What’s New In Activism – Olympus Glad For Activist Board Member

Yasuo Takeuchi, the CEO of Japanese optics products maker Olympus Corp (TYO:7733), said the involvement of ValueAct Capital was positive for the company and had led to strong share price performance.

ValueAct invested in the company in May 2018 and since then the stock is up 132%, compared with Nikkei 225’s gain of around 20%. With ValueAct partner Robert Hale in the boardroom, Olympus was able to make bold moves like selling assets and focusing on medical devices.

Q4 2021 hedge fund letters, conferences and more

"We have committed that we will become a leading global med-tech company; that requires a lot of change, eventually the change in culture and any types of diversified opinions and viewpoints are very much welcome," Takeuchi said in an interview with Bloomberg. "I'm very glad that I have Robert Hale as a board member."

Olympus is now considering a spinoff of the scientific solutions business, which could free up to $5 billion in cash for acquisitions. Takeuchi said he is looking "into inorganic growth opportunities."

The activist disclosed a stake in May 2018 and in January 2019 it gained a seat on the board for Hale. At the time, Takeuchi said there was some concern about having a shareholder representative on the board, but noted it was "an effective measure to include an investor perspective."

ValueAct joining the board of Olympus was a rare victory for an activist in Japan. Since then, activists have become increasingly successful in joining Japanese company boards via settlements and proxy fights.

To arrange an online demo of Insightia's Activism module, send us an email.

Activism chart of the week

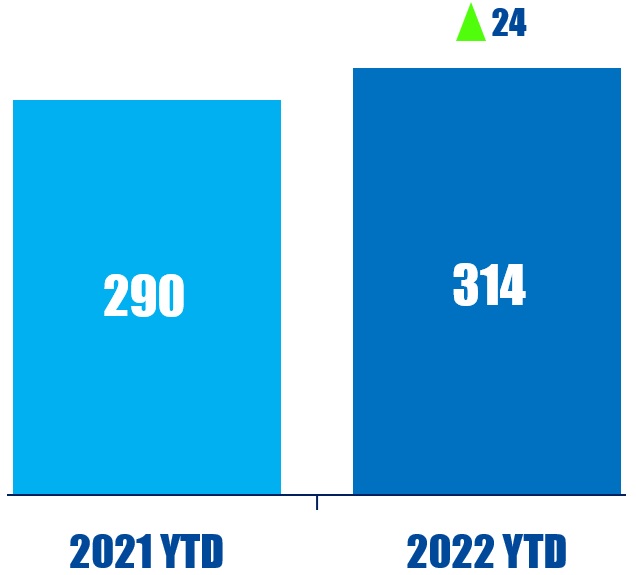

So far this year (as of March 25, 2022), globally, 314 companies have been publicly subjected to activist demands. That is compared to 290 in the same period last year.

Source: Insightia | Activism

What's New In Proxy Voting - SEC denies JPMorgan Chase

The Securities and Exchange Commission (SEC) denied JPMorgan Chase & Co (NYSE:JPM)'s attempts to block a shareholder proposal that asked for greater diversity for its board from its 2022 proxy materials ahead of the annual meeting, typically held in May.The National Legal and Policy Center's proposal, submitted on November 19, suggested a requirement that each initial list of management-supported director candidates should include "each nominee's skills, experience and intellectual strengths" presented in a chart in the annual proxy statement.In a January 11 no-action letter, JP Morgan Chase asked the SEC to agree that it could omit the proposal from its proxy materials on the grounds that it had already "substantially" implemented the suggested changes.The company said that it intends to include a "newly enhanced director skills and diversity matrix" in its definitive proxy statement that will provide expanded diversity disclosure for each director nominee. As such, JP Morgan believed that this "further demonstrates [its] commitment to diversity and transparency with shareholders.""In general, the board wishes to balance the needs for professional knowledge, business expertise, varied industry knowledge, financial expertise, and CEO-level business management experience, while striving to ensure diversity of representation among its members, including diversity with respect to gender, race, ethnicity and nationality," the company said.On March 17, the SEC disagreed with the company's claims that it had already implemented the suggested changes, adding that "based on the information [JP Morgan Chase has] presented, it appears that the company's policies, practices and procedures do not substantially implement the proposal."To arrange an online demo of Insightia's Voting module, send us an email.

