Black Bear Value Partners commentary for the third quarter ended September 30, 2021.

Q3 2021 hedge fund letters, conferences and more

“There are two mistakes one can make along the road to truth…not going all the way, and not starting.” - Buddha

To My Partners and Friends:

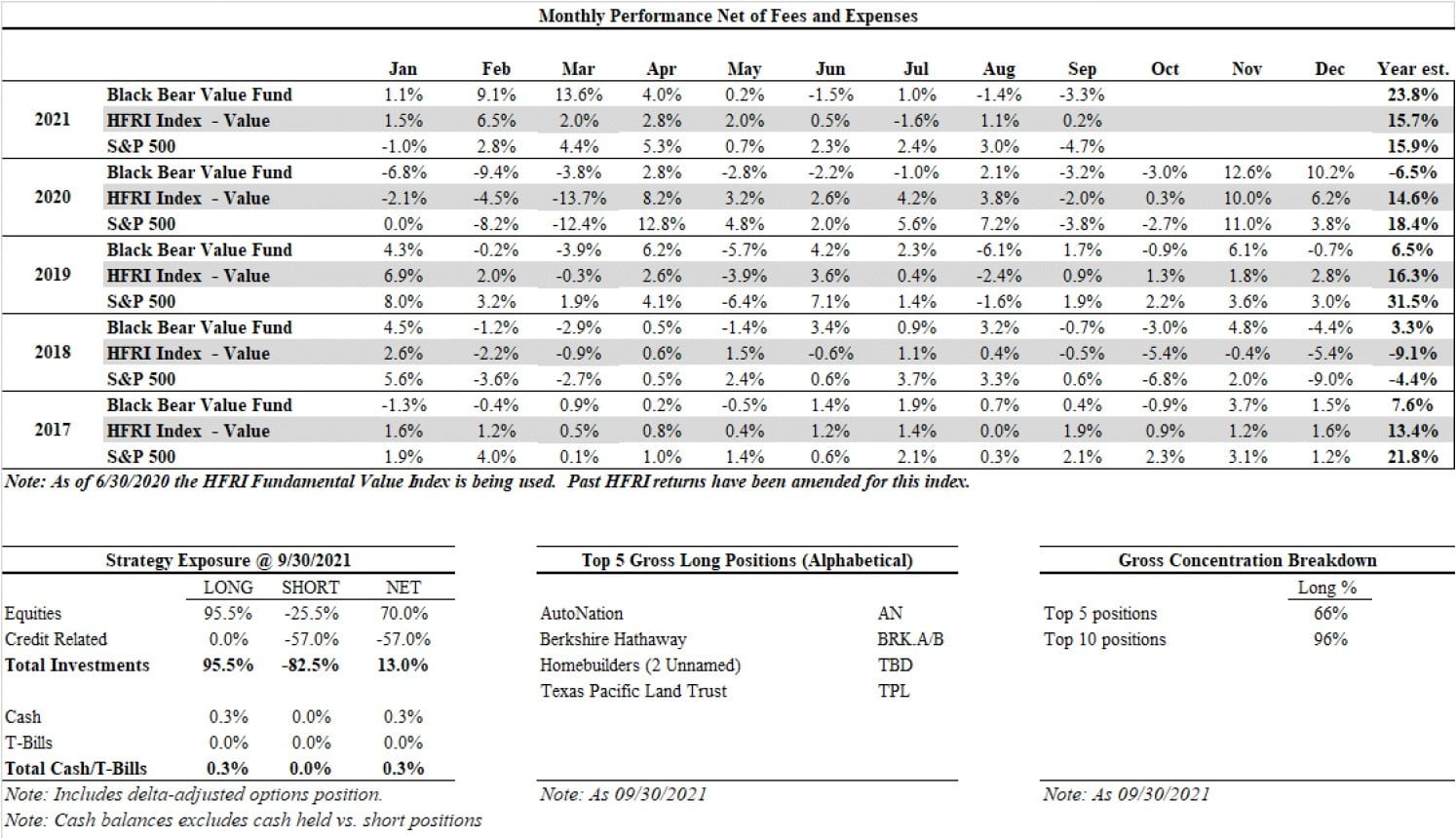

- Black Bear Value Fund, LP (the “Fund”) returned -3.3%, net, in September, -3.7% for the 3rd quarter and +23.8% YTD.

