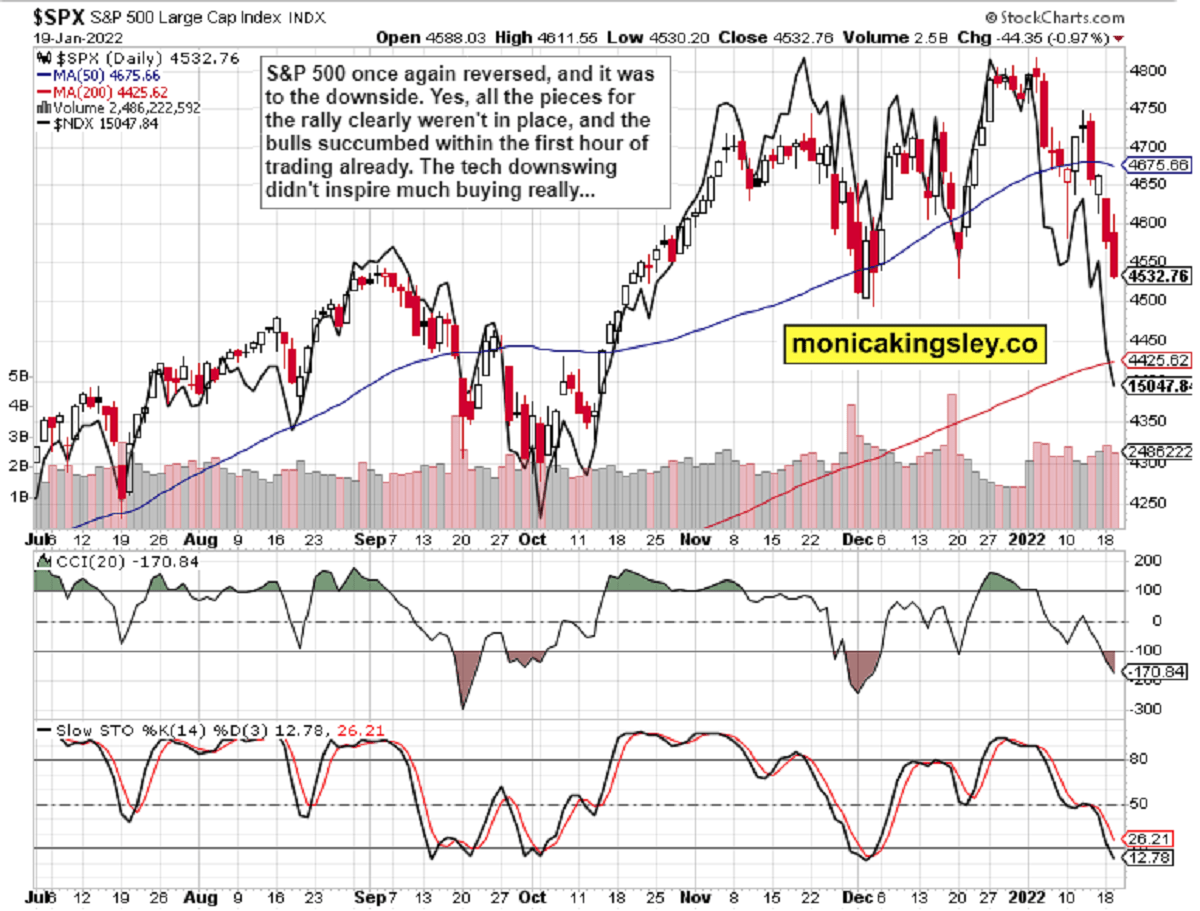

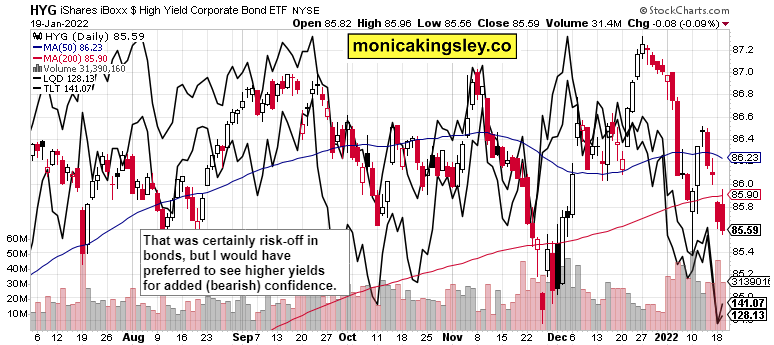

S&P 500 gave up opening gains that could have lasted longer – but the bear is still strong, and didn‘t pause even for a day or two. Defeated during the first hour, the sellers couldn‘t make much progress, and credit markets confirm the grim picture. There is a but, though – quality debt instruments turned higher, and maintained much of their intraday gains.

