The Broad Market Index was up 6.58% last week and 38% of stocks out-performed the index.

Stocks have been performing well (relative to bonds) as high and rising corporate growth in recent quarters makes stocks the only asset with a hope of outperforming inflation.

Last week bond yields dropped slightly for the first time since the start of the invasion and bond prices were up. That is a more typical response to lower stock prices and indicates that bonds were useful again as defense against lower company growth.

Q1 2022 hedge fund letters, conferences and more

Large Inflation GAP

The gap between measured inflation now at 8.3% and long bonds yields now at 3% has closed but remains very large. Meanwhile corporate growth remains unusually high with high sales growth, rising gross profit margins and lower costs producing a dramatic acceleration in corporate cash.

Corporate growth remains unusually high with sales growth exaggerated by a recovery wave from the virus and powered by the sharp jump in inflation. Most large companies are passing the higher costs to the final consumer as higher product prices and the average gross profit margin is up.

Cash Keeps Flowing

Higher sales growth and rising gross profit margins are further enhanced by lower Sale, General & Administrative (SG&A) expenses, lower interest costs is now producing the highest cash flow growth ever. That is clear evidence that corporate growth will fall in the future but how fast. The virus wave has peaked in most effected industries with only travel related industries remaining in the swell.

What Stocks To Avoid

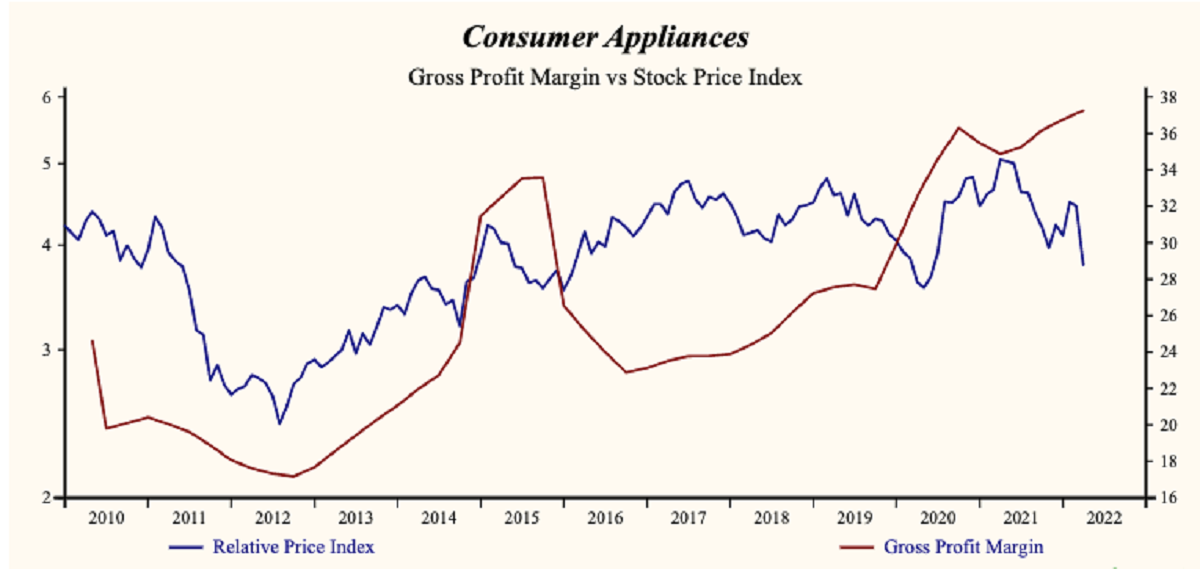

Shares of falling growth companies are now being reflected poorly in the markets so we need to be vigilant to maintain acceleration attributes in our portfolio companies. As we ride the now crested virus wave down, rising sales growth stocks will be more difficult to maintain. That makes it essential to pursue rising gross profit margin companies. Shares of companies that cannot pass on rising costs to their customers will be likely be in peril.

Inflation Has Peaked

Inflation has evidently reached a top with a slight drop in April. Higher energy costs are the primary driver of higher prices and at current oil prices we do not see a moderation of the year-over-year change until later this year.

