Review your retirement accounts today and be astonished on how passive your investment strategy has become. Over the years, most brokers and investment managers have completely abdicated responsibility for their accounts by buying ETFs representing every investment in the world and then have made no changes in those allocations. That is infinite diversification!

Q3 2020 hedge fund letters, conferences and more

The changes that are made (mostly in target date funds) are based on age so the older you get the more bonds you own. This is Toxic!

With US long bonds at the lowest yield in history; bonds do not yield enough to pay the fees and let alone taxes and inflation. The future of interest rates and inflation is up and the future of bond prices is down.

Major Stock indexes reached all-time highs last week as optimism increased about a strong and immediate recovery in post-virus corporate growth. This contradicts optimism about sustained ultra-low interest rates as both are highly unlikely. If the recovery is strong, interest rates will rise and stock prices will fall. If the recovery is weak, growth expectations will be disappointed and stocks prices will fall.

So How To Make Money?

At the end of the third-quarter financial statement update; we measured falling growth for the eighth consecutive quarter. All sectors except Consumer growth (healthcare) recorded lower growth with sales growth and profit margins down on average. Improvement is more frequent suggesting that by the second quarter of 2021 we will be measuring the magnitude of a broad growth rebound.

Take advantage of the recent strong rally in industrial stocks to sell companies with negative and falling sales growth. Many of these are in crisis mode and cutting costs aggressively. Make sure all the companies you own have high or rising sales growth. The recent rally in the post-virus stocks provides a rare opportunity to sell falling growth companies with poor financial condition at premium prices.

The sale of those stocks will improve the attributes of your portfolio and provides an opportunity to for you to enhance further. Many of these are trading at depressed share prices and provide an excellent opportunity to improve the growth and financial condition attributes of your stock portfolio. These will be important attributes as we navigate the next few quarters and gauge the timing and magnitude of a post-virus growth recovery.

Simply put, buy superior attributes companies and pay close attention to the direction of the profit margins.