Q4 2021 hedge fund letters, conferences and more

And that could be a sign – in spite of the bearish onslaught driving the buyers back to the basement before the closing bell – that more buying would materialize to close this week, with consequences for S&P 500 as well. I would simply have preferred to see rising yields once again, that would be a great catalyst of further stock market selling. Now, the wisest course of action looks to be waiting for the upcoming upswing (one that didn‘t develop during the Asian session really), to get exhausted.

Remember my yesterday‘s words:

(…) The rising yields are all about betting on a really, really hawkish Fed – just how far are the calls for not 25, but 50bp hike this Mar? Inflation is still resilient (of course) but all it takes is some more hawkish statements that wouldn‘t venture out of the latest narrative line.

Anyway, the markets aren‘t drinking the kool-aid – the yield curve continues flattening, which means the bets on Fed‘s misstep are on. True, the tightening moves have been quite finely telegraphed, but the markets didn‘t buy it, and were focused on the Santa Claus (liquidity-facilitated) rally instead – therefore, my Dec 20 warning is on. The clock to adding zero fresh liquidity, and potentially even not rolling over maturing securities (as early as Mar?) is ticking.

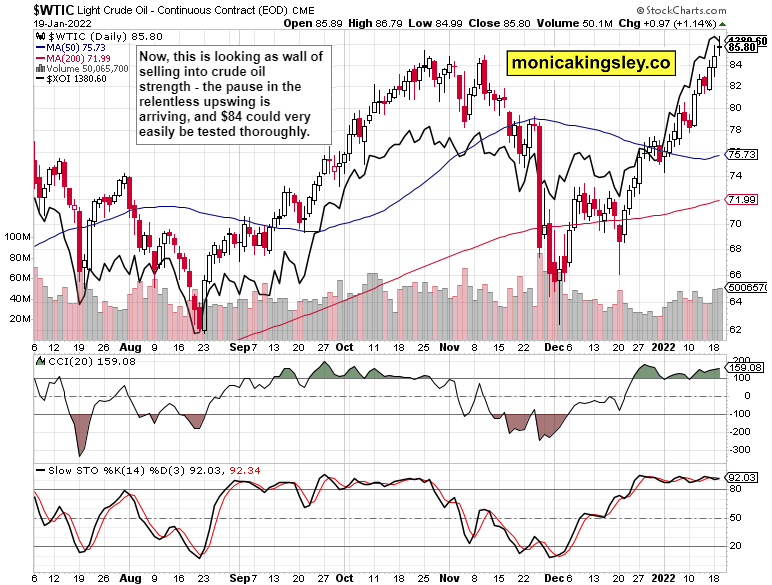

And the run to commodities goes on, with $85 crude oil not even needing fresh conflict in Eastern Europe – the demand almost at pre-corona levels leaving supply and stockpiles in the dust, is fit for the job.

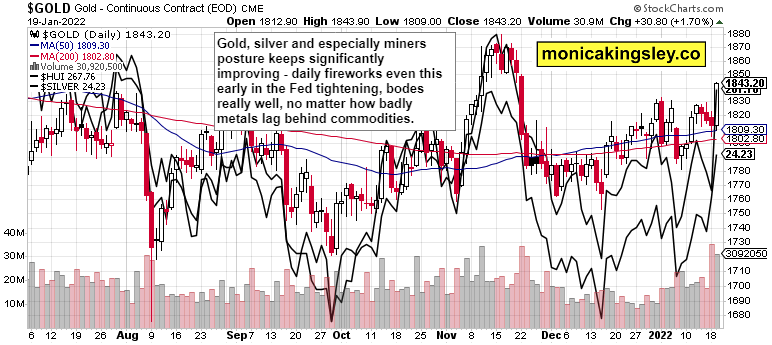

With SPX short profits off the table, crude oil consolidating, and cryptos having second thoughts about the decline continuation, it‘s been precious metals that stole the spotlight yesterday – really great moves across the board to enjoy!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 buyers are nowhere to be seen – what kind of reflexive rebound would we get next? The odds aren‘t arrayed for it to be reaching very high – yields are catching up even with financials...

