The latest issue of ‘The Globe‘, Eurizon monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “slowly, but not overly so”.

Scenario

Macro data are signalling a slowdown in economic activity, that retains a positive growth rate nonetheless, both in the US and in the Eurozone.

Inflation is falling, mostly due to the decline of raw material prices over the past few months, although core components are still dropping at a slow pace. The inflation easing process is under way, but cannot be considered complete, especially from the central banks’ perspective.

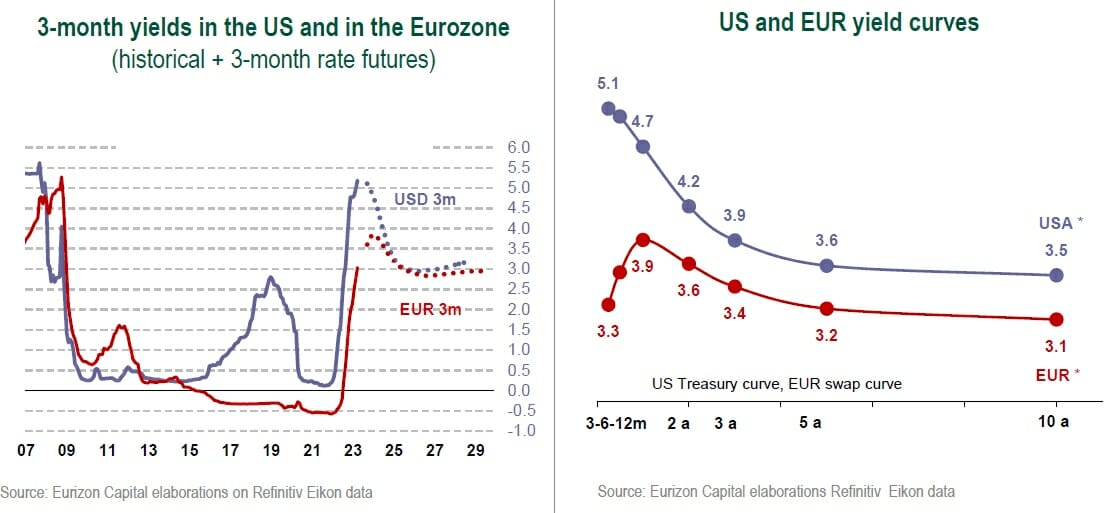

Monetary policy expectations, as implied in future contracts on near term rates, point to a 25bps rate hike at the next FOMC in May , followed by a hiatus. The Fed should then start to cut rates in the closing months of the year.

For what concerns the ECB, the market is pricing in three 25bps rate hikes at the May, June, and July meetings. Starting in the opening months of 2024, the ECB should also start to cut rates.

Compared to mid March, when tensions broke out in the banking sector, market expectations have leaned back towards a soft landing scenario for the economic cycle, rather than a hard landing. However, investor focus remains on the scope of the economic slowdown.

While the US and the Eurozone are experiencing an economic slowdown, a reacceleration is confirmed in China , where the scrapping of the “Zero Covid” policy is not replicating the excesses seen in the US and in the Eurozone, that created the conditions for flaring inflation.

Macro Economy

- Economic growth slowing, but still positive, with inflation on the decline but still well above the central bank target rates

- Monetary market futures are pricing the end of the Fed and ECB monetary restriction cycles between May and July 2023, followed by a hiatus.

Asset Allocation

- The slowdown of the economy, easing inflation, and the forthcoming conclusion of the monetary restriction make the core bond markets appealing.

- Risk assets offer appealing valuations, but could be confirmed volatile in waiting to assess the scope of the macro slowdown.

