Bretton Fund commentary for the second quarter ended June 2021, discussing their new holding, Dream Finders Homes (NASDAQ:DFH).

Q2 2021 hedge fund letters, conferences and more

Dear Fellow Shareholders:

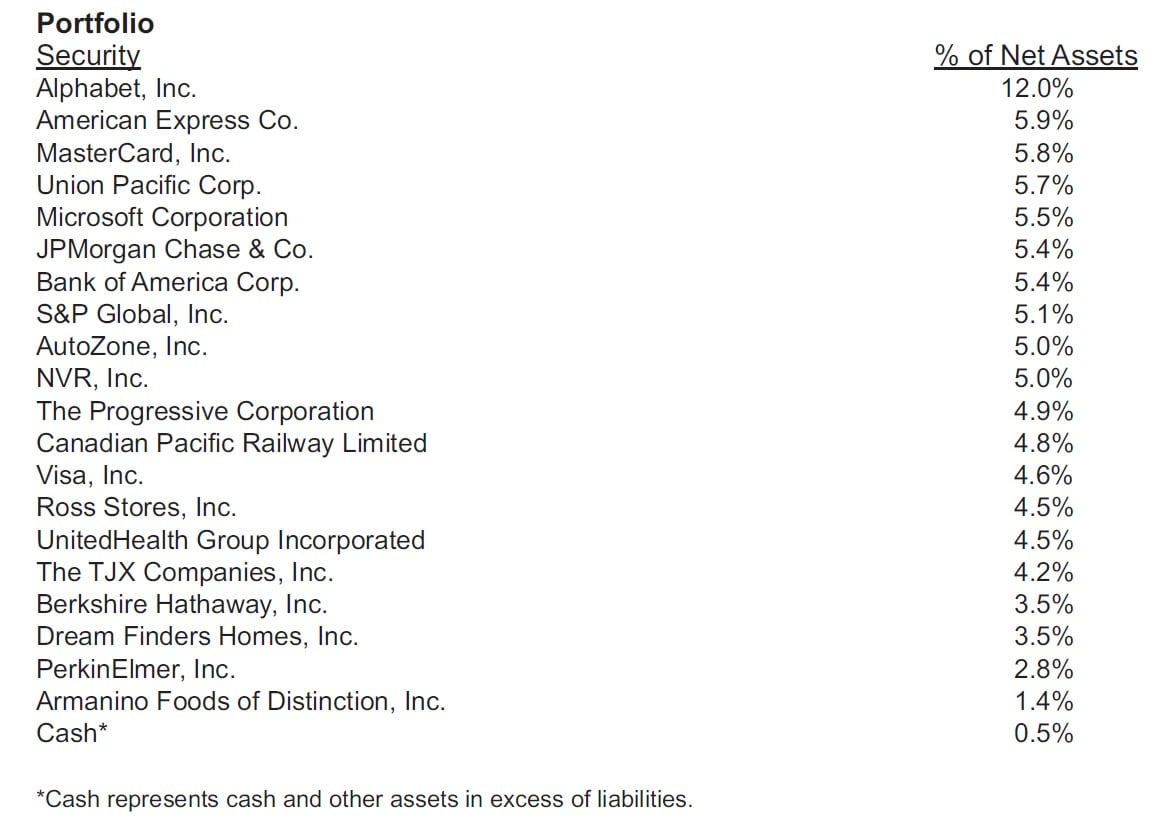

The market continued its post-Covid celebration, and we think most of us are feeling a little better about life in general than we did a year ago. While valuations are a bit stretched and there are still some pockets of ill-advised euphoria (“meme stocks” are still a thing, apparently), we are modestly optimistic and are still finding some compelling areas of the market. We initiated an investment in homebuilder Dream Finders Homes, which we describe below.

