Crescat Capital’s commentary for the month of September 2021, discussing the three themes coalescing.

Q2 2021 hedge fund letters, conferences and more

Dear Investors:

Three Themes Coalescing

With unsustainable imbalances in the global economy and financial markets today, we see unprecedented opportunities to grow and protect capital in both the near and long term. Crescat is focused on investment strategies that offer uncommon value and appreciation potential.

We believe that all of Crescat’s strategies offer an incredible entry point today based on the firm’s three core macro themes:

- China credit collapse

- Record overvalued US equity market top

- Flight to safety into deeply undervalued gold, silver, and precious metals miners

We have researched and written extensively about these themes over the last several years in our investor letters. In our strong view, these are the three biggest macro imbalances and investing opportunities in the world today. The three themes are coalescing at this very moment before the world’s eyes in a likely financial market collision and Great Rotation. We believe our portfolios will be the beneficiary.

Our positioning is contrary to many common investment portfolios in the world today. We think too many are over-weighted in extremely overvalued US growth stocks and FAAMG. Most are unprepared for a China monetary collapse or a US stock market downturn. We think too few are positioned for the inevitable stagflation that our models suggest is ahead.

As value investors, we are comfortable accepting a reasonable amount of risk to realize the strong returns that are possible from our macro themes and valuation models. Our investment principles and models give us the confidence that the intrinsic value of our portfolios is significantly greater than the current market price at any given time.

The combination of already substantial rising inflation in the US along with a China credit collapse, just as the Fed is attempting to taper, is the catalyst for all three of our themes to begin unfolding now. We are headed for a major shake-up in the world’s financial markets at a time of both historic global debt-to-GDP imbalances and record central bank money printing.

A Value Approach

Our stance is bold. It is highly analytical, valuation-based, and macro driven. As such we are willing to withstand a moderate amount of volatility as markets undergo a re-pricing to realize the ultimate capital appreciation that is attainable from our views. The confidence in our value-based investment process is what gives us the conviction to withstand higher volatility than the average fund manager. Our investment process uses equity and macro models to ensure that the intrinsic value of our portfolios, through discounted cash flow and relative-value methodologies, is always substantially greater than where the market is pricing them today. It is important that Crescat clients embrace a similar value-oriented and long-term mindset to have the confidence that short-term setbacks in Crescat’s strategies are not a permanent loss of capital.

The market price of Crescat’s activist long precious metals holdings has fallen in August and September month to date, affecting the long side of all the firm’s strategies. We think this is a mere short-term pullback that presents an incredible buying opportunity. We have the utmost confidence that these positions can deliver extraordinary long-term gains over the next three to five years based on our valuation approach. We have an extensive model to value these holdings based on conservative assumptions. We believe our portfolio of 90+ activist precious metals companies is worth 11 times where the market is valuing them today. That is at the current gold price. They are worth even more than that in a significantly rising new gold and silver bull market that our macro models are forecasting.

Pullbacks are a necessary part of the path to delivering substantial long-term returns that more than compensate for the risk. It is the macro imbalances that allow us to enter long positions cheaply and short positions dearly to ultimately deliver outsized appreciation. As value investors, we believe short-term setbacks in Crescat’s strategies offer great opportunities for both new and existing investors to deploy capital.

We are firmly positioned in a diversified deep-value portfolio of the most viable new gold and silver deposits on the planet. We own these companies early in what is likely to be a long-term industry cycle for precious metals mining after a decade long bear market. Our companies hold over 300 million target gold equivalent ounces. While the world has largely shunned gold mining stocks since their last major bull market that ended in 2011, in the past year and a half, we have been busy doing private placements to fund the world’s most viable new exploration projects, thereby acquiring gold and silver for literally pennies on the dollar ahead of what we believe will be a new M&A cycle for the mining industry. We very strongly believe that the recent selloff in precious metals, due to Fed taper concerns, is way overdone and that our strategies are poised for a major turn back up in the near term. Our gold and silver holdings have improved over the last two days, and hopefully, it is the turn already.

