The proof-of-stake (PoS) landscape is experiencing a surge in popularity, driven by increasing institutional adoption and growing investor interest.

This year has already witnessed significant milestones: EigenLayer’s TVL skyrocketed by $1 billion after temporarily removing staking caps, highlighting the potential of the PoS model. Total value locked (TVL) is a metric used in cryptocurrency to determine the total value of digital assets locked, or staked, on a particular blockchain network.

Further, ETH stake deposits reached a staggering $85 billion, with 25% of its circulating supply locked up, indicating a strong commitment from the Ethereum community.

This surge in staking activity has been accompanied by a remarkable price increase for Ethereum, reaching a new yearly high above $3,000, along with several other cryptocurrency tokens. With the PoS ecosystem thriving, many investors seek to explore the diverse opportunities presented by various staking projects.

This article presents a curated list of the best proof of stake coins to buy. It provides an overview of their unique features and potential by analyzing factors like market cap, staking rewards, and project development, empowering readers to make informed decisions in the PoS landscape.

Top Proof of Stake Coins in 2024

Crypto PoS is becoming increasingly popular in cryptocurrency, offering a more energy-efficient alternative to proof-of-work (PoW) mining.

As we move through 2024, let’s explore some of the top PoS coins to watch, considering their potential for growth and exciting features.

- Smog ($SMOG): A meme coin with a utility focus, is gaining traction in Africa. Its fair launch, massive airdrops, and community engagement initiatives have attracted over 23,000 holders. Smog operates on ETH and SOL, facilitating cross-border payments.

- Sponge V2 ($SPONGEV2): Sponge V2 builds upon $SPONGE by offering utility and rewards. Existing holders can bridge to V2, while new investors can buy and stake V1 for V2 tokens. A Play-to-Earn game adds further utility and potential growth for the project.

- Bitcoin Minetrix ($BTCMTX): By staking BTCMTX tokens, users earn “mining credits” that can be used to earn Bitcoin rewards, eliminating the need for expensive equipment or risky contracts. This approach offers an efficient way to participate in Bitcoin mining.

- Scotty the AI ($SCOTTY): A utility token integrating AI for enhanced security, fraud detection, and a user-friendly crypto experience through ScottyChat and Scotty Swap.

- Polygon ($MATIC): A Layer-2 scaling solution for Ethereum that enables faster and cheaper transactions for dApps by processing them off-chain, while leveraging Ethereum’s security.

- Algorand ($ALGO): Offering a two-layered architecture, this blockchain platform founded by a Turing Award-winning MIT professor provides secure and scalable transaction processing and smart contract functionality through an efficient consensus mechanism.

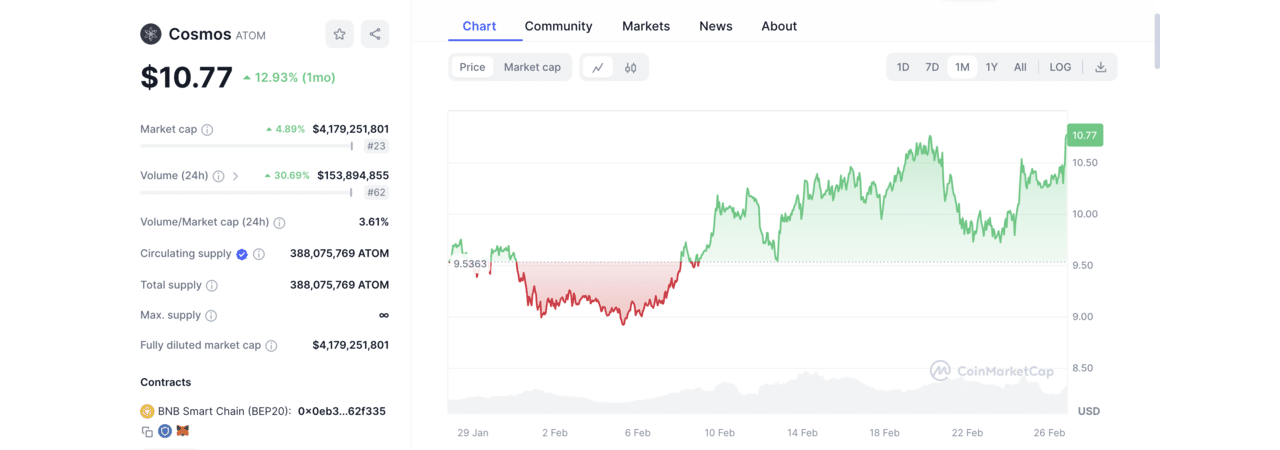

- Cosmos ($ATOM): Aims to establish an “internet of blockchains,” connecting independent blockchains for seamless data and token exchange. Its open-source framework empowers developers to build custom, interoperable blockchains within the Cosmos network.

