Ahead of the Federal Reserve’s upcoming decision on US interest rates this week, please find commentary below from Jesse Cohen, senior analyst at Investing.com.

A Difficult Decision For The Fed

“The Fed has a very difficult policy decision to make at this week’s meeting. It is still a very close call between no change and a 25bps move and a lot can happen in the days leading up to the announcement.

Q4 2022 hedge fund letters, conferences and more

"My take is that whatever the Fed does, it’s in a lose-lose ‘damned if you do and damned if you don’t’ situation. The U.S. central bank appears to be walking a tightrope, with the potential for a major policy error at each side.

"If they don’t raise rates, that qualifies as a mistake, and I would call it an egregious mistake as inflation still remains well above the Fed’s 2% target. However, the current turmoil in the banking sector has accelerated the slowdown timeline for the economy and increased the chance of a deep recession in the months ahead."

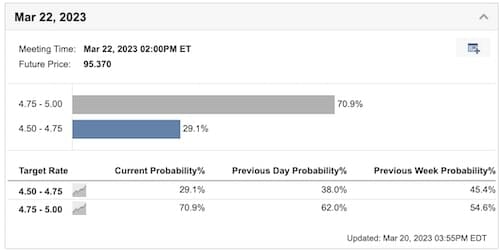

Please also find Investing.com's Fed Rate Monitor Tool, which calculates the likelihood of an upcoming Fed rate hike or cut, and also provides historical data on the federal funds rate that dates back over 30 years.