Encouragingly, calm seems to have settled over financial markets after the recent banking woes. But attention has turned to other potential pressures. U.S. commercial real estate and banking systems which proved fragile in previous crises-those in Europe and Japan in particular-are in focus. We weigh the vulnerabilities and the implications for the economy and portfolios.

Q1 2023 hedge fund letters, conferences and more

A Symbiotic Relationship

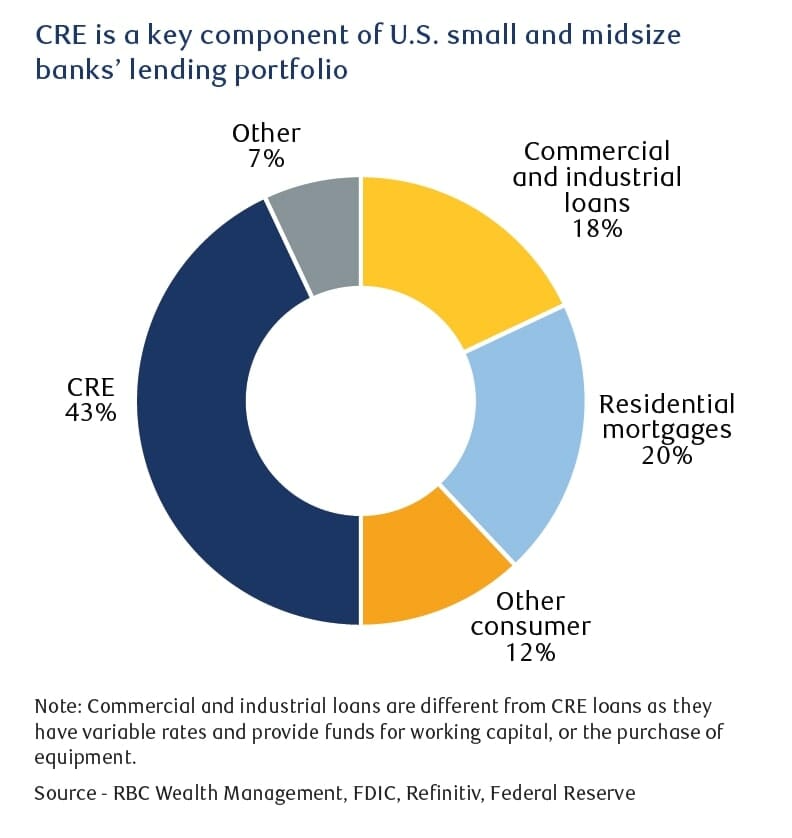

Following the recent U.S. banking turmoil, U.S. commercial real estate (CRE) has become a hot topic among market participants. CRE relies heavily on small and midsize banks for financing, which just so happen to be the most stressed financial institutions.

Overall, the commercial property industry in the U.S. owes $1.9 trillion to these banks, or twice what it owes to large banks ($0.9 trillion), according to the Mortgage Brokers Association. Small and midsize banks are heavily exposed to CRE, which accounts for as much as 43 percent of their outstanding loans.

A Sore Point

Structural and cyclical issues are darkening CRE’s prospects. Office real estate is suffering from high vacancy rates due to the post-pandemic aversion to commuting to a job and the practicalities of the work-from-home trend.

The shift to online shopping accentuated by waves of lockdowns has also reduced foot traffic at many brick-and-mortar retail locations. Cyclical issues such as the mass layoffs in tech industry dominated areas are compounding these challenges.

The U.S. office vacancy rate reached 12.5 percent in Q4 2022, just below the level seen in the aftermath of the global financial crisis in 2008, according to data provider CoStar.

By nature, CRE involves a high degree of debt and tends to struggle in a rising interest rate environment. Lower vacancy rates translate into lower rents. Landlords often have difficulty refinancing as the value of their buildings slips below that of the loan granted to purchase the properties. Some may have no other option than to offload their properties at steep discounts or face bankruptcy.

This would be an additional, unwelcome challenge for those small banks currently under stress, which are already losing deposits to their larger competitors and higher-paying money market funds.

A Manageable Risk

Still, we see reasons to believe the risk of any additional problems at small and midsize banks due to CRE defaults could be contained. For one, small banks’ lending contributes less than three percent of U.S. GDP, and U.S. commercial real estate mortgages constitute less than 20 percent of all mortgages—it’s the residential market that’s the key.

Furthermore, CRE lending standards have tightened over the past decade. Commercial property lenders now only offer loans on a maximum of 75 percent of property value, providing a cushion should values decline. In addition, non-residential real estate accounts for less than three percent of GDP.

Any CRE default would likely be isolated to a few U.S. regional banks and smaller lenders, in our view, negatively impacting individual communities. We think the direct damage to the U.S. economy would be limited, though defaults would likely lead lenders to tighten lending standards further.

In an environment in which investors are already anxious, we believe any further meaningful stress on some small and midsize banks could drag down equities and bond yields, with potential spillover effects for global financial markets.

How Soft Are European And Japanese Banks' Soft Spots?

Banks in Europe and Japan are also under scrutiny from market participants as they both have proven fragile in the past. Both countries’ banking channels are outsized, with profitability challenged by the negative interest rate environment in which they’ve operated for years.

In Europe, similar to the U.S., the concerns centre around a potential increase in the stock of bad loans and deposit flight which would likely weaken banks substantially.

Yet European banks do not share the same issues as U.S. regional banks. Regulation in Europe has made all banks there buy hedges to protect them against the risk of higher interest rates decreasing the value of their loans. Liquidity coverage ratios are also much higher in Europe.

The sector is less exposed than its American counterpart to CRE loans and has strong capital buffers to absorb potential losses. Core equity has surged close to 15 percent of risk-weighted assets, up from five percent in 2011.

European banks also are less prone to losing deposits to money market funds as there are fewer cheap and easy-to-access alternatives to bank accounts than in the U.S. Deposits are mainly retail and insured. Corporate deposits are mostly broadly diversified, unlike Silicon Valley Bank’s outsized exposure to tech startups, or that of Credit Suisse’s family offices (private banking), which withdrew deposits in unison.

Overall, the increase in European regulatory oversight and the balance sheet clean-up efforts which took place after the 2008 financial crisis and the European sovereign debt crisis four years later have put the sector on firmer footing.

But as we see it, tightening lending standards over the past few months will likely crimp revenue growth somewhat. RBC Capital Markets points out that the primary market remains effectively shut for banks, a worry at a time when funding costs are expected by most observers to rise. Following Credit Suisse’s demise, we think investors in Additional Tier 1 bonds will likely demand a higher return.

As for Japanese banks, the concern is the effect a sharp increase in the 10-year Japanese government bond yield would have on capital adequacy ratios, should inflation prove stubborn. Regional banks and Shinkin banks, cooperative financial institutions serving small and medium-sized enterprises and local residents, would then have uncomfortably low capital adequacy ratios.

Such a development would bear monitoring, in our view. Mega institutions, however, would likely cope better, given their healthy capital adequacy ratios of close to 11 percent, according to S&P Global.

Quality Is Key

We see strong reasons to believe that the risks facing U.S. CRE and European and Japanese banking systems can be contained. But the ongoing tightening in lending standards in both the U.S. and Europe may be accentuated should these pressure points flare up.

We continue to recommend investors focus on quality in portfolios, and we prefer companies with business models that are not sensitive to the business cycle.