Credit Markets

HYG is likely to pause a little next, and the degree of its move relative to the quality debt instruments, would be telling. Rates are though going to keep rising, so keep looking for a temporary HYG stabilization only.

Gold, Silver and Miners

Gold and silver keep catching fire, and are slowly breaking out of the unpleasantly long consolidation. The strongly bullish undertones are playing out nicely – these aren‘t yet the true celebrations.

Crude Oil

Crude oil looks like it could pause a little here – the stellar run (by no means over yet) is attracting selling interest. The buyers are likely to pause for a moment over the next few days.

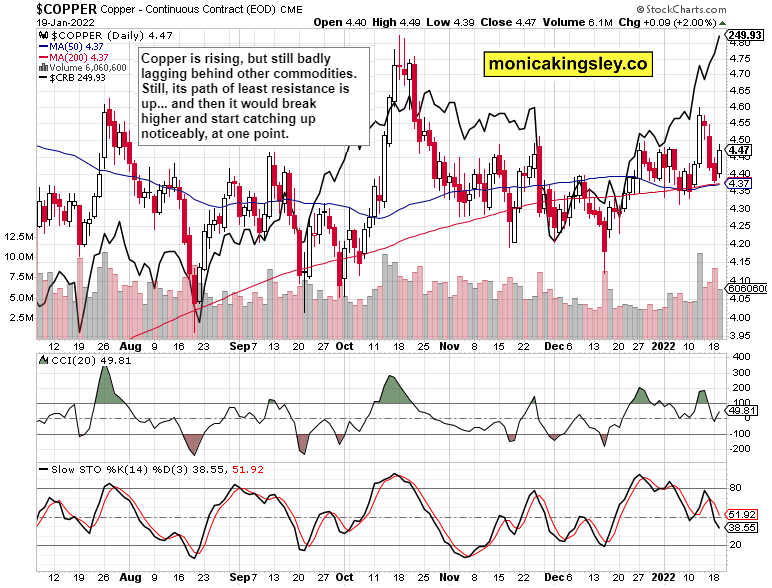

Copper

Copper is paring back on the missed opportunity to catch up – the red metal will be dragged higher alongside the other commodities, and isn‘t yet offering signs of true, outperforming strength.

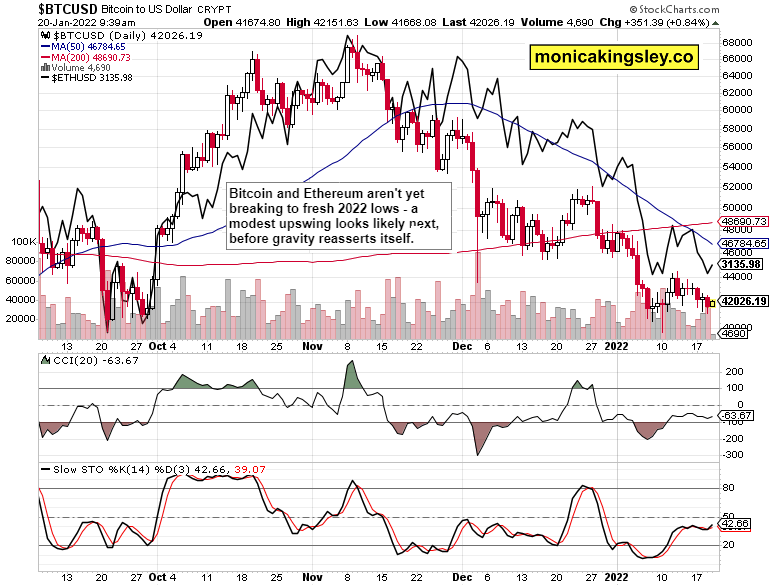

Bitcoin and Ethereum

Bitcoin and Ethereum really are setting up a little breather, but I‘m not looking for bullish miracles to happen. Still, the buying interest was there yesterday, and that would influence the entry to the coming week (bullishly).

Summary

S&P 500 upswing turned into a dead cat bounce pretty fast, and while we may see another attempt by the bulls, I think it would be rather short-lived. Think lasting a couple of days only. Not until there is a change in the credit markets, have the stock market bulls snowball‘s chance in hell. Commodities and especially precious metals, are well placed to keep reaping the rewards – just as I had written a week ago. For now, it‘s fun to be riding the short side in S&P 500 judiciously, and the time for another position opening, looks slowly but surely approaching. Let the great profits grow elsewhere in the meantime.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.