Stanphyl Capital’s commentary for the month ended June 30, 2021.

Q1 2021 hedge fund letters, conferences and more

Friends and Fellow Investors:

...........

Regarding gold, despite a rapidly increasing rate of inflation as evidenced yet again this month in CPI, PPI and even the Fed’s nonsensical PCE core, the market (for now) seems to believe the clueless Fed’s statements that it’s “transitory.” Those of you who read these letters regularly know that I’ve been adamantly in the NON-transitory camp, partially predicated on the Biden administration jamming through continual massive deficit spending (enabled by the debt-monetizing Federal Reserve) while driving up the cost of both oil and labor via increased regulation. What I hadn’t anticipated is a contingent of Senate moderates in the Democratic Party who may not let all the fiscal aspects of that happen. Thus, it’s possible that although we’ll have somewhat inflationary budget deficits accompanied by higher energy prices and wage & benefit inflation (as well as possible supply chain inflation as we move Chinese production elsewhere), this may result in perhaps a 3.5% CPI rather than the 1970s-style high single-digit figure I’ve been anticipating, and the former would be much less beneficial for gold. The outcome depends on what happens with the massive (up to $6 trillion) so-called “infrastructure” legislation that Democrats plan to attempt to pass this summer via reconciliation. I shall thus remain nimble with our gold position, and depending on the craziness of the fiscal situation may reduce it significantly if saner fiscal minds prevail (or if it further breaks down further technically). On the other hand, if insanity prevails and the technicals are okay, I plan to hold it for a while.

Regardless of whether inflation settles in as low as 2.3% (where it was before the COVID crisis began), 3.5% or 8.5%, the current 10-year Treasury yield of less than 1.5% is an unsustainable joke, and thus infinity PE stocks such as the ones found in ARKK (as well as Tesla) will inevitably collapse from current levels due to severe PE multiple compression and the Fed’s inevitable “taper,” and I thus plan to retain a large short position in them regardless of what happens in D.C. (while trimming them if they continue to go higher, so as to control their percentage of AUM).

Post-COVID Inflation

Meanwhile, if you’re in the “lowflation” camp, kindly have a look at this chart (below) and explain—as velocity accelerates in the post-COVID environment—how post-COVID inflation won’t be higher than the aforementioned pre-COVID 2.3%:

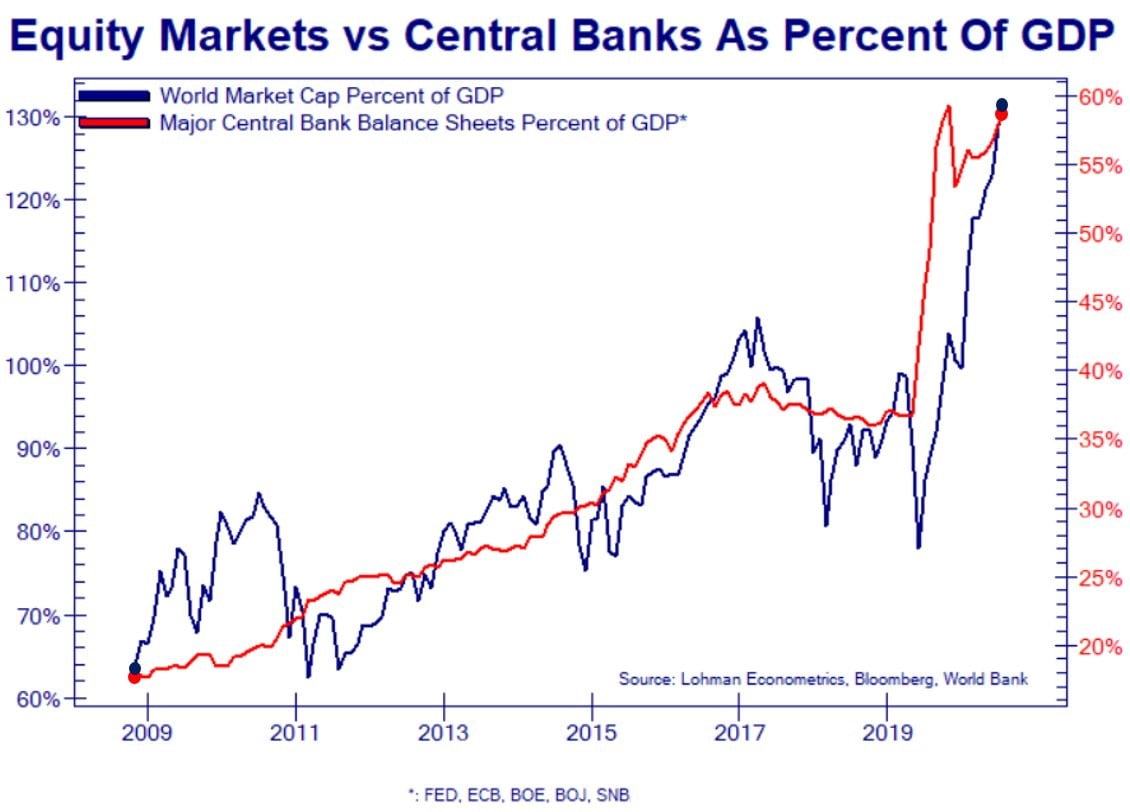

And if you think the inevitable Fed “taper” won‘t remove a massive tailwind behind high-priced stocks, have a look at this chart from Twitter user @Not_Jim_Cramer:

