The latest issue of ‘The Globe‘, Eurizon monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “growth-inflation mix still in the spotlight”.

Scenario

Stronger macro data than expected and a slower decline of inflation than over previous months have prompted the central banks to confirm hawkish tones with respect to the monetary policy intentions.

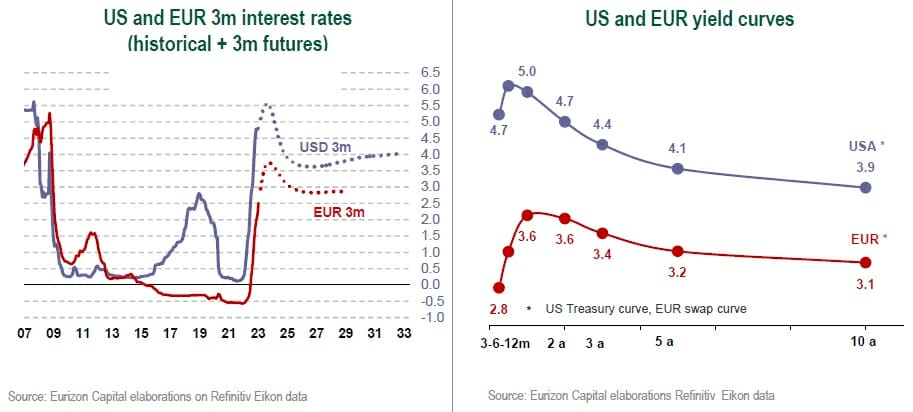

Fed Fund futures are now pricing in 25 basis points hikes at the March, May and June 2023 meetings, and a terminal fed funds rate at 5.25%-5.50%.

Q4 2022 hedge fund letters, conferences and more

Expectations for the ECB point to a terminal rate of 3.75%, with a 50 basis points move at the next meeting on 16 March. The inflation-economic growth combination will continue to be the main theme of investor focus.

The downswing of inflation, tied to the easing of bottlenecks and to the drop in commodity prices, is mostly over (in the US) or waning (in the Eurozone). The resistance of inflation is also tied to the fact that economic growth is holding up better than expected, both in the US and in the Eurozone.

The reacceleration of the Chinese economy is confirmed. The peak in the number of infection cases following the scrapping of the “Zero-Covid” policy was reached very rapidly.

Macro Economy

- Slower decline of US inflation in January. Stronger than expected macro data despite the sharp increase of interest rates.

- Monetary market futures are pricing in new rate hikes by the Fed and the ECB, as well as higher terminal rates than expected at the beginning of the year.

Asset Allocation

- The combination of high yields-to-maturity on the short and intermediate segments of the curve, combined with expectations for a macro slowdown in the medium term, adds appeal to the core bond markets.

- Risk assets offer appealing valuations, but could prove volatile as the central banks wind up the monetary restriction.

Fixed Income

- Overweight position confirmed on US and German government bonds, that offer interesting yields on the short and intermediate segments of the curve, and can offer protection in case of a macro slowdown.

- Among bond spreads, a preference still goes to Investment Grade and Emerging bonds, whereas the context for High Yield bonds still seems uncertain. Neutral position on Italian government bonds.

Equity

- Stock market valuations are at historically appealing levels, but the completion of the monetary restriction may be a source of volatility in the near term.

- The long positioning was reduced, taking profit following the sharp recovery of the past few months.

Currencies

- The weakening of the dollar observed since the closing stages of 2022, could pause, while the Fed, and not only the ECB, revise up their near-term interest rate target.

- The yen may draw support from the change at the helm of the Bank of Japan.

Investment View

The medium-term scenario points to a gradual easing of inflation in a context of moderating growth. In the immediate term, however, the solidity of macro data is prompting the central banks to press on with the monetary restriction, while inflation continues to drop at a rather slow pace.