What Does Proof of Stake (PoS) Mean?

Proof of Stake (PoS) is a consensus mechanism blockchains use to validate transactions and secure the network. Unlike Proof of Work (PoW), which relies on miners solving complex puzzles to earn rewards, PoS focuses on coin ownership.

In PoS, validators are chosen based on the amount of cryptocurrency they hold (their stake) to verify transactions and add new blocks to the blockchain. Holding a larger stake increases the probability of being selected as a validator, and successful validation earns rewards in the form of a new cryptocurrency.

Pros of PoS

- Energy Efficiency: Compared to PoW’s significant energy consumption, PoS requires far less computational power, making it a more environmentally friendly option.

- Faster Transaction Speeds: PoS generally offers faster transaction speeds compared to PoW, as there’s no need for complex computations to validate transactions.

- Improved Security: Some argue that PoS can be more secure than PoW because attacking the network would require accumulating a significant portion of the cryptocurrency, which can be expensive and risky.

Cons of PoS

- Centralization Concerns: Critics argue that PoS models with large stake requirements might favor larger holders, potentially leading to centralization within the network.

- Potential for cartels and collusion: If a small group of individuals holds a significant portion of the stake, they could collude and manipulate the network for their benefit, compromising its security and fairness.

- ‘Rich-get-richer’ effect: Existing token holders with larger stakes have a higher chance of being selected as validators and earning rewards, potentially exacerbating wealth inequality within the network over time.

Comparison with Proof of Work

While both PoS and PoW aim to achieve the same goal of securing a blockchain, they differ significantly in their approach. PoW relies on computational power, while PoS prioritizes coin ownership. This difference leads to variations in energy consumption, transaction speeds, and potential security vulnerabilities.

Different Types of PoS

Beyond the basic PoS, several variations exist, each with its own nuances:

- Committee-based PoS (NPoS): A smaller group of validators, elected by stakeholders, verify transactions.

- Delegated Proof of Stake (DPoS): Users vote for delegates who act as validators on their behalf.

- Liquid Proof of Stake (LPoS): Staked tokens remain liquid and can be traded while still being used for validation.

- Chain-based PoS: Validators are chosen based on their stake in a specific “validator chain.”

- BFT-based PoS: Utilizes Byzantine Fault Tolerance (BFT) protocols for faster consensus and improved scalability.

Understanding the various PoS implementations and their differences is crucial when evaluating blockchain projects and their potential.

Reviewing the Best PoS Tokens In 2024

Below are the top-ranked staking tokens with strong potential in the upcoming year.

1. Smog: Utility-Focused Meme Coin Tackles African Payments

Smog is a meme coin that is making waves in Africa, particularly in the areas of cross-border payments and community engagement. With a fair launch, massive airdrop campaign, and focus on utility, it aims to empower its users financially.

Bridging the Gap Between Meme Culture and Financial Inclusion

Smog boasts a unique fair launch strategy and a large-scale airdrop that has attracted over 23,000 holders and a vibrant online community exceeding 55,000 members. Its market cap surpasses $50 million, indicating its potential beyond simple meme status.

Partnerships like the one with Zealy, a work-to-earn platform, showcase their commitment to community engagement. Smog also distributes $1,500 worth of tokens daily to holders of popular meme coins, further solidifying this focus.

Tokenomics plays a significant role in Smog’s approach. 50% of the supply is dedicated to marketing, while 35% goes towards airdrop rewards. Additionally, 10% and 5% are allocated for CEX and DEX listings, respectively, ensuring wider availability and liquidity. Smog operates on Ethereum and Solana blockchains, increasing its accessibility and user base.

While the team remains anonymous, speculations link them to successful meme coin projects, potentially indicating experienced leadership. The roadmap prioritizes continued community engagement through airdrops and aims to cultivate a dedicated base of “Chosen Warriors.”

$SMOG Summary

Smog’s potential impact on Africa’s financial landscape is intriguing. Its focus on low-cost and efficient transactions could revolutionize cross-border payments and contribute to economic growth and financial inclusion across the continent.

