In this special feature we examine what we know about the biggest hedge fund launches in 2018 so far and, using data taken from Preqin’s online platform, examine how these funds stack up to their competitors as well as where new assets could come from.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

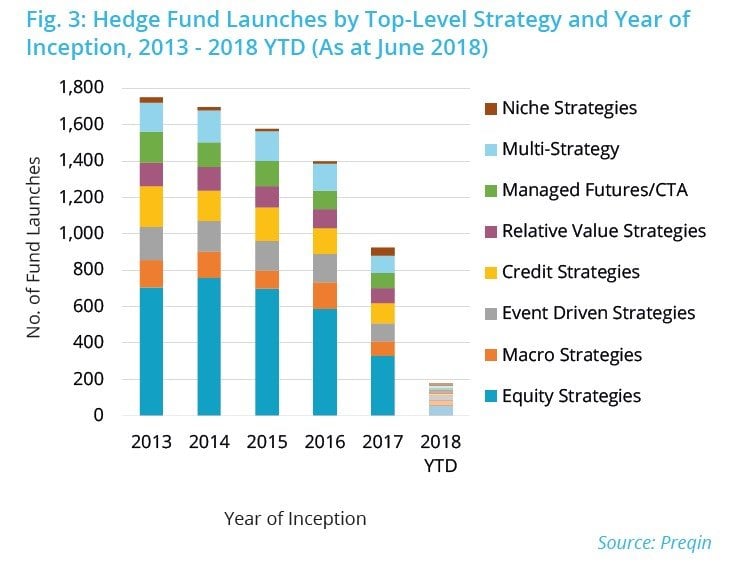

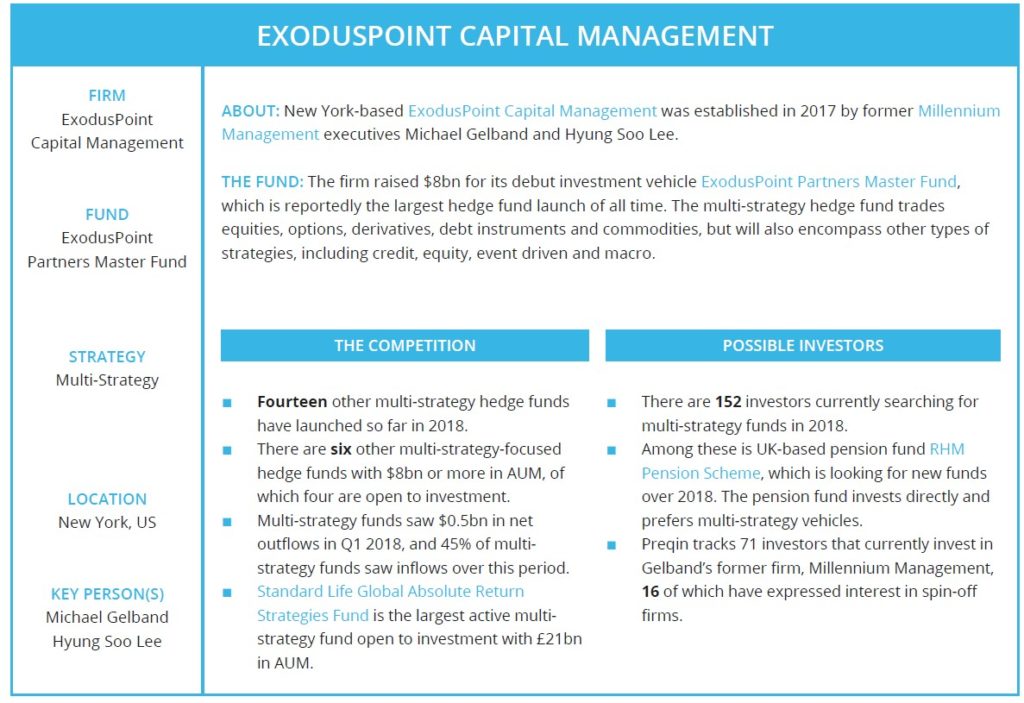

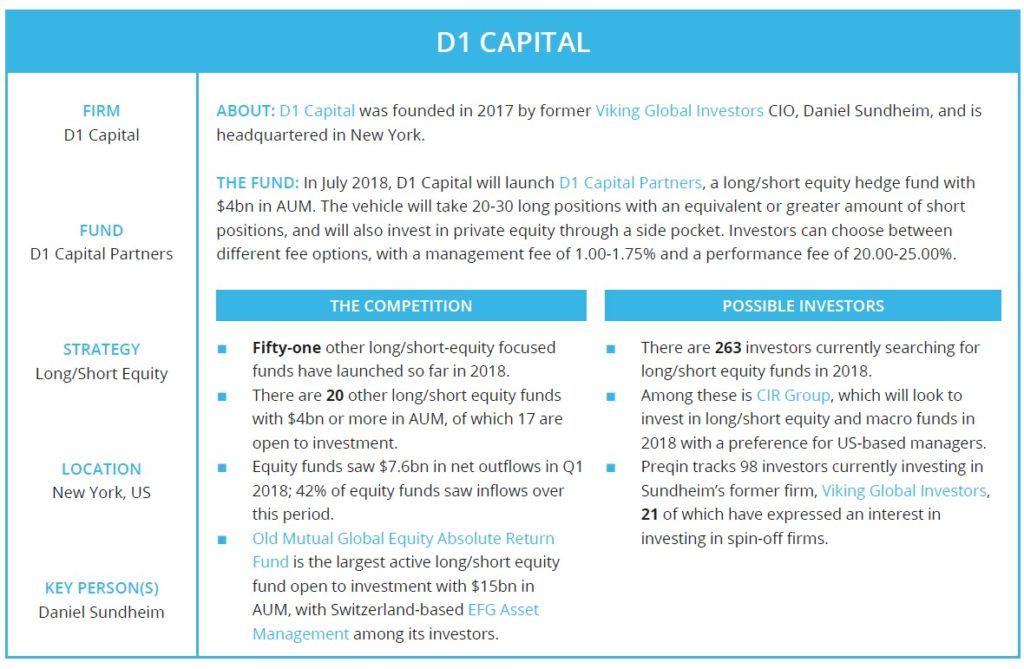

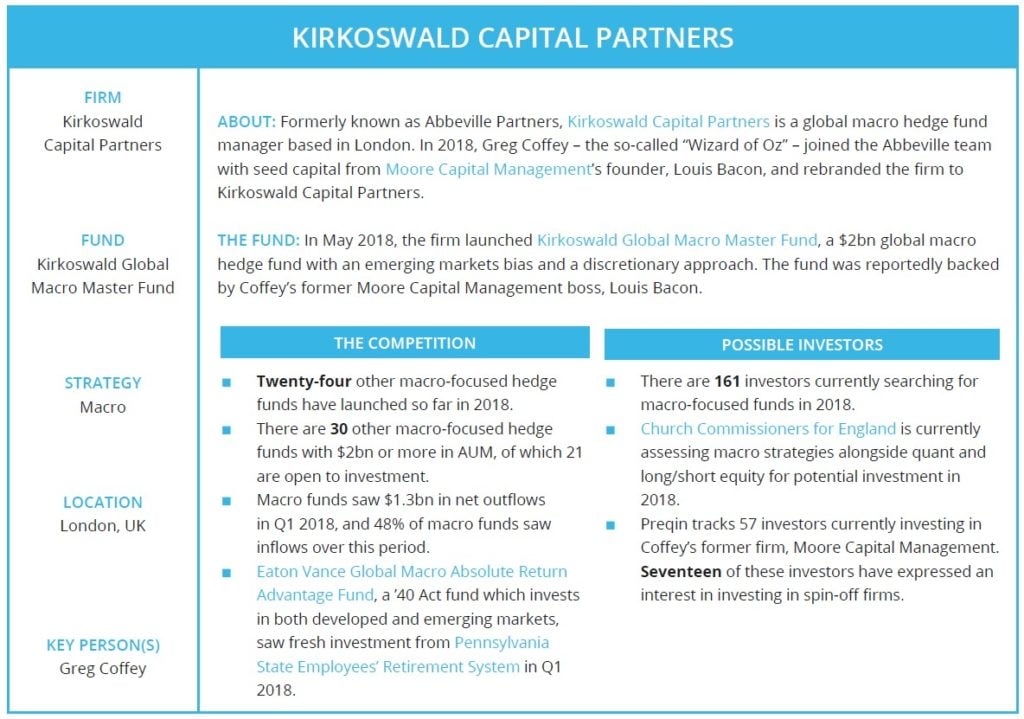

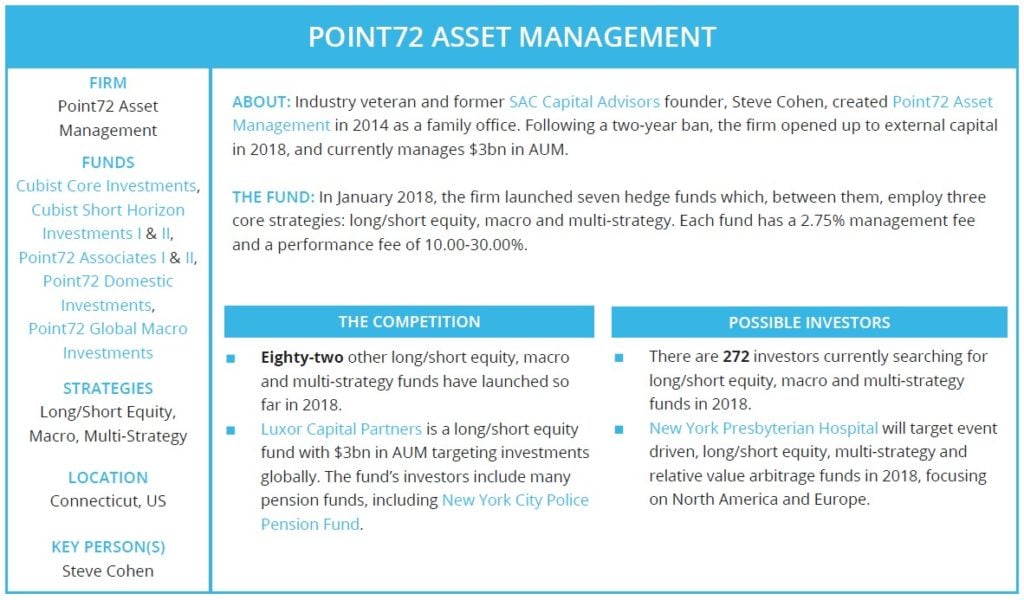

Of the 183 hedge funds that have launched so far in 2018, three have managed to attract a combined $14bn. The firms responsible for these funds are ExodusPoint Capital Management, D1 Capital and Kirkoswald Capital Partners. Point72 Asset Management, run by industry behemoth Steve Cohen, also opened up to investor capital in early 2018, and manages an estimated $12bn ($9bn of these assets are continued from its time as a family office).

Industry News

Following another positive month of returns, we take a closer look at event driven strategies funds that beat the market in May 2018, as well as investor searches initiated in the second quarter of the year.

Event Driven Funds Post Gains In May 2018

Event driven strategies outperformed all other top-level strategies for the second consecutive month, with gains of 1.61% in May. Among these funds is Numen Credit Opportunities Master Fund, which generated the highest individual return (+14.71%) of the month. Managed by London-based Numen Capital, the special situations-focused hedge fund was launched in November 2008, and primarily focuses on opportunities in Europe.

Another fund that generated strong returns in May is Accendo Capital, a €74mn fund focused on investments in smalland mid-sized publicly listed companies in Northern Europe that are driving or benefitting from technological innovation, which returned 8.41%.

Black Crane Asia Opportunities Fund, which is managed by Hong Kong-based Black Crane Capital, posted gains of 7.93% in May. The vehicle looks to take a mixture of long and short positions on investment opportunities across Asia, with a time horizon of 6-24 months.