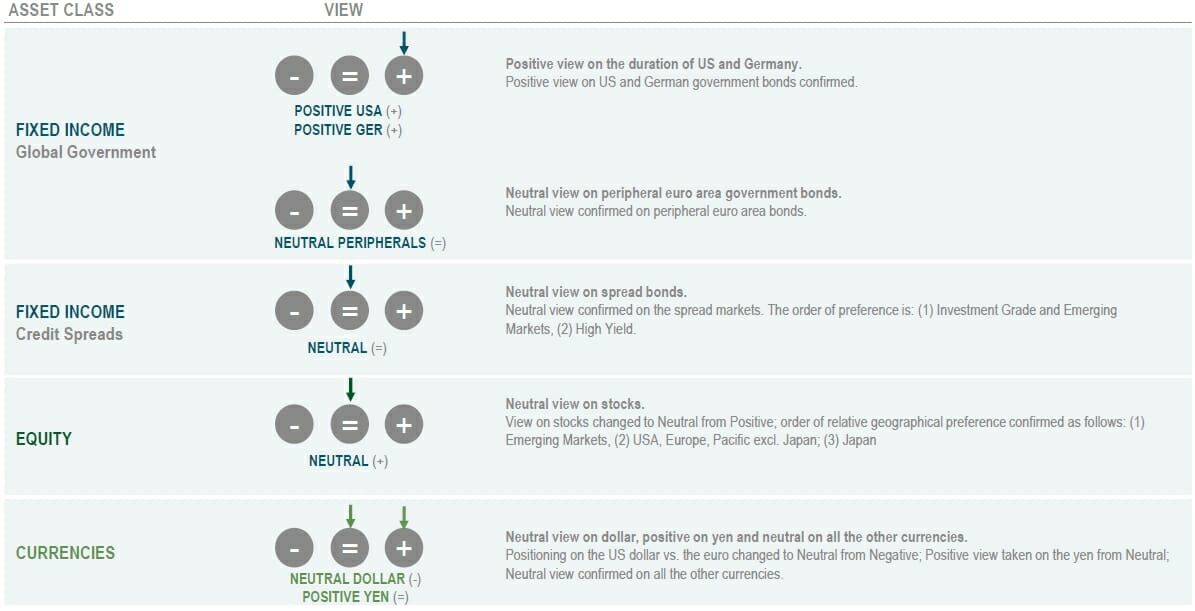

In this context, we maintain a less pronounced directional positioning than adopted since the end of 2022, restoring exposure to the stock markets to Neutral (from Overweight), while confirming the Overweight view on US and German government bonds. Neutral view confirmed on spreads in the Eurozone and on credit. Neutral positioning on the dollar, overweighting of the yen.

