Fuzzy Panda Research have taken a short position in Foresight Autonomous Holdings (NASDAQ:FRSX).

Q1 2021 hedge fund letters, conferences and more

Foresight Autonomous Holdings (NASDAQ:FRSX), claims to be changing the world of autonomous driving technology.

In reality, FRSX, an Israeli RTO, is nothing more than an aggressive stock promotion where insiders are siphoning cash to entities they control. FRSX was formerly controlled by a convicted felon before Kfir Silberman and Itschak Shrem took over. Shrem & Silberman are a duo of notorious penny stock promoters one of whom was arrested on suspicion of money laundering. The company is still under the influence of the duo who receive financial advisory fees and support from the current FRSX CEO.

After examining the full cast of characters at Foresight, we discovered connections to accused money launderers, convicted felons, numerous penny stock promotions, and financiers who have settled SEC charges of market manipulation.

Foresight Autonomous’ CEO also funnels cash from FRSX for himself to an entity he and his brother-in-law wholly control under the guise of R&D spending.

We are Short Foresight Autonomous (FRSX) and see material downside and expect this reverse-merger penny-stock promotion to collapse back to below $1 for the following reasons:

- FRSX’s cap table is littered with accused & convicted criminals.

- Insider Enrichment via egregious related party “service agreements” which allow FSRX’s CEO and the known penny stock promoters to siphon cash out of the company.

- Founding shareholders, members of the Board of Directors, and FRSX’s CFO have been involved in at least ten other stock promotion schemes. Insiders got paid but shareholders got fleeced.

- FRSX is a family affair. The new CTO is actually the CEO’s Brother-In-Law. The CEO’s daughter, is their legal advisor and VP of HR. His daughter has also received generous share grants including free extensions of expiring options despite being a part-time employee.

- Round-trip financing – shareholder capital is paid out to a party connected to Silberman – then a smaller amount is funneled back to FRSX through new financings (minus a % fee?).

- FRSX announces what appears to be “fictitious sales” in press releases. Their lawyers and accountants corroborate that these are not real sales as the financials show $0 in GAAP revenue.

- We uncovered that FRSX’s pays for its technology “awards.”

- Failed attempts at monetizing its subsidiaries via another RTO and a failed Nasdaq IPO.

- Its technology is old and dated. We found evidence that FRSX management is essentially recycling 7-year-old marketing videos from its major shareholder and then portraying it as current breakthroughs.

- FRSX does not develop any hardware of its own. Despite the fancy marketing materials, their hardware is merely off-the-shelf.

- FRSX’s purported Elbit Systems partnership is not as advertised. Management claims that the Elbit contract is worth tens of thousands and that Elbit purchased software licenses, but this never came to fruition.

- Significant selling pressure – FRSX is currently dumping stock on the open market in a very dilutive at-the-market offering and still has $46m left to sell. (pg 49)

Disclosure: After extensive research, we have taken a short position in Foresight Autonomous Holdings. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer and terms at the bottom of the report

Foresight Autonomous Group’s History – Israeli Reverse Takeover; A Convicted Felon; and the “Skeleton Traders” Including an Accused Money Launderer