Amazon.com, Inc. (AMZN) $3,162.580 BUY This Rich Company Getting Better

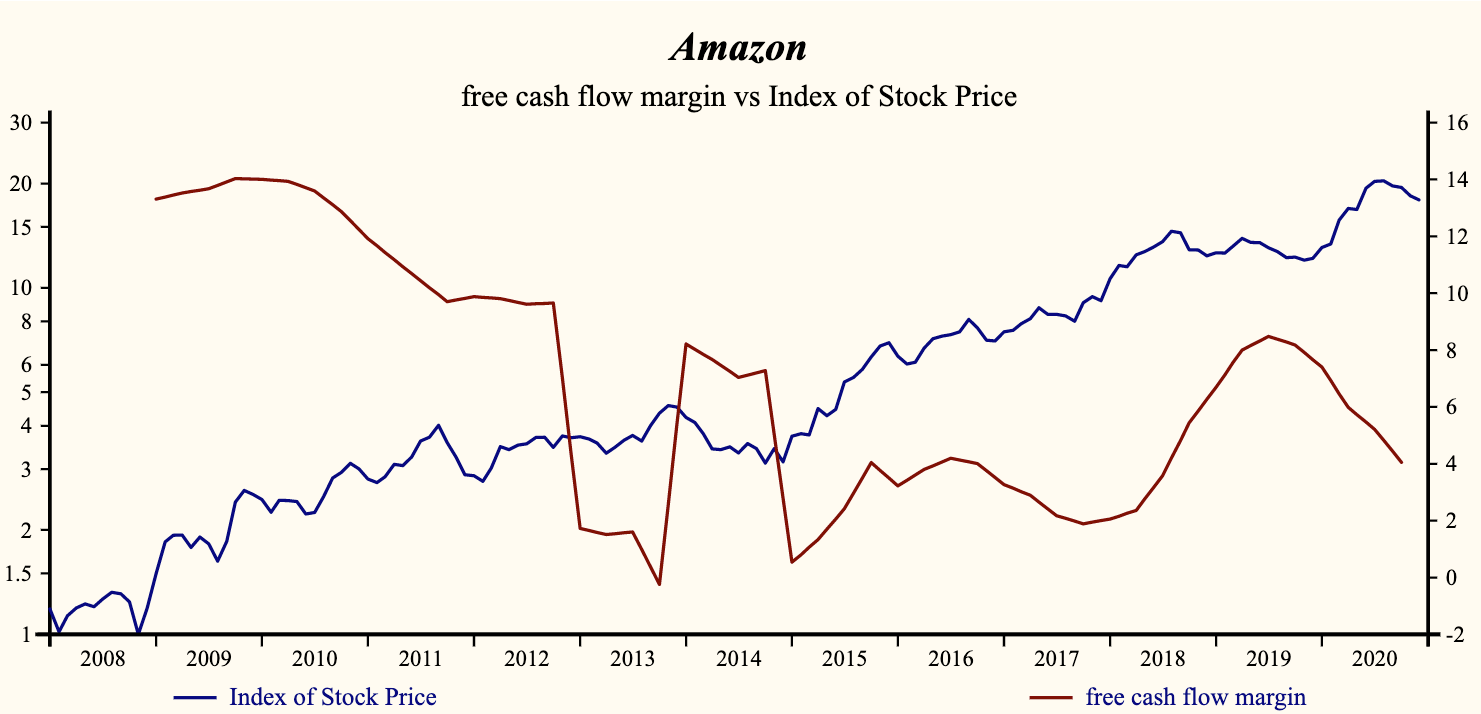

Amazon.com, Inc. (NASDAQ:AMZN) has been a profitable company with persistently high cash return on total capital of 8.7% on average over the past 21 years. Over the long term the shares of Amazon have advanced by 475% relative to the broad market index.