Fixed Income

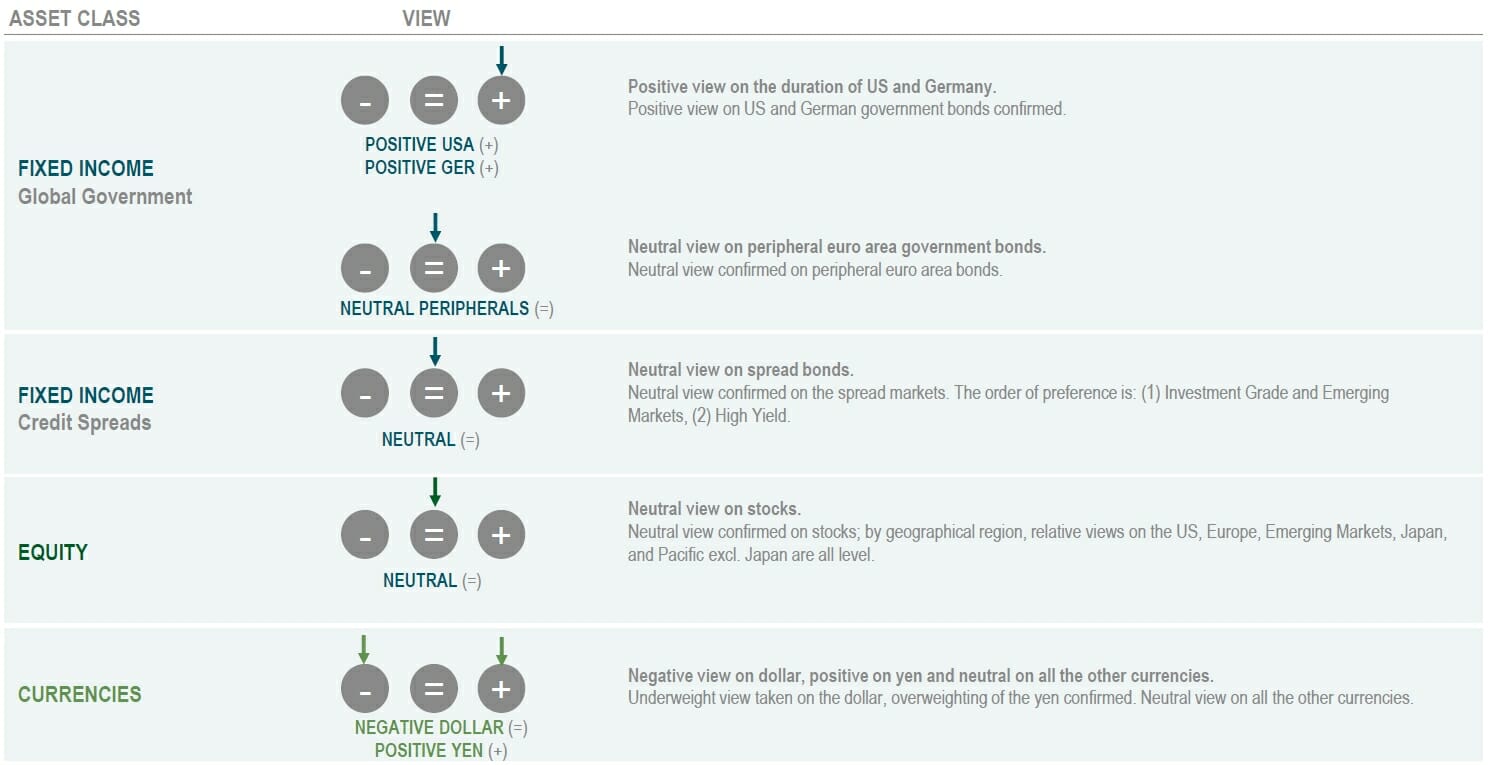

- Overweighting view confirmed on USA and German government bonds, that offer appealing yield to maturity and can provide protection in case of a macro slowdown.

