Blue Tower Asset Management commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

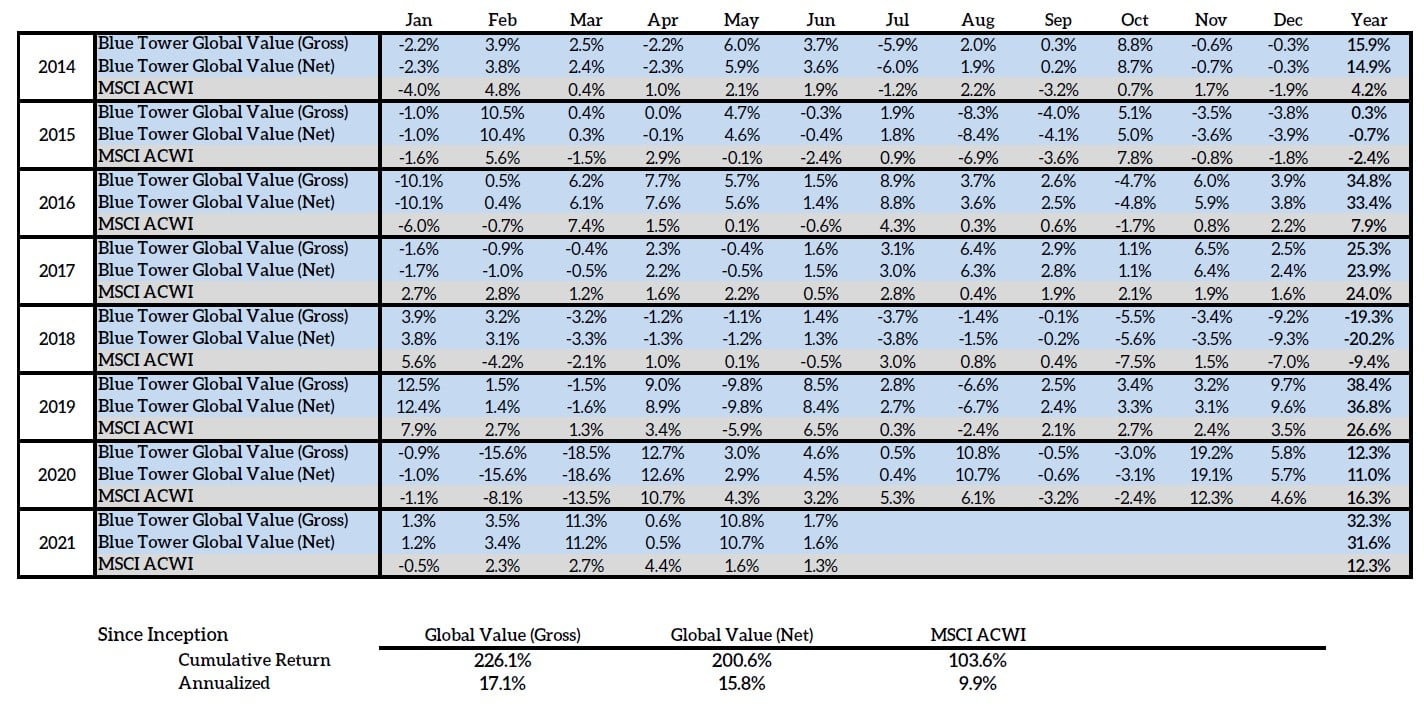

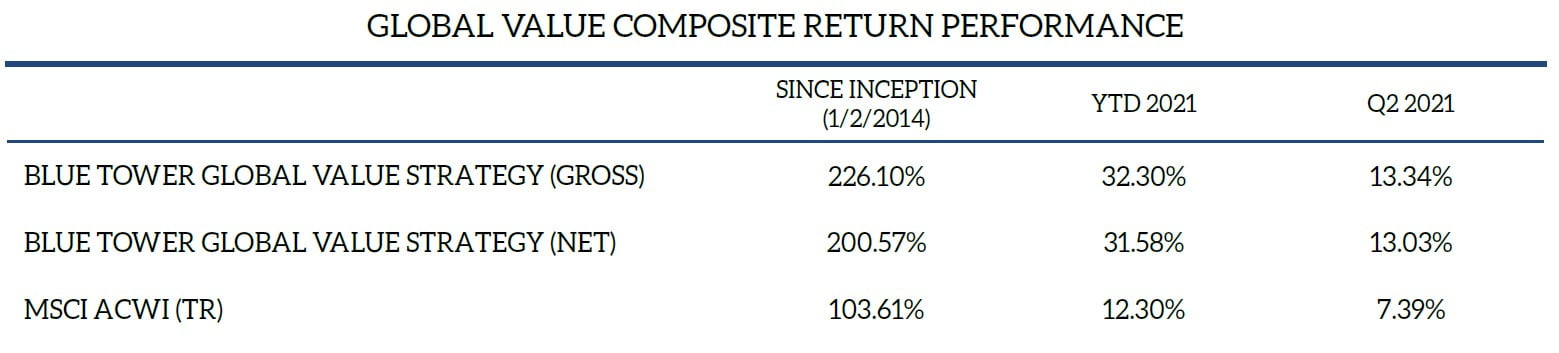

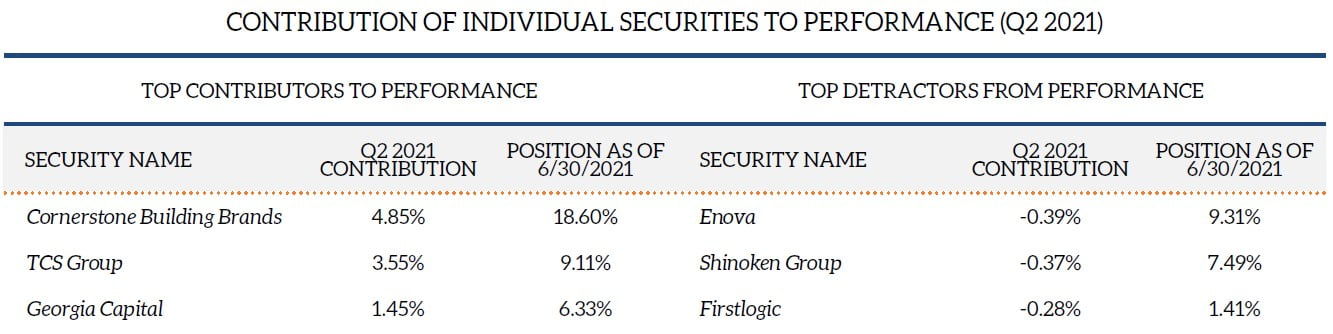

We have seen continued strength in our Global Value strategy composite which delivered a gain of 13.03% net of fees (13.34% gross) for Q2, adding to our significant gain in Q1. While we adjusted position sizes through trading, we did not any add or remove any companies to our portfolio this quarter.

