Gold’s flat performance in 2022 has been recognized by the World Gold Council as a strength. After all, the S&P 500 fell nearly 20% last year!

2022 was good for the gold market and 2023 could be even better. This is basically the summary of the WGC’s latest commentary, entitled “Gold Claims a Gain in 2022”. The fact that the last year was positive for the yellow metal might be a bit counterintuitive.

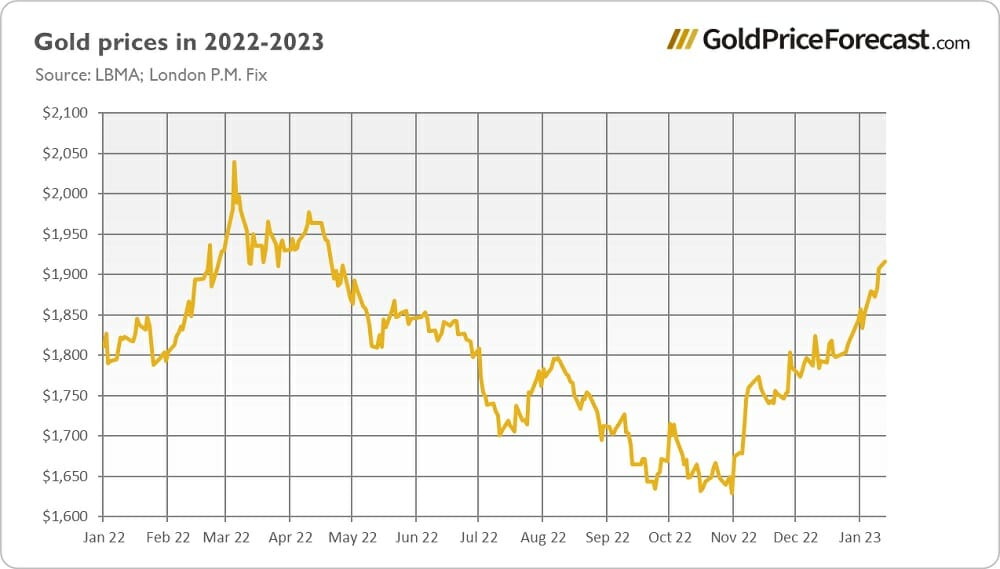

After all, as the chart below shows (courtesy of goldpriceforecast.com), the price of gold was in a downward trend for most of 2022. From early March to early November, the yellow metal slid from $2,039 to $1,629, a decline of 20.1%.

Q4 2022 hedge fund letters, conferences and more

However, the price of gold reversed this downward trend in November, jumping to $1,754 by the end of the month. In December, the rally continued and that last-minute surge took gold to $1,814, allowing it to end the year without a loss.

But how such a virtually flat performance relative to the last day of December 2021 (0.004375%) could be seen as good? Well, maybe because the real interest rates rose an unprecedented 250 basis points while the dollar appreciated more than 8%.

As the WGC notes, “the previous largest annual rise in yields was 150bps with a flat dollar. That year – 2013 – saw gold prices fall almost 30%”. Wow, please admit that zero seems like a huge win compared to -30%!

What Gold's Resilience Shows Us?

According to the WGC, 2022 was “a textbook example of gold’s stable and uncorrelated performance amid market turbulence”. Well, indeed – after all, the U.S. stock market, measured by the S&P 500, plunged 19.4% last year. It implies that gold was truly a safe haven during a market storm and a valuable portfolio diversifier.

What’s more, gold’s volatility remained close to its long-term average, something we can’t say in the case of equities. And gold’s correlation to a 60/40 equity-bond portfolio, although higher than the average, remained low at 20, which is, in the WGC’s words, “an indicator of gold’s characteristic as a consistently reliable diversifier during market turmoil”.

Implications For Gold

What does it all imply for the gold (and silver) market in 2023? Well, the WGC’s previous report saw a “stable but positive outlook for gold prices”. The latest publication confirms that the market scenario of a mild recession is playing out but “with a nod to a more severe downturn”. It means that 2023 should be positive for gold prices.

The only question is - how much. I’m usually more cautious than the perma-bull WGC, but this time I totally agree with the painted picture. Hence, I expect that the gold price will rise above $2,000 in the coming months, albeit not without turbulence, as the Fed will end its tightening cycle soon.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care