Jehoshaphat Research is short BWX Technologies Inc (NYSE:BWXT).

Q4 2021 hedge fund letters, conferences and more

With this report we are uncovering the results of a years-long investigation of BWX Technologies (BWXT). The decision to go public with these findings now rests mainly on two beliefs:

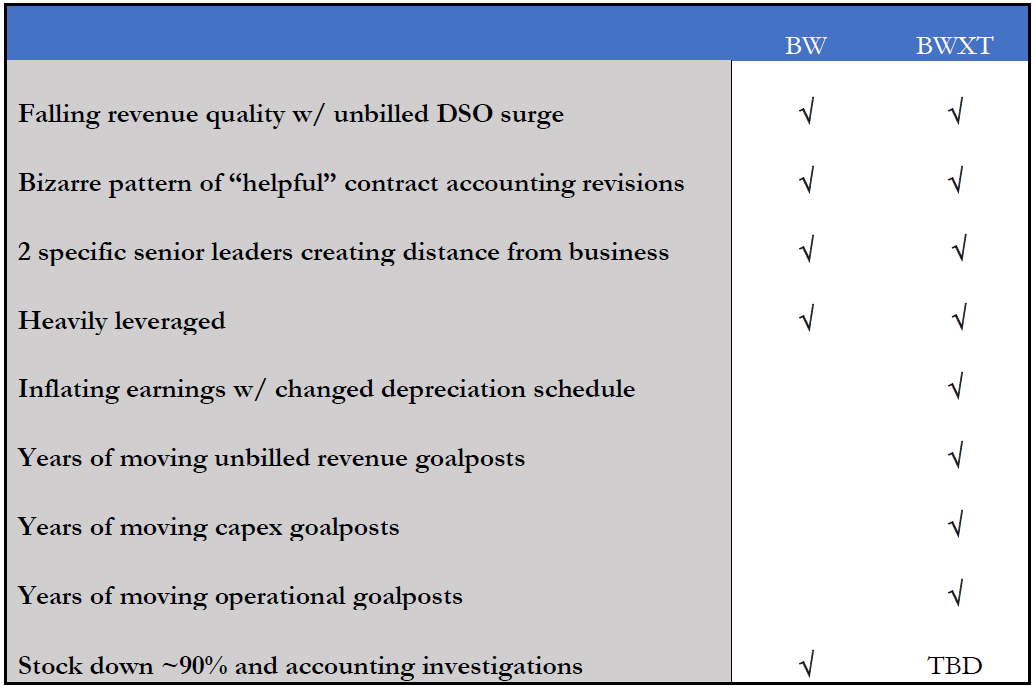

A. BWXT’s CFO and Chairman both gave notice of resignation unexpectedly in Q421. These two were also in senior roles at the inception of the disaster now known as Babcock & Wilcox (BW, spun off from BWXT in 2015). BW’s stock today is about 90% lower than at spinoff, thanks to projects that conveniently “started” souring almost immediately after BWXT spun them off. The signs of trouble at BW looked a lot what we’ve discovered at BWXT. In other words, BWXT looks like the next BW, and the guys who have seen this movie before are leaving before the end of the show.

B. We have unearthed serious problems at BWXT involving financial accounting practices. Some of the liberties taken here include changing project estimates in a way that engenders higher reported profits, altering cost accounting schedules, and constantly moving goalposts on capex inflation. We think BWXT is hiding project losses, inflating profits, and misrepresenting free cash flow power across the business, all to the detriment of its shareholders.

If you’re reading this report, you’re likely smart enough to understand that a fact pattern like this does not happen by accident. We have alerted BWXT’s auditors, the press, and others who will be interested in these discoveries. We are available at [email protected] for questions.

Executive Summary

- BWXT is playing a multitude of accounting games, especially around long-term projects. Its earnings are materially overstated and its free cash flow won’t rebound as investors believe.