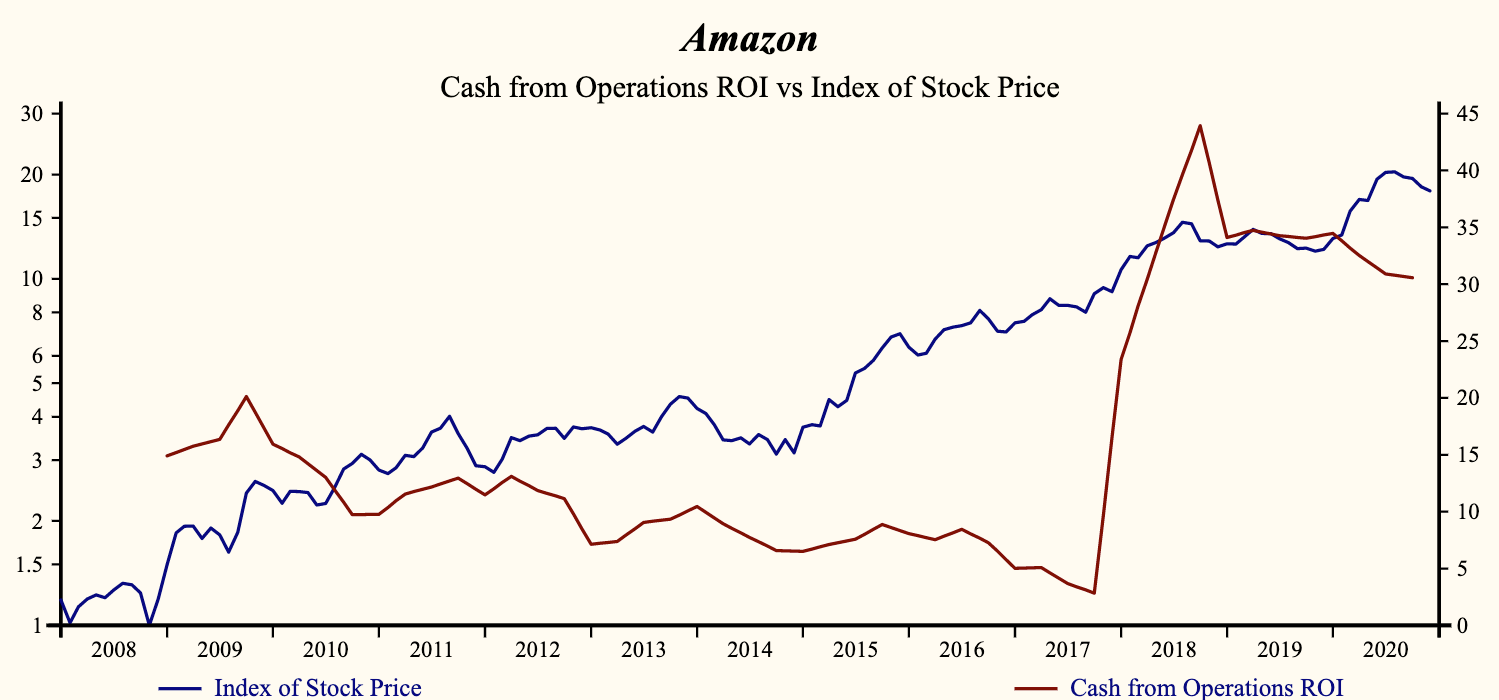

The shares have been very highly correlated with trends in Growth Factors. A dominant factor in the growth group is cash from operations (ROI) which has been highly correlated with the share price.

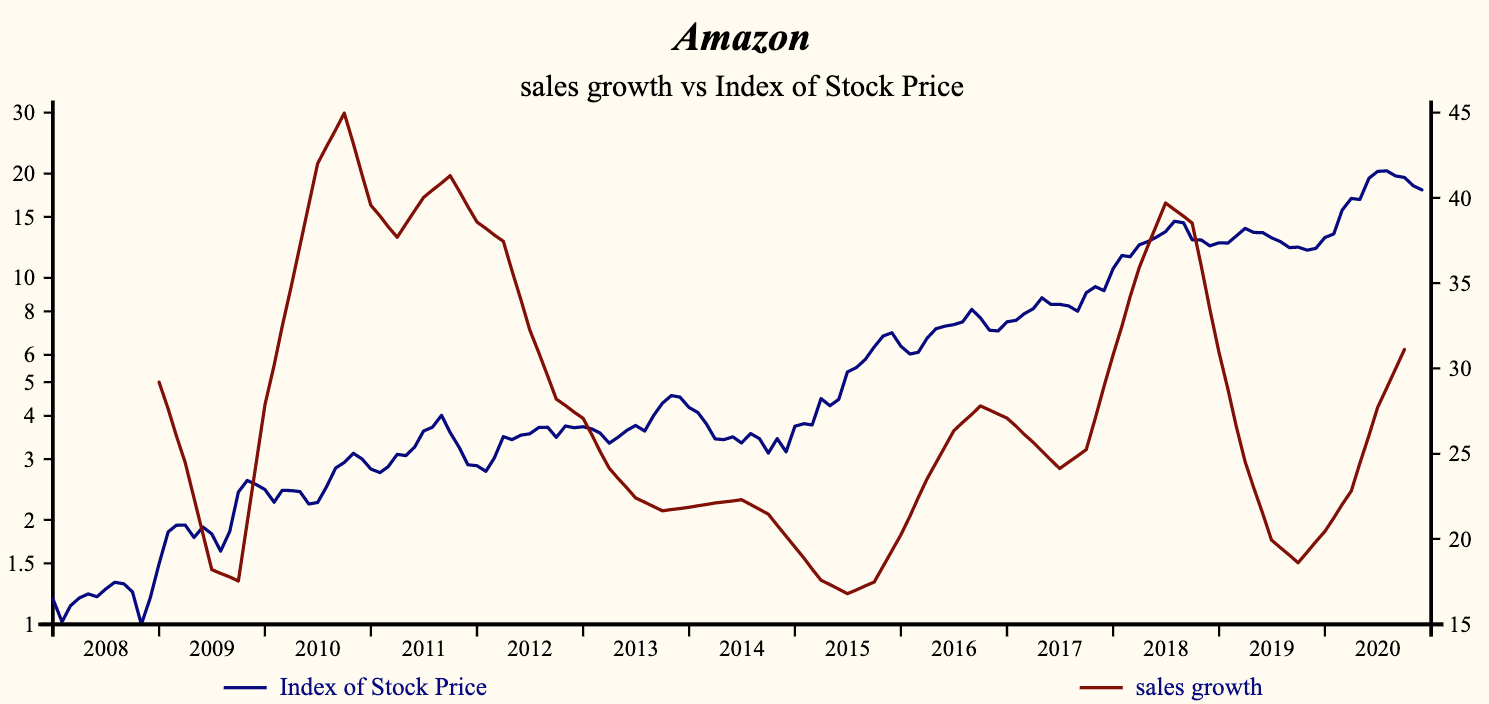

Currently, sales growth is 31.1% which is low in the record of the company but higher than last quarter. Receivable turnover has remained steady reflecting a strong quality of sales.