Asset Classes Compared

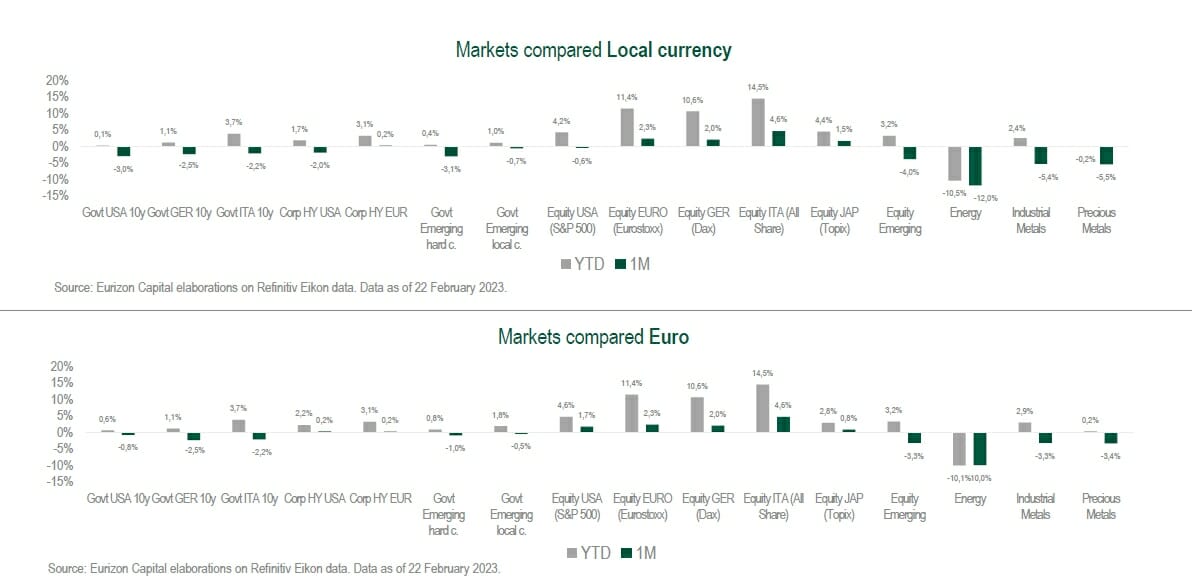

In the first half of February, government bond rates rose back across maturities both in the US and in Germany. The slope of the curve in both cases is markedly negative. The rise of core yields reflected on peripheral Eurozone markets and on credits, but in a context of stable or slightly declining spreads (Italia a 190 basis points).

The recovery of government bond rates was well tolerated by the stock markets, that in the period built on the recovery under way from October lows. On the other hand, the dollar paused its decline and rose back against the euro to 1.06.

Theme Of The Month - Growth-Inflation Mix Still In The "Spotlight"

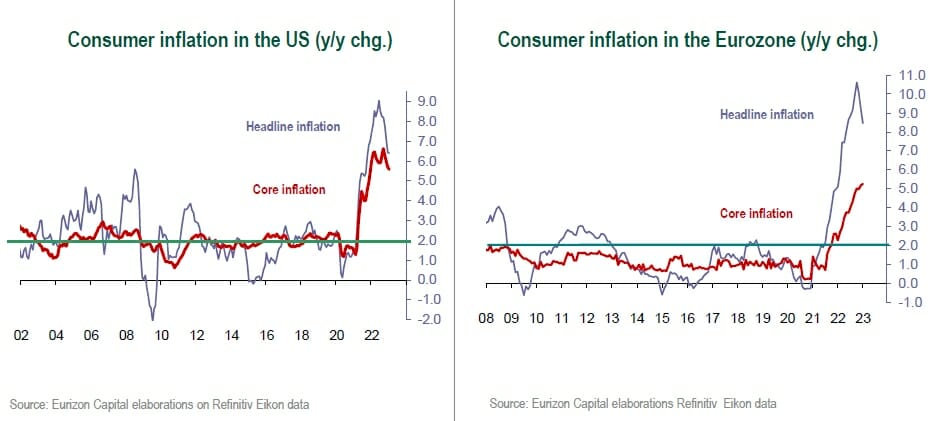

After dropping vertically for three months, US inflation slowed its decline in January, attracting investor attention again. Is the disinflation process over? Or is all going according to plan?

All according to plan, although economic dynamics rarely pan out in linear fashion, and are more commonly an unwelcome string of ups and downs.

For what concerns US inflation, the firsts downward phase, tied to the drop of commodity prices, may be considered over. The current inflation rate of 6.4% y/y combines a still high core component, at 5.6% y/y, with non-core components (food and energy) that have already dropped significantly. To date, disinflation has been driven by non-core inflation, and the “difficult” part starts now, as the baton is handed over to core inflation.

In the Eurozone, the situation is more or less the same, although inflation has peaked more recently and moves from a higher level than in the US. The current inflation rate of 8.5% y/y already incorporates the reversal of non-core inflation, while the core components have not yet peaked in terms of the year-on-year change, currently at 5.2%.

A swift decline of core inflation is hindered by the resilience of economic activity to the intense monetary restriction decided in 2022.

In fact, macro data beat expectations on the upside, not only strongly curbing expectations for a hard landing of the global economy, but actually signalling persistently excessive economic activity.