- If you owned stock in a company driven by fixed-price, long-term projects, and you were told that it exhibited all of the following characteristics:

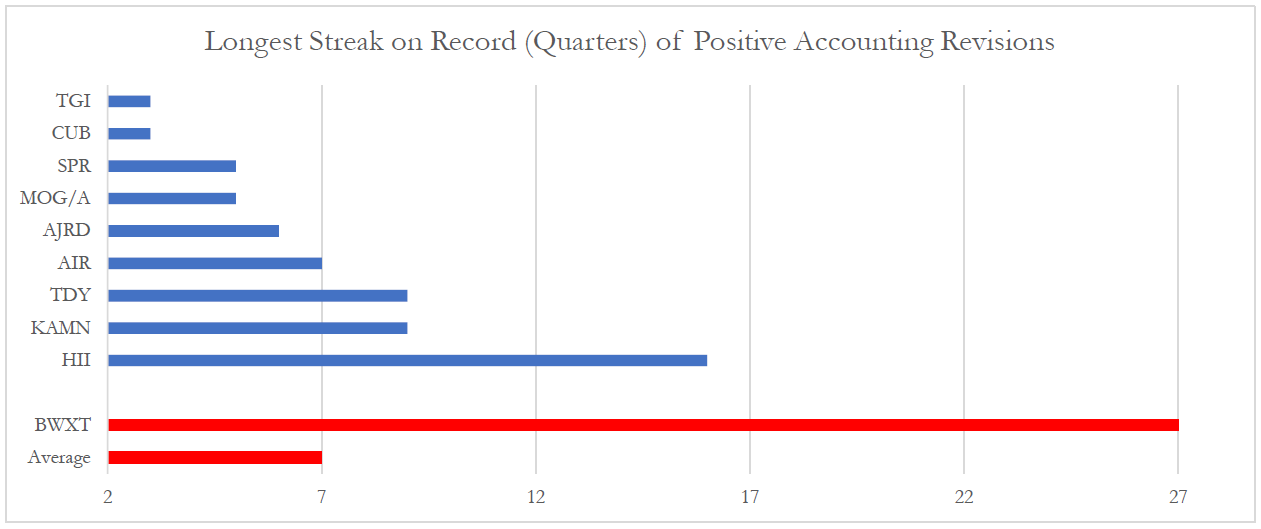

- 27 straight quarters of positive project accounting revisions (no other company in the peer group even comes close), swelling operating income by nearly $300m

- In 2018, management said high capex would drop back to baseline in 2 years. In 2019 they said 2 more years. In 2020 they said 2 more years. In 2021 they said 2 more years…all of this goalpost-moving being worth ~$600m in “unexpected” capex

- Similarly moving goalposts for working capital as it drains cash worth ~$200m

- A purposeful change in accounting policy that inflates EBIT by ~$27m, annually

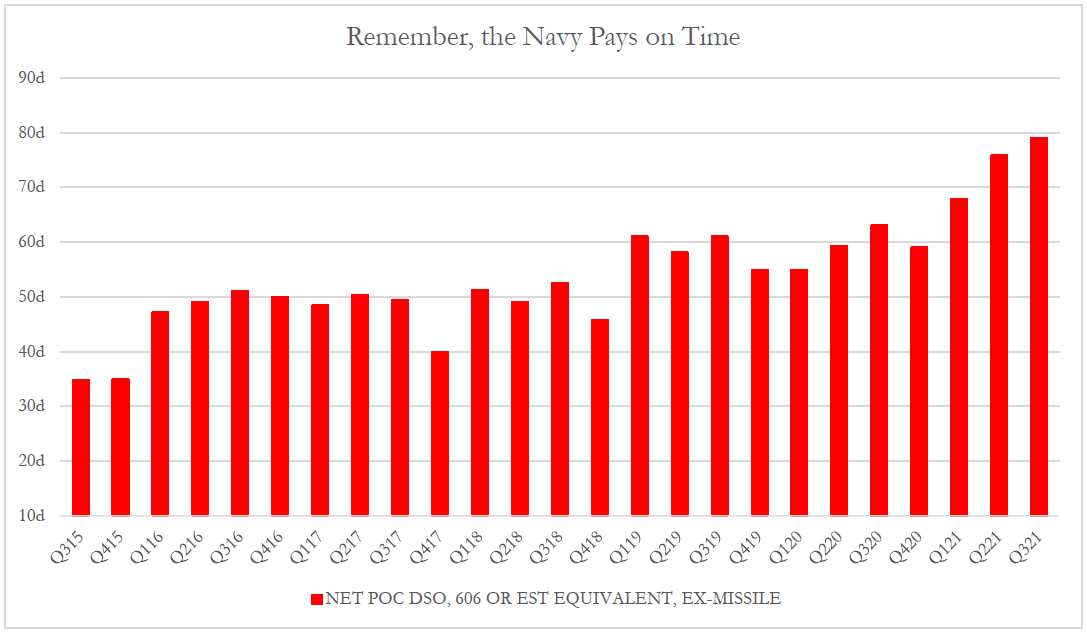

- An explosion in unbilled DSOs from the low 30s to the high 70s

- The CFO and Chairman both giving notice of resignation as these issues crestWould you be intellectually honest enough to ask, “What is going on here?”