Acknowledging the inherent volatility associated with meme coins and the importance of conducting thorough research before investing is crucial. Additionally, while not uncommon in this space, the anonymous development team raises concerns about transparency and accountability.

Overall, Smog presents an interesting case study, blending meme coin appeal with a utility-driven approach. It’s crucial to weigh potential benefits against inherent risks and conduct due diligence before making investment decisions.

| Project | Smog |

| Ticker | $SMOG |

| Blockchain Platform | Solana |

| Inception | 2024 |

2. Sponge V2: V2 Bridges V1 – Claim and Earn With $SPONGEV2

Sponge V2 is an upcoming token building upon the success of its predecessor, the meme coin Sponge ($SPONGE). It aims to provide more utility and rewards while retaining the core elements of a meme token. The primary goal is to replace V1, requiring existing holders to lock their tokens into the V2 smart contract to acquire V2 tokens.

Staking, Gaming, and Rewards

Launched in May 2023, Sponge V1 achieved significant success, reaching a market cap close to $100 million and securing listings on multiple centralized exchanges. Sponge V2 builds upon this foundation by introducing a purpose-built ecosystem and staking rewards.

Investors have two options to acquire Sponge V2:

Staking V1 tokens: Buy and stake V1 tokens in the official pool to receive V2 tokens upon launch.

Bridging V1 holdings: Existing V1 holders can bridge their tokens to V2 through a simple staking mechanism.

These options ensure V2 tokens are distributed proportionally to the number of V1 tokens staked. Once the remaining V1 supply is depleted, V2 will be available for claim.

The project is also developing a Play-to-Earn game to introduce further utility. With free and paid playstyle options, players can earn $SPONGEV2 tokens by playing and achieving high rankings. This integration is expected to affect token growth and project utility significantly.

$SPONGEV2 Summary

Sponge V2 offers several points to consider:

Migration Requirement: Investors must bridge their V1 tokens to receive V2, potentially deterring those hesitant about the process.

Play-to-Earn Potential: The upcoming P2E game adds a layer of utility and potential token value, though its success hinges on gameplay and user adoption.

Planned Exchange Listings

To increase accessibility and liquidity, Sponge V2 plans listings on centralized (CEX) and decentralized (DEX) exchanges. CEX listings can attract new investors and increase trading volume, while DEX listings promote user autonomy and decentralization. Both types of listings are crucial for $SPONGEV2’s growth and will impact its price dynamics.

Overall, Sponge V2 presents an interesting case focusing on community engagement and utility expansion. However, investors should carefully consider the migration process, the evolving P2E landscape, and potential exchange listings before making investment decisions.

| Project | Sponge V2 |

| Ticker | SPONGEV2 |

| Max. Supply | 150B |

| Blockchain Platform | Ethereum |

| Inception | 2024 |

3. Bitcoin Minetrix: Secure, Accessible Bitcoin Mining Through Staking

Bitcoin Minetrix ($BTCMTX) seeks to revolutionize Bitcoin mining by offering a novel “Stake-to-Mine” approach. Traditional mining methods often involve expensive equipment, technical expertise, and potential scams. BTCMTX aims to remove these barriers, allowing anyone to earn Bitcoin rewards simply by holding and staking its BTCMTX token.

Bitcoin Minetrix Makes Mining Accessible

Traditional cloud mining often presents challenges like high entry barriers, lack of transparency, and scams. Bitcoin Minetrix seeks to address these issues by leveraging blockchain technology. Users purchase BTCMTX tokens and stake them to earn “mining credits.”

While non-transferable, these credits can be burned to receive Bitcoin cloud mining hash power. This innovative approach eliminates the need for expensive mining equipment or risky contracts, empowering users with greater control and security.

$BTCMTX Summary

Bitcoin Minetrix’s Stake-to-Mine model has garnered significant interest, with over 14,300 members on its Telegram channel and over $11.4 million raised in its presale. This enthusiasm is further fueled by analysts’ predictions of a potential price surge upon exchange listing.

Additionally, the project’s secure smart contracts, as audited by Consult, provide further assurance to potential investors. Unique Aspects:

- Accessibility: Eliminates the need for specialized equipment or technical expertise, making Bitcoin mining accessible to a broader audience.

- Transparency: Utilizes blockchain technology for secure and transparent mining operations.

- Control: Unlike traditional cloud mining contracts, users retain control of their funds and staked tokens.