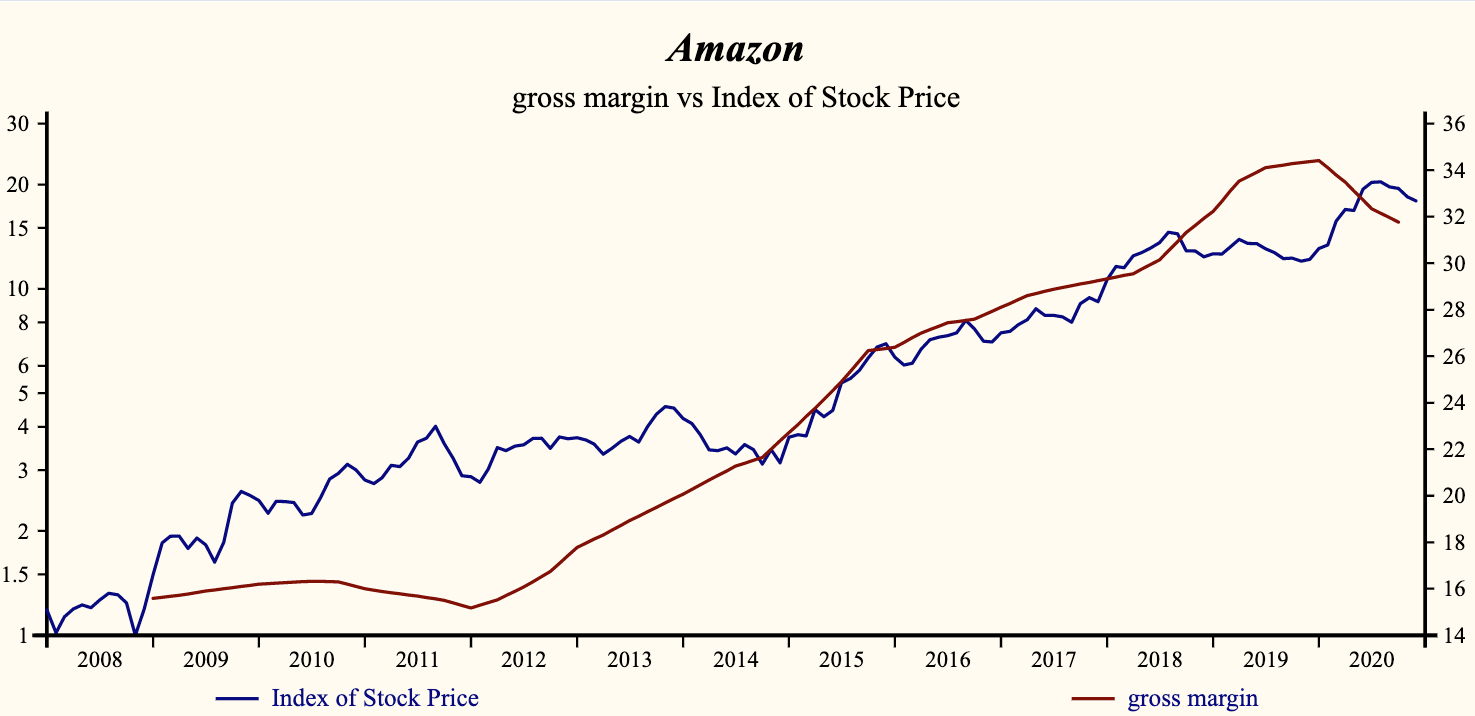

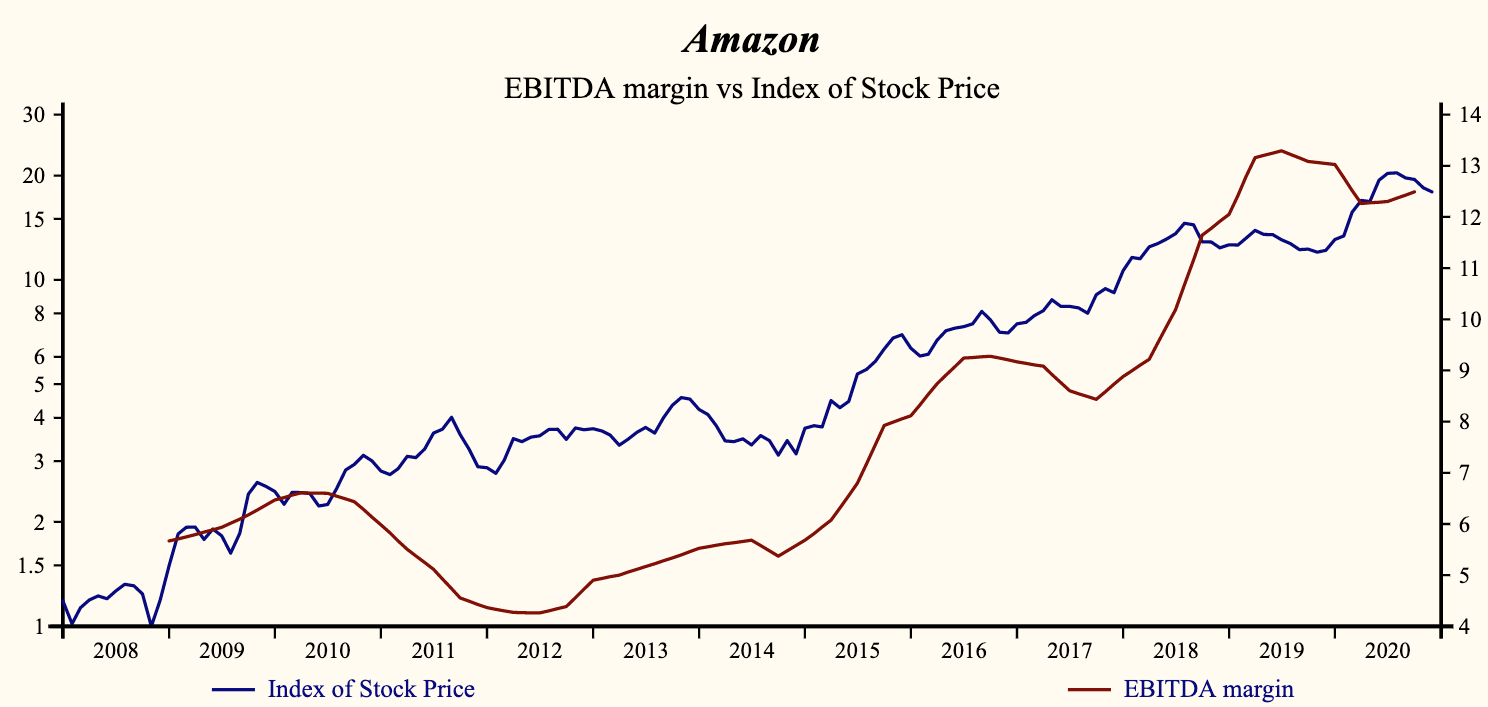

The company is recording a high and falling gross profit margin. SG&A expenses are high in the record of the company and falling. That implies that the company has further capability to accelerate EBITD relative to sales with lower costs. SG&A expenses are falling at a more rapid rate than the gross margin producing a rising EBITD profit margin.

This is a poor-quality growth trend to the extent that lower costs can insulate the bottom line from top line weakness for only a short time. Despite being under recent margin pressure, cash flow from operations and free cash flow growth remains high in the record of the company.

More recently, the shares of Amazon have advanced by 48% since the October, 2019 low. The shares are trading at lower-end of the volatility range in a 13-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

Investors do not wait. Act now!

Join our Free December 16th Online Seminar

A special invitation to experience your financial reality as FREEDOM AND EMPOWERMENT.

OTOS will host a free year-end recap on Wednesday, December 16, 2020 at 6:00pm CDT.

These quarterly reviews focus on the ‘Big Picture’, trends and projections as provided by the most recent financial statements. The panel will also present their views on Asset Allocation (Stocks or Cash), Sector Rotation (Sell Technology & Buy Industrials) and RISK (sell falling cash flow and poor financial condition).

Register here:

https://www.thefeng.org/chapters/rsvp.php?tid=13440

Hope to see you there!