- The S&P 500 returned -4.7% in September, +0.8% for the 3rd quarter and is +15.9% YTD.

- The HFRI index returned +0.2% in September, -0.3% for the 3rd quarter and is +15.7% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

In 2016, when I was considering the timing of Black Bear’s launch, I was given great advice from a fellow fund manager. He told me “Don’t wait…there’s no perfect time. Just go.” As we approach our 5-year anniversary I am thankful for that advice as well as the trust and support of my family and our LP’s. It continues to be of utmost importance that all LP’s feel a true sense of the word “Partnership”. I have tried to reflect that with both a significant personal investment in the Fund as well as a lower-fee structure. As discussed below, it was paramount that as the Fund scales, our early investors stood to benefit from a lower-fee structure. Please read below for more details as we are closing the Founders Class as of year-end and turning the page towards our next chapter.

Very little has changed in our overall portfolio construction. The businesses we own are of a higher quality than the overall market and are both cheap in relative and absolute terms. The bonds and lower-quality companies we are short remain extremely expensive. It is interesting to me that when markets start to drop, some investors question their portfolio. Price action should not inform your value of an investment. It should merely serve as a measurement of current investor emotions. I welcome negativity as it allows us to act rationally and take advantage of others overreactions. I think others would be better served to think about their investments during both up and down markets and consider their prospects independent of the emotions of the day.

The recent market weakness has allowed us the opportunity to concentrate further in our holdings. There are thousands of companies to choose from…we just need a handful. I’ve been finding new investments that are which we will disclose in our year-end letter.

On a personal front, Lauren and I welcomed our newest cub, Max Alexander Schwartz. Sydney and Zoey are thrilled to have a little brother and we feel extremely fortunate to have him join our family.

Top 5 Businesses We Own (Alphabetical)

Brief descriptions of the top 5 long positions follow as of 9/30/2021 in alphabetical order,

AutoNation

Auto dealers have been over-earning on car sales due to a lack of inventory because of the semiconductor shortage. They have been able to increase prices despite lower volumes and benefit from reduced operating expenses. It seems obvious that when the semiconductor shortage is resolved, more cars will become available and unit profitability will be reduced. In short, their earnings will likely decline in the 12 months following the inventory shortage and then resume their rise. Our longer-term horizon allows us the ability to own the business and not focus on a short-term issue. The semiconductor issue is likely to persist thru 2022 though this is a guess. Ultimately our long-term thesis on the business remains intact. If the business can extend its moat, maintain their pricing power, and remain important to both their customers and suppliers we will do fine.

AutoNation, Inc. (NYSE:AN) can generate a range of $6-$8 in free cash flow per year. This implies a 5-7% yield to us presuming limited growth. Additionally, if AutoNation achieves modest levels of success with AutoNation USA (new used-car supercenters) it could add another $5-$10 of per share value to the business. Note that at current prices, very little in the way of AutoNation USA success is priced in.

Berkshire Hathaway (same summary as Q1)

Please see Q1 letter for our Berkshire Hathaway Inc. (NYSE:BRK.B) on a Napkin investment exercise. We have written on it extensively and will save your eyeballs from extraneous reading.

Berkshire is very cheap for owning such high-quality businesses and will continue to grind higher and compound value for us.

Homebuilding Basket (2 unnamed companies).

Given the concentrated nature of the portfolio I am going to keep the names of our 2 companies out of this discussion.