Buy the Dip in Precious Metals

The pullback in Crescat’s performance over the past two months, including September month to date, has been almost entirely attributable to our long precious metals positions across all strategies. It is important to understand that these positions were also big winners for us in the prior year through July 2021. The Crescat Precious Metals Fund, our newest fund that is solely focused on this theme, delivered a 235% net return through July in a moderately down gold and silver market. That was the first 12-month period of this fund. Imagine what we should be able to do in a bull market for precious metals.

Our precious metals stocks are ultra-deep value positions with incredible appreciation potential still ahead thanks to the expertise of Quinton Hennigh, PhD, Crescat’s Geologic and Technical Director, and his 30+ years of experience in the gold mining exploration industry.

The last two months’ sell-off in gold and silver should mark the recent bottom or very close to it. March 2020 was what we believe was the primary bottom of what was a 10-year bear market for junior gold mining stocks. The majors have left exploration to the juniors, so these are the companies that control the world’s next big high-grade gold deposits after a decade of underinvestment in exploration and development.

The fact that gold along with our mining portfolios have been catching a safe-haven bid in the market in the last two days as the China Evergrande collapse has caught the world’s attention is phenomenal! This is exactly how a safe-haven currency and the best new gold and silver deposits on the planet should act as a renewed, sober financial order of the world that should emerge as China and the US stock market go into a structural downturn if not outright meltdown.

China’s "Mises Moment"

The massive US$300 billion China Evergrande collapse feeds into the much bigger $52 trillion Chinese banking system. The latter in our analysis is a phony financial accounting that we can only liken to the largest Ponzi scheme in financial world history. Wall Street came out in force today trying to calm its clients by saying that Evergrande is not China’s Lehman moment. We agree, it is not. It is much bigger than that. The scale of China’s credit bubble is unimaginable. It is 4.5 times the banking bubble in the US ahead of the Global Financial Crisis in absolute as well as relative to GDP terms! US banks were only a US$11 trillion asset bubble at the time when the US GDP was at about the same level as China today.

It is not even a Minsky moment. We think China is about to face what we would call a “Mises moment”. China’s unsustainable world-record credit expansion has simply gone on far too long already to where they have only one alternative to reconcile it. All paths lead to a massive currency devaluation.

Ludwig von Mises, one of the venerated founders of the Austrian economics school, describes it like this:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

We think most of the financial world is not prepared at all for a China currency collapse. In our global macro fund, we are positioned for a substantial China yuan devaluation and possible de-pegging of the Hong Kong dollar. The latter is an extremely cheap put option. The yuan collapse is inevitable in our view. We have been writing about it for years and believe it is highly prudent to be positioned now. We hold an asymmetric trade with capped downside and large uncapped upside where we are long the dollar and short China’s two primary currencies, the yuan and Hong Kong dollar, through USDCNH and USDHKD call options with tier-1 US bank counterparties.

US Stock Market Top

In our analysis, China’s financial woes will absolutely be contagious with the US and the world. It is already happening. There is a strong chance that the US equity market has already topped out as of Sep 2 on both the S&P 500 large cap index and the Wilshire 5000 total market index. This has been arguably the most speculative US stock market in history with the highest valuation multiples to underlying fundamentals. In our strong view, there is much downside ahead for broad US stocks. We are determined to capitalize on the equity downturn with overvalued US short positions based on our equity models in our global macro and long/short funds.

US stock and credit market’s historic valuations are compliments of rampant speculation underwritten by the Federal Reserve. These asset bubbles are ripe for bursting. The catalyst is the dual combination of rising inflation in the US and a credit crisis in China.

We think most investment managers, including hedge funds, are afraid to short stocks and will be caught wrongfooted. Our macro and equity models give us the conviction to be short today. Our firm has an excellent track record of protecting capital during market downturns via our short positions. See our performance reports which show Crescat’s negative and low “downside capture ratio” versus the market in our global macro and long/short hedge funds respectively compared to the S&P 500 and other hedge funds over the long history of these two strategies. Crescat Global Macro’s negative downside capture ratio since inception means that on average it has made money historically when both the market and the hedge fund benchmark has been down. In fact, both funds were up substantially in March 2020, the month of the Covid crash.