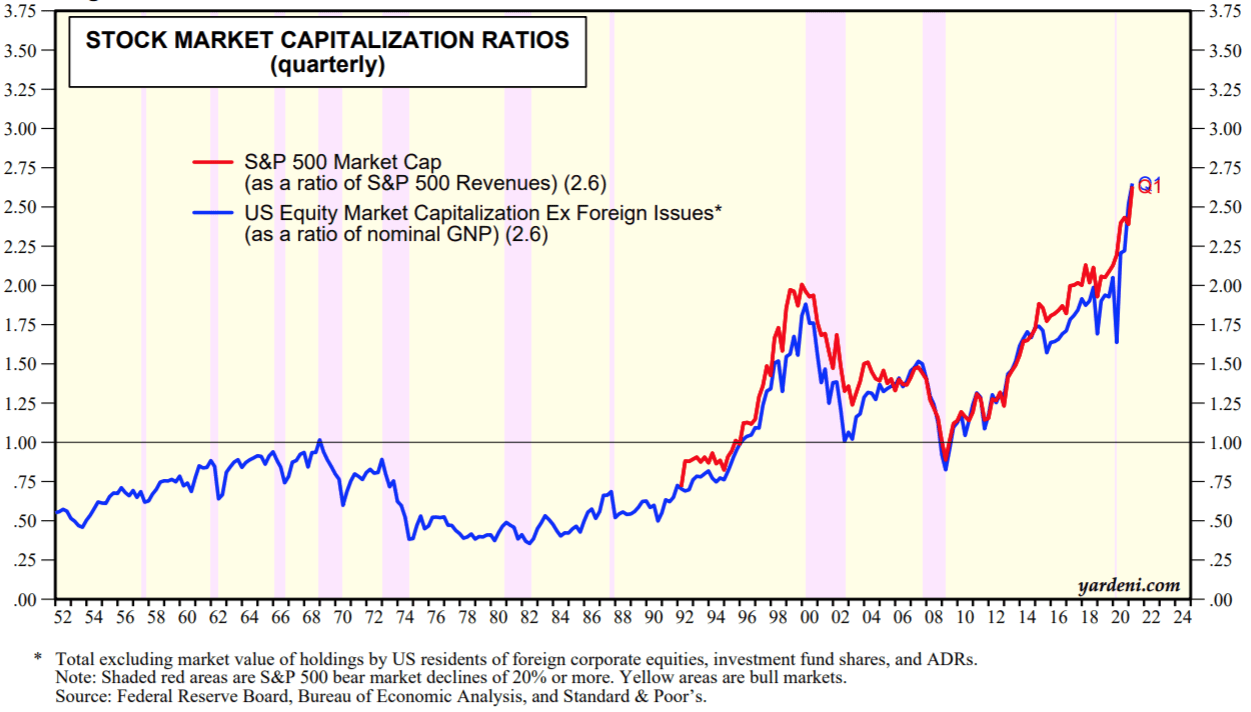

Meanwhile, equity indexes are so stretched that myriad exogenous events (both “known unknowns” and “unknown unknowns”) could pop this market even independent of inflation or Fed actions. Courtesy of Yardeni Research we can see that the S&P 500’s ratio of price-to-sales and the overall stock market’s ratio of price-to-GNP are the highest they’ve been in modern history…

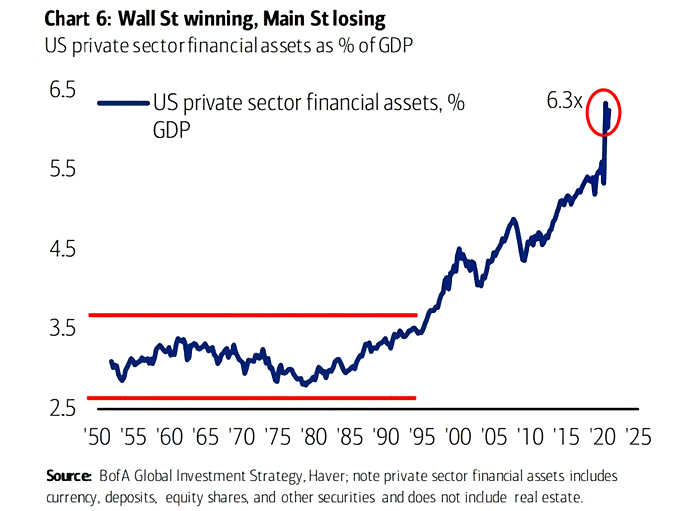

And courtesy of Twitter user @ISABELNET_SA, have a look at this astounding historical chart of U.S. financial assets relative to GDP:

