed expected, but, at the same time, he reiterated the Fed’s view of the transitory nature of elevated inflation:

These bottleneck effects have been larger and longer-lasting than anticipated, leading to upward revisions to participants’ inflation projections for this year. While these supply effects are prominent for now, they will abate, and as they do, inflation is expected to drop back toward our longer-run goal.

However, the question is: why should we trust the Fed’s current inflation outlook, given that its previous forecasts were clearly wrong and underestimated greatly the real persistence of inflation?

Last but not least, Powell offered more clues about tapering of quantitative easing. Although no decision has yet been made, “participants generally view that, so long as the recovery remains on track, a gradual tapering process that concludes around the middle of next year is likely to be appropriate”. So, my conclusions would be: given that tapering is said to be very gradual, it’s likely that it will start sooner rather than later.

Powell and Gold

Indeed, the Q&A session suggests that the Fed could announce tapering as soon as November. It all depends on whether the substantial further progress test for employment will be met or not. For Powell it is now “all but met”, even though it could happen as soon as the next meeting. After all, many of the FOMC members believe that this test has already been met:

So if you look at a good number of indicators, you will see that, since last December when we articulated the test and the readings today, in many cases more than half of the distance, for example, between the unemployment rate in December of 2020 and typical estimates of the natural rate, 50 or 60 percent of that road has been traveled. So that could be substantial further progress. Many on the Committee feel that the substantial further progress test for employment has been met. Others feel that it's close, but they want to see a little more progress. There's a range of perspectives. I guess my own view would be that the test, the substantial further progress test for employment is all but met. And so once we've met those two tests, once the Committee decides that they've met, and that could come as soon as the next meeting, that's the purpose of that language is to put notice out there that could come as soon as the next meeting. The Committee will consider that test, and we'll also look at the broader environment at that time and make a decision whether to taper.

It seems as though the only condition to be yet fulfilled is that the September employment report has to be “decent”. It doesn’t have to be fantastic, but it can’t be a disaster. Powell says:

So, you know, for me, it wouldn't take a knockout, great, super strong employment report. It would take a reasonably good employment report for me to feel like that test is met. And others on the Committee, many on the Committee feel that the test is already met. Others want to see more progress. And, you know, we’ll work it out as we go. But I would say that, in my own thinking, the test is all but met. So I don’t personally need to see a very strong employment report, but I’d like it see a decent employment report.

Implications for Gold

What does Powell’s press conference imply for the gold market? Well, the Fed Chair sounded generally hawkish. He was rather optimistic about the GDP growth and progress in the labor market. Powell also downplayed risks related to Evergrande’s indebtedness.

And, most importantly, he signaled that tapering could be announced as soon as November, as many FOMC members believe that the substantial progress towards the Fed’s goal has been already achieved. This is bad news for gold prices.

There is, however, a silver lining. There will be no interest rate hikes while the Fed is tapering. So, the real interest rates should stay at ultra-low levels, providing some support for the yellow metal.

Having said that, the dot-plot shows that half of FOMC members forecast the first interest rate hike by the end of next year. As a consequence, the market odds for the liftoff in December 2022 increased from 52.9% on September 16 to 72.7% on September 23, 2021. If the federal funds rate goes the hawkish way, it should continue to create downward pressure on gold prices.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care