Buy Now Rush To Beat Inflation

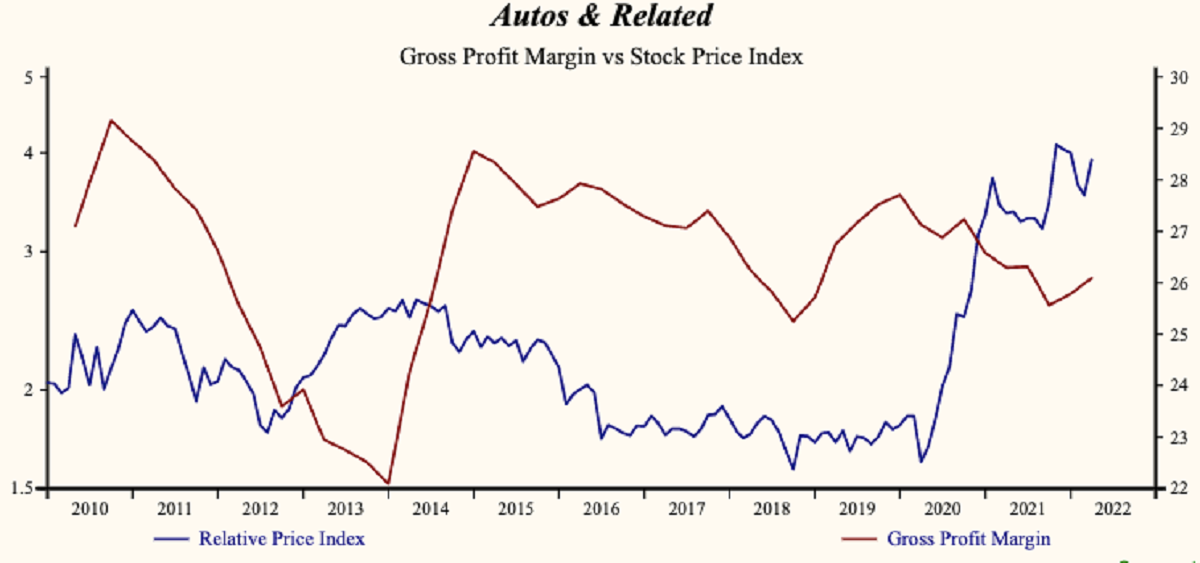

Higher interest rates in response to higher inflation has a perverse initial effect on demand as people rush to make big ticket purchases.

Higher interest rates and inflation, in the early phase of the advance can encourage people to buy now. This is particularly evident in big ticket purchases such as autos and housing where buyers perceive both higher future financing costs and higher future prices as dual incentives to buy now.

Big-Tickets Goods Outlook

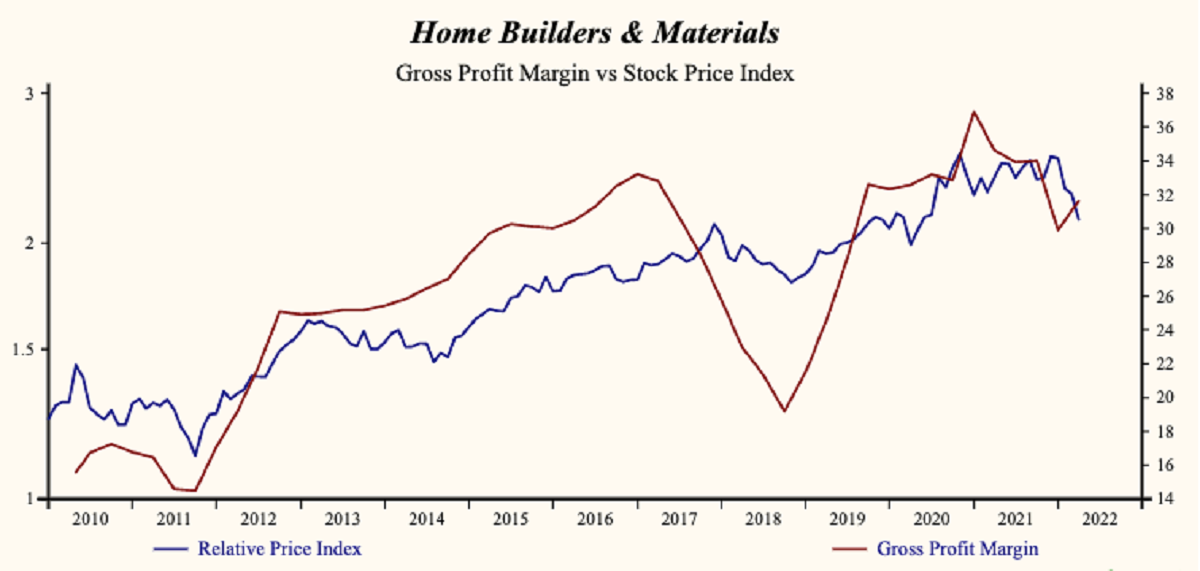

That front-end-load of big-ticket purchases sets us up for a dramatic future drop as financing costs increase, but so far sales of big-ticket consumer goods remain high and rising in Autos and high and falling in the Housing industries. In the housing and related industry, the evidence of a growth peak is clearer with a steep drop in the frequency of sales growth improvement and a drop in the average sales growth rate.

