A newly published study by Tradingbrowser.com highlights the explosive growth of cryptocurrency in highly unbanked countries where Bitcoin ATMs have been installed.

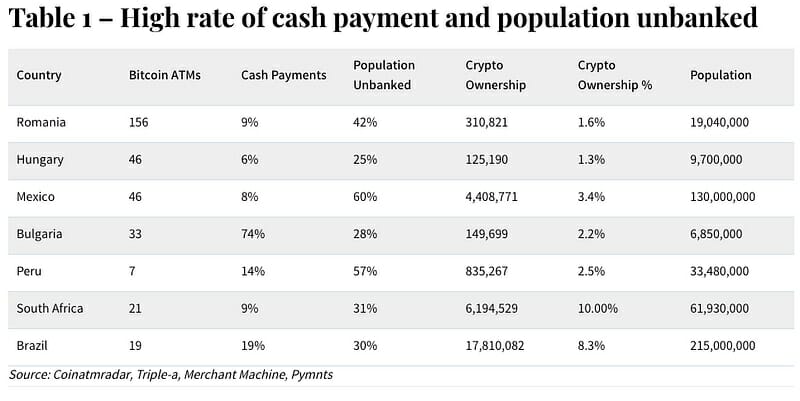

The data shows that countries with the highest rates of unbanked populations also have the highest rates of cryptocurrency adoption.

Q4 2022 hedge fund letters, conferences and more

The Rise Of Bitcoin ATMs

Here is a snapshot from the report:

- Countries that have high rates of unbanked populations also have higher rates of cryptocurrency adoption due to high cash payments and Bitcoin ATMs. If the projection of installed Bitcoin ATMs continues, these unbanked countries could see exponential growth in adoption.

- The most surprising and significant driver for the high adoption rates in highly unbanked nations is the alternative financial solution that Bitcoin ATMs and blockchain offers.

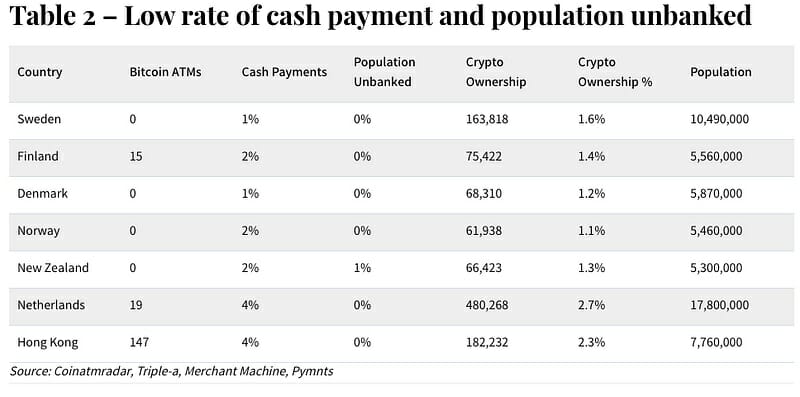

- Cashless countries like Sweden, Denmark, Norway, and New Zealand have a record-low percentage of cash payments and nearly 100% of their populations are connected to a bank account. These countries have no installed Bitcoin ATMs and have lower cryptocurrency ownership percentages than developing nations.

A spokesperson for Tradingbrowser.com shared a comment:

"Cryptocurrency adoption is a rapidly evolving phenomenon with significant implications for the future of finance and commerce. The data presented in the article and tables provide a glimpse into the diverse and complex factors that are driving adoption rates across the globe.

The rise of Bitcoin ATMs and cash payments as key drivers of adoption is a testament to the need for accessible and user-friendly infrastructure that can facilitate the seamless integration of cryptocurrency into everyday transactions.

It is worth noting that the high rates of unbanked populations in certain countries are a major contributing factor to cryptocurrency adoption rates. This highlights the need for innovative and inclusive financial services that can cater to underserved populations and empower them with greater financial autonomy and flexibility."