- If you owned stock in a company driven by fixed-price, long-term projects, and you were told that it exhibited all of the following characteristics:

- The BWXT situation today resembles the BW situation just before its implosion.

- BWXT dumped BW on the market in a 2015 spinoff, and BW stock went on to fall ~90%.

- The cause of BW’s death spiral was a series of horribly mispriced projects – projects that appeared to be doing well until shortly after the spinoff.

- Investors could have seen BW’s implosion coming had they paid attention to the warning signs – warning signs that look a lot like BWXT’s today. BW exhibited the same stresses on project working capital and oddly persistent positive accounting revisions.

- The departing CFO and Chairman were in similar roles at BWXT when it owned the BW portfolio and must have been involved with it prior to spinoff.

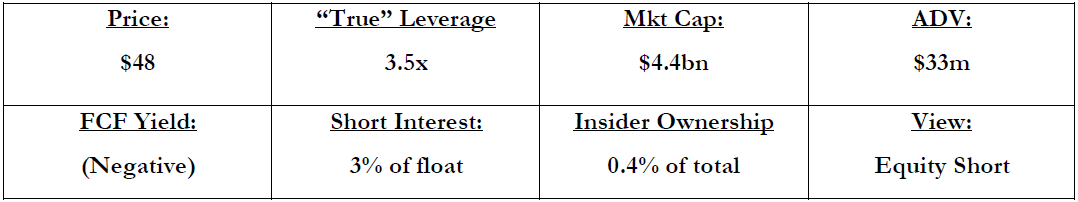

- BWXT’s balance sheet is more levered than investors think.

- Management and the sell-side talk about BWXT as “2.7x levered.” This calculation fails to account for an underfunded pension and environmental exposure obligations. Leverage is really ~3.5x.

- Clawback payments for COVID relief are now beginning, government cash reimbursements are declining to lower levels, and the company has toned down previous promises about working capital recovery. A single late customer payment seems to have necessitated a bank overdraft.

- Given its dividend, BWXT has less room for balance sheet pressure or cash flow weakness.

- BWXT’s required maintenance capex is likely significantly higher than the company claims, meaning free cash flow expectation for the “out years” is significantly overstated.

- Some investors own BWXT because of the moly-99 story. These investors are part of our short thesis.

- If you are a bull on BWXT, you may mistakenly believe that BWXT will be selling certain medical imaging isotopes by late 2022 and making money on it in later years due to chronic undersupply.

- BWXT’s timeline for FDA approval within months of submitting its application is not realistic. A major competitor required years to work through this process. BWXT has already started moving these approval goalposts, of course.

- The capacity picture for moly-99 is moving from undersupply to glut. One FDA-approved, commercialized competitor is already in the process of adding ~50% to total capacity. BWXT intends to join the fray and add more, as do other newcomers.

- Valuation: Assume that we’re utterly wrong about all of this. The stock is still a ripoff.

- Assuming BWXT capex actually were to fall to ~$100m as management has been saying, this impressive reversal would still yield only $160m or so in free cash flow. Today’s price is a high-twenties multiple on that aspirational FCF number.

- BWXT’s peer group trades at a high-teens multiple of this year’s FCF (not aspirational).

- BWXT is also highly levered versus its peers, so its EV/FCF is even more of an outlier.

Prologue: Certain Exhibits

These are some of the key charts and text snapshots in this report for those who want a quick scan. They will make more sense as you come across them again in the relevant sections and they are described with context.

- BWXT’s project accounting revisions vs peers, using the peer group that BWXT uses in its proxy. This chart is a visualized, summary version of a table we have in the section on project accounting revisions. It shows the longest-ever streak, at any time, of net-positive project accounting revisions for each company since 2015:

In a world where all of BWXT’s peers take periodic hits to their P&L as they update their project estimates, BWXT stands alone with an unblemished track record of exclusively positive “revisions” now going on seven years. Each quarterly revision to a project’s ultimate profitability, like the initial estimate, reflects judgement on the part of company management. This streak is too good to be true and we will devote considerable time to explaining why later in this report.