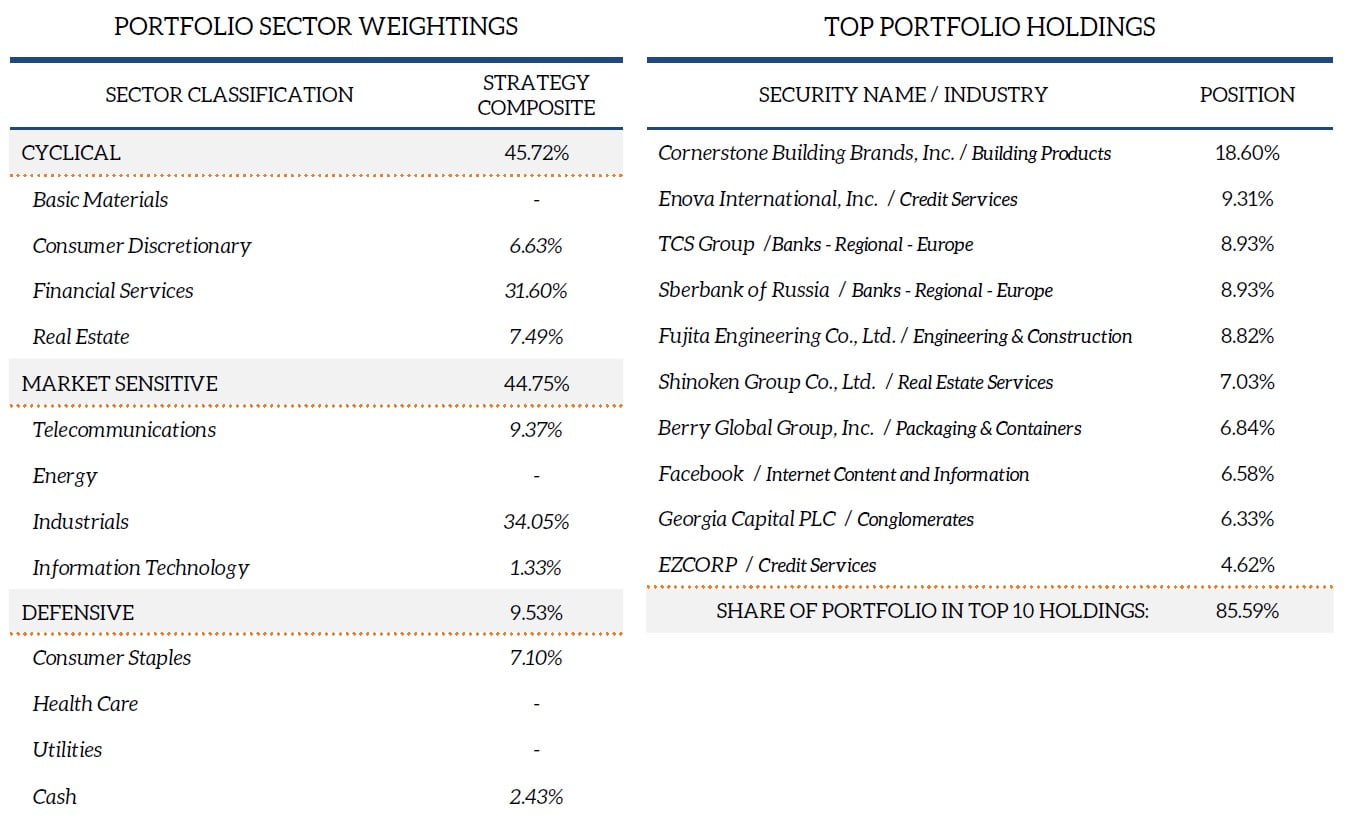

Our portfolio companies have been quite active as the US economy continues to shake off the effects of the pandemic and gradually reopens to full activity. While our companies have generally reported very strong results this year, several have been truly excellent. I will give brief updates on our investments in Cornerstone Building Brands Inc (NYSE:CNR) and TCS Group Holding (LON:TCS). I gave a deep overview of our investment in Cornerstone in our previous Q2 2019 client letter.

Cornerstone Building Brands sells Integrated Metal Panels business

While Cornerstone has been engaged in several M&A transactions since the formation of the company from NCI Building Systems and Ply Gem, this quarter saw their first major divestment of a subsidiary. On June 7th, Cornerstone announced that it had reached an agreement with the Nucor Insulated Panel Group to sell Cornerstone’s Integrated Metal Panels business for $1 billion. The Insulated Metal Panels (IMP) business was a legacy subsidiary of NCI and was focused on serving the needs of industrial and commercial clients. The IMP business generated revenues of $349M in 2020. The EBITDA margin for the commercial segment that contained IMP was 14.2% in 2020. If we assume that the IMP business had the same EBITDA margin as its segment, this gives a 2020 EBITDA contribution of $50M. By comparison, the pro forma Adjusted EBITDA for Cornerstone on the whole is $609M.

This sale appears to be accretive for the value of Cornerstone as their net debt after the transaction1 is $2.22 billion, down from $2.97 billion at the end of Q1 2021. Therefore, Cornerstone gave up 8% of their total consolidated EBITDA in exchange for a cash payment equal to 15% of their enterprise value. This will decrease their new debt-to-EBITDA level to approximately 3.9x2 and moves up their date for reaching their target debt-to-EBITDA level of 2.0-2.5x by a full year.