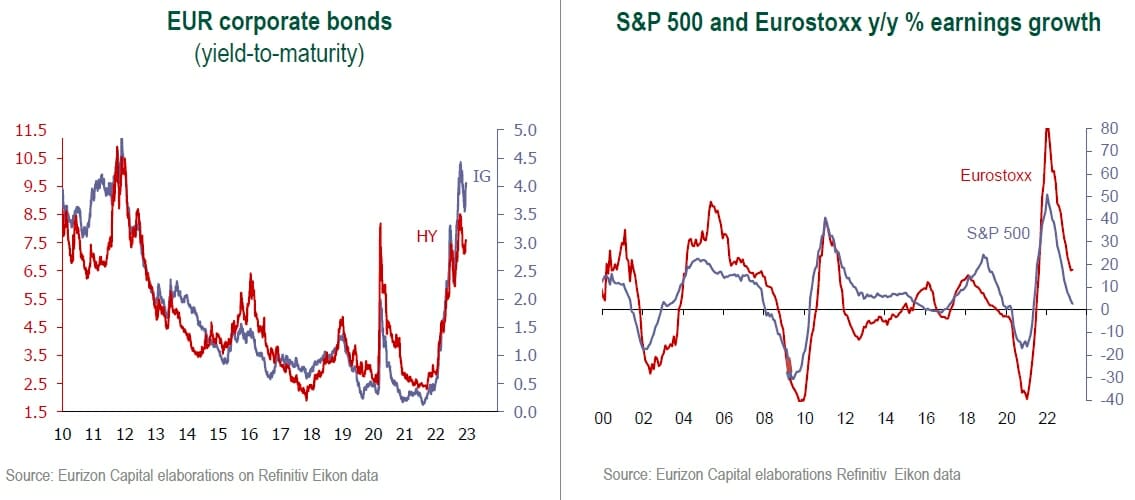

- Preference confirmed among spread bonds for Investment Grade and Emerging Market bonds, as opposed to lingering uncertainties in the High Yield segment. Neutral position on Italian government bonds.

Equity

- Stock market valuations are at historically appealing levels, but the risk of a sharper than expected macro slowdown could generate volatility.

Currencies

- The lagged inflation cycle in the Eurozone compared to the US may result in the ECB’s monetary restriction proving longer than the Fed’s, supporting the euro against the dollar.

- Scenario uncertainties and the change at the helm of the Bank of Japan could be supportive factors for the yen.

Investment View

The baseline scenario points to slowing economic growth and declining inflation, albeit still higher than central bank target rates. In light of the present picture, we confirm our Overweight view on US and German government bonds, and our Neutral stance on stocks and spread bonds, that could continue to prove volatile in waiting to assess the scope of the macro slowdown.

