You might call me crazy but in this video I discuss why I see gold bullion price at $5,000 (equal to gold per gram price of 141747.6) and $20,000. I am comparing what happened to gold prices in the last 15 years and since 1971 when the dollar was decoupled from gold. A discussion through recessions, interest rates, inflation and stagflation, central bank activity, money printing will elaborate on what is going to happen. However, there is also a twist to the story and gold prices could also fall. I also discuss why I think gold miners are the best gold hedge investment.

Will we see gold at 5,000 and 20,000?

Q4 2019 hedge fund letters, conferences and more

Transcript

Good day fellow investors. Now, me saying that gold would go to 5,000 or 20,000 sounds crazy and you might think that Sven has gone... However, in this video, I want to show you the reasoning behind why I am saying that the gold will go to 5000 or even 20,000 in the next decade or 15 years. At the end of the video, I'll show you a little twist to that scenario, in order to keep things realistic.

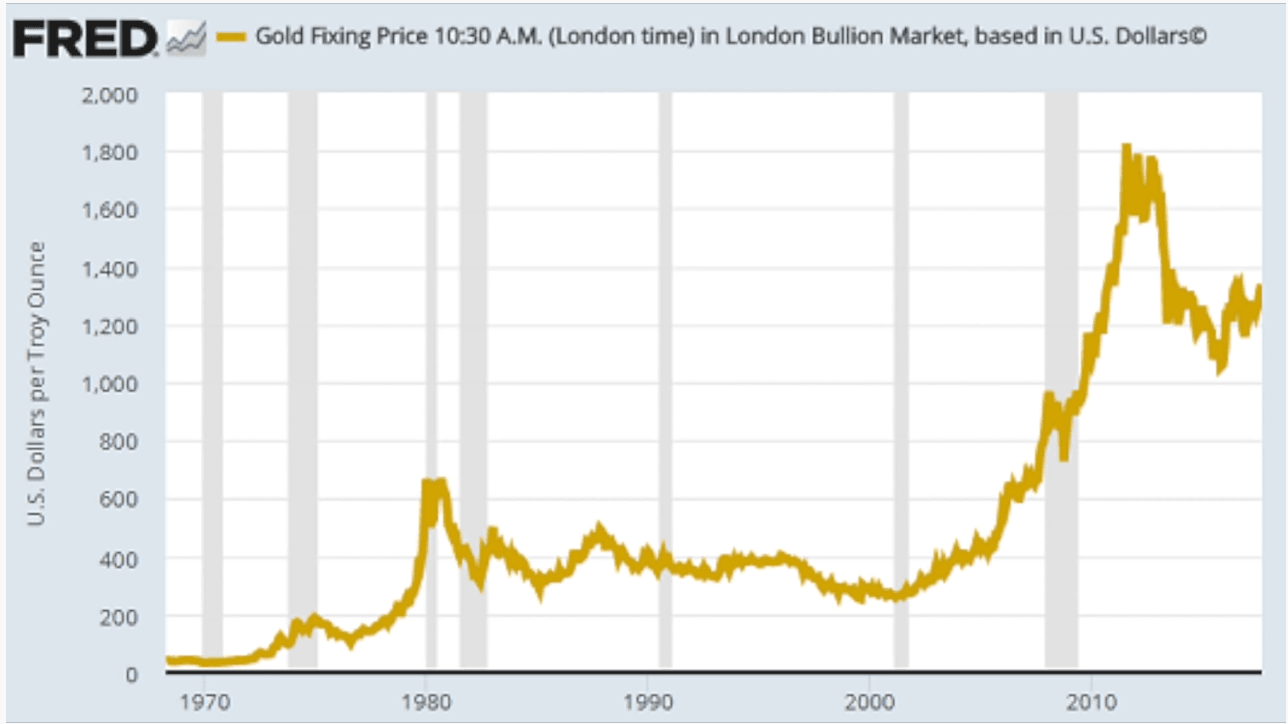

So let's immediately start with my reasoning behind why we will see gold bullion prices at 5000 at least, and there is still potential to 20,000 or more. This is a purely technical analysis. But if we look at a long term charts, not what happened yesterday, or in the last month, year, long term charts show what happens to the fundamentals of a commodity of something and that's why I want to look at this chart which shows gold prices. Since 1970s 1971 the dollar has been decoupled from gold. And since then we can look at what happened to gold in relation to the dollar and gold prices.

Gold bullion price analysis

And this is the historic part that we can take into consideration when estimating future gold price movements. The current gold price is around 1360 as I'm filming this. And let me show you the first crazy thing if somebody said in 1999, that 15 years later, gold prices would be almost a 2000. That person would be called crazy. So feel free to call me crazy. If I say now that gold will be at 5000 or even 20,000. So just think, from 1999. What happened to the price of gold from 250-260 to the current 1360. So that's more than a five fold increase. And that increase happens with an environment with very, very low inflation and declining interest rates.