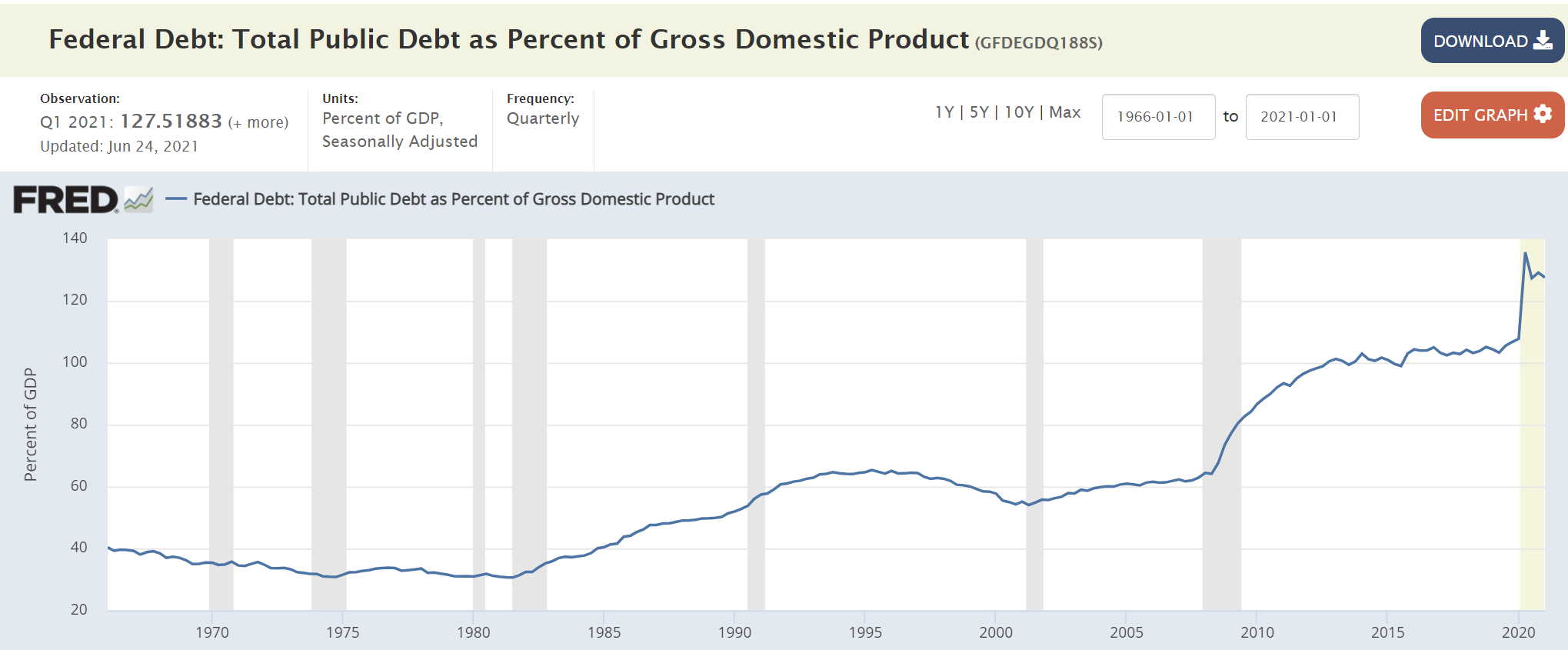

And here’s the insane amount of debt we face; the only “solution” for this is the aforementioned PE multiple-crushing inflation:

Long Positions

Here then are the fund’s other current long positions, followed by our regular update on Tesla; please note that we may add to or reduce position sizes as stocks approach or recede from our target prices…

We continue to own Data I/O Corporation (NASDAQ:DAIO), a manufacturer of semiconductor programming devices, which in April reported a solid Q1 2021, with revenue of $6 million, up 26% from the year-ago quarter and 22% sequentially, a 55% gross margin, a net loss of just $333,000 and positive adjusted EBITDA of $173,000. Most importantly, the guidance was quite strong, as management said the improvement in the business is accelerating. DAIO has $13.6 million in cash (over $1.60/share) and no debt. This company is a great play on the increasing electronic content in cars—particularly hybrids and EVs—and a great buy-out target. An EV of 2.5x run-rate revenue of $24 million would put the stock at around $8.70/share. That said, the CEO recently (in the $6s) adopted a 10b5-1 plan and has been using it, so in May and June I “joined him” in lightening our position a bit.

We continue to own Spok Holdings, Inc. (NASDAQ:SPOK), which combines a slowly fading (by around 5% a year) high-margin medical paging division with a high-margin medical software business that management is trying to grow. In April Spok reported a mediocre Q1 2021, with the all-important software revenue & backlog roughly flat year-over-year and down slightly sequentially. On the bright side, thanks to better expense management GAAP net loss was considerably improved vs. a year ago (0.12/share vs. 0.24/share), and management raised its 2021 revenue guidance significantly, although its expense guidance was raised by a similar amount and thus there was no anticipated improvement in profitability. Overall though, Spok is an 80% gross margin company with a great balance sheet ($71 million in net cash, which is over $3.50/share) that burns only around $3 million a year, and had strong 2020 and 2021 insider buying. A valuation of 5x revenue for the software business plus 1x revenue for the paging business would value the stock at around $25/share, and while we wait SPOK pays roughly a 5.2% dividend yield. However, there’s no guarantee that the software business will improve enough to realize that valuation, and following the mediocre April earnings report I lightened the position a bit.

In June I sold our Aviat Networks, Inc. (NASDAQ:AVNW) north of $40, as it approached our mid-$40s target price. This was a huge homerun for us, and I’ll happily revisit it again at a lower valuation.

Thanks and stay healthy,

Mark Spiegel