Welcome to the first update of the second quarter financial statements from US companies. The Broad Market Index was down 2.21% last week and 61% of stocks out-performed the index.

So far only companies with fiscal quarters ending in May have reported to the Securities and Exchange Commission (SEC). The larger volume of financial reports from companies with quarters ending in June will appear in late July.

Q1 2022 hedge fund letters, conferences and more

The major decline in the value of assets that we have experienced has been related to higher inflation and higher interest rates. Last month we saw a modest downtick in the performance of stocks versus long treasury bonds indicating that the market has begun to adjust to the prospect of lower growth.

Topline Growth

Sales growth is now unusually high in US corporate history and has been falling on average and more frequently. Partly, this is the result of the virus wave that caused a steep drop in sales growth in 2020 and strong rebound in 2021.

We are on the downside of the virus wave now and the second quarter reports will help gauge how steep the drop will be. In recent quarters, the population of companies achieving an improvement in sales growth has dropped from 83% at the peak to 43% in the most recent reports.

Meanwhile, the average sales growth rate has remained very high and has fallen slowly.

Sector Outlook

We measure very high sales growth in the Consumer Cyclicals, Basic Industry and Energy sectors. Consumer cyclicals include big ticket purchases of autos and housing as well as retailers. Evidence so far suggests that retailers will experience a steep drop in sales. Last quarter among retailers, sales growth fell broadly and steeply, profit margins are down, and inventories are up.

Stocks

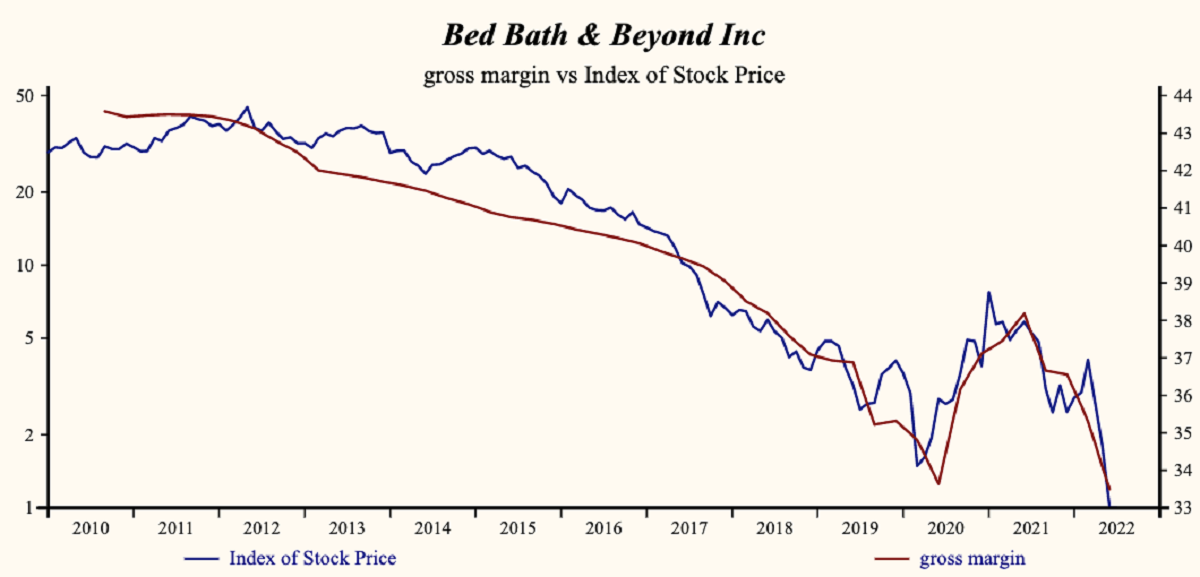

Last week, Bed Bath & Beyond Inc. (NASDAQ:BBBY) reported the steepest decline in sales growth to the lowest in the company history, nearly twice as low as the depth of the virus. This illustrates that the consumer is less willing and possibly less able to spend on discretionary items.

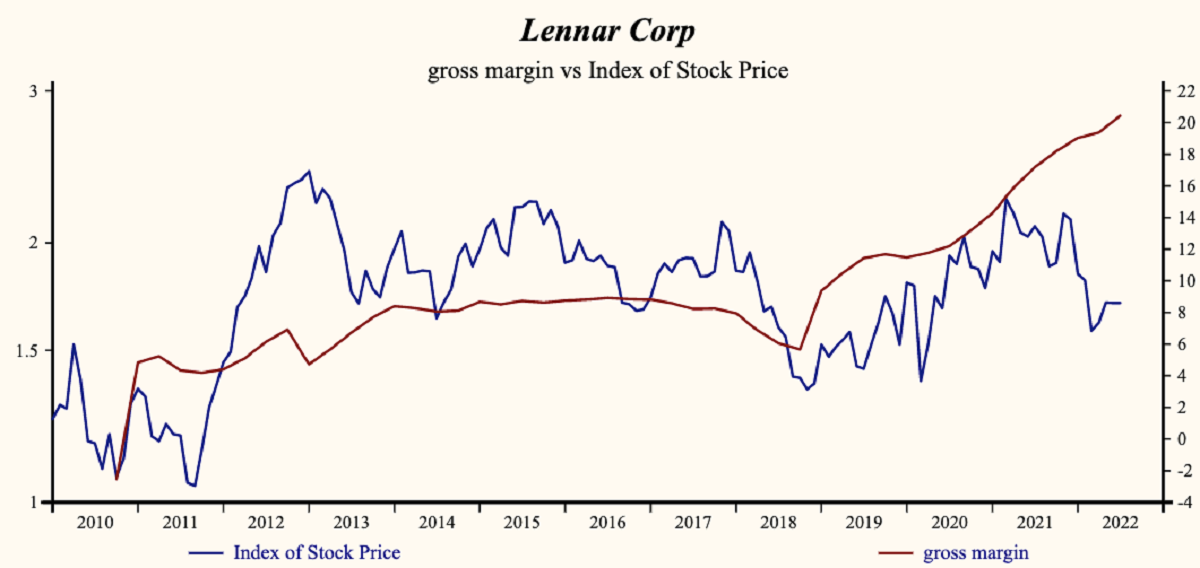

Meanwhile, Lennar Corporation (NYSE:LEN), a homebuilder, reported an improvement in sales growth to 22%, an improvement in profit margins and lower inventory. Big ticket consumer purchases tend to be front-end-loaded when inflation and interest rates are rising.

That incentive to buy now leads to a steep decline once it is exhausted, but Lennar tells us that it is not exhausted yet. That means that inflation will remain elevated and interest rates will continue to rise. That depressing effect on asset prices will be exaggerated by lower corporate growth.

Cash & Bonds

Bonds will perform poorly, and stocks will be worse. To defend against that I have made sure that all our portfolio companies have acceleration attributes. Otos MoneyTree with a tall green plant in a golden pot.

Market Strategies

Otos growth strategies have a large cash allocation since higher interest rates have an exaggerated negative effect on growth stocks. Many growth stocks are depressed now but most have been displaying falling growth attributes and should be avoided until inflation is moderated and growth improves.

Otos value strategies have been actively buying depressed shares in the volatile market in recent weeks.

The broad growth improvement in consumer cyclicals, basic industry, energy and REITS has created bargains.

The 2nd quarter numbers will illustrate if that big-ticket-consumer driven industrial/commodity acceleration will continue. Stay tuned.