For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

“October is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.” – from “The Tragedy of Pudd’n’head Wilson” (1894) by Mark Twain.

November marks the starting bell for the best six months of the calendar year, especially in mid-term election years. As I have said before, bear markets often die during October.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

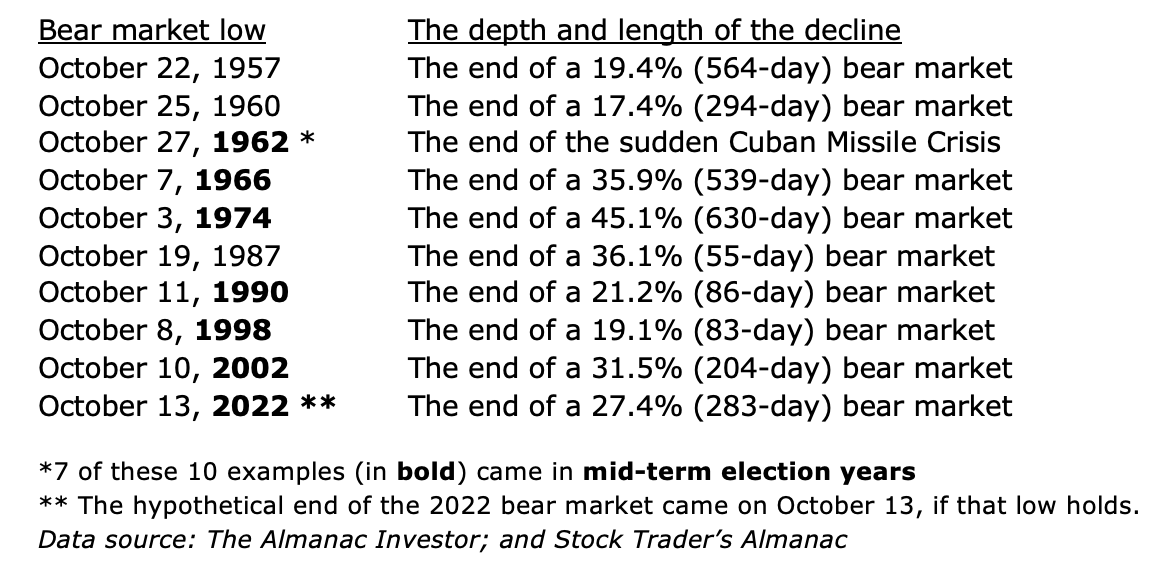

About a dozen post-World War II bear markets bottomed out during October, starting in 1946. The most recent bear market low may have come mid-morning on October 13, 2022. Some of the other October market bottoms have been:

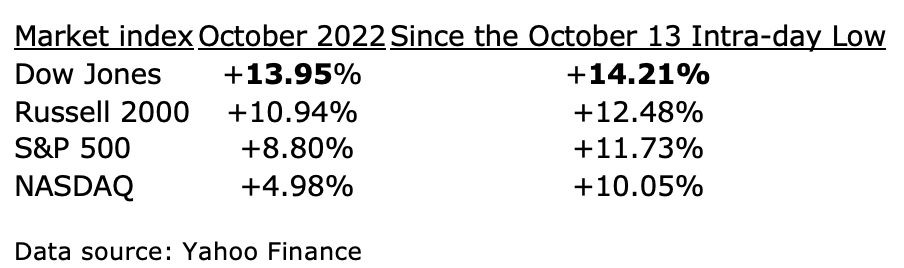

Was October 13 the low this year? So far, most major market indexes are up by double digits from the intra-day low set on October 13, 2022, so that may or may not be the bottom of the current slide, but the month of October certainly lived up to its recent reputation for stellar performance in the major indexes:

This scenario is right in line with what I have been predicting, based on historical patterns, since last May. When the market was bottoming out last June, I again said the eventual bottom was more likely to come in October than June, although May/June had provided bottoms in two or three mid-term election years.