A housing peak is more likely with sales growth lower at 83% of companies and the gross profit margin is lower at 74% of companies.

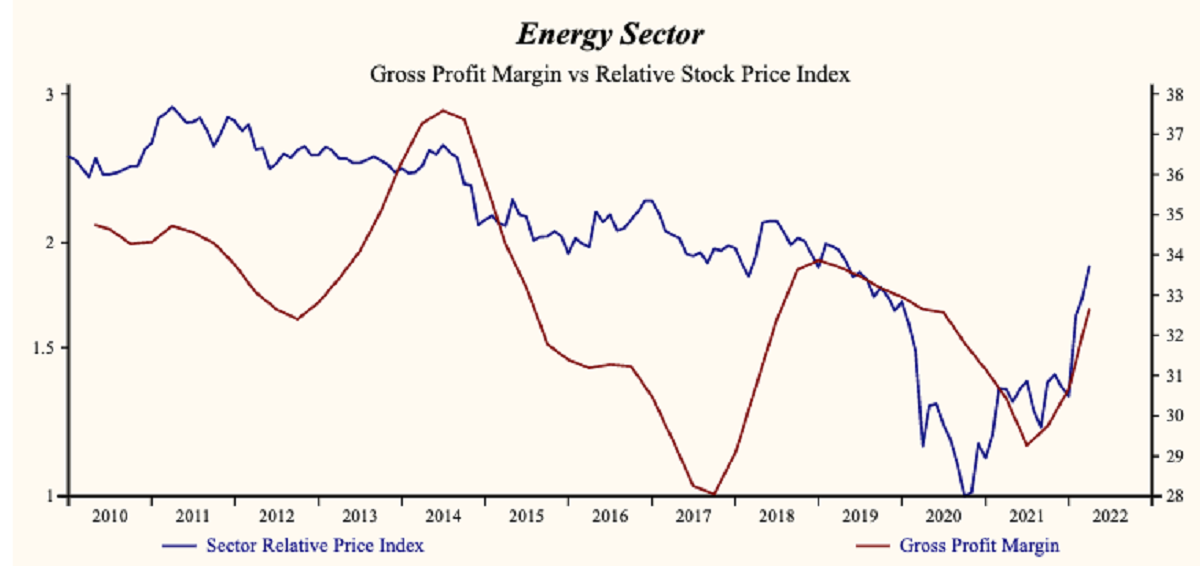

Energy Growth Trend

Again, it all comes down to the future of oil prices. Companies are broadly successful in passing on rising costs to the consumer as rising prices indicated by a gross profit margin advance by 55% of the Otos total market index, unchanged from last quarter. The average gross profit margin is up.

We observed last fall that lower capital expenditures by oil companies are a reliable indicator predicting that oil prices would rise and that, with the long lead time between money spent and oil flowing, there would be an extended supply crisis. Sales growth in the energy sector has recovered dramatically from levels depressed by the virus.

Oil Prices Peaked?

The average sales growth rate this period was 50%, with 70% of energy companies (accounting for 83% of sector capital) achieving a sales growth improvement. Profit margins are up and costs are down producing the strongest advance in corporate cash we have ever measured. Capital expenditures continue to decline relative to sales and it is that indicator that reliably marks the peak in oil prices.

The invasion has provided political cover and encouragement for more drilling and the government strategic oil reserve has been deployed to supplement supply. Such a shift in attitude towards oil production will enhance spending but, so far, real deployment of capital expenditures persists lower. Oil prices will continue to rise.

Market Outlook

In the current update, our Otos.io recent Securities & Exchange Commission (SEC) filing update is 92% complete. The volume of SEC financial statement filings will decrease in coming weeks.

Corporate growth is unusually high and falling more frequently. Inflation is likely to remain high and interest rates will advance further. Falling growth and rising interest rates is a terrible combination for stocks and asset values generally.

Maintain portfolio companies with high sales growth and rising profit margins (tall green MoneyTree in a golden pot)

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.