Europe-based Investor Searches Issued In 2018

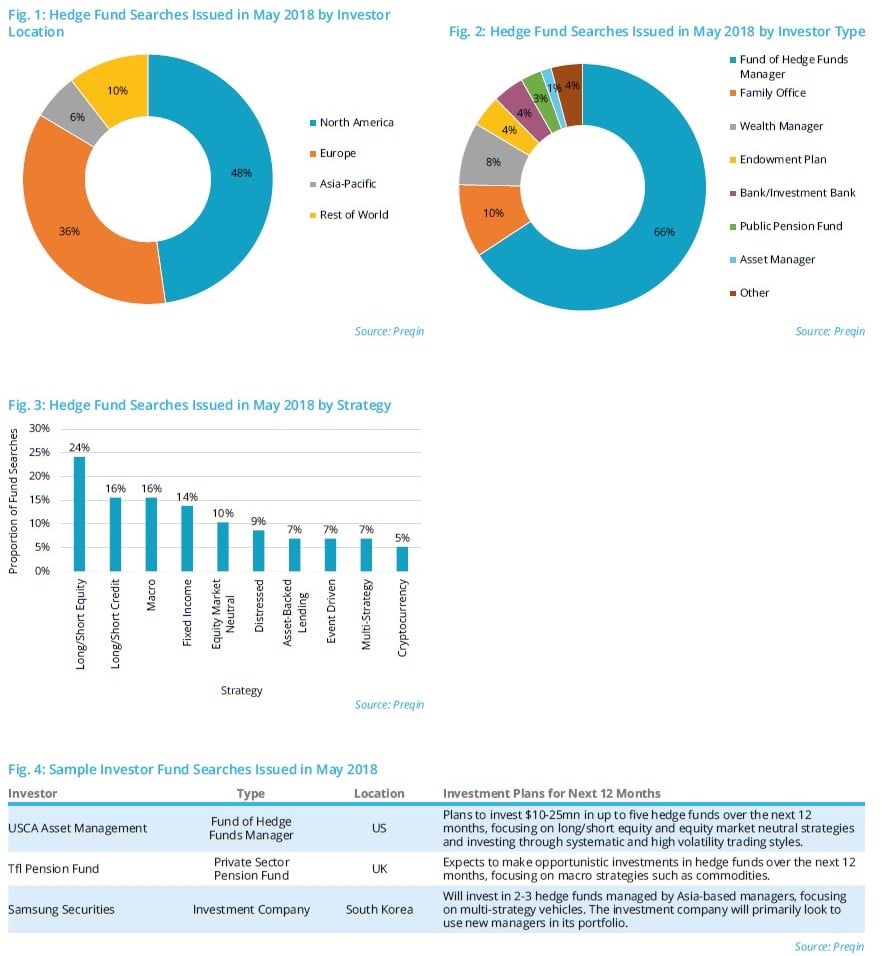

Systematic Absolute Return, a Switzerland-based fund of hedge funds manager, is planning to invest in 20-25 hedge funds in the next 12 months across a globally diversified set of strategies.

Germany-based asset manager KONTOR STÖWER Asset Management will target single-manager vehicles focused on special situations and macro strategies in Europe, and will use a mixture of new and existing managers in its portfolio.

Valida Pension Management expects to invest in three hedge funds in the next 12 months using new managers it has not previously worked with. The Austria-based corporate pension fund will focus on macrostrategies and managed futures/CTAs with a global reach, typically investing €50-100mn per hedge fund.