Gold Wins Whether Safe-Haven Flight or Inflation Hedge

On China’s woes, gold should be getting the monetary metal safe-haven bid even though ultimately it is the inflation protection buying on the back of a fiat currency war that makes gold the most attractive to us. When the Fed acts with new measures to counter the strong dollar vs. yuan that would otherwise crimp the US economy, that is when precious metals should go ballistic. We need to be positioned for all of that now, and we are.

The Fed is expected to announce the taper tomorrow. A fully committed taper announcement would likely only further catalyze China’s credit collapse and the US equity downturn in our opinion. That is a possibility, but we think a soft taper announcement with a lot of hedging language given China and the potential contagion effects is a more likely event. It still should not stop the US equity market downturn, and it will do nothing to help China. If it is a hard taper, it is just game-on even more so for our equity short positions and China yuan puts. Regarding precious metals, the odds are that gold has already fully priced in the taper based on its pullback over the last two months. If the Fed gives us the “soft taper”, it should allow gold to catch a huge bid and be off to the races.

Current Inflation Spike Already Rivals Stagflationary 1973 and 1980

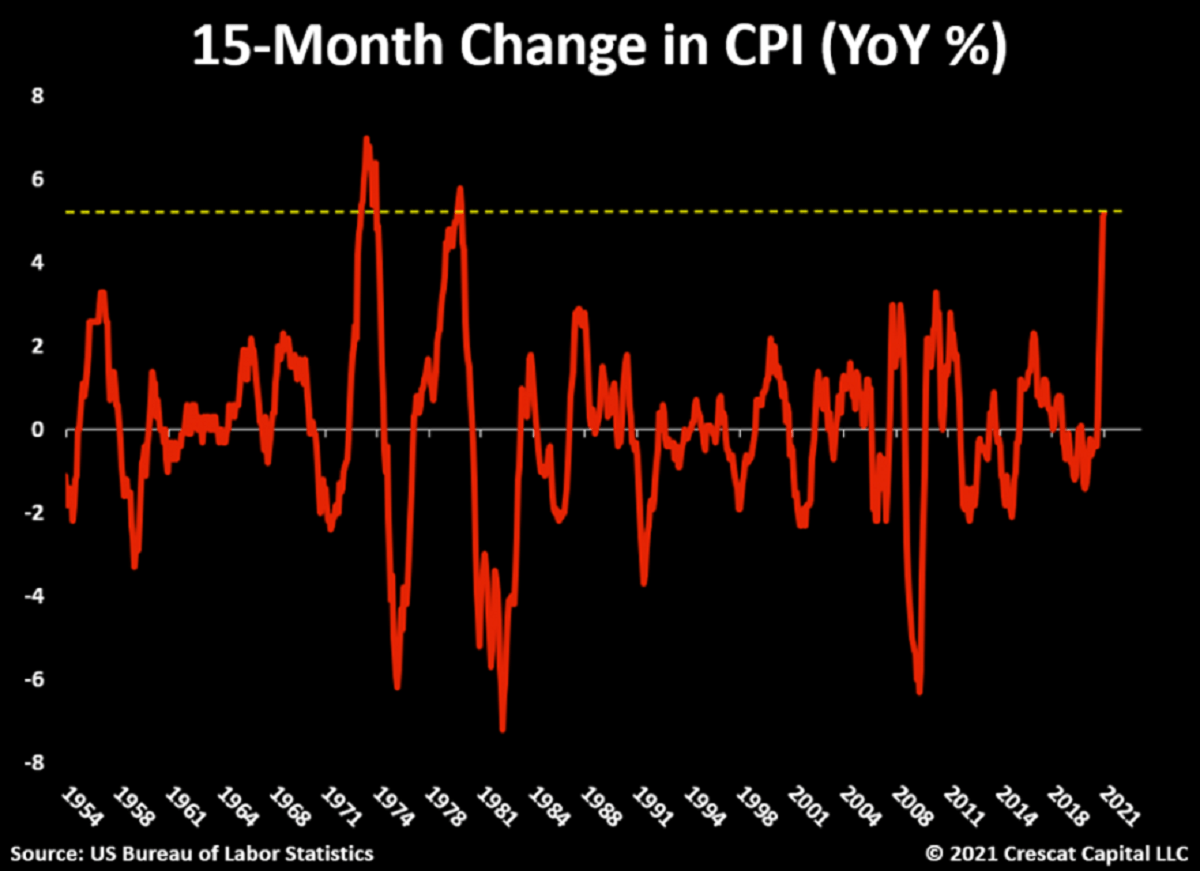

The US Consumer Price Index has risen from 0.3% annualized to 5.3% over just the last 15 months. The last two times we saw this big of a rise over this short of a time were in 1973 and 1980, the two most notorious episodes of stagflation and rising gold prices in US history.

Just like in the 1970s, policy makers are trying to tell us not to worry because inflation is “transitory”. But just as then, there is a host of “non-transitory” drivers that include an incipient wage-price spiral, the lag-effect of rents to already substantially higher housing prices, global supply chain shocks from Western trade disintegration with China, and highly probable ongoing deficit spending and debt monetization in the US as far as the eye can see.

The big difference between today and the 1970s stagflation is that the Fed has not done anything to fight rising inflationary pressures but instead has done everything to aid and abet them. For instance, from 1972 to 1973, the Fed had already raised its funds rate from 3.5% to 10.8%. And, from 1976 to 1980, it raised the rate from 4.7% to 17.6%. In contrast today, the Fed has kept the funds rate at 0% for the last 16 months and engaged in $4.3 trillion of quantitative easing over the last 18 months monetizing 88% of $4.9 trillion in new debt taken on by the US Treasury over the same time. Fed officials must be looking at this data and internally freaking out. That is why they are probably seriously considering tapering.