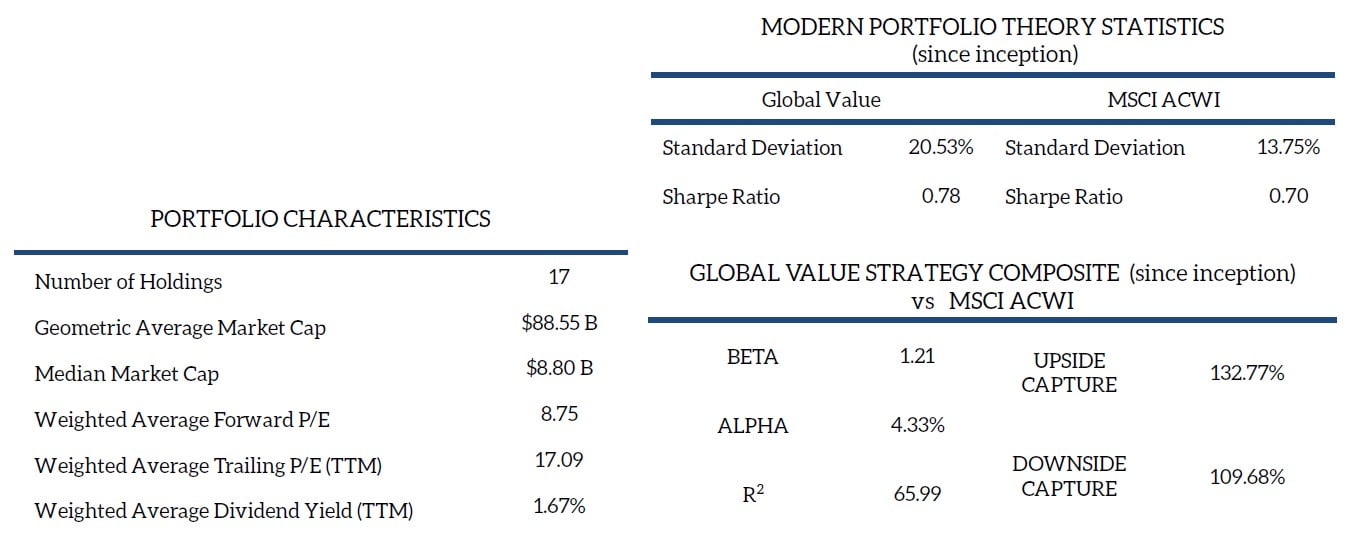

The central idea of our investment philosophy is to buy businesses at bargain valuations. As most stocks trade roughly near their intrinsic values, we must always ask ourselves why businesses appear to have been misjudged by equity markets. In the case of Cornerstone, we believe this was due to three main factors. 1) The large transactions and mergers associated with combining NCI and Ply-Gem created many one-time expenses and hid the underlying profitability of the business. 2) The large amount of debt held by the company caused many institutional investors to be unable to invest in the company due to mandate restrictions. 3) We held the belief that the construction sector, a cyclical industry, was likely to outperform the overall US economy as the country had been building an insufficient amount of new housing for at least the past decade. As the company realizes acquisition synergies, the housing boom continues, and Cornerstone pays down debt, the company’s value will become apparent to investors and share price will rise to meet its true fundamental value. Investors who were previously repelled by the high debt levels will invest at lower leverage levels. The share price has already tripled from the average price our long-term investors in the strategy composite paid, but we still believe the company has a high expected forward rate of return.

TCS Group: High earnings-multiple is more than justified

The highest percentage gain so far this year for us has been our position in the TCS Group Holding PLC (MCX:TCSG), up 166% in the first half of 2021. TCS Group Holdings PLC is a holding company for a Russian banking subsidiary, Tinkoff Credit Systems Bank. Tinkoff is a provider of online retail and small business financial services. Tinkoff started as a branchless digital bank and credit card issuer in 2006. They are now the second largest credit card issuer in Russia. The company wanted to develop a depth of financial products, making it a genuine financial ecosystem of different products rather than just an online credit card issuer.

The company leans heavily on their software teams to make their business model function. The advantages of a digital model are enormous in banking as the branchless model allows them to function at a fraction of the workforce of established competitors and at lower costs. Through its subsidiary of Tinkoff Software DC, they are developing a network of software development hubs in major Russian cities.

The competencies of Tinkoff in the fields of artificial intelligence, banking automation tools, and other software are the main source of their competitive advantage going forward. These AI advantages could enable them to be the low-cost provider of financial services for years into the future.

The high profitability and return on capital of Tinkoff within Russia has made them disinterested in strongly pursuing opportunities outside of Russia when they still have so much growth runway available within the country. There is no need to pursue opportunities internationally when it would tie up capital that has a higher marginal return domestically.

The Covid-19 pandemic pushed many activities, including financial transactions, towards digitalization. Cashless payments in Russian retail increased to 70% in 2020, whereas they were only 32% as recently as in 2016. After the end of the pandemic, many of these shifts towards digitalization will be permanent.

In this environment, Tinkoff saw some of the fastest growth in their company’s history. At the end of 2019, Tinkoff had 7.2 million active customer accounts across their various products. By the end of Q1 2021, that had increased to 10.3 million, an impressive 43% increase in just 5 quarters.

On January 7th 2021, the founder of Tinkoff, Oleg Tinkov, converted his super voting class B shares to normal class A shares resulting in the company having a uniform class structure. As a result of the conversion, Oleg Tinkov's voting rights in the Group decreased from 84% to 35%. This has relieved concerns of some investors about corporate governance and increased confidence in the evolution of the group as a public company.

In light of these improvements to the fundamentals of their business, their growing competitive advantages, and improving corporate governance, the TCS stock price increase so far this year has justification.

I enjoy whenever I receive questions from investors, so please feel free to reach out.

Best regards,

Andrew Oskoui, CFA

Portfolio Manager

Blue Tower Asset Management