- Security: Secure smart contracts audited by Coinsult to mitigate potential security risks.

Overall, Bitcoin Minetrix presents a novel approach to cloud mining, offering potential benefits for both experienced and new cryptocurrency users. However, it is crucial to remember that, as with any investment, thorough research and due diligence are essential before making any financial decisions.

| Project | Bitcoin Minetrix |

| Ticker | $BTCMTX |

| Max. Supply | 4,000,000 |

| Blockchain Platform | Ethereum |

| Inception | 2024 |

4. Scotty the AI: AI-powered Security, Swap & Chat for Crypto

Scotty the AI ($SCOTTY) stands out in the utility token landscape by merging Artificial Intelligence (AI) technology with blockchain functionalities. The project aims to enhance security and user experience within the crypto sphere through its AI-powered offerings, including a conversational assistant, a secure token exchange, and advanced security features.

Beyond the Hype, Towards Utility

Scotty the AI leverages its AI engine to provide various functionalities, including:

Real-time transaction monitoring: Real-time transaction monitoring is a critical feature of AI-powered blockchain security systems. This technology leverages the power of machine learning to continuously analyze all incoming transactions and identify any suspicious activities that may indicate fraud or security breaches.

Advanced security tools: The primary objective of this project is to develop reliable and effective cybersecurity solutions that can accurately detect any anomalies and potential threats that may arise across various ledgers.

AI-powered conversational assistant: ScottyChat is a platform that provides a highly intuitive and user-friendly AI-powered chatbot to help users interact with the platform and access information easily. The chatbot is designed to provide a seamless experience by understanding user queries and providing relevant responses in real time.

Seamless token exchange: Scotty Swap is an advanced spot exchange that employs artificial intelligence technologies to provide rapid and secure token swaps for cryptocurrency traders. With Scotty Swap, users can enjoy fast and efficient trading, while also benefiting from enhanced security measures that ensure the safety of their assets.

$SCOTTY Summary

Scotty the AI positions itself uniquely by merging AI functionalities with conventional crypto utilities. Its AI engine focuses on security aspects, aiming to identify fraudulent transactions and enhance overall blockchain security through real-time monitoring and anomaly detection. This differentiates $SCOTTY from many meme tokens criticized for lacking real-world use cases.

Furthermore, staking rewards of up to 145% (as of publication) incentivize holding $SCOTTY tokens and demonstrate the project’s commitment to rewarding early supporters. Additionally, a successful smart contract audit by Coinsult bolsters investor confidence in the project’s security and legitimacy.

While Scotty the AI has garnered early interest and raised over $500,000 during its presale, the long-term success of the project and its ability to deliver on its promises remain to be seen. With its passionate community and exciting product launches on the horizon, Scotty the AI has quickly risen to prominence as one of the most promising altcoins to debut.

