Warren Buffett is one of the best investors in the world. The reason why he’s so famous is that he has managed to compound money at an above average rate of return for over 70 years.

Q3 2021 hedge fund letters, conferences and more

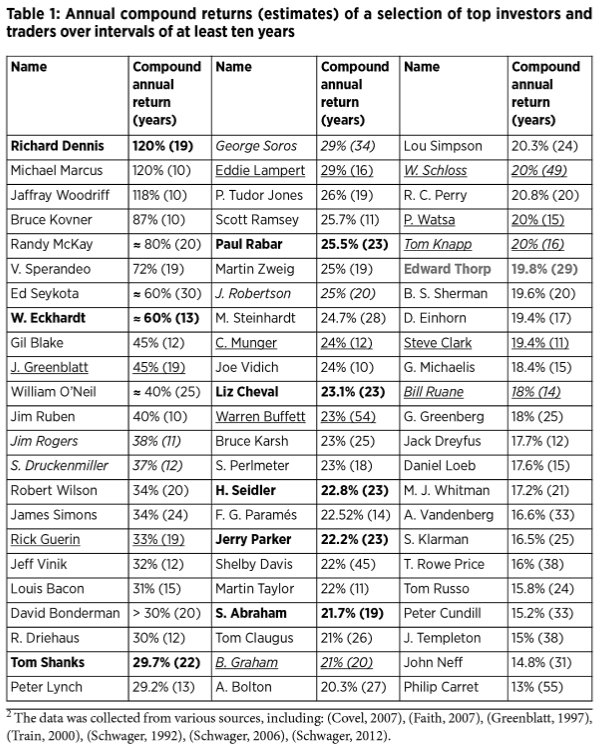

Historical Returns Of Famous Investors

If you look at this chart of historical returns of famous investors, you would notice an interesting fact.

The first is that the investors who have generated very high rates of return tend to only last for a short period of time, until their performance ends up deteriorating and they leave investing.

Source: Excess Returns

There are very few investors who manage to stay in the game for several decades, while also delivering amazing returns.

Warren Buffett is an outlier in this regard. It is very tough to deliver amazing returns and do it for a long period of time.

This is why I have found it important to study Buffett, his methods and observe him make investments.

Buffett's Adaptability

I believe that he was able to deliver amazing performance because of his adaptability. This is a skill that we all need to acquire, in order to be able to compound wealth.

His adaptability is a result of studying investing, and looking at opportunities in front of him, as opposed to sticking to a particular formula. This adaptability was instrumental in his ability to build his fortune.

Buffett basically started as someone who follows charts, followed by investing in a traditional value stocks that fit certain quantitative screens. He managed to invest following this Ben Graham approach throughout the 1950s and 1960s. As the number of companies in his investable universe dwindled for multiple reasons, he ended up folding his partnership, and focusing mostly on running Berkshire Hathaway. Having $100 million in assets under management in 1970 was also a different ballgame than having $10,000 to invest in 1950.

The next phase of his journey meant focusing more on buying quality companies at attractive valuations, and largely holding them. As the size of his operations grew, he managed to start buying entire businesses. His operations were aided by the float generated by his massive insurance operations, which essentially provided a no-cost margin loan to further magnify his investment returns.

In between, Buffett has managed to buy stocks at a discount, and dabble in options, derivatives etc. The moral of the story is that he was able to adapt to the environment he is, and not just blindly follow a strict set of rules.

Knowing When To Hold And When To Fold

The main difference between Buffett and the ordinary investor is that Buffett knows when to hold and when to fold. He has worked very hard, by working 70 hours per week on his craft for over 70 years.

He has managed to do this by reading excessively. He reads annual reports, industry publications, stock manuals, and scans Wall Street Journal and Financial Times for information. All of this information ends up compounding his knowledge over time. The best thing he does is learning new information, which in many cases means unlearning old ideas that no longer work or were wrong in the first place. Discarding old beliefs that you may have cherished is a very hard thing to do, but this could impede your development as an investor. Changing your mind when the facts change, or when you discard an old belief is hard, but necessary for the development of the investor.

He has managed to expand his circle of competence through experience of investing for over 70 years. That has allowed him to make new connections between ideas, and make investments. Even that experience of course is not enough to be right 100% of the time and make money 100% of the time.

But overall, the plan is to keep your investment losses low, but let your profits run for as long as possible. This is where his recent experience investing in technology comes in handy for illustrative purposes. Buffett made a large bet on IBM about a decade ago. Unfortunately, that bet didn't work out, and he ended up disposing of his position a few years ago. I'd assume that he broke even on this investment, between his purchase price and any dividends received. Many investors believed that he has lost his touch, that he went outside his circle of competence and as a result he is making a mistake.

Apple Bet

Buffett then made another large bet on Apple Inc (NASDAQ:AAPL), which was a value sitting in plain sight. Most investors didn't believe that Apple had much value, and the largest company in the world at the time sat there in plain sight, grossly undervalued. In the past four years, Buffett's Berkshire Hathaway has generated over $100 billion in profits from the investment in Apple. This counts some stock sales that were done along the way, along with dividends received as well.

This shows us that investing is not like following a cookbook. Rather, it is a process of continuous improvement, and adapting to change. This makes investing puzzling, and fascinating, because on one hand, you are supposed to stick to your strategy through thick or thin and not jump ship at the first sign of trouble. On the other hand, you also need to know when to hold and when to fold and adapt to any new conditions we are in, without falling prey to fear of missing out or throwing out all caution to the wind.

How do I try to adapt?

Writing this site helps me evaluate my thinking over time, and reasons for why I do things. Having a diary of sorts that discusses strategy, reasons for investment is helpful. It is very important to be honest with myself. A review of past decisions helps identify places for improvement.

Reading various literature, observing other investors making decisions, and reviewing investments after I had done or reviewing investments I skipped on definitely helps. Trying to better myself at analyzing investments is important, but I also need to recognize the fact that there is a point of diminishing returns as well. There is this psychological bias where gathering more information about a security may increase our conviction, but in reality I may be just fooling myself as I am just looking for information that confirms my thesis. This brings me to the point where disconfirming evidence may be a decent checklist item, even if it turns out it doesn't add value. The downside of course is being discouraged from investing due to poor reasoning. As always, there are two sides of the coin.

Understanding that I need to limit downside is important, because the future is somewhat unpredictable. Therefore, I need to allow my investments maximum time to compound, while also limiting the impact of losses when I have them. This is where diversification helps for me, because I do not want to be in a position where one poor decision can set me back years on my journey.

Challenging beliefs is important as well, along with reading as much as possible. Reading about history shows that events are not always predictable. However, human nature does not really change much over time. This is one area that could help in identifying investments, but it is hard to interpret as well.

Relevant Articles:

- The one lesson about Warren Buffett's success that no one wants to hear

- What Attracted Warren Buffett to IBM?

- Invest in Products People Love

- How Warren Buffett built his fortune

Article by Dividend Growth Investor