iPhone sales are in trouble… Apple Inc (NASDAQ:AAPL)’s “dirty” growth tactic can no longer mask its disappointing results… Could this “mystery” project save Apple from doom?…

Dark Days Closing In On Apple

- I’ve got some bad news… Dark days are closing in on Apple.

I understand this may come as a shock.

Apple (NASDAQ:AAPL) is the largest and most popular stock in the world.

Q4 2022 hedge fund letters, conferences and more

It’s worth $2.4 trillion—the combined value of Google (NASDAQ:GOOG), Facebook (NASDAQ:META), and Tesla (NASDAQ:TSLA).

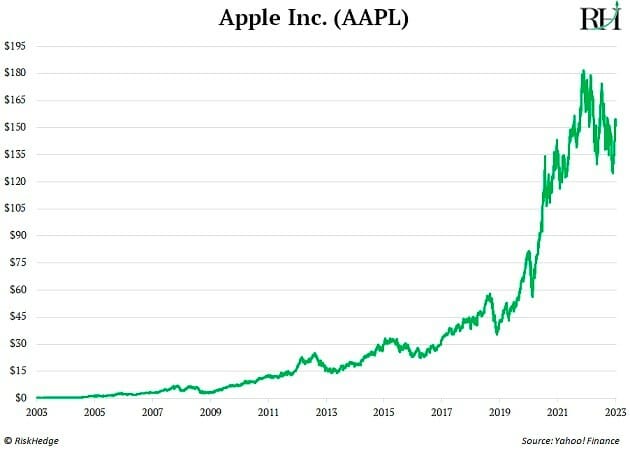

Over the last 20 years, AAPL soared over 60,000%!

If you’d put $10,000 into Apple in 2003, you’d be sitting on $6 million today. And you’d have collected an additional $1.6 million in dividends:

Not many stock charts look as good as this.

Big Idea Crisis

- Unfortunately, Apple is facing a “BIG IDEA” crisis…

Apple is what I call a “big idea” disruptor...

It needs to release a new revolutionary product every few years to maintain its growth.

Did you know Apple almost went bankrupt in the mid-90s?

It mostly sold computers back then, and its Mac brand made up less than 5% of the market. In fact, competitors like Dell outsold it 10 to 1.

Apple was in serious trouble and about 90 days from going broke.

Then along came the iPod—a small, sleek music player that held tens of thousands of songs. This little device revolutionized how we listen to music... and by 2006, it accounted for 40% of Apple’s revenue!

One “big idea” saved the company. It grew from a struggling computer maker into a $100 billion powerhouse.

Then, in 2007, Apple came up with another big idea—the iPhone.

Compared to other phones at the time, it was a Ferrari. The iPhone was the first smartphone to ditch the keyboard and feature a “giant” multi-touch display. It had lots of memory for storing photos and songs. And it was the first mobile phone to offer a computer-like web-browsing experience.

Over the next eight years, Apple became the #1 smartphone seller in the world, and its revenues 10X’d.

iPhone Sales

- Problem is, the iPhone trend is out of gas...

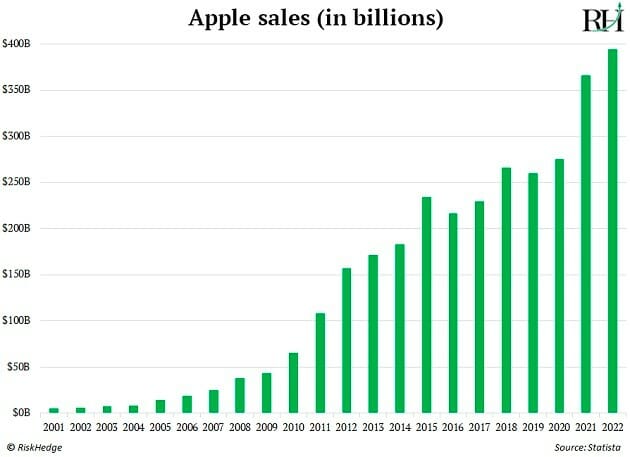

Looking at Apple’s sales, you wouldn’t know anything is wrong.

