The Broad Market Index was down 2.67% last week and 48% of stocks out-performed the index.

With 60% of companies now reporting financial statements to the Securities and Exchange Commission (SEC) for the December period, growth remains elevated. Sales growth continues to fall on average but remains high at nearly 15%. The frequency of improvement is up again for the second consecutive quarter.

Q4 2022 hedge fund letters, conferences and more

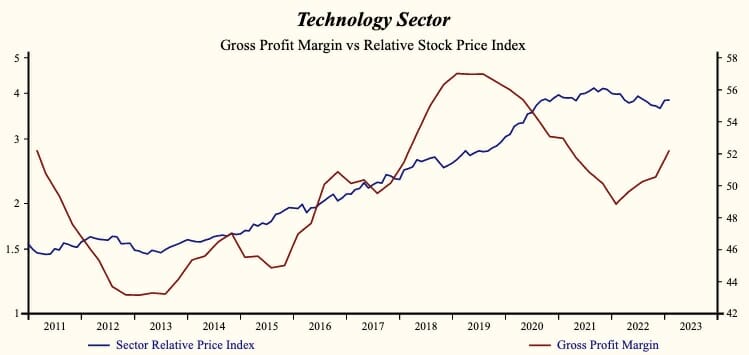

Gross profit margins are rising more frequently in all sectors except technology where only 24% of technology companies are achieving a gross margin improvement. This is the lowest proportion in the record of the technology sector. This is as bad as the peak of the virus down-wave in the third quarter of 2020.

Tech Sector Leadership Starting To Fail

The shift in growth leadership from technology to industrials and energy has been underway for a year but still only modestly reflected in share prices. That means that the great market crash that we have been anticipating since inflation advanced last year will be the result of lower growth and higher interest rates.

The technology sector dominated the US stock market for a decade benefiting from lower manufacturing costs (higher gross profit margins) and higher than average sales growth. Over the same period, globalization and fracking caused slower growth from industrials and energy.

That changed with the virus and now the war. Globalization has failed and is reversing. Much of the benefit, lower prices for consumers and higher gross profits for companies is reversed.

That means that the passive investing disaster for retirement portfolios last year has only just begun and will get much worse. We must actively focus on shifting portfolios towards accelerating companies (Otos MoneyTree with a green globe and a dark trunk in a golden pot).

Interest Rates

With short-term interest rates now above 5%, the urgency to make that shift is smaller. Rising interest rates will depress asset prices across the board and the best we can expect from our accelerating companies is better returns in a falling market.

Use the recent strength in long-term bonds and technology stocks to sell stocks of falling growth companies. (Otos moneyTree with red globe and red trunk in a red pot). Place the funds in short duration bonds (MINT) and wait.

Be on the lookout for companies in their acceleration phase, such as Automatic Data Processing Inc (NASDAQ:ADP):

Automatic Data Processing $224 3/4 BUY This Rich Company Getting Better

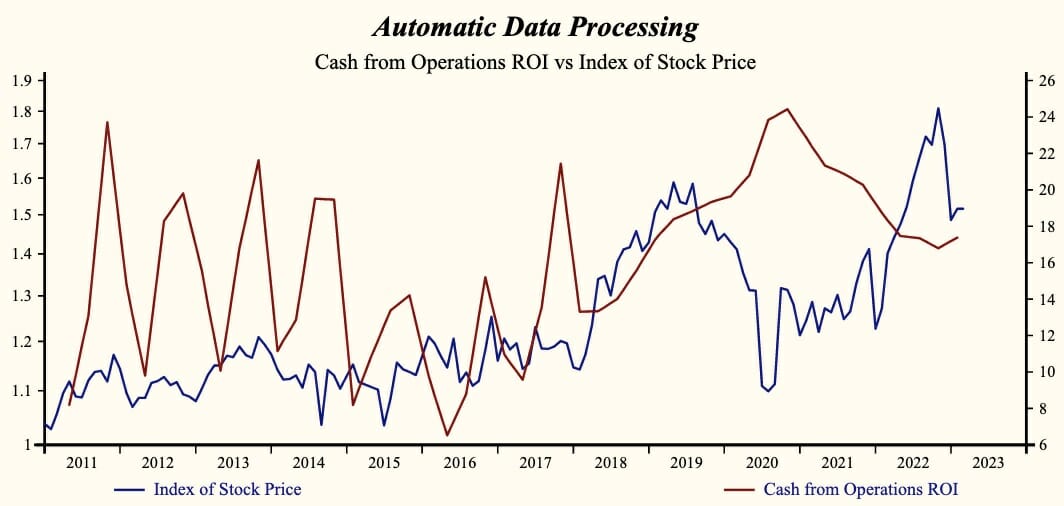

Automatic Data Processing (NASDAQ:ADP) has been an exceptionally profitable company with persistently high cash return on total capital of 19.3% on average over the past 20 years. Over the long term the shares of Automatic Data Processing have advanced by 38% relative to the broad market index.

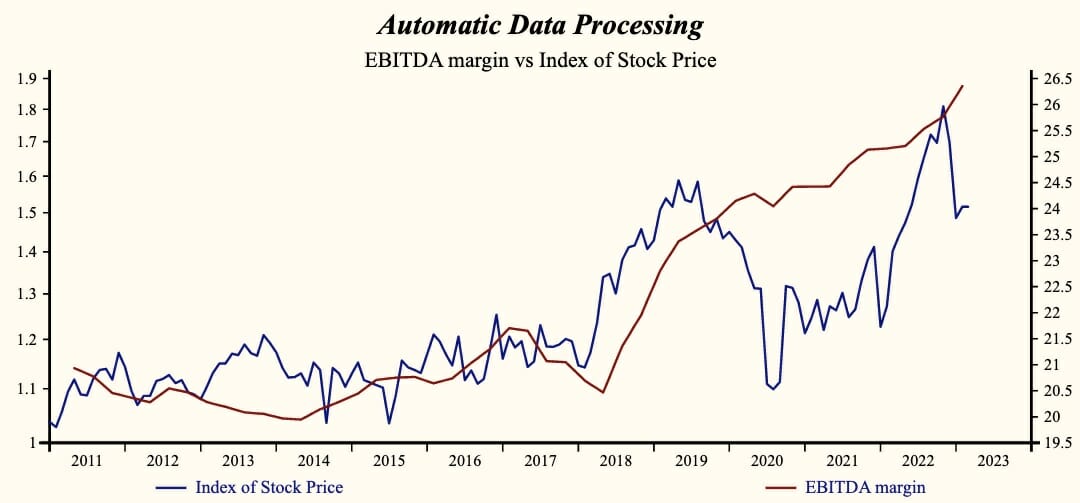

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is EBITDA Margin which has been 93% correlated with the share price with a one-quarter lead.

Strong Growth

Currently, sales growth is 9.9% which is high in the record of the company and higher than last quarter.

The company is recording a low and rising gross profit margin. SG&A expenses are low in the record of the company, but falling. Higher gross margins and lower SG&A expenses are producing a leveraged acceleration in EBITD relative to sales.

Strong Cashflow

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. Lower capital expenditures have been supporting free cash flow for quite some time. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth for the first time since late 2020.

Strong Buy

More recently, the shares of Automatic Data Processing have advanced by 36% since the August, 2020 low. The shares are trading at lower-end of the volatility range in a 30-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.