Dear fellow investors,

Q3 2021 hedge fund letters, conferences and more

Aesop: The Originator Of Investment Logic

Warren Buffett and Charlie Munger always refer to Aesop as the originator of investment logic. His first dictum was “a bird in the hand is worth two in the bush.” His second dictum was the fable of the “Tortoise and the Hare.” We have been getting many questions about the strength of our results and the strength of the stock market in general. We want to remind everyone that investing is a marathon, and in our case, Aesop’s marathon.

In a world of microscopic interest rates, the market participants are dramatically more interested in the “two in the bush” than they are in the “bird in the hand.” Fast revenue growth, from “innovative” companies sporting very high price-to-sales (P/S) and price-to-earnings (P/E) ratios, is all the rage. We have heard everyone from John Malone, Bill Ackman and Jeremy Grantham warn investors recently about this financial euphoria. They have joined us as looking like “the boy(s) who cried wolf!”

As Buffett so clearly stated in May at the virtual annual meeting of Berkshire Hathaway, interest rates serve as a gravitational pull to P/E ratios. High rates begat low P/E ratios and low rates begat high ratios. To state the obvious, we have the lowest interest rates of my 63 years. Therefore, it appears to us at Smead Capital Management that the “two in the bush” will stay levitated until those rates move higher. We have told people for years that you shouldn’t hold your breath until the interest rates start going up in a sustainable way.

The “bird in the hand” goes back to what Buffett says about owning a stock. He says, “Buy it as if the stock market is closed for five years.” His point is, would you be happy to be the owner of this business if you owned the whole thing as a private company? Would the free cash flow and after-tax profits reward you “in the hand?” How many investors would be willing to be the sole owner of the “innovation” stocks which are all the rage, if there were no “bigger fools” coming in behind them?

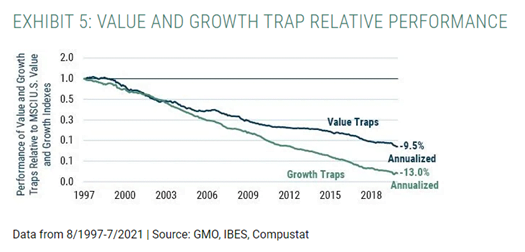

The tortoise was slow and consistent, while the hare was a sprinter. The hare got way ahead in the race and had a seemingly insurmountable lead. However, the chart below shows the history of the hare’s performance over long stretches of time. What it proves is that when the hare gets tired, the abuse stockholders endure is much more powerful than the declines in the tortoise stocks:

Looking For A Needle In A Haystack

You see, Buffett pointed out that “innovation” investing is like looking for a needle in a haystack. Out of 2000 auto companies over 120 years in the U.S. from 1900 to 2020, there were few who survived. Everyone loves Amazon, while we’re one of the few lovers of eBay, but almost nobody else made it out of the Dotcom Bubble profitably alive. Do all those Beyond Meat and Peloton shareholders out there, who are getting crucified lately, understand this? Do Rivian and Lucid bidders think that the bloom won’t come off their rose?

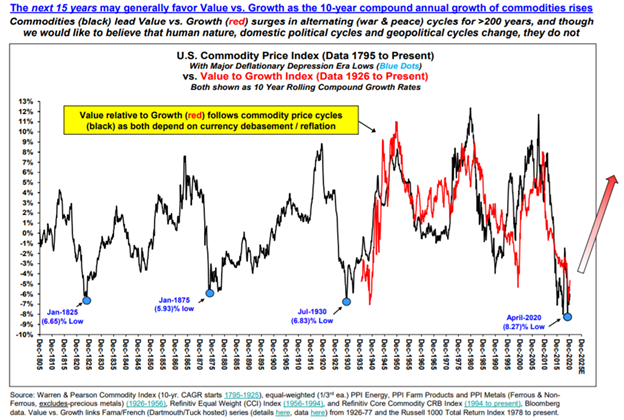

The chart below shows us where the “bird in the hand” has come from, as well as where it might come from in the future:

As for us, we will stick with companies which are providing the “bird in the hand” via free cash flow and expect good things from the reversion to the mean in commodity prices versus stock prices. Look no further than the oil and gas industry (CLR, OXY and COP). We believe Berkshire Hathaway’s market inactivity is tied directly to the fact that wise investors run in Aesop’s marathon! We thank our investors for their patience as we help them fear stock market failure.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2021 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.