We’re all familiar with the song “Diamonds Are A Girl’s Best Friend,” where Marilyn Monroe exults the values of compressed carbon. Although we had to wait 72 years, finally we can update the lyrics to “Diamonds are an Investor’s Best Friend!”

Q2 2021 hedge fund letters, conferences and more

Diamonds As An Investment Resource

That’s right, finally, diamonds are available as a commoditized, tradeable investment resource. With perfect timing for investors seeking a safe haven, diamonds can provide an inflation-hedged storage of wealth, plus significant potential for investment returns.

But how did we get here? Diamond Standard recently received regulatory approval for the world’s first and only fungible diamond commodity — making diamonds an investable asset, just like gold.

Risk is building, as the COVID-19 Delta variant and subsequent virus strains continue to worry investors, traders, and companies — and the stock market is reaching heights that defy all logic. We face potential changes of the Federal Reserve’s monetary policies, and the ongoing concern that inflation will prove to be more than just transitory, pushing Central Banks to take action. It’s no surprise that investors are looking to boost their portfolio yield, but also hedge with hard assets. In order to protect a portfolio from that inflation risk, diversification including hard assets is essential for capital preservation, risk management, and consistent returns.

Diamonds are a $1.2 trillion natural resource - more than silver and platinum combined. However, diamonds have always lacked the benefits of price discovery, transparency, liquidity, and low transaction fees. They were never standardized because they are all unique, and every diamond sold was a negotiation. In market terms, there was too much friction for investors to properly be able to invest in diamonds as a commodity.

But now, there is a significant investment case for why they should – over the last 10 years, diamonds have had the same performance as silver, with a lot less volatility.

Gold vs Diamonds

Only in the last two years has gold outperformed diamonds, before diamonds were available to investors. Now, given the rise in market volatility, in part sparked by the COVID-19 pandemic and investor’s increased interest in hard assets, diamonds are seeing a strong increase in demand.

In the case of diamonds, there is no more supply, which means the new demand will lead to an increase in price. Notably, since August 2020, diamonds have gone up 31%, which matches the S&P 500 during the same period, while gold went down 11%. By investing now, before diamonds are added to the commodities index, investors have the opportunity to beat the freight train of investors that will be accessing them via alternative means.

Source: Bloomberg

In terms of the value such an investment has, it’s important to look at the commodities market as it stands today. Commodities are a hard asset and precious metals in particular provide inflation protection, diversification with low correlation to stocks and bonds, and serve as a significant investment during times of economic turmoil, as metals typically outperform the stock market.

They also have intrinsic value as they cannot be printed or issued like stocks and bonds – more diamonds can’t be naturally created, it’s impossible to dig deeper to find more. No matter what your portfolio looks like today, if you add diamonds to it, your risk is significantly lower. For the next 15 years, as investors build positions in diamonds for the first time, the one-way demand is likely to outweigh short-term economic trends.