| Project | Scotty the AI |

| Ticker | $SCOTTY |

| Max. Supply | 1,734,567,890 |

| Blockchain Platform | Ethereum |

| Inception | 2023 |

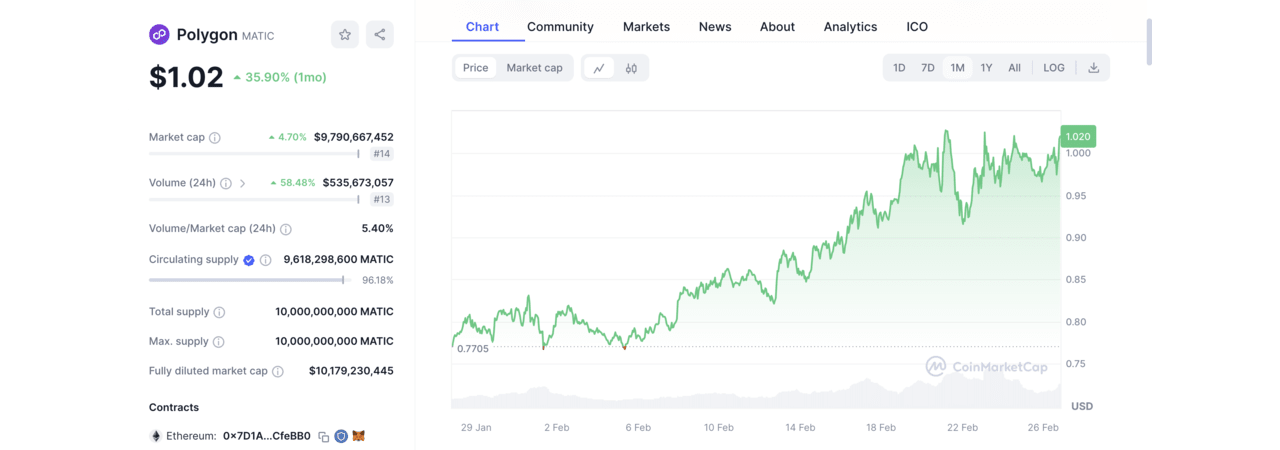

5. Polygon: A Scalable Solution for Ethereum

Polygon, formerly known as Matic Network, is a platform aiming to address the scalability limitations of the Ethereum blockchain. It facilitates the creation of interoperable blockchain networks, enabling developers to build secure and scalable dApps that leverage the Ethereum ecosystem’s security and network effects.

Addressing Ethereum’s Scalability Hurdle

Polygon operates as a “Layer-2” scaling solution, functioning alongside the Ethereum mainchain. It utilizes “Commit Chains” to process transactions off-chain faster and cheaper.

These Commit Chains bundle and verify batches of transactions before submitting them to the Ethereum mainchain for final settlement. This approach significantly reduces transaction fees and processing times compared to directly using Ethereum.

$MATIC Summary

Polygon has garnered significant traction within the blockchain space, attracting over 250 DApps, facilitating millions of transactions, and boasting hundreds of thousands of unique wallet users. Its core strengths lie in:

- Scalability: Polygon’s Layer-2 architecture offers significantly faster transaction speeds and lower fees compared to the Ethereum mainchain.

- Interoperability: Polygon allows seamless communication between Ethereum and other blockchain networks, fostering a more interconnected ecosystem.

- Security: By leveraging the security of the Ethereum mainchain, Polygon inherits its robust security profile for deployed applications.

However, it’s crucial to acknowledge the challenges associated with Polygon’s reliance on centralized infrastructure for its Proof-of-Stake consensus mechanism. Additionally, the project’s long-term roadmap envisions integrating other Layer-2 scaling solutions beyond Commit Chains, which may introduce further complexities.

Overall, Polygon presents a promising solution for scaling the Ethereum ecosystem, offering developers a framework to build secure and scalable dApps. While the project faces certain challenges, its growing adoption and ongoing development signal its potential to play a significant role in the future of blockchain technology.

| Project | Polygon |

| Ticker | $MATIC |

| Market Cap (Feb, 2024) | $9,790,628,669 |

| Max. Supply | 10,000,000,000 |

| Blockchain network | Ethereum |

| Inception | 2017 |

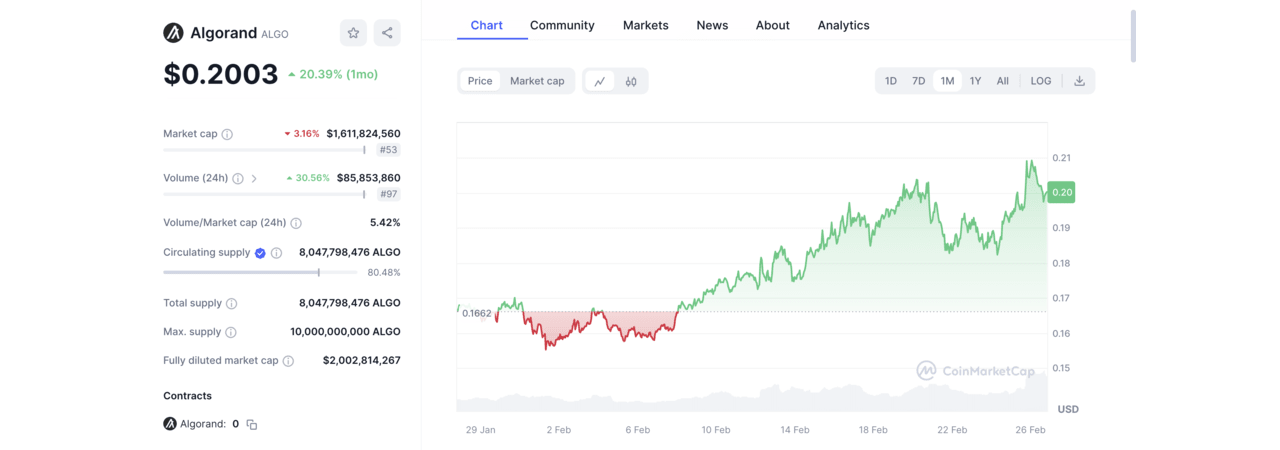

6. Algorand: Scalable, Secure Blockchain for Next-Gen dApps

Algorand ($ALGO) is a blockchain platform designed to address the “blockchain trilemma” – simultaneously achieving scalability, security, and decentralization.

