Since Monday’s premarket open, the S&P 500 was steadily rising before stabilizing above the mid-June tops. While the index comfortably closed at its intraday highs, can we trust this breakout? While a little breather following the string of five consecutive days of solid gains isn’t unimaginable, I think the unfolding rally has legs enough to confirm this breakout shortly.

Q2 2020 hedge fund letters, conferences and more

Factors Going for the Stock Bulls

I say so despite the uptrend in new U.S. Covid-19 cases that has many states stepping back from the reopening, rekindling lockdown speculations. I say so despite the Fed having its foot off the pedal in recent weeks, which makes for more players looking at the exit door as the rising put/call ratio shows.

The summer months will be one heck of a bumpy ride, and the bullish picture is far from complete as the lagging Russell 2000 shows. But emerging markets are on fire, not too far from their February's lower high already – Monday's boon in the China recovery story keeps doing wonders. That's wildly positive for world stock markets, including the U.S. ones.

V-shaped recovery being real or not, corona vaccine hype or not, stocks love little things more than the central banks standing ready to act. And the punch bowl isn't about to be removed any time soon. Let's take the most recent Fed policy step, which was the decision to start buying individual corporate bonds. So far, less than half a billion dollars has been deployed to this purpose – but the corporate bond market is firmly holding up nonetheless, with the Fed waiting in the wings.

That's just one of the factors going for the stock bulls, and today's analysis will deal with yesterday's market performance so as to form a momentary, spot-on picture.

