The Broad Market Index was down 2.13% last week and 77% of stocks out-performed the index.

Welcome to the first week of the new first quarter 2022 financial statement update. Like a bolder dropped in a pond, the virus caused a huge implosion in sales in late 2020 and now, in late 2021, a huge explosion with sales growth over 25% for two quarters in a row.

Q1 2022 hedge fund letters, conferences and more

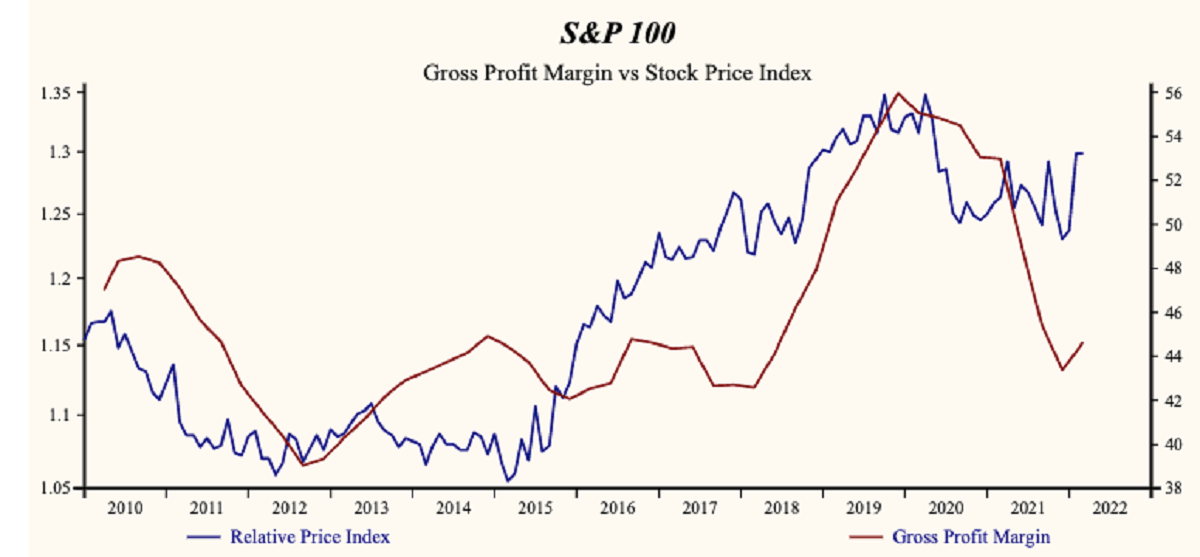

These exaggerated sales growth rates will fall in the future. Frequency of improvement is already down. Will we revert to something more stable or will we drop into another decline? First quarter numbers will give a hint.

Then There Is Inflation

Inflation now at 8.5%, even the increase in long bond yields recently does not keep up, the gap gets wider. With corporate growth high and rising, higher interest rates (bond yields) have brought higher volatility but stocks continue to outperform bonds.

If the corporate growth rate falls steeply without and abatement in inflation, we will have falling growth and rising interest rates. This combination is a great destroyer of value and is very difficult to defend against. Our best strategy now is to own accelerating companies.

Finding Growth Stocks

Only rising growth can defend our asset value from the destructive effect of inflation.

Rising sales growth will be more difficult to achieve in coming quarters as the downside of the virus wave works through. Still, sell stocks of companies where sales growth falls to less than inflation (8.5%) particularly if profit margins are falling.

Early companies filing in this quarterly period are those with fiscal quarters ended February. The larger volume of SEC filings will appear later this month. It is important to be methodical and take our time when assessing new financial reports.

Otos MoneyTrees

Sell MoneyTrees with red trunks and red pots as they appear in the coming weeks. The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Otos identifies decelerating companies “Sell MoneyTrees” with a red stem (even high and falling sales growth is a very negative attribute), a brown globe (falling profitability) and a trim red pot (falling profit margins and no operating/financial leverage).

Visit our website Otos.io and experience your financial reality as FREEDOM AND EMPOWERMENT.