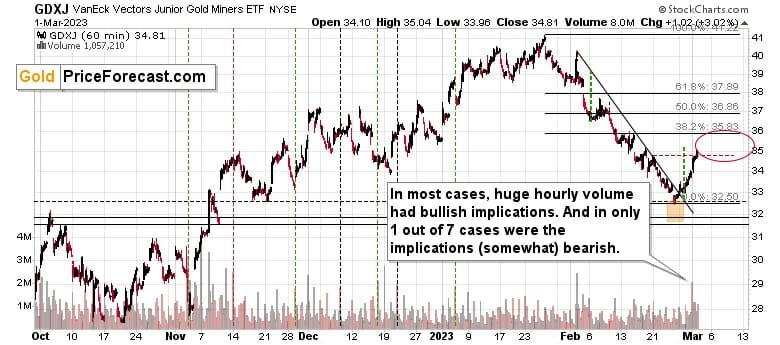

Let’s start today’s analysis with a very short-term chart (hourly candlesticks) featuring the Gold ETF (GDXJ) – a proxy for junior mining stocks. These miners have been the most volatile part of the precious metals sector – at least, it’s the more popular part.

As I had indicated earlier, the big-volume decline that we saw on the hourly candlestick was likely to trigger another quick rally. Indeed, we saw another sizable intraday upswing that allowed us to take profits from our quick long positions.

Q4 2022 hedge fund letters, conferences and more

Why did I take profits there instead of waiting for the junior miners to move to even the first of their classic Fibonacci retracement levels?

Two reasons:

- My idea behind the previous long position was to catch the “easy” part of the rally, as given the strength of the medium-term downtrend, the biggest risk was to miss profits from the decline.

- The mid-Feb. intraday highs also served as at least somewhat important resistance.

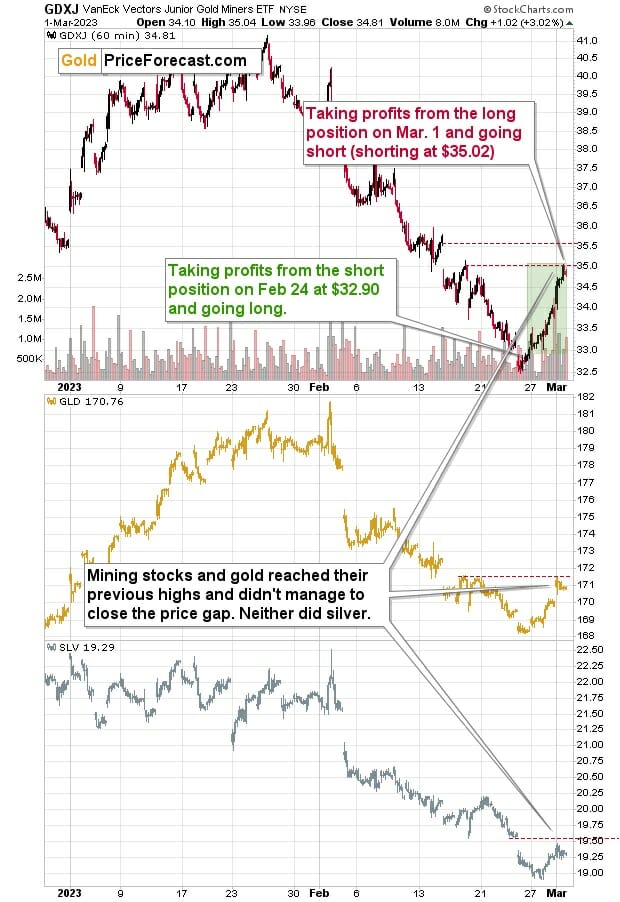

You can see the latter even more clearly on the below chart.

You can additionally see that it was not just the GDXJ ETF that touched the resistance created by the previous intraday highs. We saw the same thing in the GLD ETF (a proxy for gold).

The SLV ETF (proxy for silver) wasn’t even that strong. The white metal topped below its mid-Feb… lows.

What’s next? Well, given the critical action in the stock market that we just saw, it seems quite likely that the next move lower is already underway, or it could start very soon.

The thing is that the S&P 500 moved below its rising support line based on the October and December 2022 lows and also its declining support line – thus invalidating a breakout above it.

There was some back-and-forth movement after those breakdowns, and they were verified as a result. Thanks to this, we know that those moves lower were not accidental or artificial. To be precise, one can never be 100% certain on anything on the market, but the above seems very likely.

Since stocks and the precious metals market declined together and then rallied together, it seems that they can slide together in the following weeks as well.

So, all in all, it seems that the next big move lower is either already underway or about to start.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice.

Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported.

The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports.

Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.