Founded in 2017 by Silvio Micali, a renowned cryptographer and Turing Award winner, Algorand boasts a unique two-tiered architecture for smart contracts. This architecture fosters developer adoption and caters to various use cases.

Pure Proof-Of-State and Two-Tiered Architecture

The Algorand blockchain uses a novel consensus mechanism called Pure Proof-of-Stake (PPoS) to achieve fast transaction processing speeds (over 1,000 transactions per second) and low fees.

PPoS ensures security by randomly selecting a committee of users to validate transactions, eliminating the need for energy-intensive mining prevalent in Proof-of-Work (PoW) blockchains.

Algorand is known for its developer friendliness, supporting various programming languages like Java, JavaScript, Python, and Go. This, coupled with its fast transaction processing and low fees, makes it an attractive platform for building and deploying decentralized applications (dApps).

$ALGO Summary

Algorand’s strengths lie in its strong technical foundation, experienced team, and established partnerships. The platform’s unique architecture offers scalability and security while fostering developer adoption.

Notably, Algorand has formed partnerships with entities such as the Republic of the Marshall Islands and Circle to bring real-world applications to its platform, including the ability to power a nation’s digital currency and provide fiat-backed stablecoins.

It’s worth noting that Algorand is not as established as Ethereum or Cardano, which may have implications. While it boasts no downtime (or outage) since launch, the long-term sustainability and security of its PPoS mechanism require continuous testing and scrutiny.

Overall, Algorand presents a promising option for those seeking a fast, secure, and developer-friendly blockchain platform. However, potential users should carefully consider the project’s stage of development and weigh its advantages against potential risks before making any investment decisions.

| Project | Algorand |

| Ticker | ALGO |

| Market Cap (Feb, 2024) | $1,615,787,895 |

| Max. Supply | 10,000,000,000 |

| Blockchain network | Algorand |

| Inception | 2019 |

7. Cosmos: Connecting the Blockchain Universe

Cosmos aims to create an “internet of blockchains” – a network of independent blockchains that can communicate and interact. It allows developers to build their own custom blockchains, called “zones,” that can connect and exchange data and tokens with other zones in the network.

This interoperability aims to overcome the limitations of isolated blockchains and unlock the full potential of blockchain technology.

“Internet of Blockchains”

The Cosmos network is anchored by the Cosmos Hub, a Proof-of-Stake (PoS) blockchain serving as the central communication hub. This hub facilitates token and data exchange between various zones within the network.

Launched in 2019, the Inter-Blockchain Communication (IBC) protocol is the backbone for inter-zone communication, enabling seamless token and data transfer between individual blockchains.

Developers benefit from the Cosmos SDK, a modular and customized blockchain framework. This allows them to tailor individual blockchains to specific needs while inheriting the security and scalability benefits of the Cosmos ecosystem.

Furthermore, the network utilizes the Tendermint consensus engine, implementing a PoS algorithm for network security.

$ATOM Summary

Cosmos presents a unique approach to blockchain interoperability, aiming to overcome the limitations of siloed blockchain networks. By fostering communication and collaboration between diverse blockchains, the project holds the potential to unlock new possibilities for decentralized applications (dApps) and the overall blockchain ecosystem.

However, it’s crucial to acknowledge that the project is still under development, and the long-term success of the “internet of blockchains” vision hinges on widespread adoption and integration by various blockchain projects. Additionally, security considerations across interconnected chains remain a crucial aspect to be addressed as the network evolves.

| Project | Cosmos |

| Ticker | ATOM |

| Market Cap (Feb, 2024) | $4,172,550,493 |

| Total Supply | 388,075,769 |

| Blockchain network | Cosmos |

| Inception | 2014 |

Is Ethereum Proof of Stake Still Profitable?

