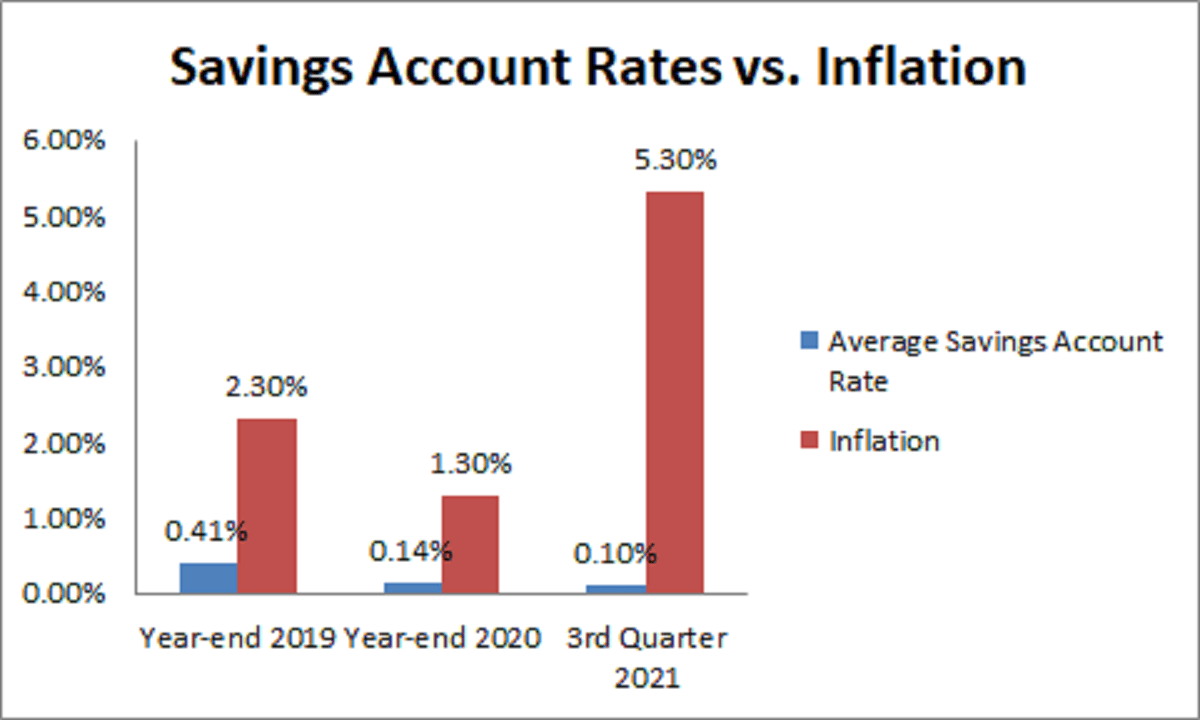

If you’ve been saving money over the past several years, you know that savings, CD, and money market account (MMA) interest rates are dismally low. Just when you think they’ve hit rock bottom, they fall lower. Even with the shaky COVID economy, inflation is rising, and interest rates for deposits are expected to remain in the basement for the foreseeable future.

Q2 2021 hedge fund letters, conferences and more

What does that mean for people who prefer to keep some money in easy-to-access savings products? It means that the days of 5% interest may never come back and you can’t count on the interest from deposit accounts to grow your wealth. Still, for people who use these accounts, there are bright spots. A few individual online and brick-and-mortar banks offer better-than-average interest rates on deposits. MoneyRates conducted an analysis to find America’s Best Rates for consumers who want to maximize their savings.

America’s Best Savings Account Rates

Savings account rates had a slight uplift at the beginning of 2019 but have been falling steadily since. The average savings account rate as of September 2021 is now just 0.06%.

Savings account rates don’t all fall at the same speed or to the same degree. Some of the top savings account rates are 0.50% or better.

Most of the best rates are usually found with online accounts. The average online savings account rate of 0.319% is more than nine times the average rate of 0.034% for traditional, branch-based accounts. MoneyRates recognizes the financial institutions that offer the best rates for consumers.

As of September 2021, these 10 banks have the best savings account rates:

- 1st place: Axos Bank, 0.61%

- 2nd place: SFGI Direct, 0.51%

- 3rd place (tie): 0.50%

- Ally Bank,

- iGOBanking

- Marcus by Goldman Sachs

- Synchrony Bank

- TIAA Bank

- 8th place (tie): 0.40%

- American Express National Bank

- Barclays

- Capital One

- CIT Bank

- Discover Bank

America’s Best Money Market Account Rates

MMA rates have historically been higher than savings account rates, but that’s changed in the last few years. Money market rates have fallen fast and landed lower than their savings counterparts. As of September 2021, the average MMA rate was 0.08%.

Online MMAs offer better average rates than those from brick-and-mortar financial institutions. While the average traditional MMA rate is only 0.047%, the online average is 0.235%. The MMAs with the highest rates are:

- 1st place (tie): 0.50%

- Ally Bank

- First Internet Bank, 0.50%

- 3rd place (tie): 0.45%

- CIT Bank

- Sallie Mae Bank

- 5th place (tie): 0.40%

- Northeast Bank

- TIAA Bank

- 7th place : Synchrony Bank, 0.35%

- 8th place (tie): 0.30%

- America Plus Bank

- Discover Bank

- 10th place: Virtual Bank, 0.25%

America’s Best CD Rates

CD rates with longer terms tend to have the best rates. MoneyRates analyzed one- and five-year CD rates to find people the best offerings for both short- and long-term accounts.

One-Year CD Rates

One-year CD rates are higher than the average savings and MMA rates. While the national average for all CD rates is 0.14% as of September 2021, the average online one-year CD rate is 0.337%, compared to just 0.134% offered by traditional financial institutions. The highest one-year CD rates found by MoneyRates are:

- 1st place: First Internet Bank, 0.60%

- 2nd place (tie): 0.65%

- Ally Bank

- iGOBanking

- Marcus by Goldman Sachs

- Sallie Mae Bank

- Synchrony Bank

- TIAA Bank

- 8th place (tie): 0.50%

- American Plus Bank

- Discover Bank

- 10th place: Beal Bank, 0.46%

Five-Year CD Rates

The best rates from the entire study came from five-year CD accounts. When you “lock up” your money for five years, financial institutions pay a higher rate. You can still access your money with a CD of any length but may pay a penalty for withdrawing it before the term is up. The average rate for five-year CDs is 0.27%.

Like the other categories in this analysis, the average five-year CD rate for online accounts is higher than rates offered by branch-based accounts. The average online rate is 0.504%, while the traditional bank rate average is 0.290%.

If you want to sock away some money for five years and don’t need a bank branch in your area, an online bank for a five-year CD looks like the best way to go. If you choose an account at a bank that is FDIC insured, your money will be safe. Even if you need flexible access to your money but don’t need a physical bank branch, try to focus your account search on online banks.

How the Winners Were Picked

The latest America's Best Rates survey of savings, MMA, and CD account rankings was based on posted rates as of September 2021. Accounts that are available to customers with a $10,000 balance and no prior relationship with the bank are used for this survey.

This analysis is based on the MoneyRates Index, a consistent sample of accounts reflecting a cross-section of the retail deposit industry. The MoneyRates Index is comprised of 50 of the largest retail deposit institutions in the U.S, 25 smaller banks, and 25 medium-sized banks.

About the Author

Kristin Marino is a banking analyst for MoneyRates.com