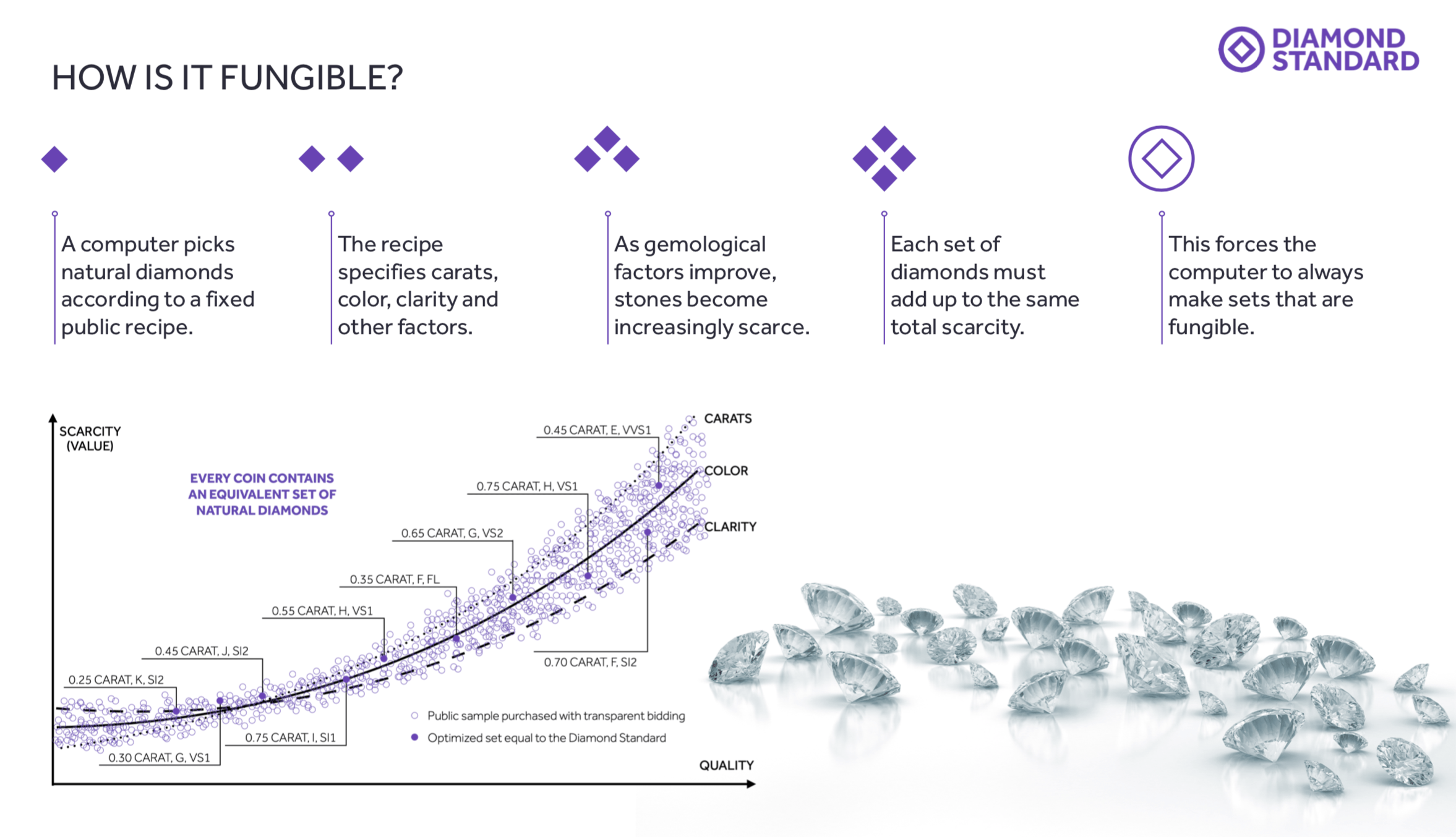

In order to make diamonds an investable commodity, significant research was conducted in order to create an ethically sourced, regulator approved Diamond Standard coin. Like the .999 standard for gold, Diamond Standard bids on millions of diamonds to buy statistically identical samples that achieve the “diamond standard.” The diamond coins contain an optimized set of natural diamonds that add up to an equivalent geological scarcity of carat, weight, color, and clarity. Inside each Diamond Standard Coin, a wireless encryption chip stores a blockchain token. The owner of the token is the legal owner of the Coin, and the token can be traded on digital asset exchanges - just like a Bitcoin but with a physical asset behind it.

While every diamond is unique based on these characteristics, the coins are equal and are purchased through a statistical sampling process, by automatically bidding on global diamond inventories, to purchase a statistically valid sample of thousands of natural diamonds from around the world. This means that for the first time ever, we can discover the price and deliver the entire yield curve of diamonds.

Source: Diamond Standard

In addition, the public index of gemological content inside the commodity has been approved by regulators and the trillion-dollar natural resource is available as a commodity. To create the index, Diamond Standard formed an electronic exchange with the participation of over 100 leading diamond dealers.

Finally, in the midst of the perfect storm for higher diamond prices, investors can take advantage of this under-allocated trillion-dollar natural resource. The Diamond Standard commodities have already been approved to settle futures being listed on the CME Globex, and options being listed on MIAX Options. An ETF is pending SEC approval for listing on the NYSE.

Fast forward one global pandemic, and the diamond industry certainly hasn’t faded from view. If anything, it has only taken on greater importance. Over the past year, there has been explosive growth in the industry as many investors continue to see diamonds as a big winner from lockdowns around the globe as access to rival luxury offerings was limited. The time is now for investors to take notice of this secure, deliverable, and easily traded commodity.

About Cormac Kinney

With innovations cited in nearly 4,000 U.S. Patents, Cormac has been the founder of four software startups acquired by public companies. He is a quant finance pioneer who invented heatmaps, designed over 100 institutional trading systems, and perfected sentiment analysis for statistical arbitrage, using it to manage over $500 million for Tudor and Millennium. Most recently, he built a business social network integrated into premium news publications, which was acquired by News Corp. Cormac studied computer science at Carnegie Mellon, earning Bachelors and Masters of Science degrees. Now, as founder and CEO of Diamond Standard, he has solved the challenge of creating a standardized diamond commodity. Delivered as a physical coin or bar, this regulator-approved commodity can be transacted as a token on a blockchain, with diamonds supplied fairly via transparent bids on an electronic diamond exchange.