November 1 Also Marks The Best Day To Buy

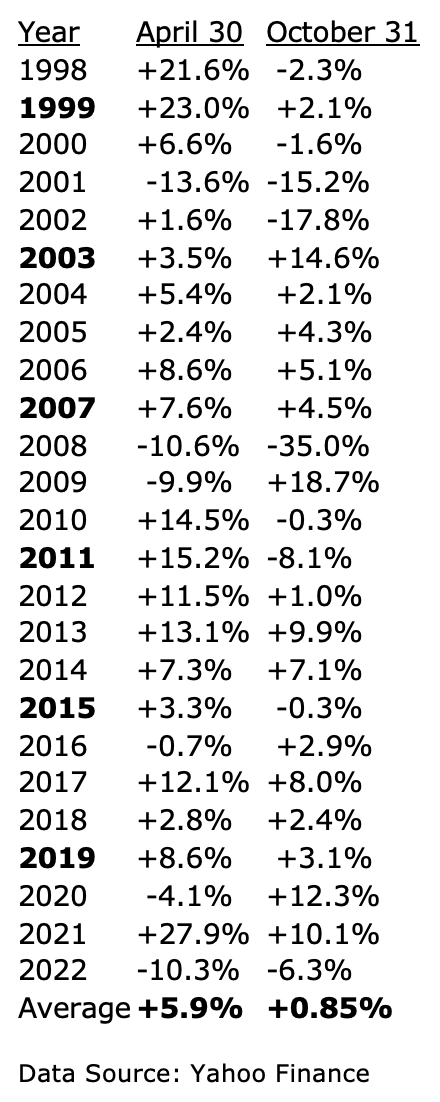

You may have heard the maxim, “Sell in May and Go Away.” We don’t agree with selling stocks in May, but the maxim is based on the fact that since 1950, the best six months for the S&P 500 have been from November 1 to April 30, with May 1 to October 31 being sub-par.

What’s more, November begins the best three months (November 1 through January 31), so November 1 is the day that screams, “Buy stocks now.”

Put in weather terms, the market tends to be HOT in the colder months, and cold in the hotter months.

Like most retrofit formulas, this one worked far better in the distant past than recently, but from 1990 to 2020, according to Investopedia, the S&P 500 has averaged just 2% annually from May to October vs. about 7% from November to April.

My own hand-made charting (since 1998) shows an average of 1.5% gains from May to October and +5.9% from November to April. Here’s the record of the last 25 years.

That’s a lot of numbers, but look for the special path in mid-term election years. From November 1 (just before the mid-term election) to October 31 the next year, the average gain in the last six cycles is +13%.

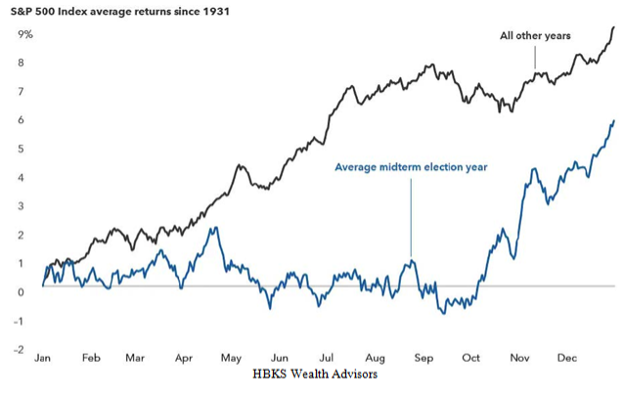

When combined with mid-term election years, this November to April trend becomes even stronger. The mid-term election year is the worst year of the four – as this year has shown us – but the third year (next year) is the best, and the electoral celebration usually begins before mid-term election day (chart, below).

