Well, that’s not the first crisis that we’ve seen in this millennium. There were COVID-based lockdowns, and there was the infamous 2008 slide in practically all asset prices.

It’s easy to follow the emotion in the markets. It’s easy to follow the herd.

It’s difficult to make profits.

Why?

Q4 2022 hedge fund letters, conferences and more

Because it takes resilience and courage to ignore the commotion and ask good questions. For example: all right, but what’s really going on and what happened when the same thing happened previously? Were there some typical reactions? Can I apply it now? What else happened, and what else is happening now? What’s the context?

In our case and in the current situation, the key questions are:

How did those crises really work for gold? For stocks? For mining stocks?

Let’s start with the more recent crisis – the 2020 one.

The Recent Crisis

At first, gold soared while the USD Index declined. People ran for the hills, took their gold bars and coins with them, and rushed to buy more while on the way. And I’m only half joking.

There was an initial top and an initial decline, and it was followed by a corrective upswing – a sizable one – which took about a week.

Gold soared initially (late-February – early March 2020), and it moved slightly above its previous high. People were very bullish at that time as it seemed that the world was ending. The world came to a standstill almost overnight! The job numbers were horrible and unprecedented. It made sense to buy gold, right?

Well, gold soared in huge volume, so many people thought that it was a good idea.

Yet, that was the worst moment to buy gold from a short-term point of view, as that was when gold topped, and it then declined several hundred dollars in about a week.

What happened?

The gold price peaked along with uncertainty. As people moved to the currency that they can and want to actually use in day-to-day transactions – USD – gold plunged and the USD Index soared.

While the gold was still soaring and the USDX was moving lower, we also saw a consolidation on the stock market (that happened after a short-term decline) and a rebound in mining stocks. The rebound in miners (early March 2020) was notable, but it wasn’t nearly as big as the rally in gold.

Then, as gold and stocks declined, mining stocks (in particular junior mining stocks) truly plunged. The value of the GDXJ was pretty much cut in half in about a week.

Please keep in mind the parts that I put in bold while we move to the next crisis – the 2008 one.

Well, what happened?

There was an initial (July 2008) top and an initial decline, and it was followed by a corrective upswing – a sizable one – which took about a week.

While gold was moving sharply higher in September 2008 (on huge volume), the USD Index declined. Also, stocks were moving back and forth after a decline, and mining stocks moved higher in a notable manner but not as visibly as gold did.

In 2008, gold didn’t rally back to its previous highs, but everything else was remarkably similar, even though the two crises were over a decade apart!

It’s simply normal for people to first “run for the hills” and buy gold, and then switch to the USD while selling stocks (and – most of all – silver and mining stocks).

With this context in mind, let’s see where we are now.

People are very concerned about the health of the banking sector – it looks like a severe banking crisis. Is the world ending? It might seem so, but is the fear really as big as it was when the entire globe was in lockdown back in 2008? Not really – the current situation is not as severe as the previous one.

What is gold price doing right now?

Exactly. The. Same. Thing.

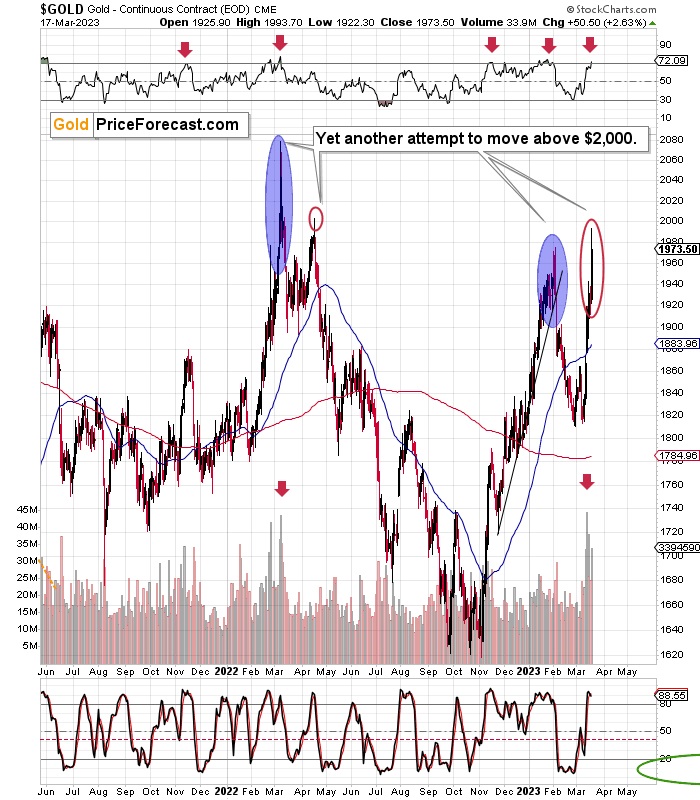

Gold was after an initial decline and downswing and now it’s been rallying for about a week now. This rally was accompanied by huge volume.

Do you see the link already?

Gold moved slightly above its previous high. In fact, in today’s pre-market trading, gold even moved somewhat above $2,000. This doesn’t invalidate the analogy, because the ultimate top for gold relative to the previous high was the only thing that wasn’t very similar in case of both previous crises.

What about the rest? The other markets?

The Other Markets

The USD Index dipped (main part of the above chart) just like in mid-2008, right before its sharpest rally in many years.

Stocks (bottom of the above chart) moved sideways after a decline.

And mining stocks?

Miners moved higher, but the size of the move was much smaller than what we saw in gold.

All this means that while it might be difficult to believe (as it’s natural for everyone to focus on what happened recently), what’s happening on the markets right now is a typical reaction to the early stages of crisis-based declines.

The implications are extremely bearish for junior mining stocks.

They are also bearish for the rest of the precious metals sector. However, it’s least unclear how high gold might move in the immediate term.

Still, do you know the saying that time is more important than price – when the time is up, the price will reverse?

The “weekly move” analogy was surprisingly accurate – gold’s final pre-slide rally took about a week. And that’s how much time the current rally took. This means that it’s likely to end today or shortly, anyway.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice.

Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported.

The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports.

Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.