S&P 500 in the Short-Run

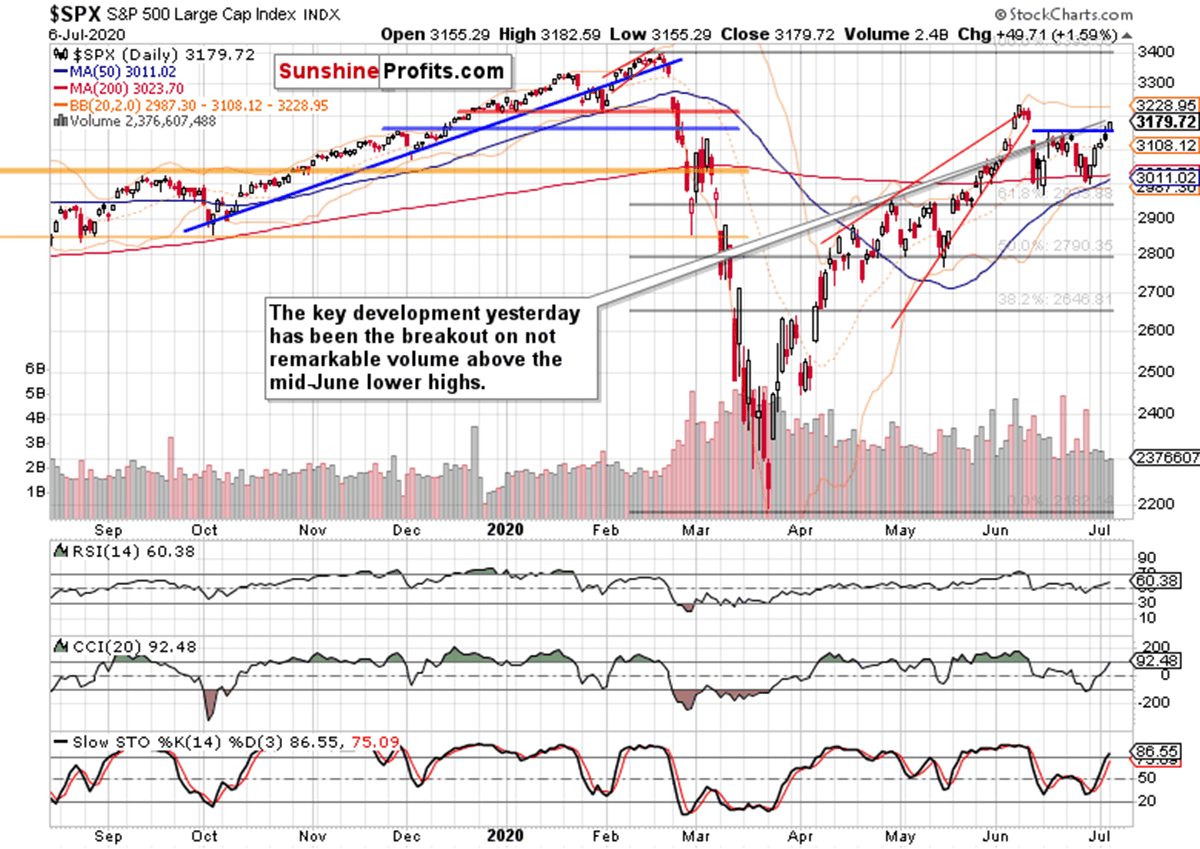

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

If I had to pick just one chart for today, this one would cut it. Having broken above the mid-June highs, the S&P 500 closed strongly. But it's also true that it has been languishing below 3170 despite reaching this level at the onset of European trading already, unable to extend gains during the regular session.

Recapping the obvious, stocks are on the upswing after the bears just couldn't break below the 200-day moving average, which means that the momentum is with the bulls now. The daily indicators keep supporting the unfolding upswing, and volume doesn't raise red flags either.

The breakout above the blue horizontal resistance line stands a good chance of succeeding. That's true regardless of the S&P 500 futures dipping below 3145 as we speak. It's that the majority of signs speak in favor of the upswing to continue, short-term breather to come or not.

Crucially, do the credit markets agree?

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) are clearly rising in unison with the S&P 500. Please visit this free article on my home site so as to see more charts – feel free to let me know should you wish to see them included in full, on the site you are reading this analysis now.

Back to the HYG ETF – so far so good, its daily indicators are reflecting the daily upswing positively, and the volume doesn't smack of an impending reversal. In short, there are no clouds on the junk corporate bonds chart horizon.

Investment grade corporate bonds are also powering to new highs. Then, the ratio of high yield corporate bonds to all corporate bonds (PHB:$DJCB) has bottomed at the rising support line connecting its March, April and May intraday bottoms. The question remains whether it will turn higher next so as to support the stock upswing that surely appears getting a little ahead of itself when viewed by this risk-on metric alone.

But it can't be denied that risk is staging a comeback into the market place, albeit a painstakingly slow one.

Or isn't it that slow when we examine the performance of technology, and other clues?

Technology and USDX in Focus

The tech sector (XLK ETF) keeps making new highs, and the volume remains quite healthy and free from bearish implications. The sector continues leading the S&P 500 higher, and perhaps most importantly, its internals have improved yesterday.

I mean semiconductors (XSD ETF). While they are not yet at their early June highs, they are within spitting distance thereof. The technical posture has improved with yesterday's show of strength, and as the segment leads the whole tech, that means a lot.

The flies in the short-term bullish ointment are volatility ($VIX) refusing to stick to its intraday move lower, another black daily candle in smallcaps (IWM ETF) or greenback's overnight upswing attempt.

Nothing unsurmountable, and definitely not overshadowing improving market breadth in the S&P 500 or the still very low bullish sentiment that can power stocks higher - you know what they say about the times when everyone moves to the same side of the boat…

Summary

Summing up, the S&P 500 broke above short-term resistance formed by the mid-June tops yesterday, and the rally's internals keep supporting more gains to come. Importantly, emerging markets and semiconductors sprang to life yesterday. Signs are though mostly arrayed behind the bulls, and most importantly, the credit markets continue supporting the unfolding stock upswing regardless of Monday's intraday wavering that could foreshadow some short-term sideways moves. The key word is could – S&P 500 market breadth is getting better while the sentiment remains too bearish to enable a sizable downswing attempt to succeed. What else can the stock bulls wish for?

I encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

All essays, research and information found above represent analyses and opinions of Monica Kingsley and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Monica Kingsley and her associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Ms. Kingsley is not a Registered Securities Advisor. By reading Monica Kingsley’s reports you fully agree that she will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Monica Kingsley, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.