Asset Classes Compared

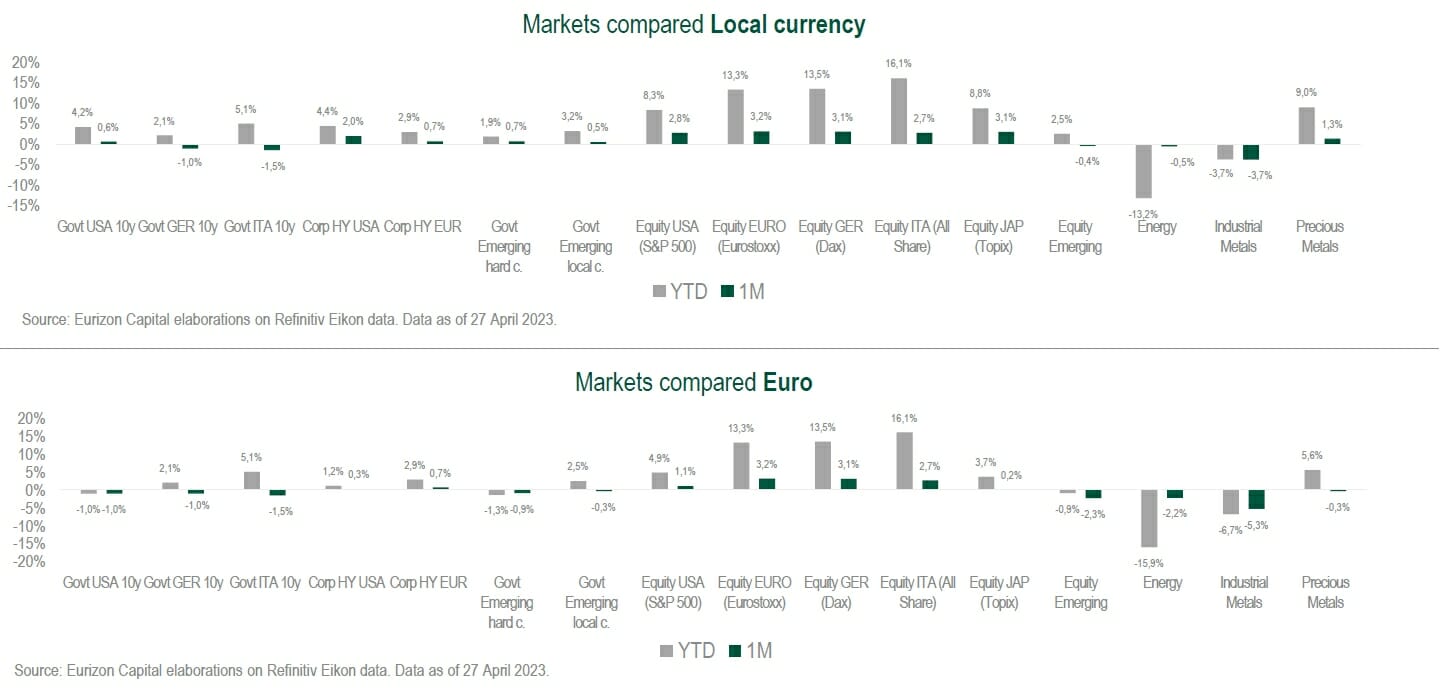

Government yields rose back marginally in April, after dropping rapidly as banking sector turbulences broke out in mid March. However, yield to maturity levels are lower than the highs marked at the beginning of March, and US and German yield curves remain inverted.

Spreads were little changed in the Eurozone, unaffected by the volatility triggered by banks. Investment Grade, HY, and Emerging Market bond spre ads narrowed back and stock indices recovered, after being impacted by uncertainty in mid March. The downswing of the dollar resumed, back to levels in line with its lows for the year in the 1.10 area.

Theme Of The Month: Slowly, But Not Overly So

Macro data have generally outlined a slowdown in the past weeks, although economic growth remains positive both in the United States and in the Eurozone.

For the time being, therefore expectations have not materialised for negative growth in the opening months of 2023, that could be expected due to the combined effects of the inflation shock and of the rate hikes implemented last year.

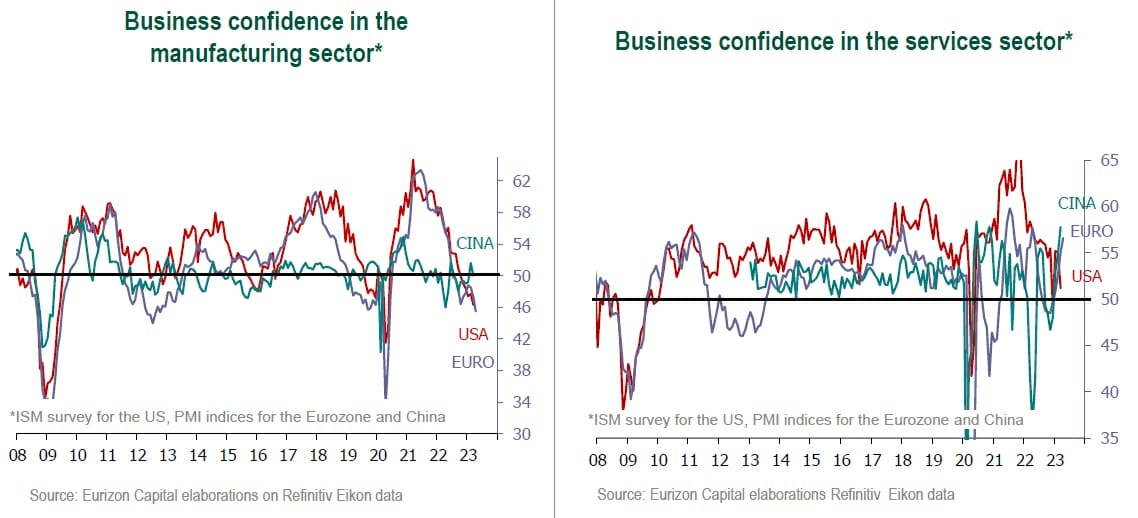

In fact, over the past few months business confidence indices in the manufacturing sector have weakened considerably, dropping into contraction territory in the US and in the Eurozone, as opposed to a stagnation in China.

In addition to reflecting the monetary restriction, the moderation of economic activity is also a result of the post-reopening excesses recorded since 2021 being reabsorbed.

On the other hand, business confidence indices for the services sector, that offer a presentation of the dynamic of domestic demand in the various regions, remain in sustained positive growth territory in the Eurozone and China.

This resilience is benefiting from several supportive elements: the still positive impact of fiscal policy, the good state of health of the labour market, the reactivity of consumers to declining inflation and, in China, post-Covid reopenings.

The scope of the economic slowdown will be the main focus theme in the coming months, also considering that inflation remains above the central banks’ target rates, and will prompt them to carry on with the monetary restriction.