Apple’s revenue has consistently marched higher since 2001:

But there’s a problem hidden in this chart…

Apple’s revenue is growing... but it’s not because people are buying more iPhones.

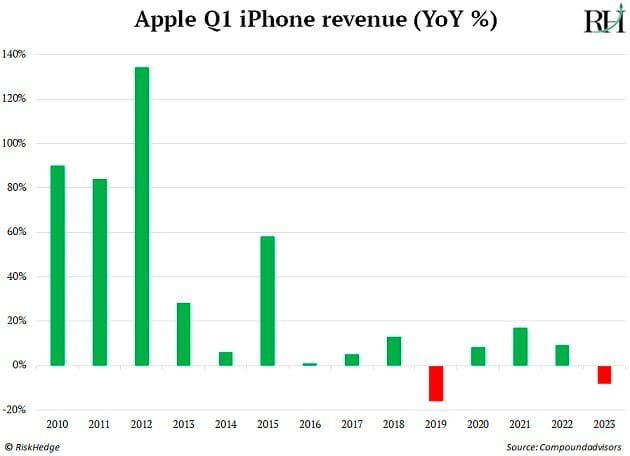

As you can see, in 2015, iPhone revenue grew 58%. But Apple hasn’t come close to that kind of growth for eight years now…

Keep in mind the iPhone is Apple’s crown jewel, generating over half of its overall sales.

Another 20% of Apple’s revenue comes from iPads and computers.

But those businesses are stagnant too. All told, about 70% of Apple’s business is currently going nowhere.

So where’s all the revenue growth coming from?

Dirty Tricks

- Apple has kept revenue growth alive by using a “dirty” trick…

In 2007, Apple released the first iPhone for $499.

In 2012, the iPhone 5 set you back $649.

By 2022, the price of a new iPhone 13 had ballooned to $829. That’s more expensive than most new laptops. And if you wanted the top-of-the-line iPhone Pro Max version with 1 TB of storage, you’d have had to shell out a stunning $1,599.

That’s how Apple has kept its revenue growth alive—with price hikes.

But how much higher can the iPhone’s price tag go?

$2,000?

$3,000?

Apple can’t keep doing this forever.

To make matters worse, Statista estimates 7 billion people already own a smartphone—out of roughly 7.8 billion people on the planet.

In short, the smartphone market is already tapped out.

Apple needs to come up with the next “big idea”—and soon—if it wants to grow.

Post-iPhone Era

- The post-iPhone era is here, and it won’t be kind to Apple’s stock…

On February 2, Apple reported its most disappointing earnings result in years.

Yearly sales dropped 5.5%, the most since 2016. And iPhone revenues plunged 8%.

Without another “big idea,” I believe we’re witnessing the beginning of Apple’s decline.

To be clear, I’m not predicting Apple will go bust.

It has $50 billion worth of cash in the bank and earned $100 billion in profits last year. It can coast on its past innovations for years without having to worry about bankruptcy.

But unless Apple can pull off another iPod/iPhone-style megahit, its days as the world’s #1 stock are over.

Unless…

VR And AR Glasses

- This “mystery” project could save Apple from decay.

Rumors have been circulating that Apple is getting ready to release its new big idea disruption this year—virtual reality (VR) and augmented reality (AR) glasses.

My colleague Chris Wood says AR glasses, in particular, could be a game-changer…

He predicts AR glasses will be the “next smartphones.”

At first, they’ll probably be an accessory to your phone. Eventually, when the tech is good enough, they’ll replace your smartphone altogether.

And Chris believes AR glasses could be a huge success for Apple.

In addition to its track record, Apple has tens of millions of die-hard fans who’ll buy anything the company makes.

There are about a billion iPhone users in the world today. That’s an enormous user base.

While it’s unlikely all of them will convert to VR/AR headsets right away, many of them will jump at the chance to try a new Apple product… generating billions of dollars in sales in the process.

Me? I’m a little more skeptical. How many people will realistically buy one of these AR headsets for $3,000? At the very least, I don’t expect them to be an instant hit.

Article by Stephen McBride - Chief Analyst, RiskHedge

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.