For weekend reading, Louis Navellier offers the following commentary:

Q4 2021 hedge fund letters, conferences and more

There are so many opinions about the Fed that you could pave a highway of paper to the moon and back with views, pro and con, about the impact that raising interest rates might have on various markets this year, but seldom do I see anyone going back to the last few rate-raising cycles to show us what happened.

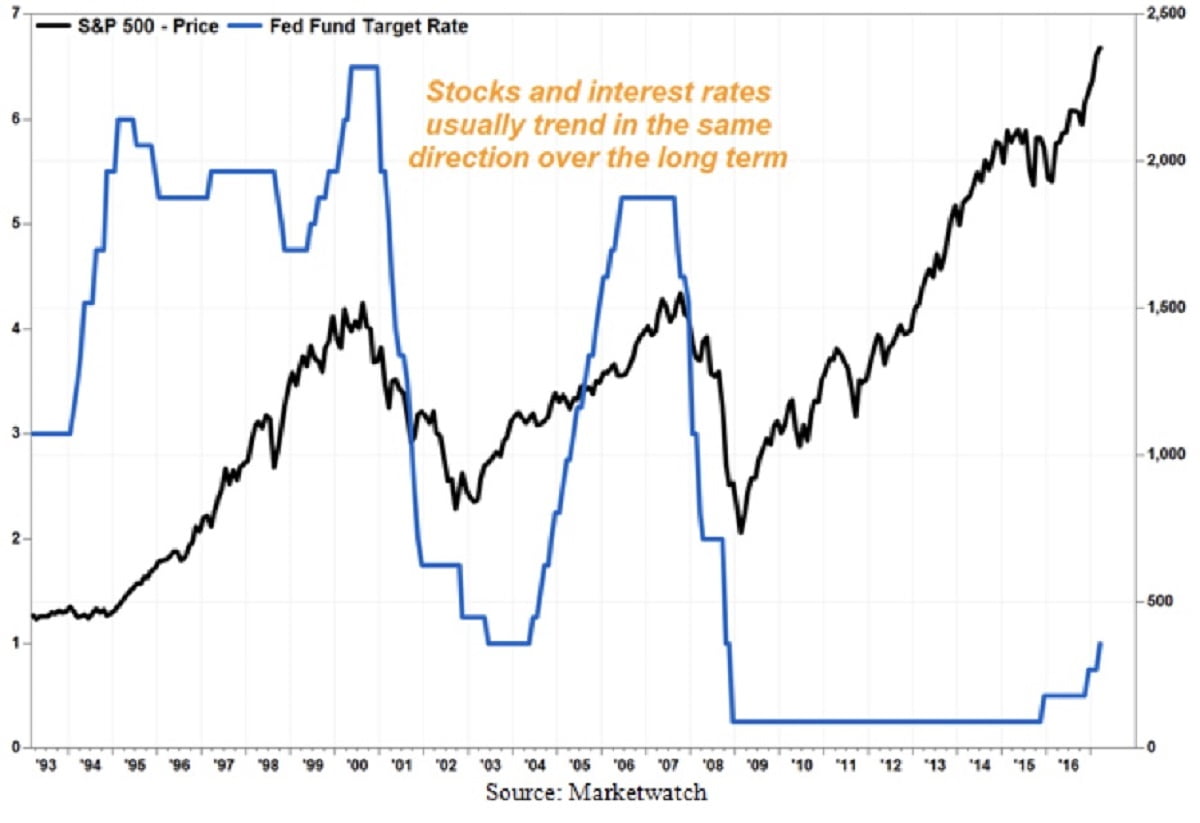

Upfront, here is a capsule summary of what I see from the historical record of the last 30 years:

- The only weak outcome is when the Fed raises interest rates without warning, for no reason – as in 1994.

- The market will usually rise (see 1999) and won’t “freak out” unless the Fed goes “too far” (2018).