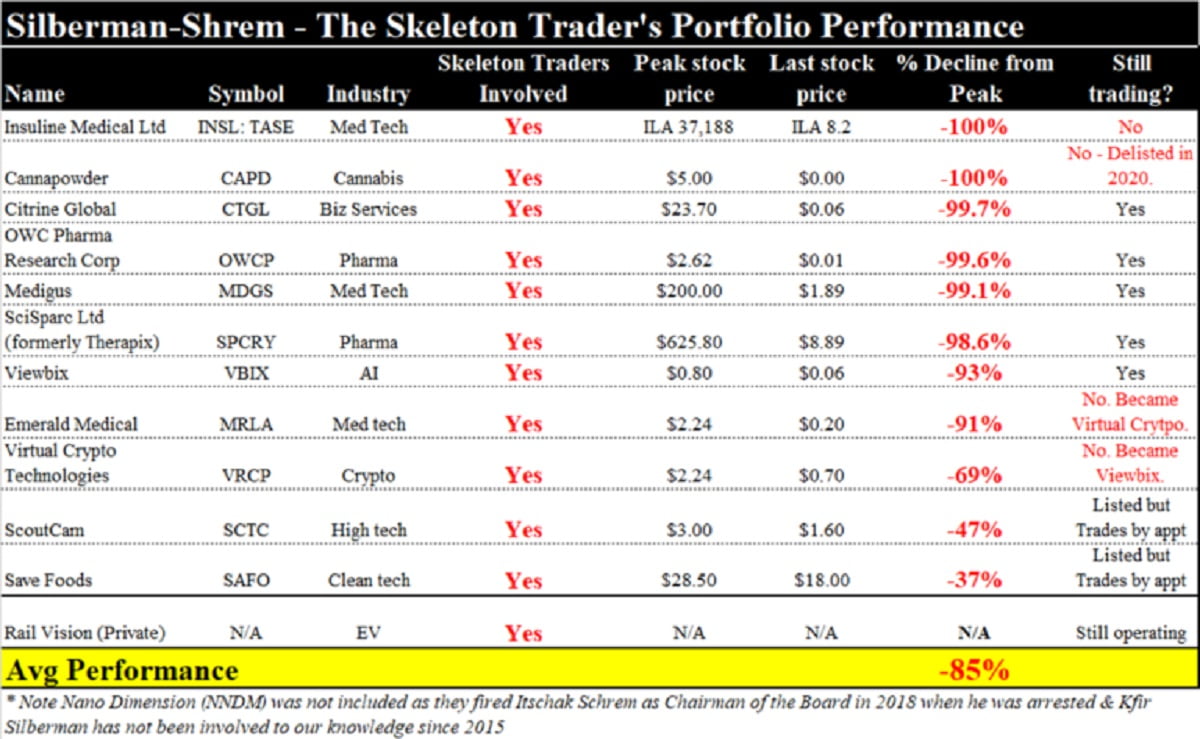

Foresight Autonomous (FRSX) is an Israeli RTO (reverse takeover) that was formed when Magna BSP “sold” (RTO’d) their Foresight Automotive Subsidiary into a shell company, Asia Development Ltd. The shell was controlled by the duo of Kfir Silberman & Itschak Shrem. Silberman & Shrem are best known as the “Skeleton Traders” by local media and Itschak Shrem became infamous after his 2018 arrest on suspicions of money laundering, aggravated fraud, and securities offenses. The “Skeleton Trader” nickname for the duo came from the multitude of dying shell companies Silberman & Shrem have purchased and reverse merged with trendy promotional ones. They have a consistent pattern of enriching themselves while retail shareholders pay the price.

Before Foresight was Asia Development Company and controlled by the “Skeleton Traders,” it was known as Golan Melachat Machasvat (20-f pg 19) which was controlled by Oded Dessau, who was convicted of fraud and theft from the company. Dessau served time in prison for this fraud.

Silberman & Shrem, the “Skeleton Traders,” are still deeply involved in Foresight. The Foresight CEO is even publicly quoted referring to them as both as friends and great colleagues:

“…they complement each other. I call the connection between them, a connection of Noah’s Ark. Why Noah’s Ark? Because it’s a great pair, when the young man brings a temperament with him, and the adult brings a calm, capable, connected with him. Kfir is frantic, wants to “burn” the world, and Itsack Shrem brings the experience and the connections…(later)…I will definitely work with [Silberman] again.”

~Haim Siboni, CEO of Foresight Autonomous Group (Article translated from Hebrew)

Organizational Structure – Foresight has been in the autonomous vehicle space since 2011 and in that time has generated ZERO Revenue and has ZERO Auto OEM Partners/Investors.

Foresight’s Business consists of 2 fully owned “autonomous vehicle products/divisions” and a minority position in Rail Vision. Silberman-Shrem have already tried and failed to spin off Eye-Net Mobile into a reverse merger (May 2018) and failed at completing a Nasdaq IPO for Rail Vision (Nov 2017).

- Quadsight Vision System (a 4-camera stereo-vision system for cars) – 100% owned

- Eye-Net Mobile (a cellular collision avoidance system) – 100% owned

- Rail Vision Ltd. (minority shareholder in with a 19.34% stake, 16.5% fully diluted) – (link) RailVision is another Silberman & Shrem company (link here to Israeli corporate registry)

The only thing Foresight sells is their own stock and lots of it. Then they direct the cash proceeds, through “services agreements” to 3rd party entities controlled by insiders.

We discovered that FRSX’s CEO, Haim Siboni and Kfir Silberman are enriching themselves via payments to 3rd party entities they control—Magna B.S.P., Pure Capital (L.I.A.) and the Shrem Zilberman Group. In total FRSX has paid out over $6.7 million in cash and issued >$8.5 million worth of shares to these related parties. We uncovered:

- “Services Agreements” that send large monthly payments to these related parties.

- “Finder’s fees” for investor introductions.

- Free Stock for Nothing. Options & shares issued which get reset and extended if they are underwater.

Will FRSX’s recently raised >$50m cash be directed to related parties too? We think so. As FRSX’s history of insider enrichment shows what will likely happen next.

Magna B.S.P. is controlled and run by FRSX current CEO, Haim Siboni (LinkedIn) and Haim’s Brother-in-Law Levy Zruya (LinkedIn). Magna owns 11.1% of FRSX’s shares.

- Large Monthly R&D Payments – Magna receives monthly service payments that are booked as R&D expense (SEC filing – pg F-14). These payments have occurred since 2016 and are currently costing shareholders $877,000 a year for “software R&D services.” However, Magna has only 1 software programmer and 13 employees on LinkedIn. It seems highly unlikely that Magna is an essential software developer for anyone.

- $8.5 million of Free Shares – Magna BSP “employees” have received free options currently worth $8.5 Million. Due to foreign filer rules, insiders get to dump stock onto to the market without clear disclosure to the market since Form 4s are not filed.

- 950,000 at a ~$0.23 strike price in July 16, 2020 (Link)

- 970,000 in June, 17 2017 (pg F-19). option price was favorably reset from $0.99 to $0.56 (pg 11) and the term later extended for underwater options.

- Brother-In-Law as the New CTO – Magna’s only other executive officer and a beneficiary of these related party cash outflows happens to be Haim Siboni’s Brother-in-Law (pg 45). Levy Zruya (LinkedIn) became FRSX’s CTO in Jan 2019.

“Mr. Levy Zruya was married to Mr. Haim Siboni’s sister”

- Liabilities Shifted onto FRSX – Magna began being paid out day 1 having FRSX assume a $661,000 debt obligation to the Israel Innovation Authority. (20-f pg 18)

- Part-time CEO? – Haim Siboni is only required to spend 80% of his time working for FRSX (employment agreement pg 2)

Without FRSX capital, Magna BSP would be long extinct. Magna BSP was founded back in 2001 and had only raised ~$2m of outside funding ~40% of which came as the Israeli government grant that had its repayment shifted onto FRSX Haim Siboni, Magna’s CEO claims that Magna’s technology protects Israeli borders but that seems hard to believe. We highly doubt that a company with minimal amount of engineering support and an inability to raise capital is responsible for protecting Israeli borders.

Read the full article here by Fuzzy Panda Research