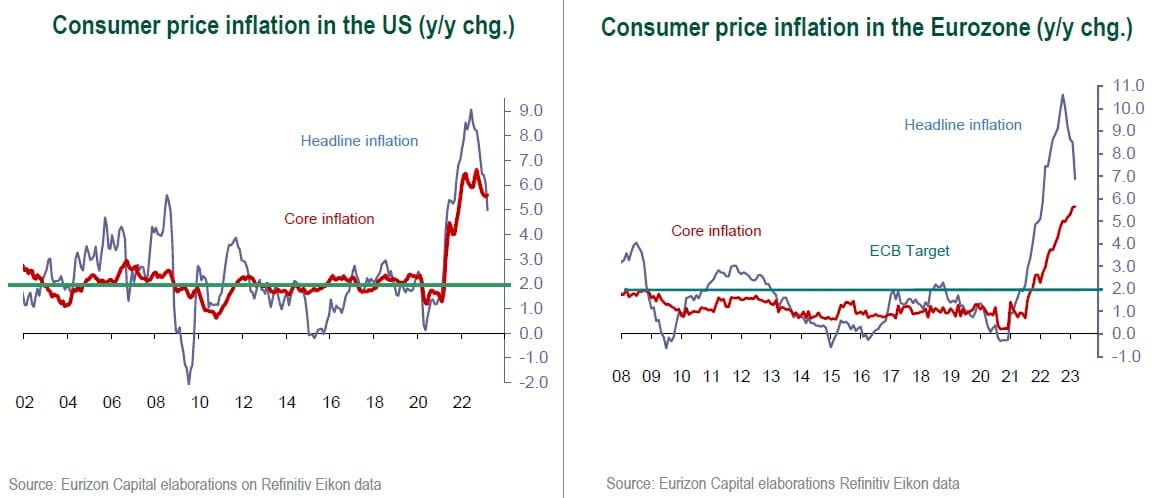

In the United States, the fall of inflation is evident in the headline index, down in year-onyear terms from 9.1% last June to 5% in March this year. Headline inflation has now dropped below core inflation, still at 5.6%, confirming its decline at a very slow pace, also due to still strong final demand.

Compared to the United States, the inflation cycle is a few months behind in the Eurozone, although here as well the reversal of headline inflation is evident in annual terms: after peaking in October last year at 10.6%, it dropped to 6.9% in March. In the Eurozone, however, core inflation has not yet formally peaked, and rose by 5.7% y/y in March.

Going forward, housing-related cost items will be monitored in the US, after the initial signals a moderation shown in the past month; if confirmed, these signals could help core inflation drop more at a faster pace.

In the Eurozone, the core inflation peak should not be far off, considering that headline inflation has now been on the decline for almost six months.

However, the Central Banks are unlikely to reverse the course of monetary policy until they see a consolidation of the downswing of inflation, especially considering how effective they have been in preventing a system-wide contagion of banking sector turbulences.

Since banking sector broke out in mid-March, market expectations have been revised in a less pessimistic direction for the economic cycle, to include a higher terminal rate for the monetary restriction cycle, and postponing the start of the downswing of rates.

The Fed is now expected to hike rates by a further 25bps basis points to 5%-5.25%, and then to stay on hold until the autumn. The ECB should hike rates by a further 75 basis points by the end of July, targeting a deposit rate of 3.75%.

In effect, in light of the stabilisation of the banking sector, market expectations have leaned back towards a soft-landing scenario for the economic cycle, rather than a hard landing.

Government bond rates have risen back, while staying below March highs, with a still negative curve slope. The short and intermediate segments offer attractive coupon rates (carry), whereas the longer maturities offer ample margin of protection in case of a hard landing of the economy.

As concerns over the stability of the banking sector and the resilience of economic growth eased, risk assets recovered, although stocks and spreads failed to mark new highs and new lows for the year respectively.

On the other hand, the volatility of stocks dropped to a new relative low, at levels in line with the end of 2021, before the Fed’s restrictive turn. This is an important indication that seems to reflect expectations for a soft landing of the global economy among investors in stocks.

This inclination could prove to be slightly premature, considering that the slowdown of earnings does not seem to have ended, whereas signals of a weakening of the macro picture could intensify in the coming months as a result of the credit squeeze realised, in the US especially, that followed the banking crises in March.