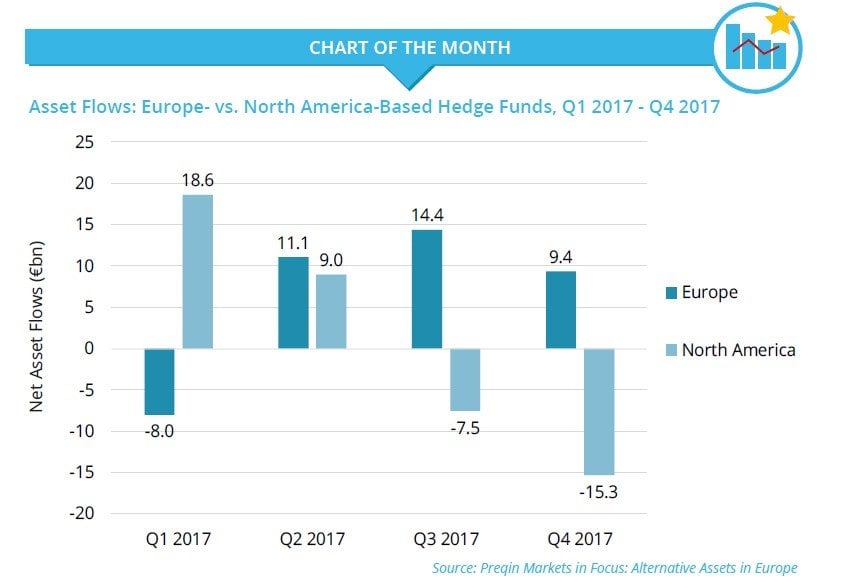

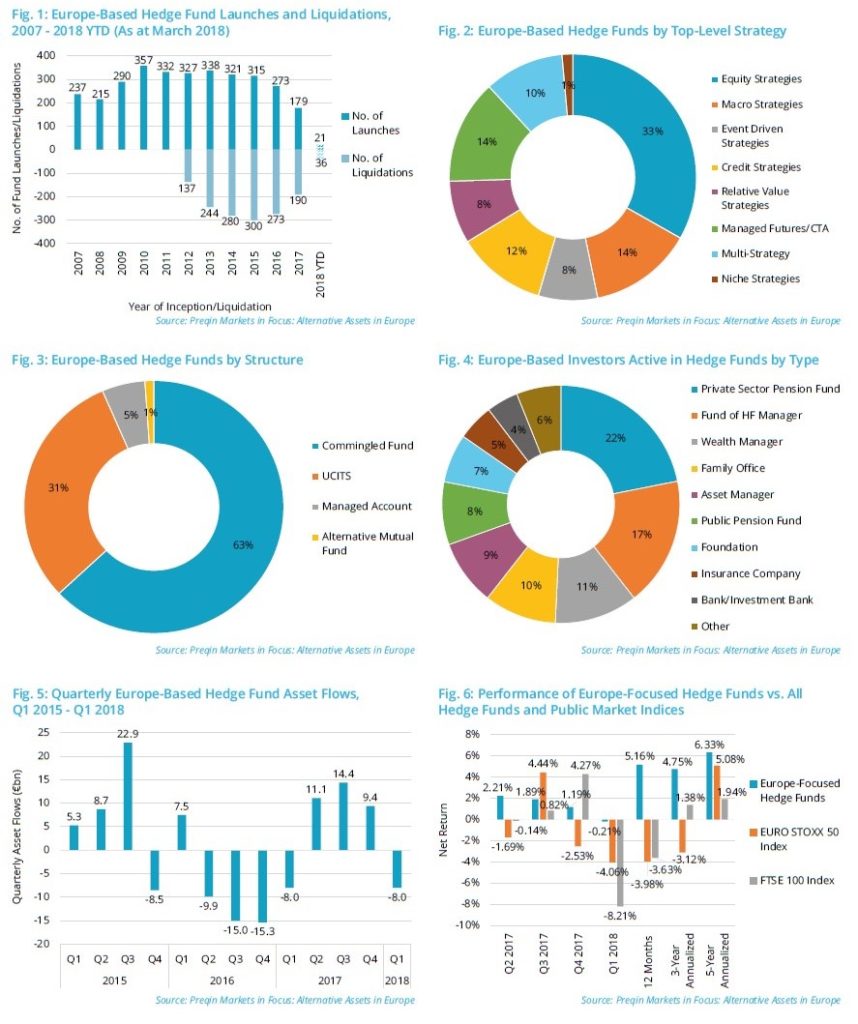

As shown in the chart above, North America-based hedge funds saw outflows amounting to €23bn in H2 2017, almost wiping out the positive flows of H1. By contrast, Europe-based hedge funds saw net inflows of €24bn across the whole of 2017.

The positive inflows in Europe in 2017 are translating into a more active 2018 when it comes to new European products hitting the market, as it appears that managers in Europe are anticipating more opportunities. As seen in Preqin's November 2017 survey of hedge fund managers, 39% of Europe-based managers reported they had a new launch planned for 2018; conversely, just 23% of North America-based hedge fund managers reported the same.

Even though managers and investors alike in Europe are facing challenges, the outlook is positive: both more funds are expected to launch and more capital is expected to flow into hedge funds from Europe-based investors and funds.

Performance Benchmarks

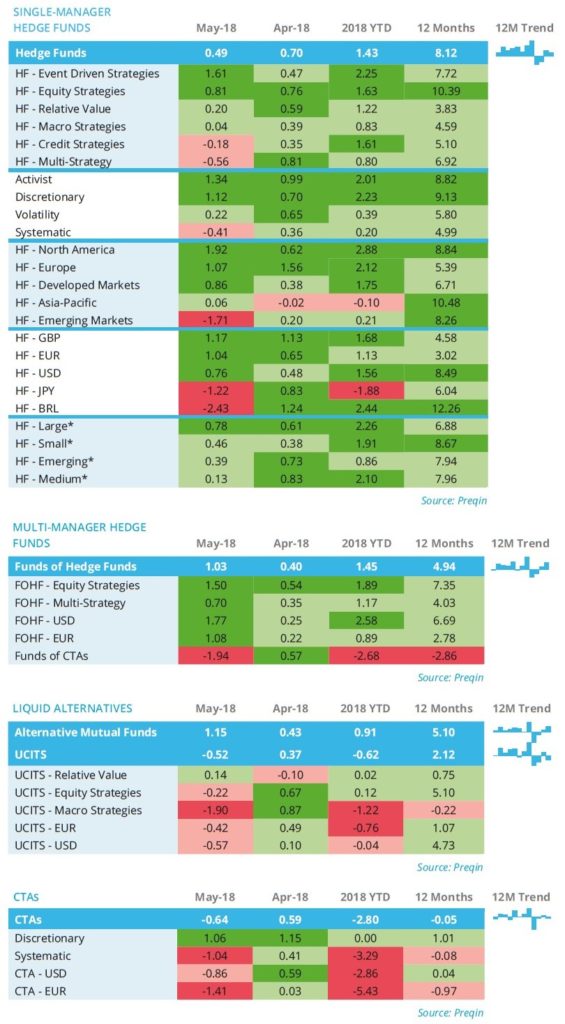

- The Preqin All-Strategies Hedge Fund benchmark generated 0.49% in May, the benchmark’s second consecutive month of positive returns.

