What’s New In Activism – Voss Secures Seats At Thunderbird

Thunderbird Entertainment Group Inc (CVE:TBRD) agreed to add Voss Capital’s Asha Daniere and Mark Trachuk to its board and include a third director on management’s slate in a settlement deal that will also see the Canadian media production company launch a strategic review.

That third individual will stand for election on Thunderbird’s seven-person slate at the upcoming elections on March 6, the company said in a Thursday statement.

Q4 2022 hedge fund letters, conferences and more

Thunderbird also agreed to create an advisory committee tasked with assessing the company's capital allocation strategy and evaluating "all strategic opportunities to maximize value."

During the proxy contest, Railroad Ranch Capital Management sided with Voss, supporting the idea that a review would help to unlock trapped value at Thunderbird. Railroad said the company's stock did not reflect the "positive trajectory" in its fundamentals.

Activism chart of the week

In the 12 months ending January 19, 2023, globally 52 energy companies were publicly subjected to activist demands. That is compared to 43 in the 12 months ending January 19, 2022.

Source: Insightia | Activism

What’s New In Proxy Voting - ISS & Glass Lewis Questioned Over ESG

A group of 21 republican state attorneys general wrote to Institutional Shareholder Services (ISS) and Glass Lewis, questioning if their ESG policies may breach their legal obligations to the states’ investment vehicles.

In the January 17 letter, the states' officials stated that both have potentially violated their legal and contractual duties as proxy advisers, by advocating for and acting in alignment with climate change goals, and advocating for and acting in alignment with diversity, equity, and inclusion quotas.

The letter added "We question how such recommendations, and the policies that led to them, are based on the financial interests of the investment beneficiaries rather than other social goals and, if they are based on the latter, how that complies with your duties."

"Moreover, your attempts to force companies identified by Climate Action 100+ to achieve 'net-zero emissions' and 'to set short- and medium-term targets' in line with the Paris Agreement appear unsupported by your duty to consider only the economic value of investments," the letter contended.

The group gave a January 31 deadline by which Glass Lewis and ISS are asked to respond.

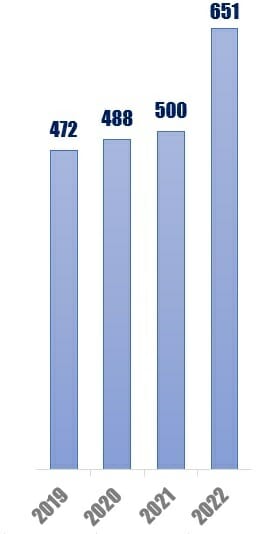

Voting chart of the week

There were 651 shareholder proposals voted at Russell 3000 companies in 2022, a record high in recent years.

Source: Insightia | Voting

What’s New In Activist Shorts - Iceberg Short On BigBear.ai

Iceberg Research accused BigBear.ai Holdings Inc (NYSE:BBAI) of pumping its stock through misleading statements and said the consulting company had a rapid burn rate that will likely lead to more dilutive share issuances.

"With a funding gap, low liquidity, and a rapid burn rate, BigBear will have to turn to dilutive funding. We expect pressure on the stock with the expiration of options at the end of this week," said Iceberg in a series of tweets on January 17.

Iceberg said that BigBear's press release was misleading because the contract is, in fact, a competitive award, which means the company will have to compete with 93 other companies for future orders.

The short seller also questioned BigBear's technology, saying the company was likely presented as an AI-powered consultant to attract capital for its public debut in December 2021, which took place through a merger with a special purpose acquisition company.

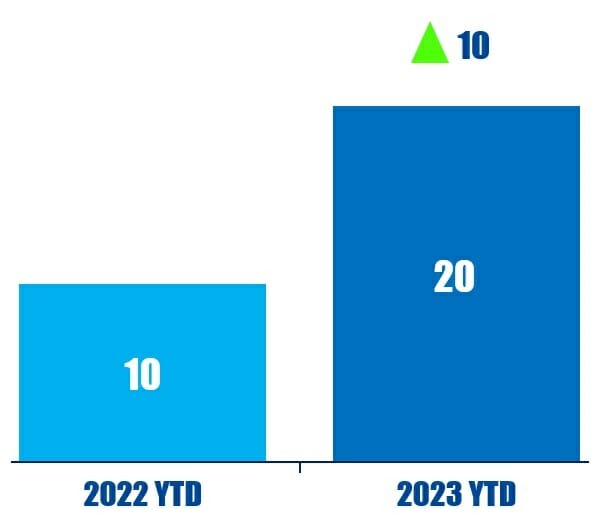

Shorts chart of the week

In the 12 months ending January 20, 2023, 20 public activist short campaigns alleged product ineffective against the company. That is up from 10 in the 12 months ending 20 January, 2022.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from AmeriServ in a letter criticizing Driver Management for launching a proxy contest. Read our coverage here.

“We hoped the firm would appreciate that our board could not blindly agree to an 8.1% shareholder’s demands to designate 33% of the company’s directors and take leadership roles on multiple committees.” – AmeriServ Financial