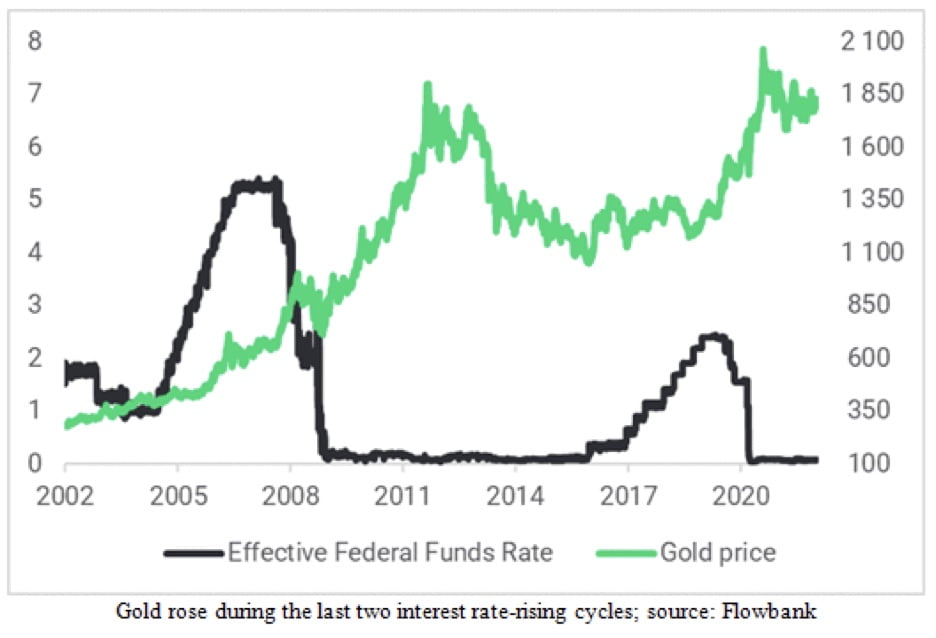

- Gold usually rises, going against those pundits who say that “rising rates hurt gold” (see 2004-6).

Cycle #1: February 4, 1994, to February 1, 1995 – Greenspan Raises Interest Rates 7 Times in a Year, Fighting Phantom Inflation

On Friday, February 4, 1994, Fed Chairman Alan Greenspan shocked Wall Street when he began a year-long pre-emptive strike against non-existent inflation by issuing the first of seven interest rate hikes. The Dow careened down 96 points (-2.43%) that day, from 3967.66 to 3871.42. Then it kept trending down.

Before Greenspan’s move, the Dow was closing in on a record-high 4,000, and inflation was only 3%.

As a result of Greenspan’s blunder, it took well over a year for the Dow to eclipse its record (set earlier that week) of 3,978.36. Meanwhile, President Bill Clinton fumed at the Fed’s assault, since the dismal 1994 stock market fueled a Republican Revolution during the mid-term elections of November 1994.

Here’s a summary of the 1994 rate-rising cycle:

- First rate increase: Friday, February 4, 1994, raising the Fed Funds rate from 3.00% to 3.25%

- 2nd rate increase: March 22, 1994, to 3.5%

- #3: April 18, to 3.75%

- #4: May 17, to 4.25% (+50 basis points)

- #5: August 16 to 4.75% (+50 bps)

- #6: November 15 to 5.50% (+75 bps)

- #7: February 1, 1995, to 6.00% (+50 bps)

Summary: Seven increases in one year, from 3.00% to 6.00%. The Dow lost 3% in that year. Gold also went down about 2% in those 12 months. This is what happens when a rate increase comes “out of the blue,” unexpected and unannounced, for no good reason. The Fed learned to announce their moves better.

Cycle #2: June 30, 1999, to May 16, 2000 – Greenspan Raises Rates 6 Times, Fighting Phantom Y2K Fears

The economy was soaring in mid-1999: For the full year, GDP rose 4.8%, unemployment was near an all-time low at 4.0%, and inflation was dormant, at 2.2%, but Greenspan wanted to slow the economy while also adding liquidity as insurance against an emergency cash shortage on January 1, 2000, due to the Y2K computer bug – a tricky double play. In all, he raised rates six times in 10+ months by just 1.75% (total):

- First rate increase: Friday, June 30, 1999, from 4.75% to 5.00%

- 2nd increase: August 24, 1999, to 5.25%

- #3: November 16, 1999, to 5.50%

- #4: February 2, 2000, to 5.75%

- #5: March 21, 2000, to 6.00%

- #6: May 16, 2000, to 6.50% (+50 bps)

Summary: Six increases in 10-1/2 months, totaling 1.75%. During that time, the S&P 500 rose 6.8%, the Dow rose +7.35%, and the red-hot NASDAQ shot up 38.4%. Y2K did not turn out to be a problem. Even gold rose 5.7%, all despite a major fall in dot-com stocks and tech stocks in March & April 2000.