- Event driven strategies outperformed all other top-level strategies for the second consecutive month with gains of 1.61% in May, bringing the year-todate return of the strategy to 2.25%.

- Credit strategies (-0.18%) and multistrategy vehicles (-0.56%) were the only top-level strategies that suffered losses in May.

- Hedge funds focused on North America (+1.92%) performed particularly well, outperforming Europe-focused funds (+1.07%), reversing the April return and achieving the benchmark’s best result since November 2016 (+2.58%).

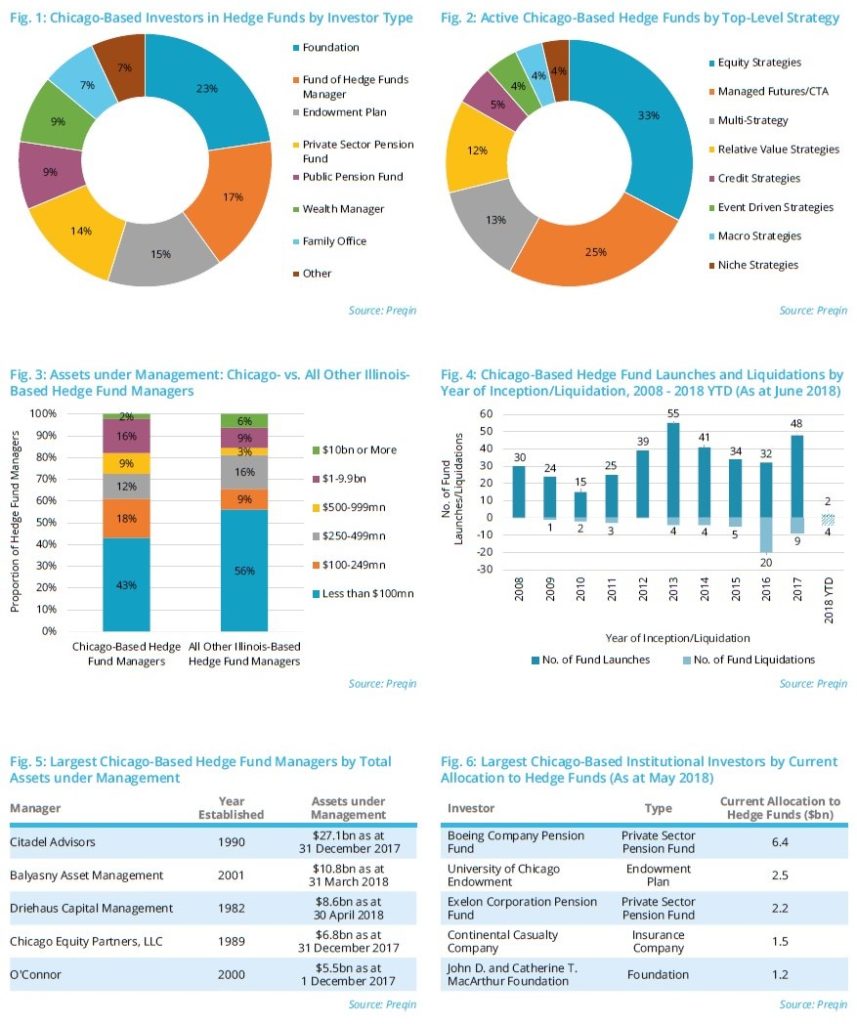

Hedge Funds In Chicago

We provide a snapshot view of the hedge fund industry in Chicago, looking at investors and fund managers based in the city as well as fund launches and liquidations over the past 10 years.

Hedge Funds In Europe

Using data from Preqin Markets in Focus: Alternative Assets in Europe, we detail hedge fund activity in the region by strategy, structure, fund type and more.

Fund Searches And Mandates

We take a look at the hedge fund searches issued by investors in May 2018 on Preqin's online platform, breaking them down by investor location and type, and also provide sample fund searches.

Article by Preqin