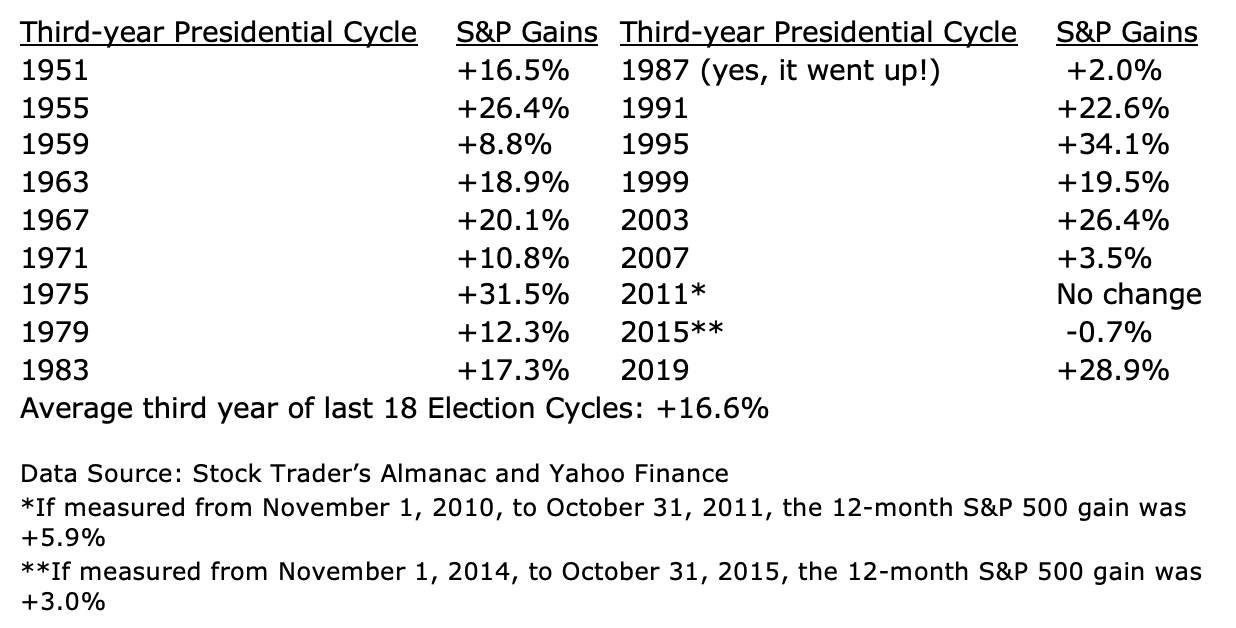

Not convinced yet? Consider this. Since 1950, there have been 18 mid-term elections, and stocks have gone up the following 12 months every time. Just looking at the third year of the four-year presidential cycle, 16 were up, with one flat year and one small loss, averaging +16.6% gains. Not bad.

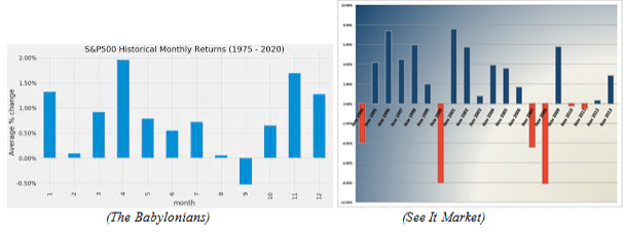

Shorter-term, November itself has a strong historical record, #2 (to April), measured 1975 to 2020:

Recently (right, above), November has seen a long series of winning streaks, interrupted by a downdraft. Each November was up from 1995 to 1999, then it fell in 2000 (during the Bush vs. Gore presidential kerfuffle over “hanging chads”).

Then, each November from 2001 to 2006 was strong before the 2007-09 Great Financial Crisis, with a slow recovery. November then enjoyed a nine-year winning streak, 2012 to 2020, before suffering a losing 2021. We could be ready to start a new November winning streak in 2022.

Burying The Corpse Of Fascism (and Other "Virulent Isms")

After we solve the stock market’s riddles, let us pause to recall that fascism was born 100 years ago this week. On Tuesday, October 31, 1922, after his March on Rome the previous weekend, Benito Mussolini was appointed Prime Minister of Italy by King Victor Emmanuel II, becoming the youngest man to bear that title to that date.

Mussolini named his clan Fascisti after the Italian fascismo, derived from fascio, meaning “a bundle of sticks,” implying that we work better if we unite (and don’t think for ourselves). *

Almost exactly five years earlier, Vladimir Lenin, Leon Trotsky, and their comrades took over Russia in the Bolshevik Revolution, dubbed the October Revolution due to Russia’s Old Style Julian Calendar date of October 25, 1917.

But the rest of the world knew that date as November 7 (in the New Style/Gregorian Calendar), so it’s no wonder that late October has a terrible reputation, amplified by Wall Street in 1929.

Between those two revolutions, in 1919, a successful engineer, entrepreneur, and peace activist named Herbert Hoover established a think tank on his alma mater, Stanford, called “The Hoover Institution on War, Revolution and Peace,” beginning as a library a decade before its namesake became U.S. President.

When I first visited the Hoover Institution in 1969, those in charge nicknamed it the “Institute for the study of the virulent isms” (mainly communism and fascism). That phrase stuck with me – these “isms” act like viruses, infecting the minds of the masses.

Over the years, I’ve read most books by their most outstanding economic scholars, namely Milton Friedman and Thomas Sowell, as well as their current star historians, Niall Ferguson and Victor Davis Hanson. (Former U.S. Secretary of State Condoleezza Rice became director in 2020.) It still ranks as one of the top 10 most influential think tanks in the world.

We can all hope that communism died with the crumbling of the Berlin Wall in 1989 or the Kremlin hard-liners in 1991, but I’ve always thought it’s a mistake to divide totalitarianism between right (fascist) and left (communism). They’re both the same, a will to control others, and they are a constant threat to us all.

So, the first order of business is to give thanks for freedom, and the slow death of the most virulent isms.

*Being a jazz DJ for over 20 years now, let me add that October 31, 1922 also marks the birth date of three jazz saxophonists – Illinois Jacquet, famous for his tenor sax solo on “Flying Home” for Lionel Hampton in 1942, Ted Nash, famous for his alto sax solo on “Peter Gunn” for Henry Mancini in 1958, and King Norodom Sihanouk of Cambodia, famous not only for playing sax and loving jazz, but also for defying the CIA (see his 1973 book, “My War with the CIA”).

Even Benito Mussolini gave us a musical son, Romano, who became a jazz pianist after the war. Actress Barbara Bell Geddes (film, Vertigo, and TV series, Dallas, was also born on Halloween Day of 1922.