There is a long-term fundamental supply/demand imbalance in housing inventory. This is a direct result of underproduction of new homes amid a challenging mortgage financing environment over the last 10+ years since the Great Financial Crisis. Looking forward we should have increased housing demand from millennials as they enter the family-phase of life and desire more space. Rates are still near historic lows and people are desiring more personal space as remote work becomes more acceptable.

One of our investments is a small-cap homebuilder with a unique ownership/board who takes a more land-heavy approach. The benefit of being smaller is the ability to be nimble. The downside is that you cannot be as capital efficient as the 10,000 lb. gorilla (NVR) and get options on land as easily. As I’ve gotten to know the management team and fellow owners, I am confident in their business strategy and areas of the country they are focused on. They are focusing more on the 1st time and 2nd time homebuyers in areas with rapid demographic expansion. I think we own this business at a 10-15% steady state free-cash flow yield with extremely high growth prospects. Currently the company is reinvesting their cashflow back into the business which means their net cash available to shareholders looks low. So long as they are reinvesting into high IRR projects this is a great use of cash. With the shareholders/board members and management team currently in place I think the odds are in our favor to do well over the next 5-10 years as shareholders of this business.

Texas Pacific Land Trust

We continue to own Texas Pacific Land Corp (NYSE:TPL) as it still looks reasonable to me with asymmetric upside if energy inflation takes hold. As a reminder, TPL is a royalty company with 100% of their acreage located in the Texas Permian Basin. In a nutshell they make money when drilling activity occurs but DO NOT have the capital needs. The incremental amount of work on TPL’s part is minimal as the extraction and movement of the oil/natural gas is undertaken by others. They are merely a toll collector with Returns on Capital of 80+%.

In an inflationary environment, businesses that have lower capital intensity both in capital assets and people, stand to benefit. In other words, if oil goes up a lot, the incremental cost to TPL is close to 0 so it is all incremental profit. This is a business that should benefit in a massive way if we have energy inflation. In the meantime, we likely own it at a 3-5% free cash flow yield with massive upside.

Closing of the Founders Class and Next Chapter

I am excited to share some details of the next chapter for Black Bear Value Partners. We will be closing the Founders Class to new investors after the 12/1/2021 subscription date. I will be introducing 2 new (but familiar) share classes starting in 2022. Most importantly, we will be reducing the incentive fee for all existing Founders Class investors to 10% starting in 2022.

As I have communicated in the past, I believe those who made an earlier commitment and investment in our partnership (YOU) should be a beneficiary of our business success as it scales.

Earlier in our Funds’ lifecycle, I lowered the management fee from 1% to 0.5% to increase alignment and reduce non-performance based-annual costs to our LP’s. The 0.5% management fee/15% incentive fee aligns us (in addition to most of our net worth invested alongside you). I want to keep that fee structure going forward beyond the Founders Class but have always felt our Founders should have the best deal of all our LP’s. So, in short, all LPs in the Founders Class will have their incentive fees reduced beginning in 2022. Please read below for the updates/changes coming in 2022.

- The Founder’s Class (0.5% management fee/15% incentive fee/2Y lockup + 1Y rolling redemption) will close to new investors after the 12/1/2021 subscription date.

- This allows existing investors sufficient time to add to their capital and be grandfathered in at the lower fee structure.

- Beginning in 2022, the Founders Class will have its fee structure reduced to 0.5% management fee and a 10% incentive fee.

- As a reminder, you have matching rights for all capital you have invested and that will remain at the new fee structure (0.5%/10%)

- Beginning in 2022 our new Class B and Class C will be as follows:

- Class B – 1.5% management fee / 20% incentive fee / 1Y rolling redemption

- Class C – 0.5% management fee / 15% incentive fee / 2Y lockup + 1Y rolling redemption

- Note: Per the note, above you have matching rights on all capital committed thru 12/1/2021 at 0.5% management fee and 10% incentive fee.

Thank you for your trust and support.

Black Bear Value Partners, LP