Cycle #3: June 30, 2004, to June 29, 2006 – Two Fed Chairs Raise Rates in 17 Consecutive FOMC Meetings

The Federal Open Market Committee (FOMC) meets eight times each year. From June 30, 2004, to June 29, 2006 – under Alan Greenspan (until January 31, 2006), then Ben Bernanke – the FOMC met 17 times and raised rates 25 basis points in each of 17 consecutive meetings, from a super-low 1.0% to 5.25%.

According to most financial pundits, raising rates that much would send both the stock market and gold reeling. Financial pundits constantly tell us that gold suffers when interest rates rise, since “gold offers no income,” but that is not the case in most cycles. Gold hit its first bubble peak in 1980, at $850, when the Fed funds rate doubled from 10% (in April 1979) to 20% (in March 1980). In the past three Fed rate-raising cycles, gold has also risen in all of those cycles, most notably in the 2004 to 2006 cycle.

This 2004-06 cycle is the cleanest example of a long and predictable rate-rising cycle, with 0.25% rate increases in 17 straight FOMC meetings, and the stock market did very well, while gold and silver soared.

For 2022, Goldman Sachs sees gold rising to $2,150 or higher AND they see the Fed raising interest rates SEVEN TIMES, from 0.25% to about 2.0%, so they recognize that gold can rise along with rising rates.

Cycle #4: The Fed Raised Rates “One Time Too Many” in Late 2018 – Causing Gold to Soar and Stocks to Collapse

Like 2022, 2018 was a mid-term election year – one which resulted in voters rejecting the dominant (then-Republican) Party in the House. In 2018, the Fed raised rates four times, but it also practiced quantitative tightening (QT), the opposite of today’s quantitative easing (QE), or money creation. They took money out of the system rather than printing more of it. Not much happened the first nine months, but when the Fed went too far, Fed Chairman Jerome Powell became the Grinch that stole Christmas.

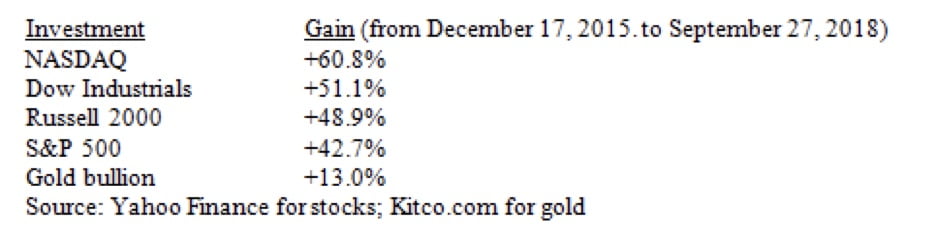

Here’s the positive performance during the first eight interest rate increases in that cycle (2015-2018):

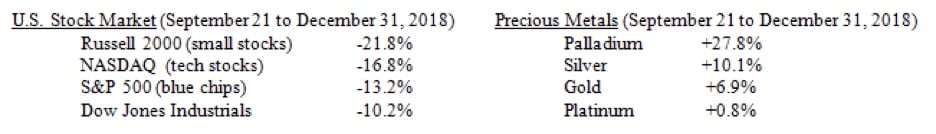

Stocks did just fine in the first eight Fed Fund rate increases, but then the Fed went too far. The final Fed Funds rate increase came on December 19, 2018, and that move sent the stock market reeling, while supercharging the precious metals. Gold rose from $1,246 the day before the rate increase, then gained $35 (+2.8%) to $1,281 by year’s end, while stocks fell from 10% (Dow) to 22% (Russell 2000).

That could happen again this year, if the Fed went too far and raised rates more than four times this year.