On January 31, 2023, William Blair initiated coverage of Cutera, Inc. (NASDAQ:CUTR) with a Market Perform recommendation.

Analyst Price Forecast For Cutera Suggests 64.58% Upside

As of February 1, 2023, the average one-year price target for Cutera is $57.32. The forecasts range from a low of $33.33 to a high of $73.50. The average price target represents an increase of 64.58% from its latest reported closing price of $34.83.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The projected annual revenue for Cutera is $319MM, an increase of 27.40%. The projected annual EPS is -$0.42.

Rtw Investments holds 1,770,400 shares representing 9.03% ownership of the company. No change in the last quarter.

Millennium Management holds 1,551,447 shares representing 7.91% ownership of the company. In it's prior filing, the firm reported owning 1,412,942 shares, representing an increase of 8.93%. The firm increased its portfolio allocation in CUTR by 27.27% over the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 1,304,460 shares representing 6.65% ownership of the company. In it's prior filing, the firm reported owning 1,150,910 shares, representing an increase of 11.77%. The firm increased its portfolio allocation in CUTR by 39.88% over the last quarter.

Voce Capital Management holds 1,210,224 shares representing 6.17% ownership of the company. No change in the last quarter.

Gamco Investors, Inc. Et Al holds 1,066,130 shares representing 5.44% ownership of the company. In it's prior filing, the firm reported owning 1,077,975 shares, representing a decrease of 1.11%. The firm increased its portfolio allocation in CUTR by 29.17% over the last quarter.

Fund Sentiment

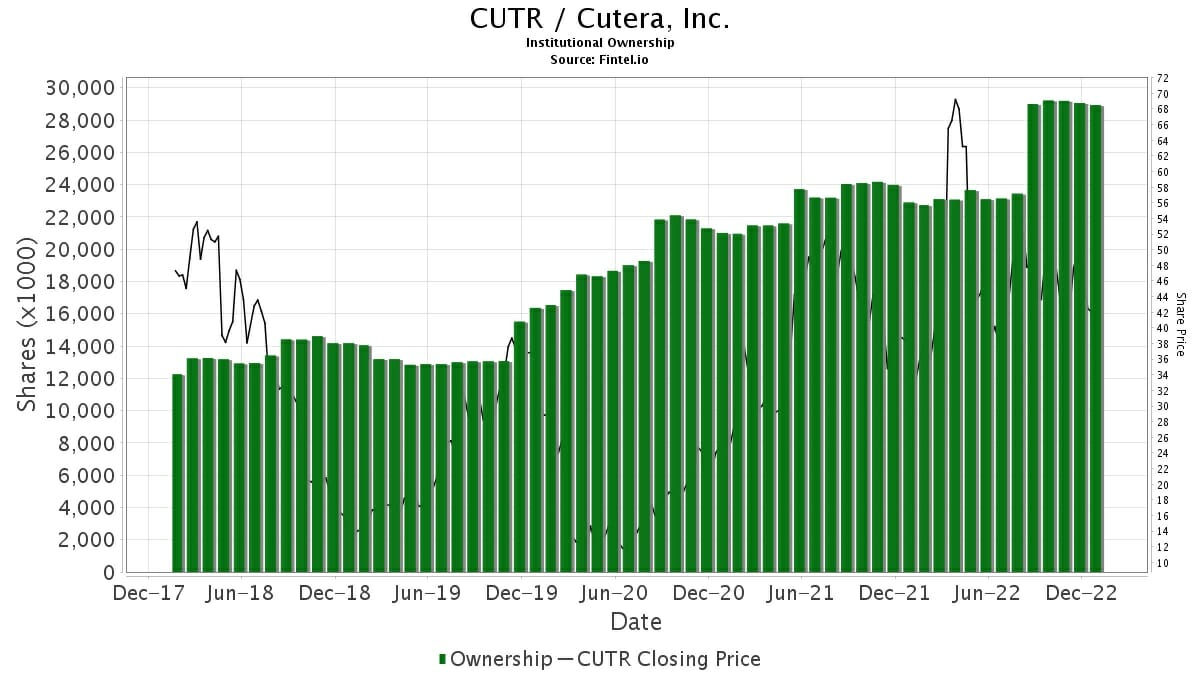

There are 410 funds or institutions reporting positions in Cutera. This is a decrease of 14 owner(s) or 3.30%.

Average portfolio weight of all funds dedicated to US:CUTR is 0.2960%, an increase of 35.0082%. Total shares owned by institutions decreased in the last three months by 0.88% to 28,928K shares.

Cutera Background Information

(This description is provided by the company.)

Brisbane, California-based Cutera is a leading provider of laser and other energy-based aesthetic systems for practitioners worldwide. Since 1998, Cutera has been developing innovative, easy-to-use products that enable physicians and other qualified practitioners to offer safe and effective aesthetic treatments to their patients.

Article by Fintel