Okay, so declining interest rates, gold bullion prices goes up, logically more money, quantitative easing, and anything. Now, let me ask you a question. What will the Fed, European Central Bank, Bank of China Bank of Japan do, when the next recession hits the global economy? People have stopped believing that there will be a recession ever again. But since the beginning of time, the economy human nature works in cycles, nature works in cycles. So, again, we will see a downturn it's inevitable. We always like to push growth as long as it goes and then downturn and then we push it again to higher level important that it's always higher lows and higher tops, that's the important for the economy.

Slowdowns and precious metals

But in those recessions, which they will be, but those recessions and there will be one coming anytime soon or later. What will the Fed do, the Fed and all other banks will print more money more quantitative easing, and we'll be seeing negative interest rates.

Usually the Fed lowered interest rates by 5.5%. So minus four in that environment, gold should go even higher. Since 1999, it went up five fold. If it goes five fold up now we're at 6000. So in the next recession, I see gold at 5000, 6000 amid the printing.

Central bank policy and gold

Now, let me show you the 20,000 gold bullion price target. If we go back a little bit to the 1970s, the gold bullion prices was about 40 $50 per ounce. And then from the 70s to the 1980s. It went to about $600 per ounce. This is a 15 fold increase in 10 years, what was the difference between the 70s and now? In the 70s, the inflation rate was extremely high so gold was a protection against inflation. If we see the combination, recession, inflation, that's stagflation, then I see gold at 20,000. Because central banks will lose control of what's going on, brief money, Weimar Dodge Republic, think about history, history rhymes all the time. And boom, you have gold at 20,000 in a matter of a few years. So that are clear possibilities and I would even say that I'm convinced it will happen.

I don't know when, but somewhere in the future it will happen. So the most important thing to do is to be hedged with the part of your portfolio. And the most beautiful thing is that you just need a small part of your portfolio in gold miners, for example, and those that small part hedges you against everything that could happen in the future.It's important to keep a small part of the portfolio because if you think now when you're saying gold will go to 5000 to 20,000, then it's better to put 50% 100% in gold miners. And then after a few years, we are rich, not that fast.

Gold bullion price target

In the short term, however, we could see gold below 1000, below 800 or even to 600. That wouldn't be a surprise to me. And here I know I lose a lot of subscribers or watchers because people would like to seek confirmation for their ideas.

Unfortunately, I can give you that because I and nobody else in the world knows what will happen in the short term, medium term long term and when it will happen. The only thing we can do, we can assess scenarios, probabilities for those scenarios, and then adjust our portfolio accordingly. We know the world is not linear, has been in the last eight years, it won't be in the next eight years. So we have to be prepared.

How it could happen

And let me show you a scenario where gold bullion prices go to below 1000. if interest rates start increasing, if the economy does well continues to do well, if the Fed starts trimming its balance sheet, the ECB starts buying less bonds, the Bank of Japan starts selling in stocks, for example, it can happen, probably it won't, but it can happen. Then gold that has no yield will be sold off and will go down very, very quickly and fastly. So from the current level could easily go to below 1800.

In that case, and that's why it's important to have only a few percentage points of your portfolio. In gold, you lose 50% if you own physical gold, 80-90% if you're gold miners, and that's the catch. I don't know what will happen first, will we see 5000 or we will see 600 or even 500. Quick look at the gold miners cost curve, below $1,000 most of them would be in trouble. However, we cannot look at gold from a commodity perspective because gold bullion prices work on sentiment not on an industrial factor or something like that. So, okay, interesting to look at the cost curve, but don't take it as a given.

Gold bullion prices conclusion

So to conclude, I'm saying again 5000 definitely 20,000 high possible in turmoil situation with a lot of money printing, printing, and the central bank's losing the type control and grip on the economy they have now, gold at 800 a little bit less likely. That's why I'm already positioned in gold miners. And I'm ready okay, if gold goes down to 800 I'm ready to lose 80% of my for gold portfolio, that's normal.

I will rebalance accordingly and start buying even more if that happens. There is no other way to play gold, however, it's very important to have gold in your portfolio in order to be hedged and protected. Remember low risk, high return is what leads you to satisfying, sustainable long term returns. I'm looking forward to your comments. What do you think of my gold 5000-20,000 theory?

Or the 600 theory? What are the probabilities that you attach to one or the other? Or do you see just gold continuing to go up as it has been growing up in the last few months? Thank you for watching, consider subscribing. If you haven't yet. I'm researching a few gold miners so you can now expect a few gold mining videos about interesting investments that I think will do good in the next year, two years, three years no matter what happens in the gold environment. Thank you for watching, and I'll see you in the next video.