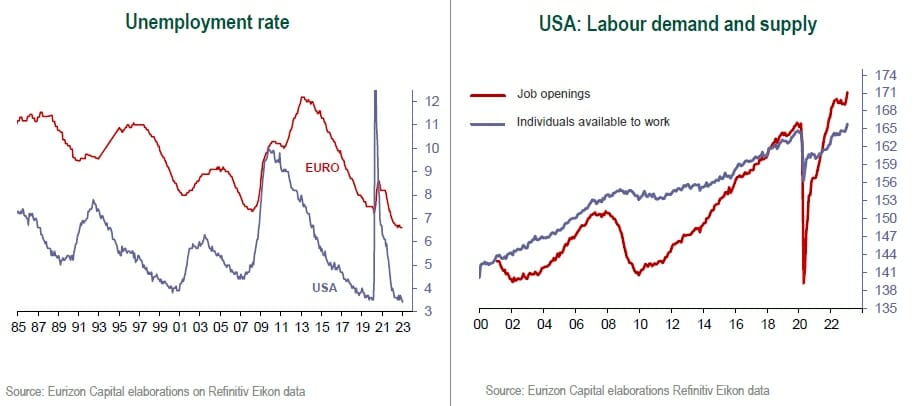

Labour market indicators in particular are outlining an overheating. Unemployment rates are at their lowest ever both in the US, at 3.4% in January, and in the Eurozone, where the latest reading was 6.6%, well below pre-Covid levels and below the troughs marked in previous cycles.

The resilience of economic growth reflects at least three factors. On the one hand, the impact of fiscal stimulus injected in 2020-2021 is still strong. Secondly, the monetary restriction has been significant, but also very swift, and has not yet reaped its full impact on the economic cycle. Lastly, the reacceleration of the Chinese economy following abandonment of the “Zero- Covid” policy, is a supportive element for global growth.

Inflation on a slow downtrend, and a tight labour market, represent a still excessively “hot” combination for the central banks to stop hiking interest rates. Last year came to an end with high expectations for the monetary tightening process to be wound up by both the Fed and the ECB in 1Q 2023, with terminal rates for the cycle of 5% in the US and 3.5% in the Eurozone.

Over the past few weeks, these expectations have been revised up and the timeline lengthened. At the present stage, the terminal fed funds rate is forecast at 5.25%-5.50%, to be reached between June and July. The ECB policy rate is forecast to rise to 3.5%-3.75% by the end of the summer.

Given these central bank rate targets, the short ends of the yield curves have again adjusted upwards in the past few weeks, in part exerting a pull effect on longer term rates as well.

However, bond curves remain markedly inverted, reflecting the confidence investors have in the ability of the central banks to contain inflation and restore economic activity to a more sustainable pace of growth.

However, the current re-pricing of monetary policy expectations does not represent a repeat of 2022, rather its completion. And the bond markets, after correcting sharply last year, offer more opportunities than risks.

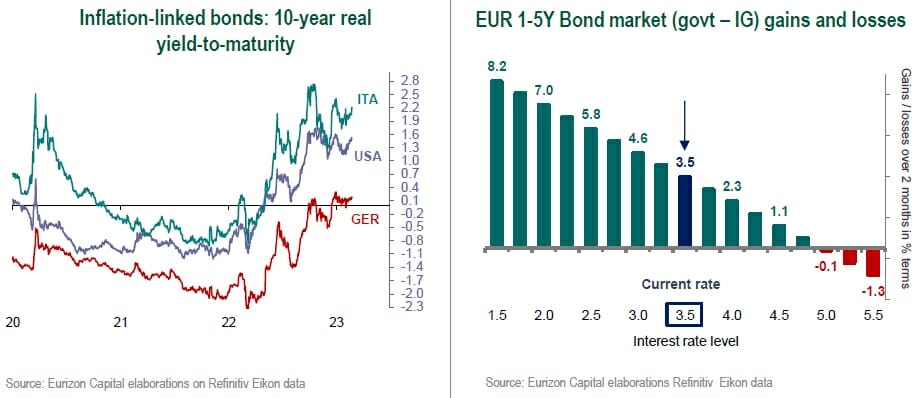

Real rates paid by inflation-linked bonds are back in positive territory both in the United States and in the Eurozone and, with the appropriate diversification and net of near-term volatility, offer an appealing opportunity for real portfolio remuneration.

For what concerns nominal rates, despite the sharply inverted curves, long-term bonds offer ample margins for portfolio protection in the event of resurging risks of a hard landing of the economy.

Short and medium maturities, at current yield to- maturity levels, are “resistant” to the possibility of a further re-pricing of monetary policy, and this represents a significant difference compared to last year, when coupon rates were at zero, if not negative.