BlackRock has been moving to redefine its identity from a firm focused on index investing to a firm that emphasizes ESG (environmental, social and corporate governance) investing. However, one organization argues that this move is less about doing something good for investors and more about enabling BlackRock to charge more in management fees.

Q1 2020 hedge fund letters, conferences and more

Transformation at BlackRock in ESG

The Institute for Pension Fund Integrity said in a recent white paper that BlackRock's ESG shift is moving it from being a low-fee, efficient index provider and toward becoming a "higher-fee forecaster of economic and social trends, with a bias toward stocks and bonds that meet its new ESG bias."

The organization also noted that about $4 trillion of the $6.5 trillion in assets it manages for clients are held by institutional investors like pension funds, governments, foundations, sovereign wealth funds and family offices.

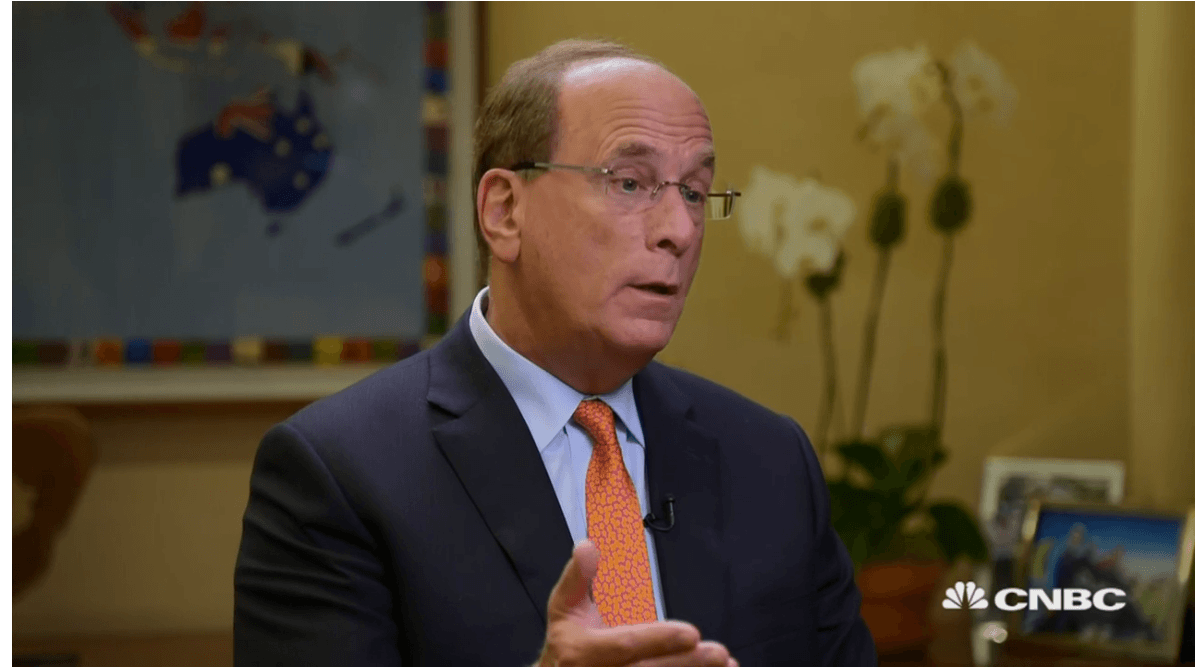

The IPFI noted that this year BlackRock's Larry Fink wrote a letter to clients talking about the firm's focus on sustainability and climate change, which he said are creating a "fundamental reshaping of finance." The BlackRock Global Executive Committee also said in a second letter that sustainability is the foundation of the firm's investment strategy.

BlackRock's definition of sustainability is "understanding and incorporating environmental, social and governance (ESG) factors into investment analysis and decision-making."

Promoting ESG and sustainability

The client letter stated that the company would make "ESG funds the standard building blocks in multi-asset solutions such as model portfolios." The firm also promised to reduce the supposed ESG risk in actively managed portfolio and remove from its discretionary active investment portfolios the stocks and bonds of "companies that generate more than 25% of their revenues from thermal coal production."

Further, BlackRock plans to launch new ESG-oriented investment products and strengthen its commitment to sustainability and transparency in its "investment stewardship activities," a reference to its proxy voting and other types of pressure it exerts as a shareholder.

The IPFI noted that BlackRock has historically been a packager and marketer of index portfolios, meaning that it doesn't actually choose their contents. In addition to the index business, the firm also has a smaller business in active investment management.

As of the end of March, the firm held managed assets of $609 billion. It also manages non-public portfolios for institutions, which is most of its business. Most of those portfolios are index portfolios, but some are managed.

ESG underperforms index

At this time, just a minimal amount of BlackRock's assets are invested in ESG portfolios. The IPFI said just 1% of its public funds are held in ESG assets. The firm wants to double the number of ESG products it offers and make those products "building blocks" of client asset holdings. The IPFI expects the company to make its sustainability-focused models into its flagships.

The organization notes that owning a cap-weighted index of stocks is much more transparent than owning an index weighted by ESG factors. It also pointed to research which indicates that conventional index portfolios outperform ESG portfolios.

One of the reasons for this outperformance is because ESG portfolios charge higher fees. The IPFI pointed to a study conducted by Pacific Research Institute that looked at 18 public ESG funds over 10 years. The study found that a $10,000 ESG portfolio would be 43.9% smaller than an investment in an S&P 500 index fund. Only two ESG funds beat the index fund over 10 years.

Beware BlackRock's ESG focus

The IPFI argues that pension funds should be wary of BlackRock's new ESG focus. The organization quoted a 2016 paper by former Treasury Department official Alicia Munnell, who said public pension funds aren't suited for social investing. She said the effectiveness of social investing is limited, and it "distracts plan sponsors from the primary purpose of pension funds — providing retirement security for their employment."

The IPFI argues that BlackRock is distracting from the primary purpose of pension funds as retirement security will no longer be the sole or even primary purpose of pension funds that invest with BlackRock.

"Judging from Fink's letters, we can only conclude that the world's largest asset manager wants the public to view it as a firm deeply concerned with climate change and ESG investing," the white paper states. "Those may be admirable pursuits, but for public pension funds, the BlackRock shift is a red flag. It is an indication that BlackRock is adopting a goal for its investing decisions outside of the goal of the best returns for shareholders."

The IPFI believes having two goals like ESG and strong returns is impossible, although BlackRock argues that ESG investing recognizes risks the rest of the market doesn't. The IPFI describes this as "a hubristic notion that runs directly counter to the philosophy and strategy of index investing, which has been BlackRock's franchise."

Why the change in focus?

In considering the reason for BlackRock's shift toward ESG, the organization said it could be "a sincere recognition that the market does not know how to price the prospects of climate change and the policy changes that may jeopardize earnings or the very existence of some businesses in the future." The organization also said Fink might see a march niche that's not being filled by asset managers, or he might have to respond to the "race to the bottom among similar firms."

The IPFI also said that cutting fees lower and lower might not be a good way for BlackRock to boost the returns of its shareholders, but looking for a way to increase its fees could be.

A BlackRock spokesperson did not respond to a request for comment.