Regulation to have biggest impact on advice industry, say US advisors

Financial advisors think regulation, demographic change and technological innovation will reshape the industry over the next 3 to 5 years

Q4 2019 hedge fund letters, conferences and more

(London, February 2020) U.S. financial advisors say regulation will have the most significant impact on the advice industry over the next few years, new research shows.

53% of U.S. financial advisors think regulation will have a severe impact on the advice industry

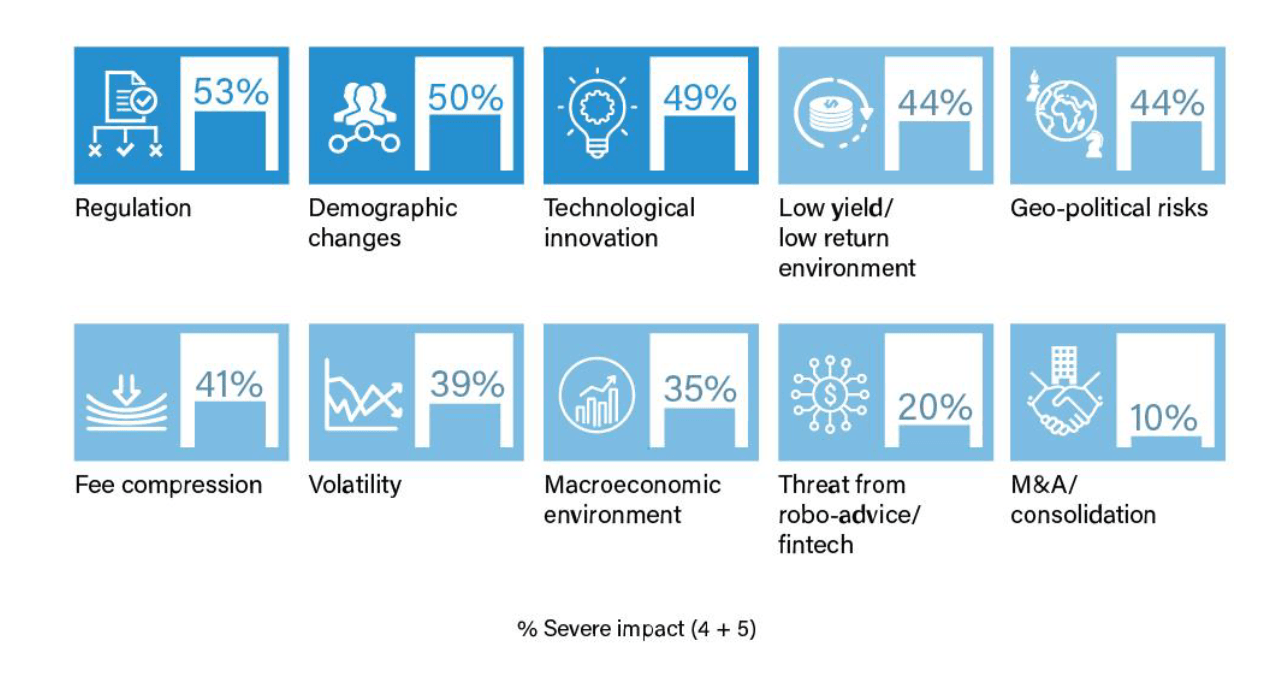

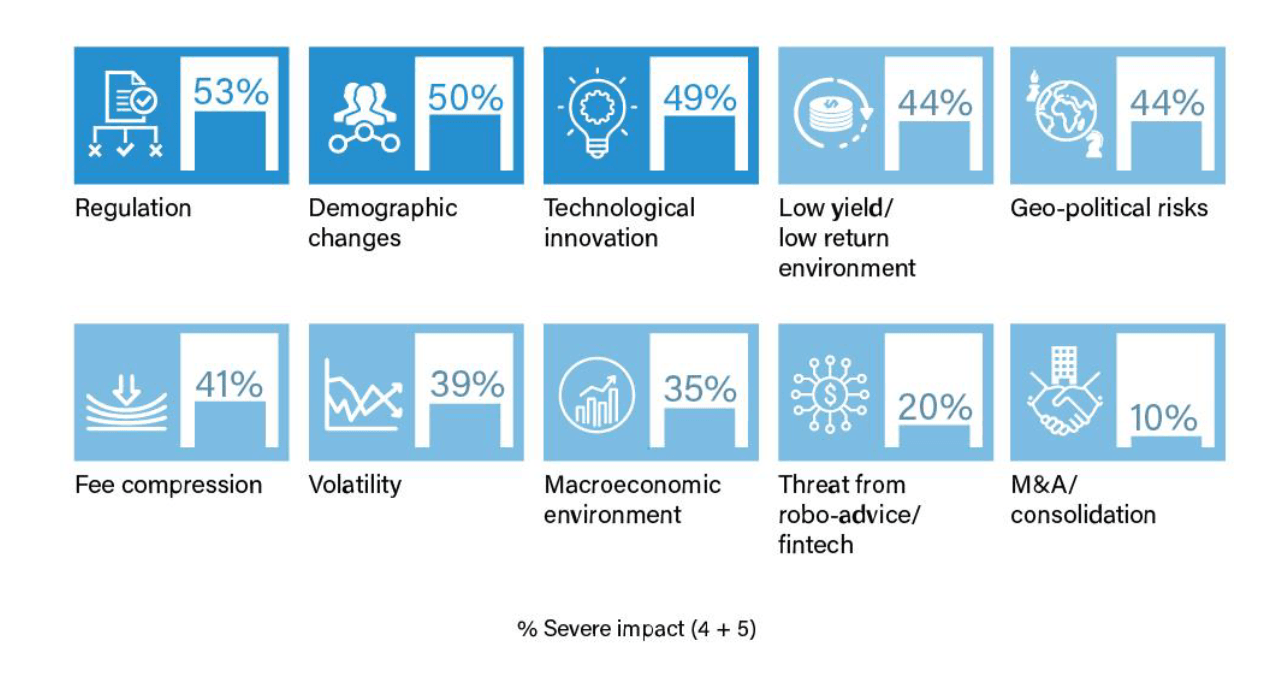

A CoreData Research study of over 200 U.S. financial advisors found more than half (53%) think regulation will have a severe impact on their industry over the next 3 to 5 years. This is followed by demographic change (50%) and technological innovation (49%).

“Our findings show that U.S. advisors recognize the forces of regulation, demographics and technological innovation are structural changes that will reshape the advice industry in the years to come,” said Craig Phillips, head of International, CoreData Research.

About four in 10 advisors say the low yield/low return environment (44%), geopolitical risk (44%) and fee compression (41%) will have a severe impact. More than a third think volatility (39%) and the macroeconomic environment (35%) will significantly affect the industry.

Far fewer advisors point to the impact of robo-advice/fintech (20%) and M&A/consolidation (10%).

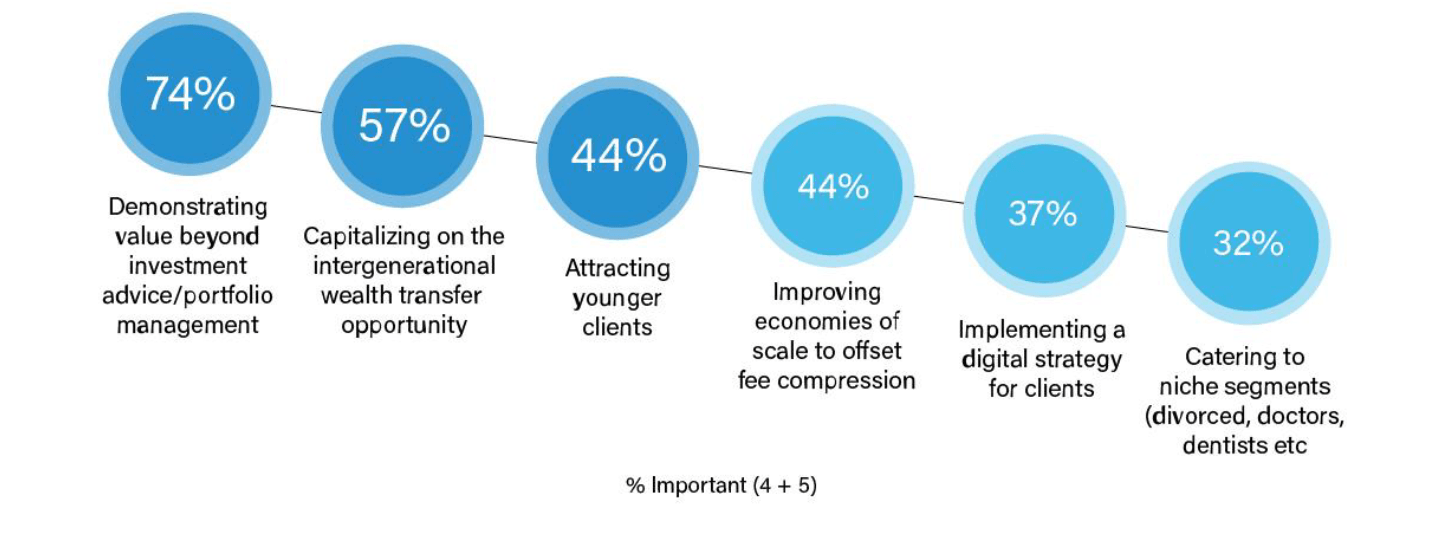

Meanwhile, advisors say the most important factor when it comes to the growth of their business over the next 2 to 3 years is the ability to demonstrate value beyond investment advice/portfolio management (74%). This is followed by capitalizing on the intergenerational wealth transfer opportunity (57%) and attracting younger clients (44%).

Improving Economies Of Scale Is Important To Business Growth

A further 44% say improving economies of scale to offset fee compression is important to business growth, while 37% cite the importance of implementing a digital strategy for clients.

The CoreData study also sheds light on what advisors want from asset managers. When asked how asset managers can help them over the next 2-3 years, the most popular option — selected by over half of advisors— is new risk management products and strategies (56%). Informative educational materials (53%) and content including market commentary/updates (40%) complete the top three choices.

“The appetite for new risk management strategies reflects elevated levels of uncertainty against a backdrop of heightened geopolitical risks,” added Phillips. “And the thirst for educational materials and market commentary underscores a desire to understand how these risks and uncertainties can impact portfolios.”

Key Findings

What impact will the following have on the financial advice industry over the next 3 to 5 years?

Please choose on a scale of 0-5 where 0 = zero impact and 5 = very severe impact

In the next 2-3 years, how important are the following to the growth of your business?

Please choose on a scale of 0-5 where 0 = no importance and 5 = extremely important

About CoreData

CoreData Research is a global specialist financial services research and strategy consultancy. CoreData Research understands the boundaries of research are limitless and with a thirst for new research capabilities and driven by client demand; the group has expanded over the past few years into the Americas, Africa, Asia, and Europe.