- BWXT’s history of moving the goalposts on capex. For this summary below, we pick just a few of the clearer selections showing management’s ever-changing assessment of its “peak” capex year. These are management’s words, not ours. To us, they say that BWXT has been understating its ongoing maintenance capex and kicking the can down the road on when to acknowledge this (and now it’s the new CFO’s problem):

- Q118: “But the -- as far as – this [2018] will be the high of our capital [expenditure], and I think it'll start going down.”

- Q418: “So as far as capital, right now, we're in a capital year of roughly [150], and we feel that, that will probably be sustained in '19.”

- Q220: “Following 2020, capital expenditures are anticipated to start a downward trajectory...”

- Q321: “And Peter, to take the capital question, you've asked about capital for the remainder of [2021]. We said about $250 million for the year. We said next year, which is '22, would be less than that... [and continue declining from there].”

We have a table, later in this report, noting every moved capex goalpost over the past five years with far more detail and explanation.

- BWXT’s explosion in net unbilled DSOs, which are driven by revenues recognized in excess of billings. We note that the US Navy is BWXT’s largest customer (by far) and therefore a rising DSO does not seem to be evidence of mere collection slowness. We adjust the net DSO for (remove) the minor impact of the missile reserve taken in Q318:

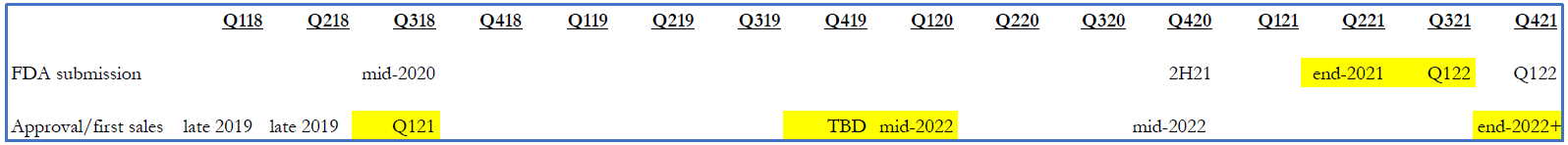

- BWXT’s ever-moving timeline for FDA approval of its moly-99/TC-99 medical isotope products. This refers to management repeatedly “updating” its expectation for when FDA submission will happen and when FDA approval is expected:

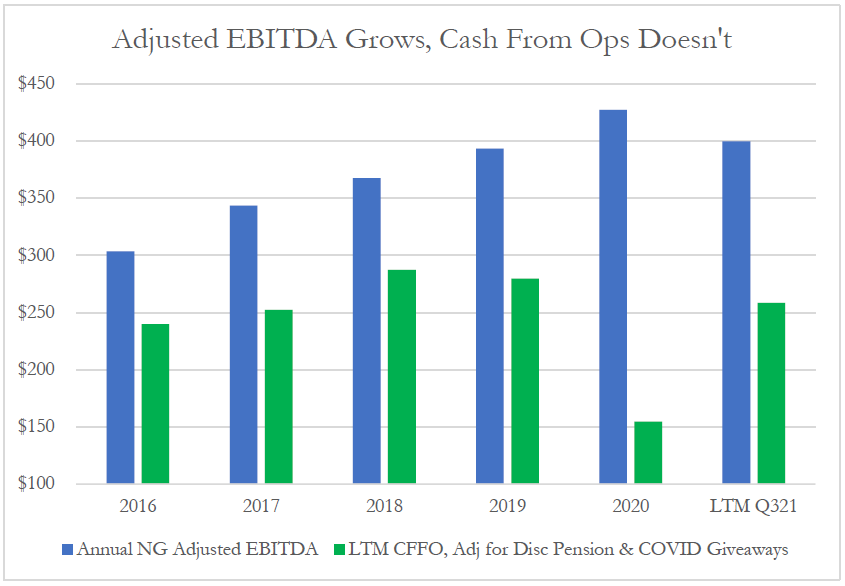

- BWXT’s cash flow from operations, adjusted for COVID subsidies and discretionary pension contributions, compared to its Adjusted EBITDA:

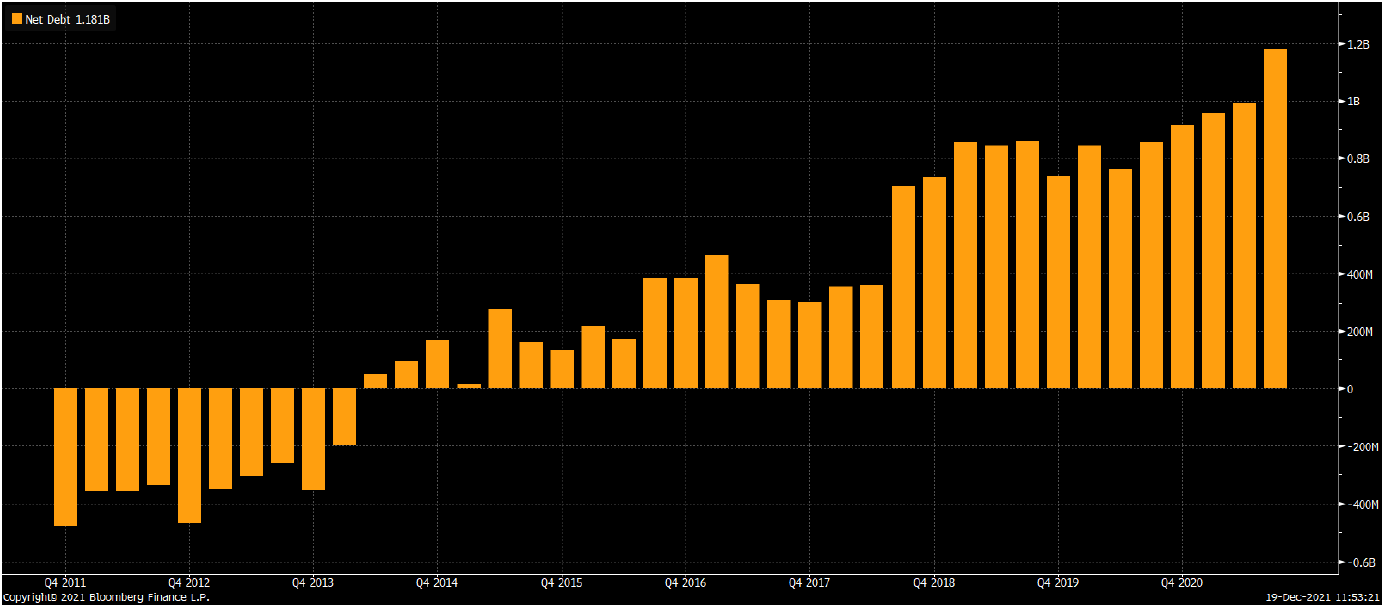

- BWXT’s multi-year transition from cash-rich balance sheet to highly levered one:

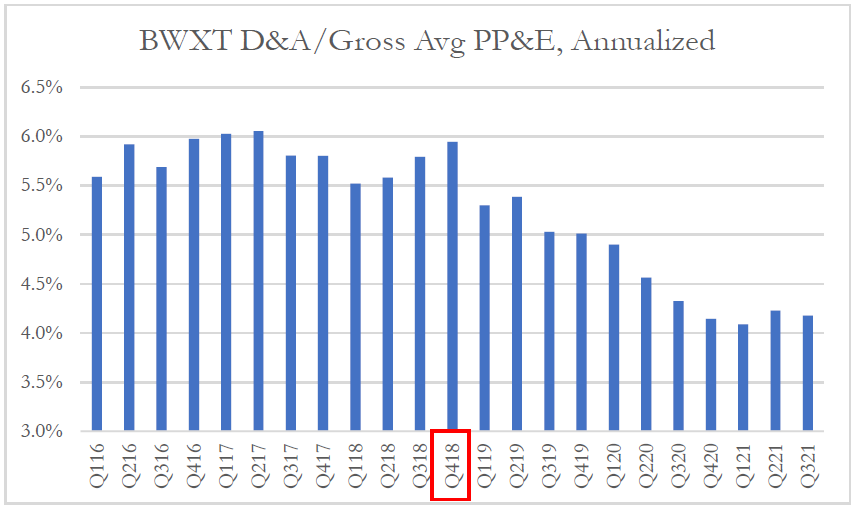

- BWXT’s falling depreciation as a percentage of gross PP&E, highlighting the quarter in which an apparent depreciation accounting change was disclosed. We estimate that this discretionary accounting change is worth ~$27m of annual EBIT to BWXT:

Read the full report here by Jehoshaphat Research