Stagflation

When monetary policy becomes truly extreme, like it was when the US abandoned the gold standard, for instance, we can get both inflation and a stock market crash at the same time. 1973-74 was the prime example. Gold stocks went up 5x in just two years while the S&P 500 was down 50%. At the same time, the popular but overvalued Nifty Fifty large cap growth stocks went down substantially more. Only those alive during the 1970s with money invested in the stock market truly know how shocking and substantial such a crisis can be. It could have been devasting or glorious depending on how one was invested.

Gold Launches as Tech Busts

Even in less extreme monetary policy situations, gold stocks can go up while widely-held overvalued equities collapse. Late 2000 through 2002 was a perfect example. Then large cap growth and tech stocks were being decimated at the same time as gold stocks began what would ultimately become a ten-year bull market albeit with a significant selloff in late 2008.

These two examples are the types of markets for both gold and broad US stocks that we envision over the next two years.

Gold Stocks In The Great Depression

The Great Depression is yet another example of how gold and gold stocks can perform versus stocks at large in the most serious of financial times. Homestake Mining was the largest precious metals miner of the time.

Fed Policy Error

Fed watchers are rightly concerned about a forthcoming policy error, but the truth is that the accumulation of global economic and market imbalances and inflationary pressures after many years of taking the path of least resistance with quantitative easing and low interest rate policy has already been the gigantic policy mistake. These misjudgments are not isolated to domestic affairs but have aided and abetted massive credit bubbles in other countries too, particularly China.

We believe it is only a matter of time before investors begin stampeding out of S&P 500 index funds and FAAMG stocks and into tangible assets. We think this is the time to get ahead of the curve.

As Warren Buffett’s mentor, the legendary Ben Graham, said:

“In the short run, the market is a voting machine that requires only money, not intelligence or emotional stability, but in the long run it’s a weighing machine.”

We think a little bit of intelligence and a lot of emotional stability could go a long way right now in selling hyper-overvalued stocks at large and buying deeply undervalued gold stocks. We strongly believe the opportunity to put money to work on the recent pullback in Crescat’s strategies is phenomenal today.

Performance

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

303-271-9997

Cassie Fischer

Client Service Associate

(303) 350-4000

Linda Carleu Smith, CPA

Member & COO

(303) 228-7371

© 2021 Crescat Capital LLC