Contributors to Performance

Over the past six years of owning Google (NASDAQ:GOOGL), one of our minor annoyances as shareholders has been the company’s occasional lack of focus and cost control. It’s hard to tell from the outside with any certainty how “well spent” their ever-increasing costs were. Revenue would reliably increase 20% annually, but in recent years, costs would often increase more than that, leading to shrinking margins and earnings growth that trailed revenue growth. As a long-term investor, we absolutely want the company to be investing back into the business, paying its employees well, creating new products, spending on research, etc., etc. If that results in lower earnings that year, that’s fine. But we often had a nagging feeling that at least some of the rapid spending increases—and side projects— weren’t all that well thought out. Again, it’s hard to tell from the outside, and the core business was so good that the extra spending didn’t really affect our evaluation of the company.

Then something interesting happened in the aftermath of the pandemic. Like a lot of companies, Google cut back as the world went into lockdown. Advertisers reeled in campaigns. As advertising came back in a major way this year, Google’s spending was still restrained, resulting in revenue increasing 32% in the first quarter, while pretax earnings doubled. In the fourth quarter last year, we saw the same thing: revenue increased 23% while pretax earnings went up 69%. Spending will come back—as it should—but seeing how much revenue was able to increase with minimal cost increases gives us more assurance that Google is a great business. Not all companies can do that. Their stock rose 21% in the second quarter, contributing 2.1% to performance.

As investors became more optimistic about a recovery, American Express (NYSE:AXP) shares increased 17% and contributed 0.8% to the fund. S&P Global and Microsoft (NASDAQ:MSFT) each contributed 0.7%. The only detractor from the fund was our new holding, Dream Finders Homes (NASDAQ:DFH), which took off 0.3%.

Dream Finders Homes

It’s no secret that we’re in the middle of a housing boom. Interest rates are low, household balance sheets are strong, millennials are aging into the house-buying market, and perhaps most of all, a combination of the 2008 housing bust and ever-tightening zoning restrictions mean that we have a huge shortage of housing.

In 1960, there were about 180 million Americans, and about 1.2 million houses were built. There are now roughly 330 million Americans—the population has almost doubled in 61 years—and we’re making only a million new houses a year. And this was the highest pace since 2007. To take an extreme example, California had fewer than 16 million people and built 190,000 houses in 1960; it has nearly 40 million people today, and builds just 120,000 houses a year. The federal mortgage company Freddie Mac (OTCMKTS:FMCC) estimates the current shortage of homes is 3.8 million units, or slightly more than the entire housing stock of New Jersey.

And yet...we’re still finding relative bargains in homebuilders. We’ve owned Virginiabased NVR (NYSE:NVR) for three years now, and though their stock has done really well (we’re up 76%), it’s still much cheaper than the rest of the market, trading at only 14.5x its next 12 months of estimated earnings compared to 22.5x for the S&P 500 as a whole. Traditionally, homebuilders have traded at a discount to the market, in large part because of their inability to convert accounting income into sweet, cold cash. Just as the culture of oil exploration demands that even the most lucrative finds are rolled back into more drilling instead of being distributed to shareholders, builders work hard to sell houses so they can buy more land.

NVR isn’t like other homebuilders. Instead of buying raw, undeveloped land and holding it for years while it’s entitled and infrastructure is built, NVR works with land developers who do this cash-intensive work for them. NVR will front 10% of the purchase price to secure an option to buy the finished land later, and they’ll pay a somewhat higher price for it upon completion. It’s more than worth it. A typical homebuilder will convert only half of its net income into free cash flow, while NVR will convert close to all of it, effectively doubling the value of a dollar of earnings.

While many homebuilders have increased their usage of land options, no one else has fully embraced the “asset light” model for whatever reason. Until now. Dream Finders Homes started in 2009 in the depths of the housing bust and went public earlier this year. They’re the only other publicly traded homebuilder committed to using land options. Most of their business is in their home state of Florida, and they’ve grown rapidly into other markets—including Colorado and the Carolinas—often through acquisition. Starting off a small base, they’re growing fast: revenue will nearly double this year, and analysts estimate they’ll grow 30% next year. Given the structural shortage of houses in the US, we think they’ll grow quickly for a while. Plus, shares can be had for the bargain basement price of 11x 2022 earnings.

As always, thank you for investing.

Stephen Dodson

Portfolio Manager

Raphael de Balmann

Portfolio Manager