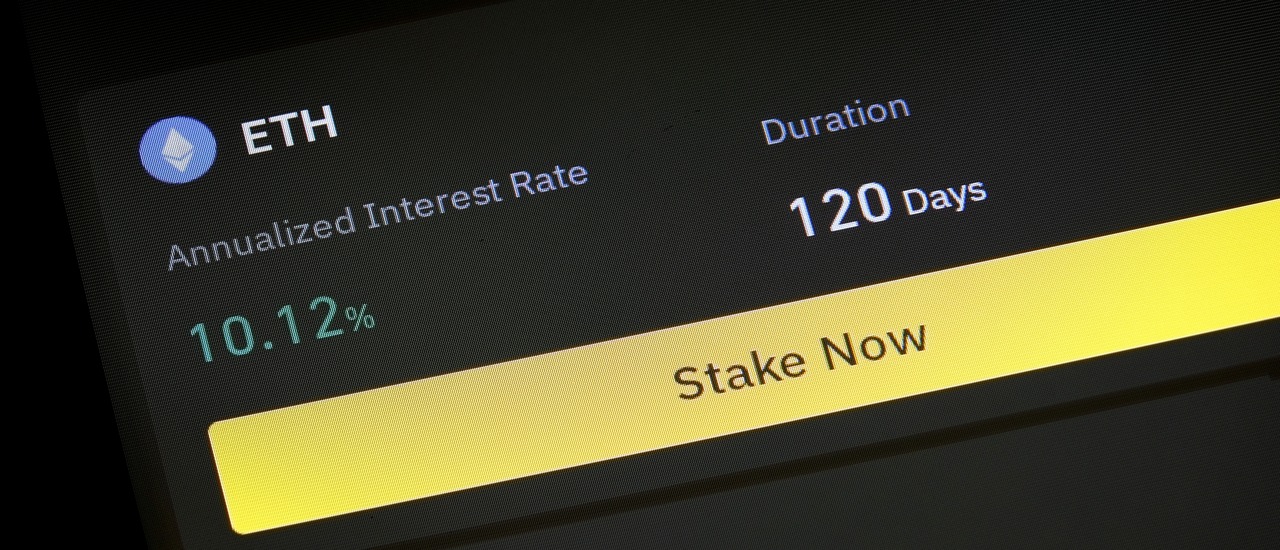

While Ethereum’s transition to proof-of-stake (PoS) in September 2022 marked a significant change for the world’s second-largest cryptocurrency by market cap, it did not make the network the most profitable option for individual stakers. This section explores why Ethereum (ETH) is not included in our list of “best proof-of-stake coins” despite its prominence.

High ETH Requirement

Unlike other PoS blockchains, Ethereum staking demands a hefty minimum investment. To become a validator on the network, users must lock up a staggering 32 ETH, which translates to over $50,000 as of February 2024. This significant financial barrier effectively excludes many potential participants, particularly those new to cryptocurrency or with limited capital.

Low APR/APY

Even for those with the capital to meet the minimum requirement, Ethereum’s current staking rewards, measured in Annual Percentage Rate (APR) or Annual Percentage Yield (APY), are relatively low compared to other PoS blockchains. As of February 2024, the Ethereum Staking Rewards ROI Calculator by Blocknative reports that Ethereum’s staking APY is around 4%, which some may consider low given the high entry barrier.

Other Tokens Offer Higher Yields

Several alternative PoS blockchains offer significantly higher staking rewards, sometimes exceeding 10% APY. These alternative platforms often have lower minimum staking requirements, making them more accessible to a broader range of investors seeking a higher return on their investment.

It’s important to note that while Ethereum staking may not offer the highest returns, it still presents an opportunity to earn passive income on your ETH holdings.

Additionally, Ethereum’s position as a leading blockchain with a vast ecosystem and potential for future growth could appeal to some investors who prioritize long-term value over immediate high yields. Ultimately, deciding whether to stake ETH depends on your financial goals and risk tolerance.

Is Bitcoin Proof of Stake?

No, Bitcoin is not a proof-of-stake (PoS) cryptocurrency. It utilizes a different consensus mechanism called proof-of-work (PoW), which relies on miners solving complex mathematical puzzles to validate transactions and secure the network.

This process requires significant computational power and results in high energy consumption, which has been a subject of growing environmental concern.

While Bitcoin remains the most valuable cryptocurrency by market capitalization, its PoW consensus mechanism has sparked discussions and explorations of alternative approaches.

Several projects, including Core Network (CORE) and LENX Finance (XD), aim to bring decentralized finance (DeFi) functionalities to the Bitcoin ecosystem. These projects often utilize wrapped Bitcoin (wBTC) tokens on other blockchains with PoS or other consensus mechanisms, allowing users to participate in DeFi activities without directly leaving the Bitcoin network.