Voting chart of the week

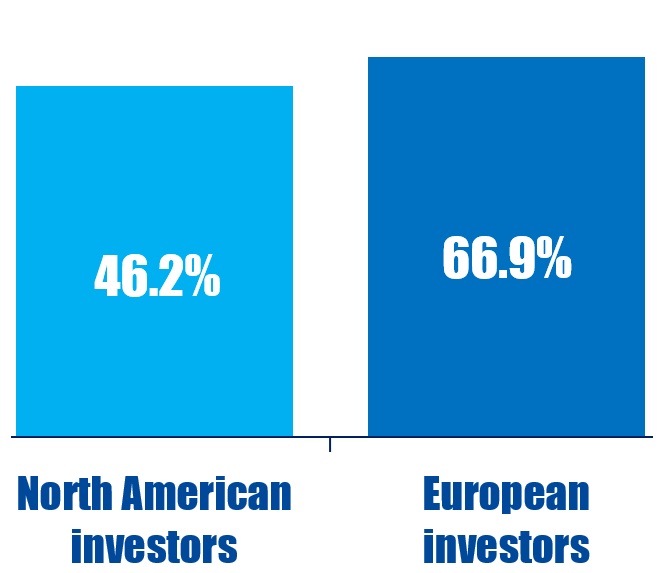

In the 12 months to June 30, 2021, North American investors supported global shareholder proposals on environmental and social issues 46.2% of the time on average. European investors supported these proposals 66.9% of the time.

Source: Insightia | Voting

What’s New In Activist Shorts - Blue Orca v Li-Cycle

Blue Orca Capital accused Toronto-based battery recycler Li-Cycle Holdings Corp (NYSE:LICY) of engaging in shady accounting to inflate its revenues and predicted the company would implode due to governance issues and lack of capital.The short seller published a March 24 short report calling Li-Cycle "a fatal combination of SPAC trash, stock promotion, awful corporate governance, faulty accounting, and a broken business model which is not economically viable."Blue Orca raised several red flags with respect to Li-Cycle and the people running it to argue that the company would likely turn to be "another trash SPAC to fall into ignominy and failure."The report alleged that Li-Cycle was using an "Enron-like mark-to-model accounting gimmick" to significantly boost its revenues and that the business was burning cash at a rate that will likely force it to raise at least $1 billion in the near term to stay afloat. Blue Orca also accused the company of hiding negative gross margins through "nebulous" reporting.The short seller also said Li-Cycle’s chairman was a "serial penny stock promoter" recently sanctioned by Canadian regulators and that the company spent $0.5 million on goods and services provided by related parties, including a leather goods maker owned by the CEO's family.To arrange an online demo of Insightia's Shorts module, send us an email.

Shorts chart of the week

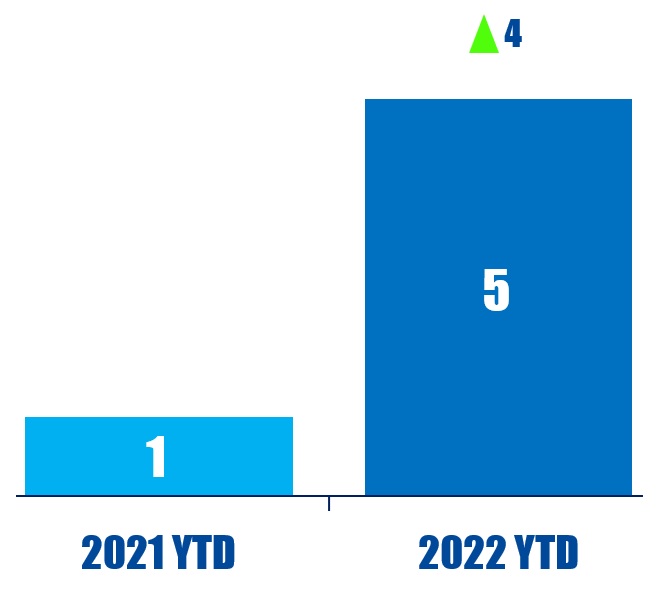

So far this year (as of March 25, 2022), five European companies have been publicly subjected to an activist short campaign. That is up from one in the same period last year.

Source: Insightia | Shorts

Quote Of The Week

This week's quote comes from Bruce David Klein on Beyond The Boardroom when asked about the more interesting things in Carl Icahn's house.

“In his office, he has some quirky items. One that seems to be getting a lot of Twitter reaction is his notebook which on the cover says ‘People I want to punch in the face.” – Bruce David Klein