The price of Bitcoin broke through $56,000 today, reaching its highest level since December 2021.

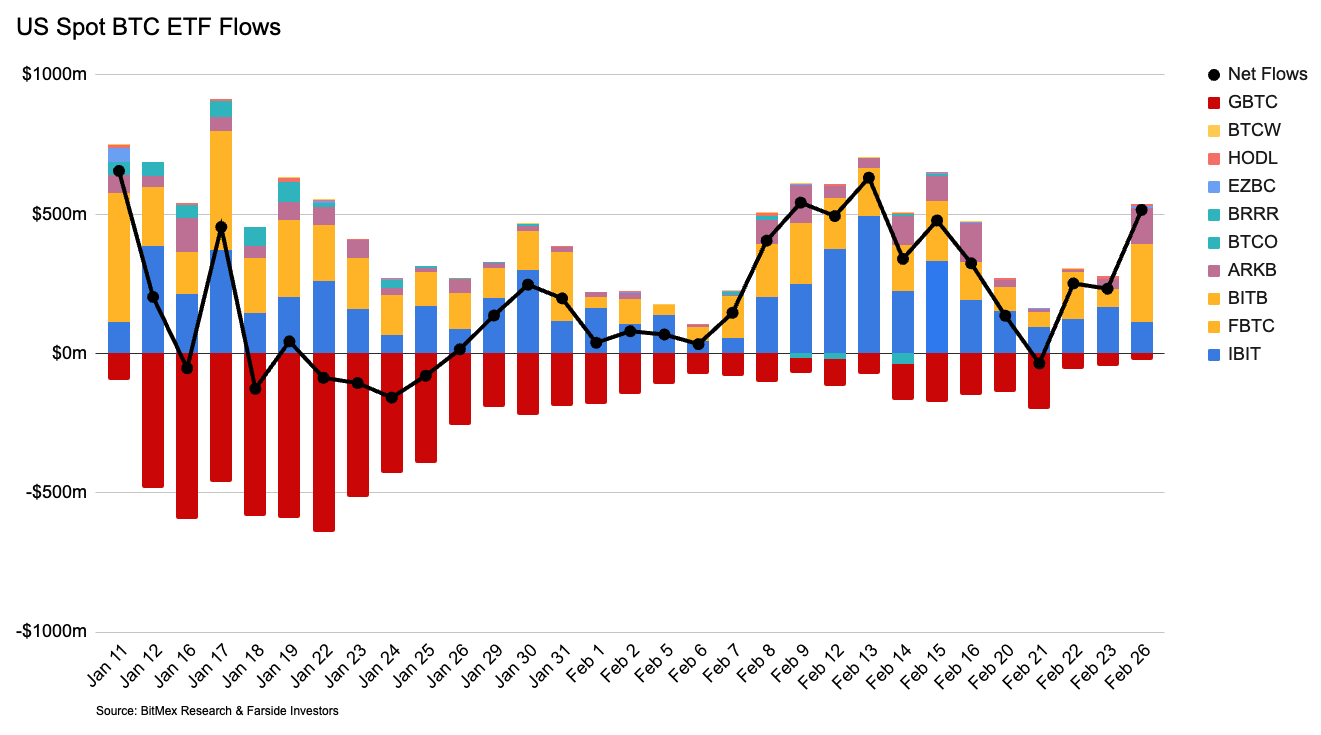

The gain reflects a 10.6% increase over the past 24 hours, which coincided with record net BTC ETF inflows.

Sell pressure also appears to be subsiding, with outflows from the GBTC ETF experiencing a record low of only $22.4 million, according to BitMex research.

The amount of BTC held in spot ETFs is now over $46 billion, or approximately 821,000 BTC, according to data from Blockworks.

Bitcoin spot ETFs work by purchasing “real” BTC from the open market and holding it on behalf of ETF buyers.

Read more: The 7 best crypto exchanges and apps for 2024

Henrik Andersson, Chief Investment Officer at Apollo Capital, predicts that the effect of ETF purchases will have a net “multiplier” effect.

Apollo Capital’s research estimates that for every $1 that flows into BTC ETFs, the price of Bitcoin will rise by $50 (a multiplier of 50x).

As of last week, the multiplier was at 40x, with an increase of roughly $40 for every dollar invested into BTC ETFs.

This weeks price surge pushes closer to the 50x estimate, which demonstrates the influence the spot ETFs have on the wider Bitcoin market.

Bitcoin supply set to halve in 57 days

Cryptocurrency traders are preparing for a supply shock, as the issuance rate of new BTC is set to halve on April 19, 2024.

This means that the amount of new Bitcoin created will reduce from 6.25 BTC every 10 minutes, to 3.125.

This process occurs every 4 years, and is a fundamental component of Bitcoin’s value proposition.

This means that the monetary supply of Bitcoin is deflationary, unlike other assets which may be variable (eg, gold) or inflationary (eg, US dollars).

Proponents of Bitcoin also advocate for self-custody, which means that the asset is often held in personal wallets rather than on exchanges.

Doing so further reduces the liquid supply of BTC, and ties back into the likelihood of a supply shock as the price pushes towards a new all-time-high.

Bitcoin has never set a new all-time-high price in the lead up to a halving date, which could make this year one of the most historic in Bitcoin’s 10+ year history.