It is important to note that implementing a major shift in Bitcoin’s consensus mechanism, like transitioning to PoS, is a complex and controversial undertaking. The Bitcoin community is known for its decentralized nature and adherence to the original whitepaper.

Any significant change would require a broad consensus among miners, developers, and users, which can be challenging to achieve. Currently, there are no concrete plans to switch Bitcoin to a PoS system.

Comparing the Best Proof of Stake Coins

| Project | Token | Total Supply | Chain | Staking | Inception |

| Smog | $SMOG | 1.4B | Solana | Yes | 2024 |

| Sponge V2 | $SPONGEV2 | 150B | Ethereum | Yes | 2024 |

| Bitcoin Minetrix | $BTCMTX | 4B | Ethereum | Yes | 2024 |

| Scotty AI | $SCOTTY | 1,734,567,890 | Ethereum | Yes | 2023 |

| Polygon | $MATIC | 10B | Ethereum | Yes | 2017 |

| Algorand | $ALGO | 10B | Algorand | No (Closed in 2022) | 2019 |

| Cosmos | $ATOM | ATOM | Cosmos | Yes | 2014 |

FAQs

What is the best proof of stake coin?

There isn’t a single “best” proof of stake coin, as each has unique capabilities and targets different use cases. Choosing the “best” depends on your investment goals and risk tolerance. Researching individual coins and considering factors like market cap, transaction fees, and staking rewards is crucial.

Is proof of stake profitable?

Proof of stake can be profitable through staking rewards, incentivizing users to hold coins, and participate in network validation. However, these rewards are not guaranteed and fluctuate based on network activity and coin price.

Is Ethereum proof of stake better?

Whether Ethereum’s proof of stake is “better” than its previous proof of work is subjective. Proof of stake offers advantages like faster transaction processing and lower energy consumption. However, it may be less decentralized than proof of work in its current form. Evaluating these trade-offs and the project’s overall roadmap is essential for forming an opinion.

Will Bitcoin ever be proof of stake?

It is unlikely that Bitcoin will switch to proof-of-stake in the foreseeable future. The Bitcoin community prioritizes decentralization and immutability, which some argue might be compromised in a proof-of-stake model. Though energy-intensive, the current proof-of-work system is deeply ingrained in Bitcoin’s identity, and changing it would require significant community consensus, which seems improbable at present.

What is the most popular proof-of-stake coin?

As of February 2024, Ethereum (ETH) is the most popular proof-of-stake coin by market capitalization. However, other contenders like Cardano (ADA), Solana (SOL), and Polkadot (DOT) are gaining traction and have established their communities.

What is proof of staking in crypto?

Proof of staking is the process of holding cryptocurrency tokens to support the security and operation of a proof-of-stake blockchain. Staked coins are essentially locked up for a certain period, and the holder earns rewards for contributing to network validation.

What was the first PoS coin?

The first cryptocurrency to implement a proof-of-stake consensus mechanism was Peercoin (PPC), launched in 2012. It introduced a novel approach to securing the network and paved the way for further development of the PoS model.

What is the disadvantage of proof of stake?

One potential disadvantage of proof of stake is that it may be less decentralized than proof of work, especially in its early stages. Additionally, some argue that staking rewards can favor wealthier users who hold larger amounts of coins.

What are the benefits of proof of stake?

Proof of stake offers benefits such as energy efficiency, reduced environmental impact, and increased scalability compared to proof of work. Stakers are incentivized to act in the network’s interest, promoting a more secure and sustainable ecosystem.

Who invented proof of stake?

The concept of proof of stake is not attributed to a single individual. It emerged from discussions and proposals within the early cryptocurrency community, with significant contributions from Sunny King and Scott Nadal in developing Peercoin, the first PoS implementation.

Sources

- https://www.linkedin.com/pulse/algorand-blockchain-powering-marshall-islands-digital-chintan

- https://www.prnewswire.com/in/news-releases/algorand-foundation-and-circle-bring-digital-dollars-powered-by-usdc-to-algorand-blockchain-847354919.html

- https://coinfomania.com/smog-bringing-cross-border-payments-to-africans/

- https://cointelegraph.com/news/eigenlayer-tvl-rockets-1b-after-removing-staking-caps

- https://www.binance.com/en-IN/feed/post/2024-02-15-ether-staking-deposits-reach-85b-25-of-circulating-supply-now-locked-4155194912041