What’s New In Activism – Digital World Not Paying Up

Backers of the blank-check company trying to take Donald Trump’s social media company public failed to pay the proxy solicitation firm they hired to drum up shareholder support.

According to the Financial Times, Digital World Acquisition Corp (NASDAQ:DWAC), a special purpose acquisition company set up by Patrick Orlando, has not paid Saratoga Proxy Consulting for its work helping to rally shareholders, citing “people familiar with the situation.”

Q2 2022 hedge fund letters, conferences and more

Short sellers Kerrisdale Capital Management and Iceberg Research both questioned the viability of the merger agreement signed almost a year ago and accused its backers of disseminating false information.

Digital World has been facing difficulties getting shareholders to approve an extension of the deal’s deadline.

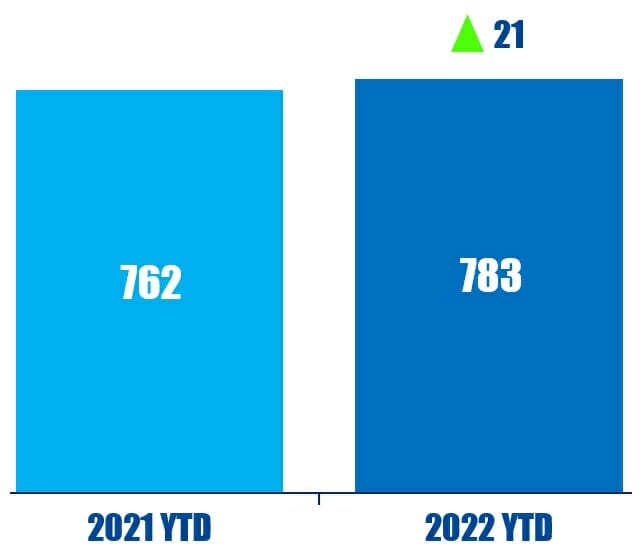

Activism chart of the week

So far this year (as of September 15, 2022), 783 companies have been publicly subjected to activist demands. That is compared to 762 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - ACCR Questions Origin

The Australasian Centre for Corporate Responsibility (ACCR) questioned Origin Energy Ltd (ASX:ORG)'s plans to divest its interest in the Beetaloo Basin to Tamboran, arguing yesterday that the move will not reduce emissions.

"With the gas offtake and 5% royalty payments, this is more like a conscious uncoupling than full throttle divorce from the Beetaloo Basin," the statement contended.

ACCR described the divestment as nothing more than "greenwashing," stating divestment is not a solution to reducing real world emissions but is "simply passing the hot potato to the next asset holder."

The environmental advocate concluded by suggesting Origin should commit to winding down its permits in the Canning, Cooper, and Browse basins, rather than seeking further buyers.

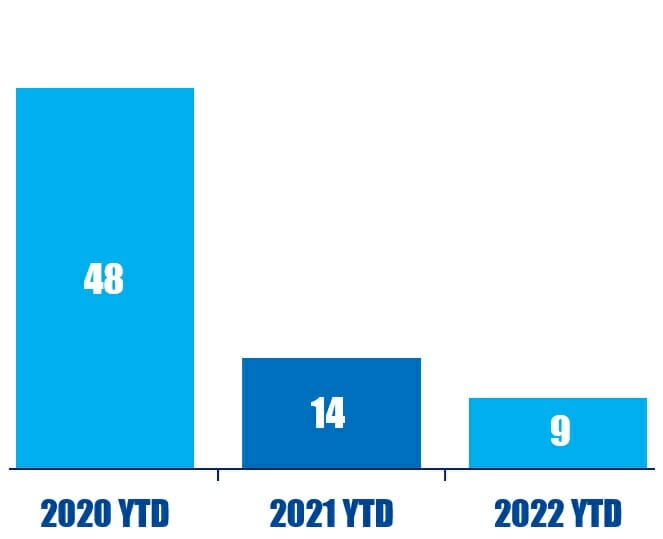

Voting chart of the week

So far this year (as of September 15, 2022) there have been nine proposals asking U.S. companies to adopt one share, one vote structures. This is down from a high of 48 over the same period in 2020.

Source: Insightia | Voting

What’s New In Activist Stocks - Miniso Fights Back Against Blue Orca

Chinese low-cost retailer MINISO Group Holding Ltd (NYSE:MNSO) said "key allegations" made by Blue Orca Capital in a report targeting the company's franchise model and its chairman were unsubstantiated.

In a short report made public on July 26, Blue Orca alleged that at least 620 stores presented as part of Miniso's independent network of franchisees were in fact secretly owned and operated by company executives or individuals closely connected to Chairman Guofu Ye.

The short outfit also claimed that, according to Chinese corporate filings, Miniso's chairman "siphoned hundreds of millions" from the company through "opaque Caribbean jurisdictions as the middleman in a crooked headquarters deal."

"The independent committee has concluded that key allegations made in the short seller report were not substantiated," said Miniso in a September 15 press release. The company offered no further details on the committee's work.

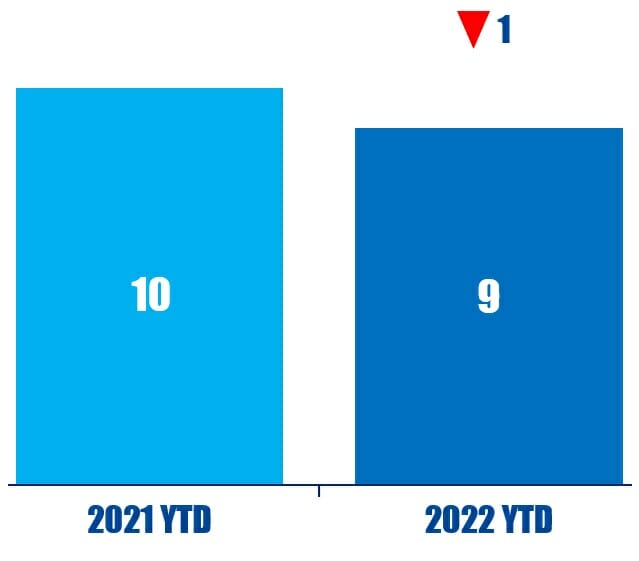

Shorts chart of the week

So far this year (as of September 16, 2022), nine public activist short campaigns have alleged accounting fraud against the company. That is down from 10 in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Kerrisdale Capital's September 15 short report on satellite-to-smartphone startup AST SpaceMobile. Read our coverage here.

“AST features a satellite design that is destined to fail, unsurprising give management’s uninspiring backgrounds, and a business case that makes little sense in nearly all respects.” – Kerrisdale Capital